- Memecoins that topped the gainers chart last week may be due for a correction.

- Meanwhile, low-cap assets could experience short-term gains.

The second week of October kicked off with Bitcoin [BTC] breaking resistance to test the critical $64K level. This marks a strong rebound after last week’s dip, where BTC briefly touched $58K.

During that phase, top memecoins posted significant surges, with some even posting triple-digit gains as capital flowed out of Bitcoin.

However, many of these memecoins are now trading below their previous peaks, signaling a potential distribution phase as market focus returns to BTC.

As Bitcoin resurges and most high-cap memecoins face a slump, AMBCrypto sees a pattern that suggests that the market may be nearing the final leg of the memecoin craze rather than the start of a “super cycle.” If this trend persists, a broader market cooldown could be imminent.

Top memecoins are lagging behind

This chart indicates that the past week marked a memecoin-led cycle, with 3 out of every 5 coins dominated by memes, each achieving over a 30% surge in just one week.

This moment marked a shift; while low-cap altcoins usually gain traction when BTC hits a bottom, traders are now flocking to high-cap memecoins for high-risk, high-reward opportunities.

In essence, the recent BTC correction triggered a capital flight into these larger tokens. However, as traders lock in profits, funds may soon flow into smaller, low-cap memecoins, reminiscent of altcoin surges seen after every Bitcoin top.

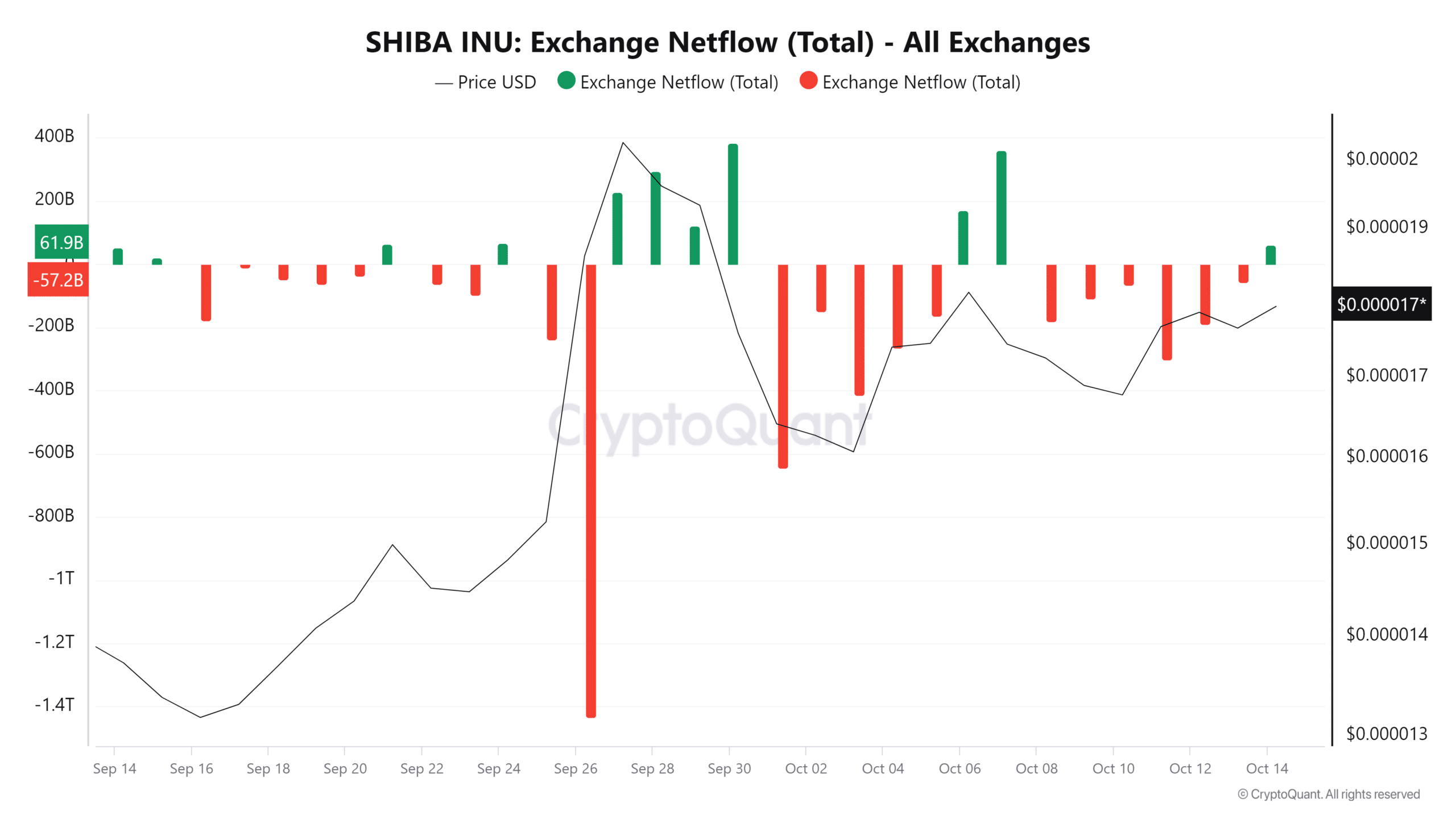

Source : CryptoQuant

SHIB, the second-largest memecoin with a market cap exceeding $10 billion, has consistently outperformed Bitcoin, posting higher daily gains during each green candlestick on the daily price chart.

This surge can be attributed to a strategy employed by traders during Bitcoin pullbacks, as they shift their focus to accumulating high-cap memecoins. Notably, the past week saw net outflows of 58 billion SHIB from aggregate exchanges.

However, with Bitcoin now breaking through a key resistance level, renewed optimism has prompted these traders to offload their holdings, resulting in a surge of SHIB inflows totaling 62 billion.

In summary, many top memecoins may be poised for a correction, as Bitcoin gears up for its next parabolic ascent. Thus, the next memecoin supercycle could initiate once BTC reaches an exhaustion point around $66K.

Low-cap tokens might see a short-term surge

Typically, an increase in BTC price boosts investors’ risk appetite, prompting them to explore more speculative assets, including lower-cap memecoins.

Despite their higher volatility, these assets are viewed as attractive options for quick and substantial returns. As a result, they may experience a short-term surge in demand.

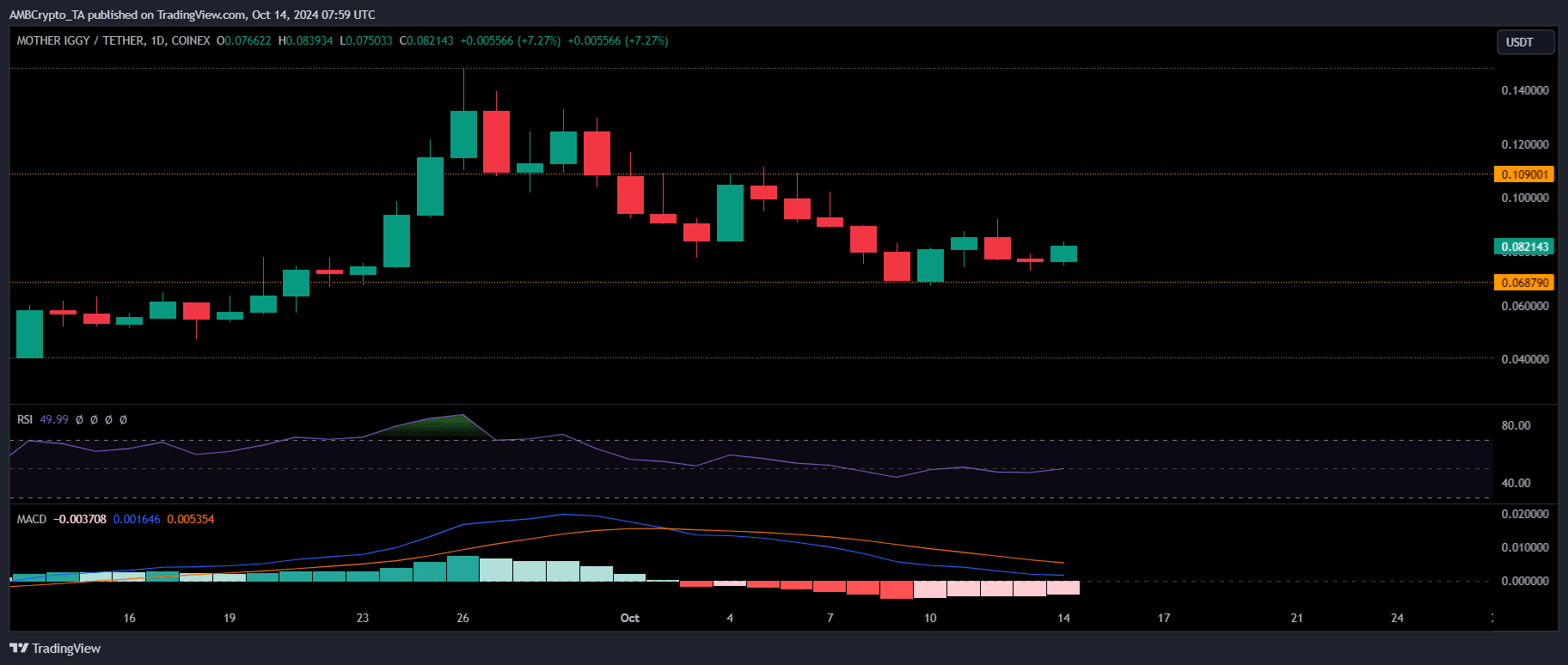

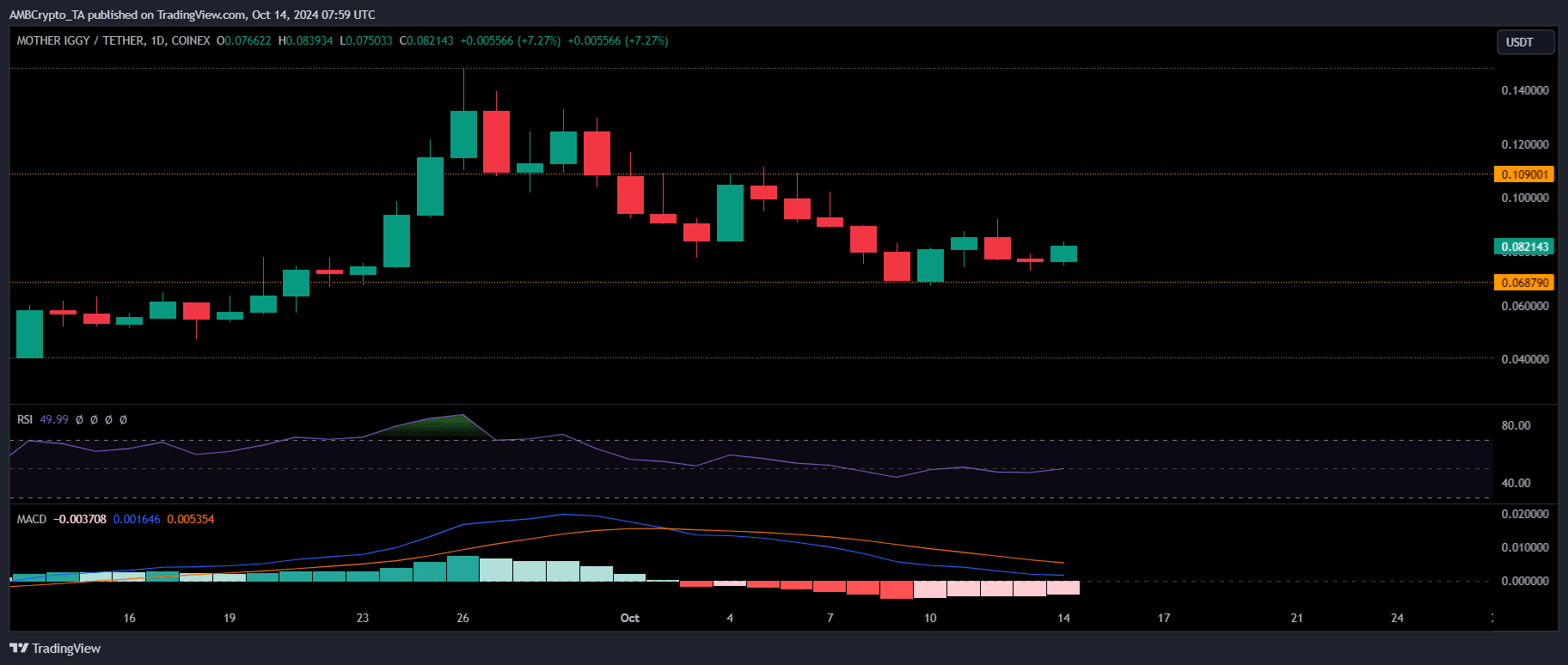

Source : TradingView

One notable example is Mother Iggy [MOTHER], a celebrity Solana-based memecoin with a market cap of $85 million. The token has regained traction, surging over 5% in the last 24 hours to $0.83. This marks a significant recovery from last week’s 10% plunge.

Realistic or not, here’s SHIB’s market cap in BTC’s terms

Historically, a similar pattern occurred during the first week cycle when BTC reached $62K, allowing MOTHER to test the $1 ceiling. If this trend continues, the memecoin could be on the verge of a bullish reversal.

Overall, the market is seeing major memecoins stagnate while smaller market-cap tokens surge, mirroring the trend after BTC reaches a top when capital shifts into smaller coins as larger players distribute their holdings.