- As of press time, the memecoin index dropped to -16% in the last 24 hours.

- Sharpe ratio index marked DOGE as one with the highest risk for entry due to its volatility.

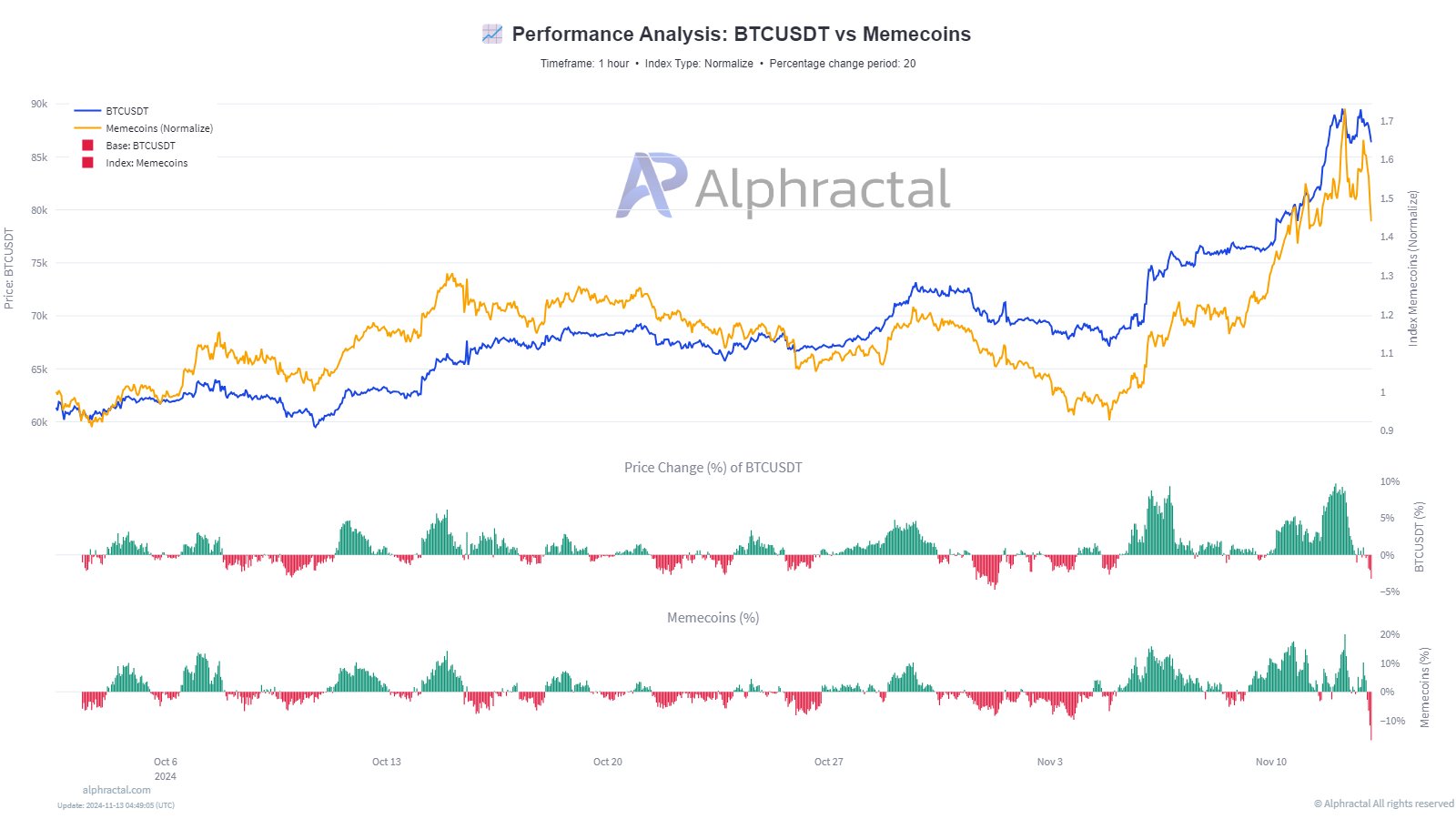

The memecoin index saw more volatility with a notable decline, particularly after Bitcoin’s [BTC] minor drop. Bitcoin experienced slight fluctuations but generally maintained a stable upward trend.

While Bitcoin’s percentage changes remained relatively contained, the memecoins exhibited larger swings, both positive and negative. The behavior warned on the higher volatility and risk associated with memecoins compared to Bitcoin.

Source: Alphractal

After Bitcoin recovered from its slight decline, the memecoin index did not rebound, resulting in a sharp drop to -16.8% in the last 24 hours as at the time of writing.

This suggested that while Bitcoin’s market movements have a directional influence on memecoins, the latter’s recovery might lag or be less pronounced, impacting investor sentiment and future investment decisions in the memecoin sector.

This pattern indicates potential for further instability in the meme market, especially if Bitcoin faces more fluctuations.

Memes face sell-off pressure

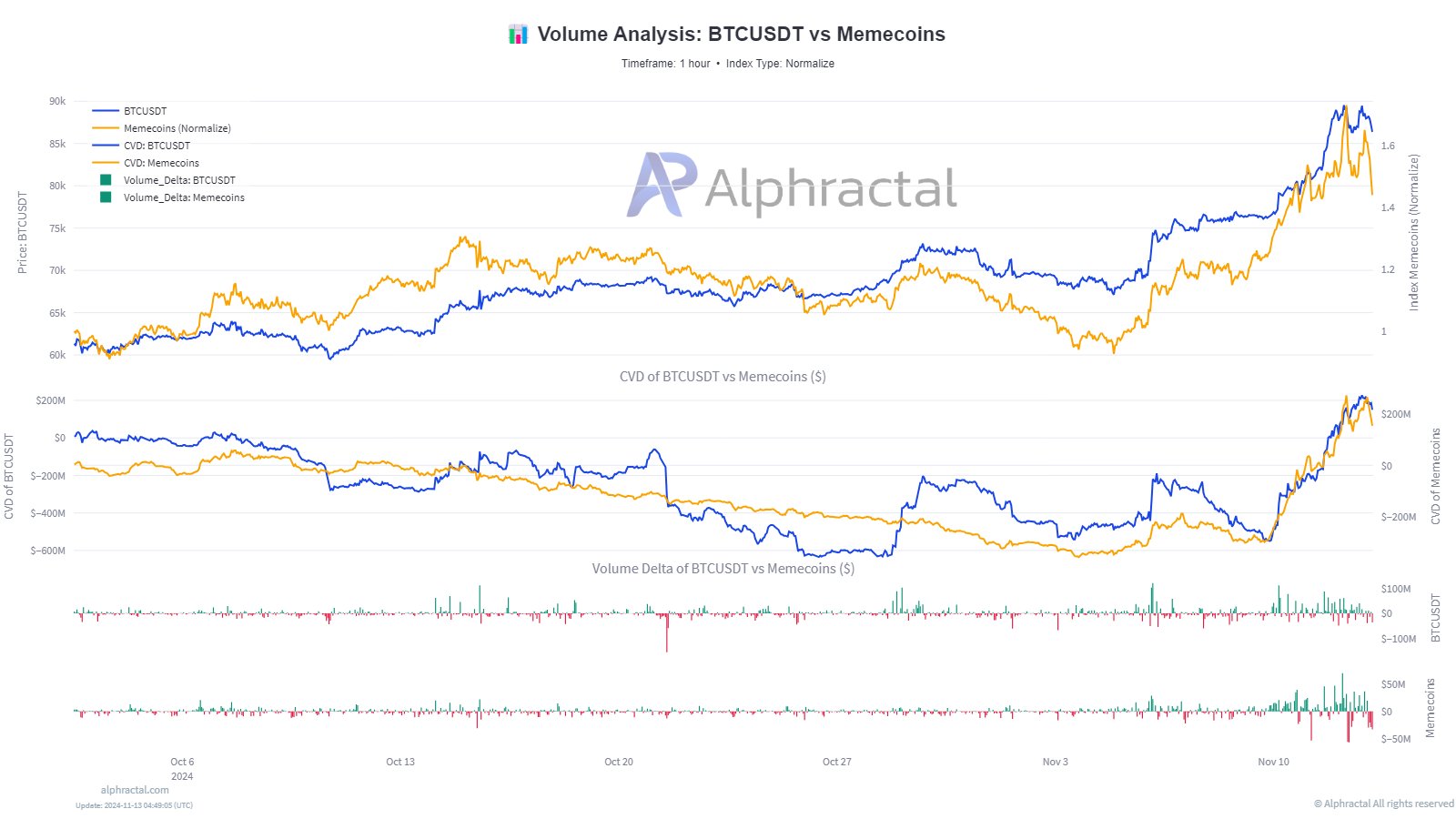

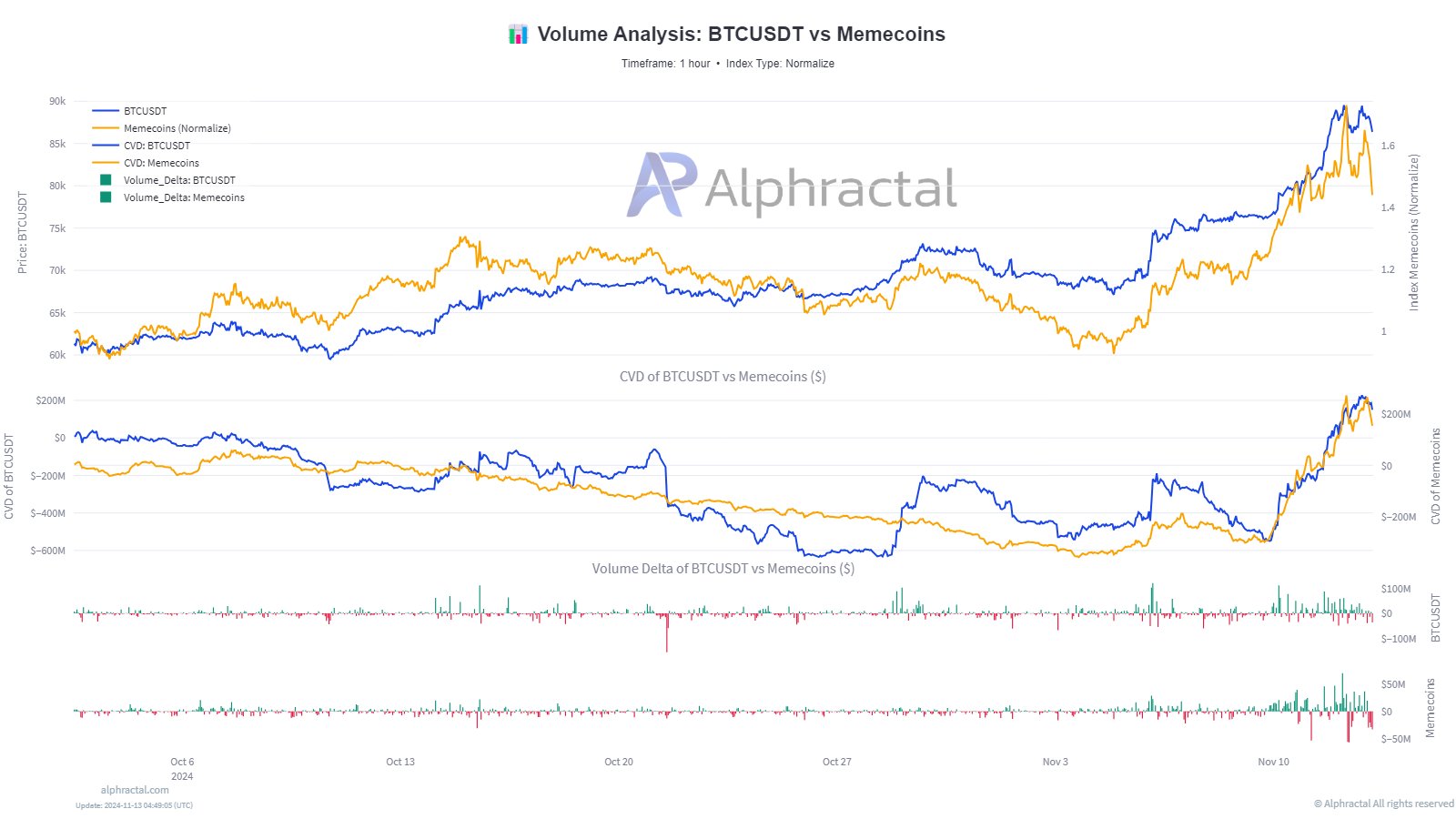

Comparing the cumulative volume deltas of Bitcoin against the normalized price index for memecoins showed that memes diverged significantly. The memecoin index experienced a sharp rise followed by a decline, aligning with the volume delta.

The volume delta for memecoins indicated significant sell-off pressure, reaching a cumulative total of -$98 Million on Binance in the USDT pair.

This suggested a strong selling activity within the memecoin market over the last 24 hours, which contributed to the index’s volatility.

Source: Alphractal

This surge in sell-off pressure could heighten the memecoin sector’s price volatility and potentially leading to further declines if the sell-off continues.

DOGE’s uptick in risk and volume

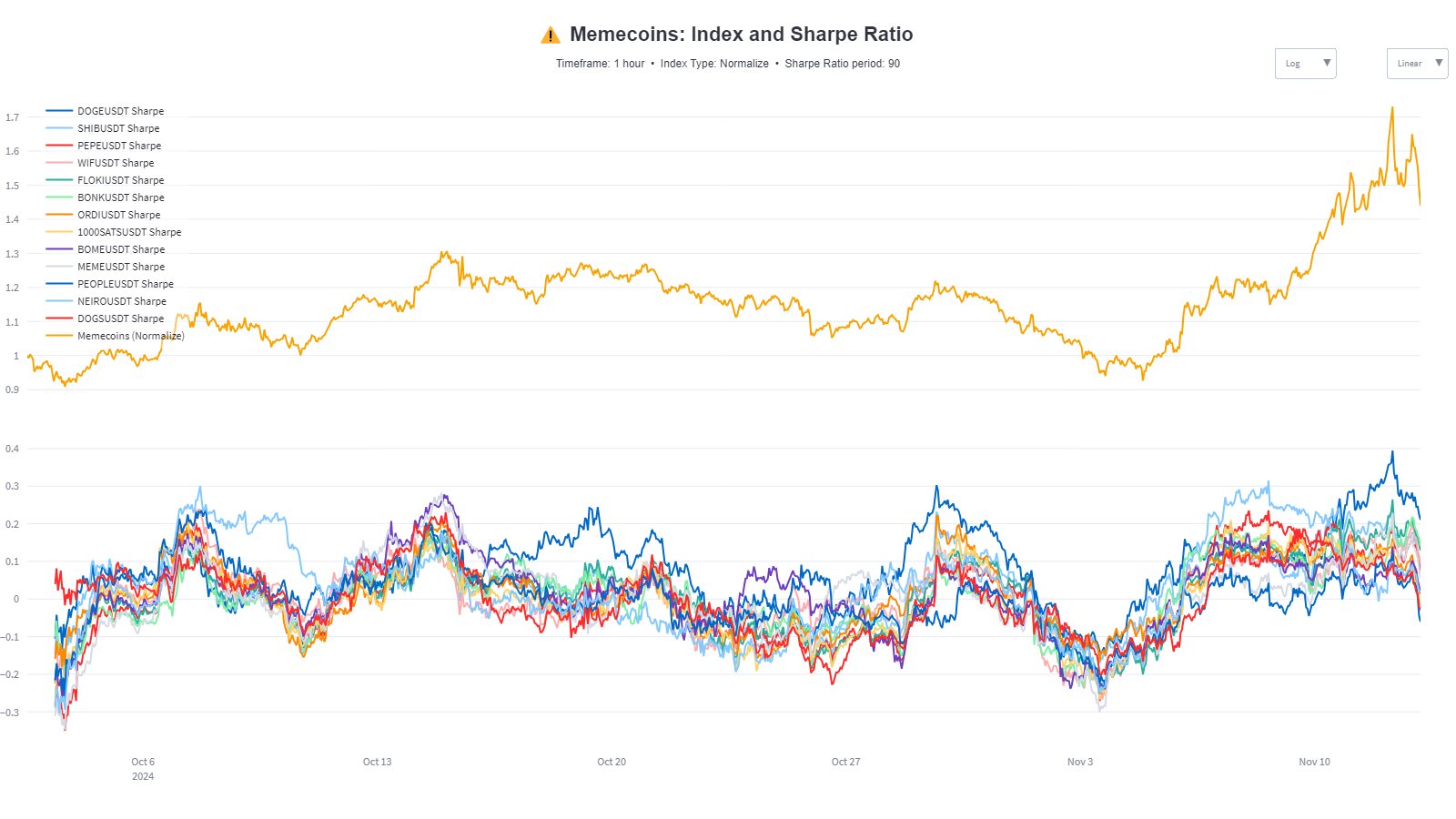

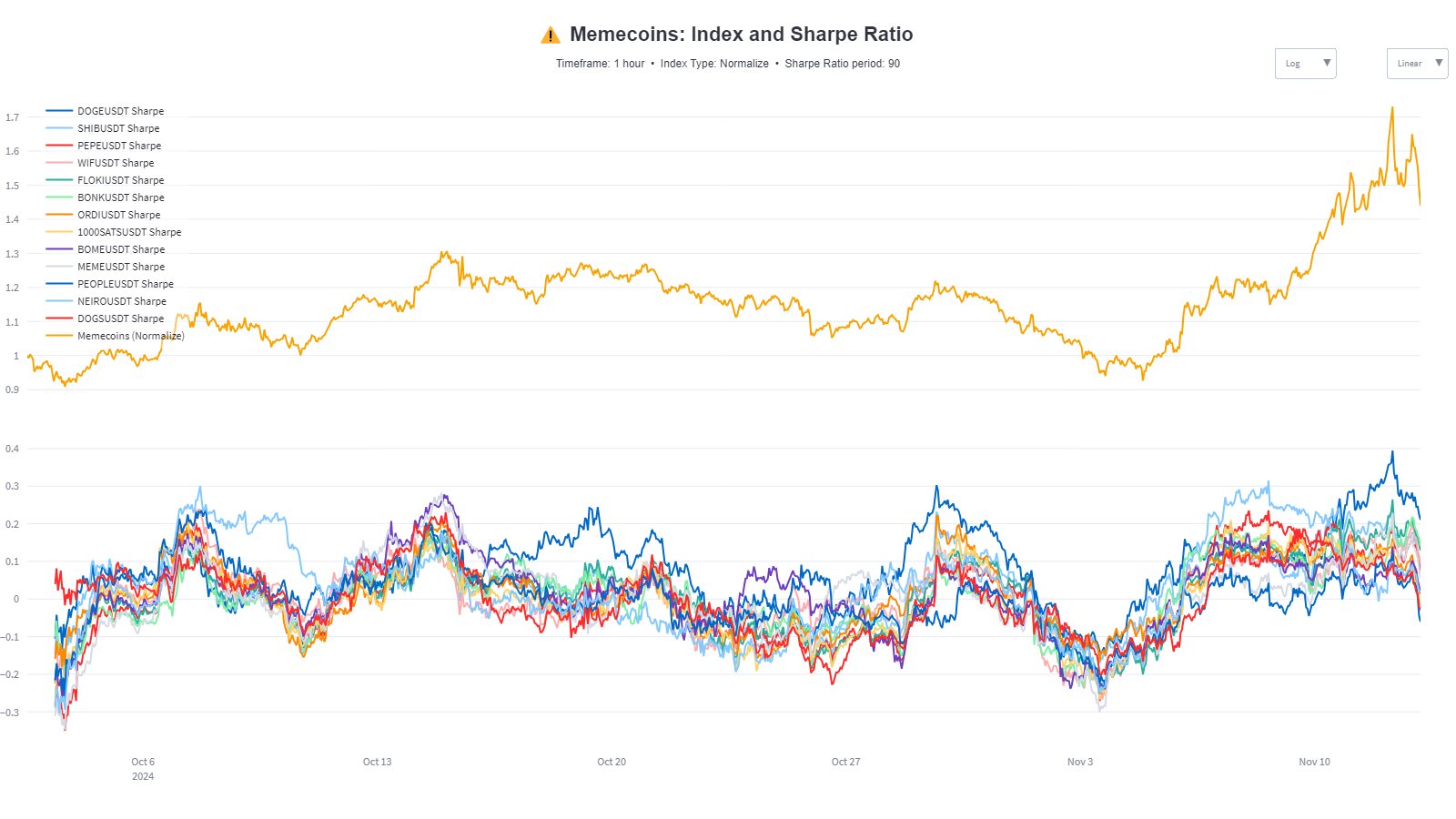

Looking at the Sharpe ratios of various memecoins along with a normalized index of their price movements noted that Dogecoin [DOGE] had the highest risk-adjusted returns compared to others.

At the time of writing, DOGE’s Sharpe ratio consistently remained lower than all other top memecoins by market cap, reflecting its higher risk due to recent aggressive volatility.

This suggested that while DOGE might offer substantial gains, it also poses a higher risk for investors considering entry points. The fluctuating Sharpe ratios across various memecoins reveal diverse investment risk profiles within the sector.

Source: Alphractal

This could impact the meme sector by possibly deterring risk-averse investors from entering at current levels, while attracting those with a higher risk tolerance looking for significant gains.

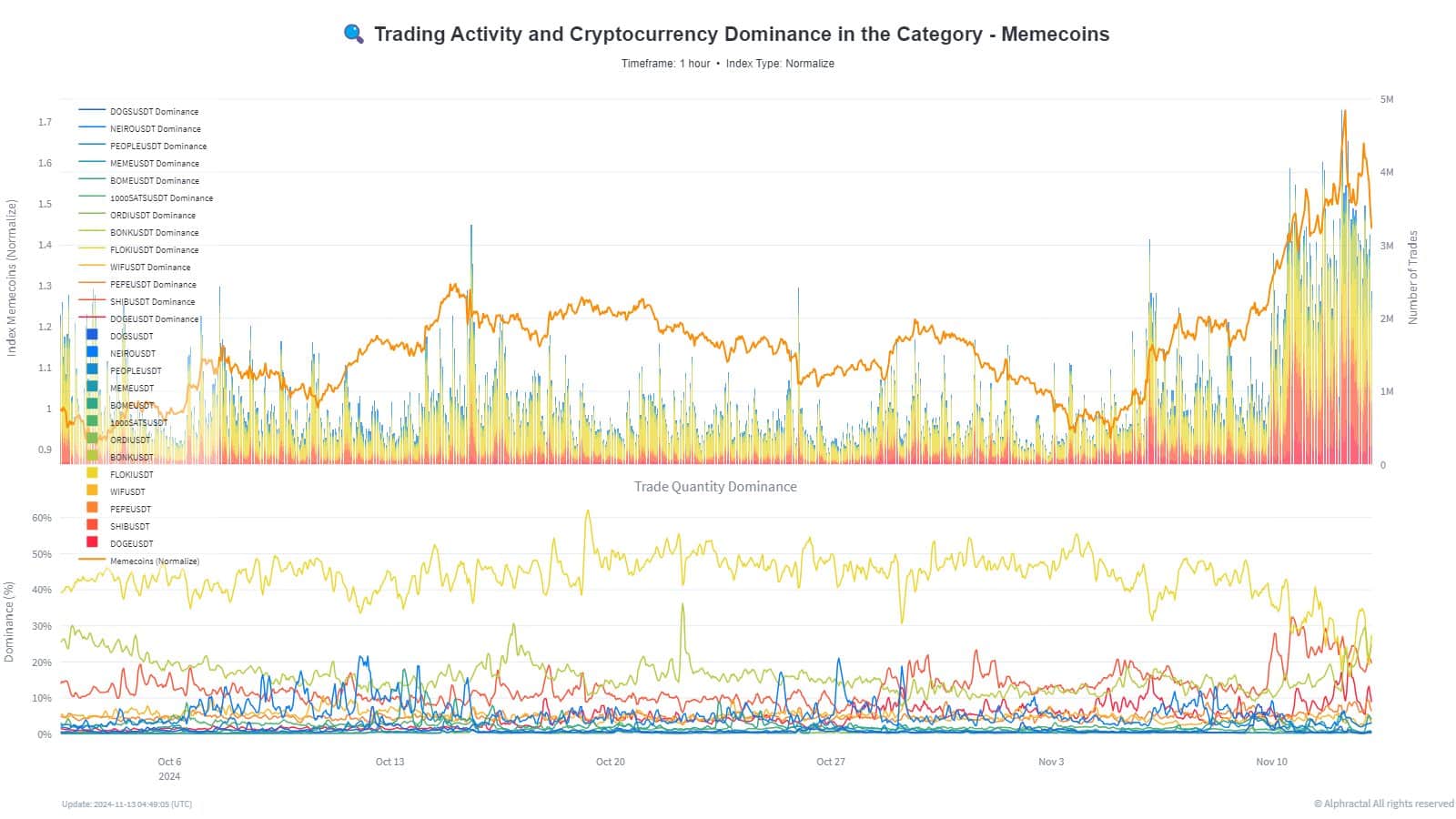

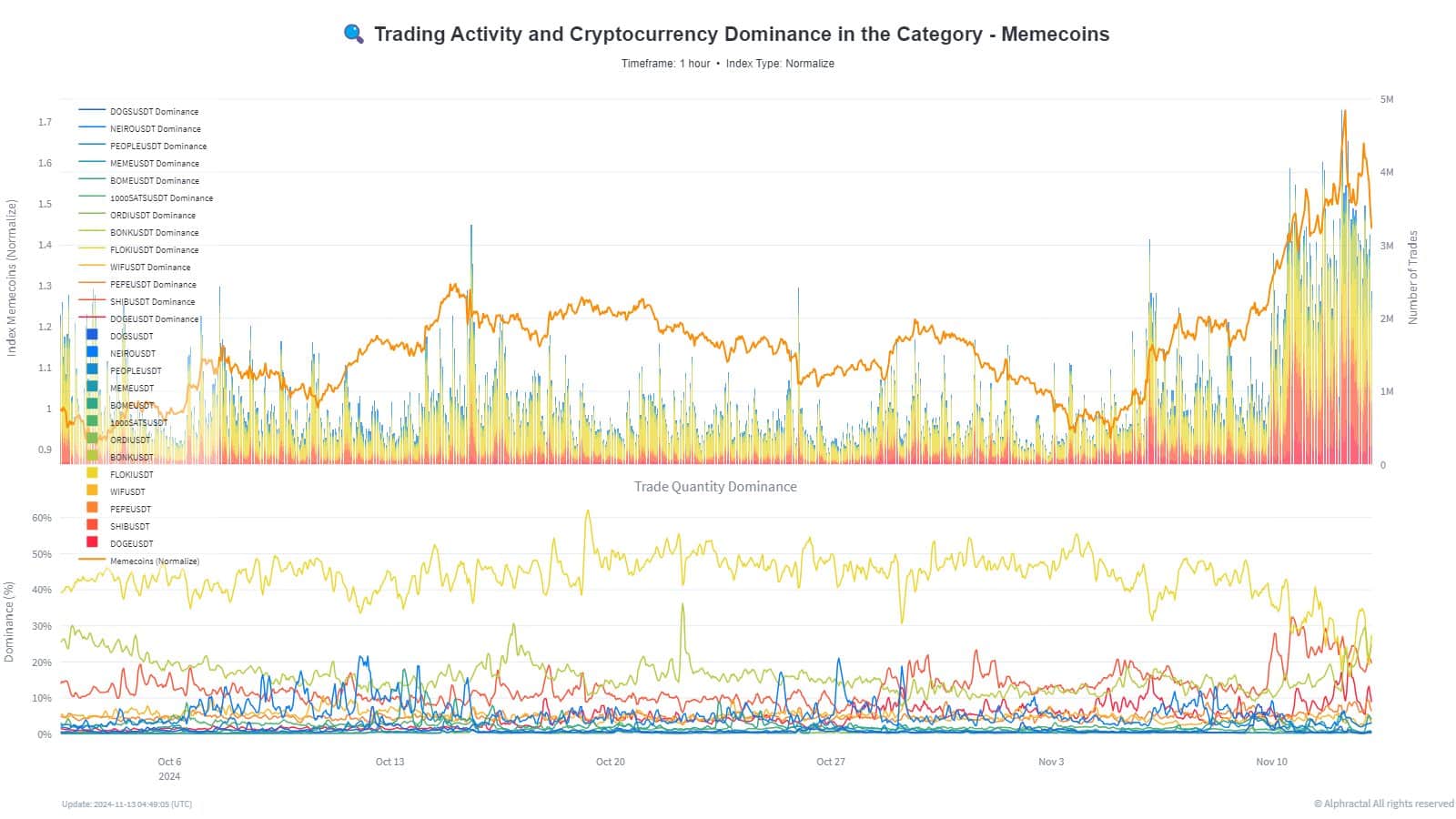

Additionally, trading activity and cryptocurrency dominance in the meme category through 2024, showed that FLOKI initially led in trade volume but was eventually overtaken by SHIB, BONK, and DOGE this week.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

This shift highlighted DOGE’s resurgence in trading activity, particularly evident in the sharp rise in its trade quantity towards the end of the year.

If the markets stabilize after recent volatility, DOGE’s dominant position and increasing trades could potentially drive its price to new highs, reinforcing its status as the leading memecoin.