- The number of short-term traders increased by 75%, signaling growing market speculation on INJ.

- INJ bounced off $25 support, eyeing a rally to $35.

Injective [INJ] has shown a promising rebound, with price movements showing that $30 may soon serve as a support level. Despite a slight 4.68% pullback in the last 24 hours, the broader market sentiment remains positive.

The token’s price fluctuated between $28.32 and $30.66 during this period, indicating some volatility, but overall confidence in the asset persists.

While INJ’s price is significantly below its all-time high of $52.75, reached nine months ago, the token still holds strong potential.

Trading volume remains healthy, with $184.35 million in transactions over the last 24 hours. Institutional backing, including support from BlackRock, continues to boost confidence in INJ’s future, even as broader adoption remains a challenge.

These factors offer a deflationary impact

The recent burn of over 11,309 INJ tokens during round 179 of the weekly burn event demonstrates efforts to reduce the number of INJ tokens in circulation.

With the launch of Inj_iAGENT, the burning process has become more streamlined and efficient. Speculation about burning 50% of the total INJ supply has generated excitement about its deflationary effects on the market.

This deflationary strategy aims to increase token scarcity, potentially raising INJ’s value over time. By reducing the circulating supply, Injective could attract more interest from investors. The continued success of these burn events will be key in maintaining upward pressure on INJ’s price.

Technical analysis points to…

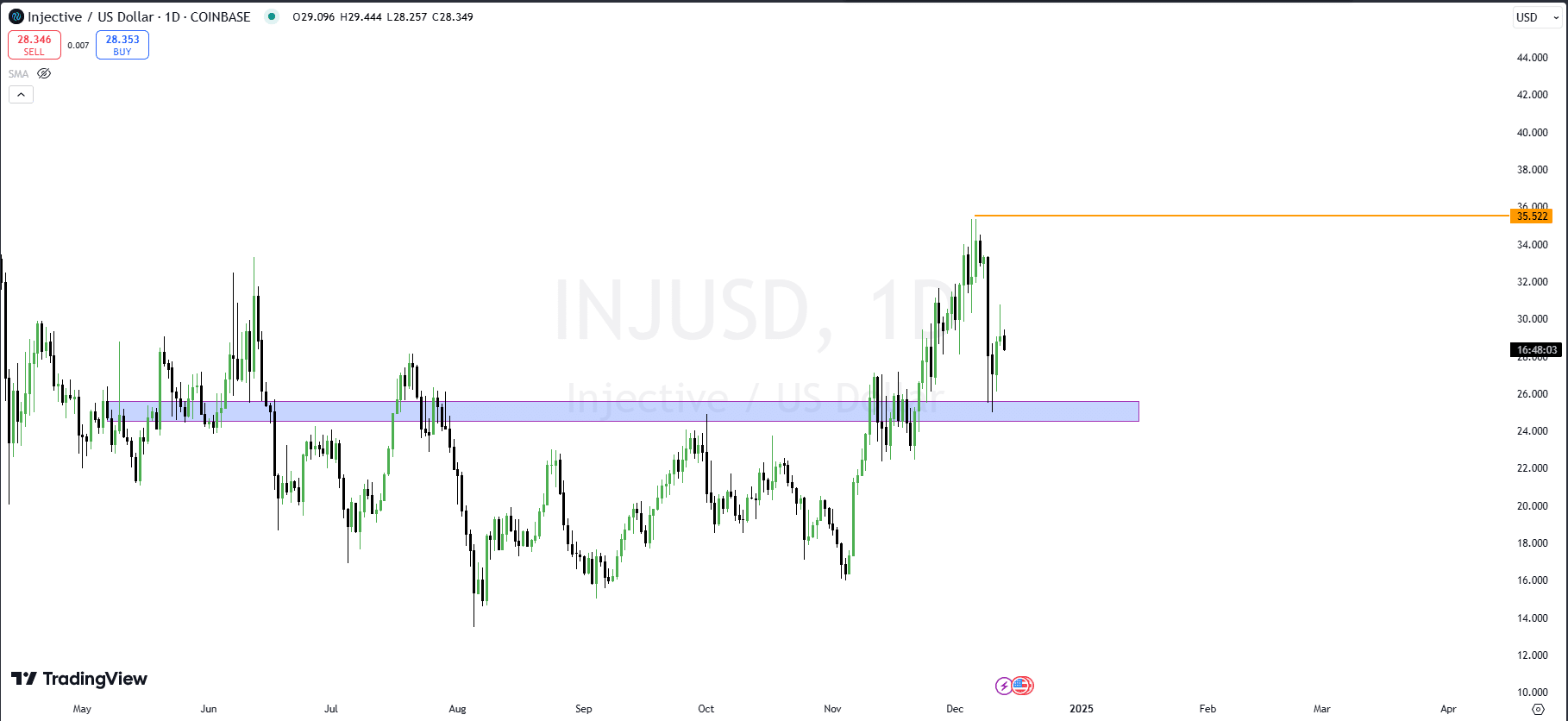

An AMBCrypto analysis on INJ shows consolidation within a range, with critical support between $25 and $30. A breakdown below this zone could signal further declines, with the next support level around $23.

However, the main resistance level to watch is near $30.00. A breakout above this could push the price towards the key $35 resistance.

Source:TradingView

The $35 mark is seen as a critical resistance level, where a successful breakout could trigger a bullish rally.

Regarding indicators, the Stochastic RSI shows a potential bullish move with a slight crossover at mid-levels. Meanwhile, the Chaikin Money Flow (CMF) remains neutral, indicating weak buying pressure.

The Alligator indicator suggests market indecision, with consolidation near the moving averages between $29.03 and $29.31.

Source: TradingView

How did short-term sentiment shift bullish?

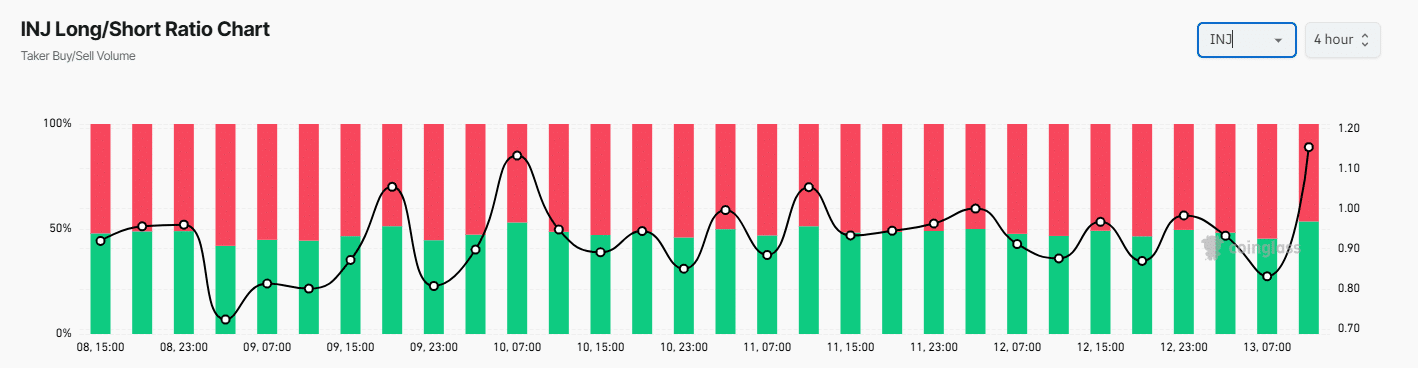

In the short term, the INJ market has shown a clear shift towards bullish sentiment. Long positions surged on the 13th of December, pushing the Long/Short Ratio above 1.10.

Source: Coinglass

The increase in long positions reflects growing optimism, while the fluctuating ratio indicates periods of market indecision. Despite fluctuations, the rising number of long positions shows renewed confidence among traders.

The Long/Short Ratio has fluctuated between 0.70 and 1.20 in recent days, with a significant rise on the 13th of December. This indicates a shift towards a more bullish market outlook, as traders adjust their positions in response to recent price action.

Holders’ behavior reflects long-term optimism

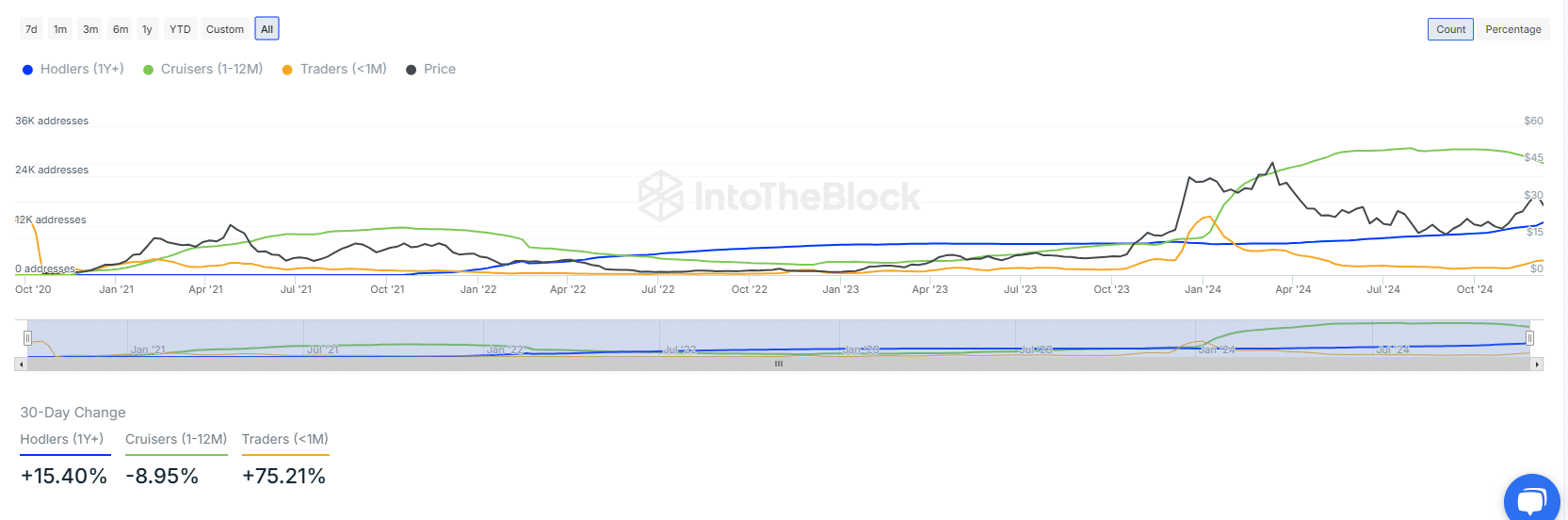

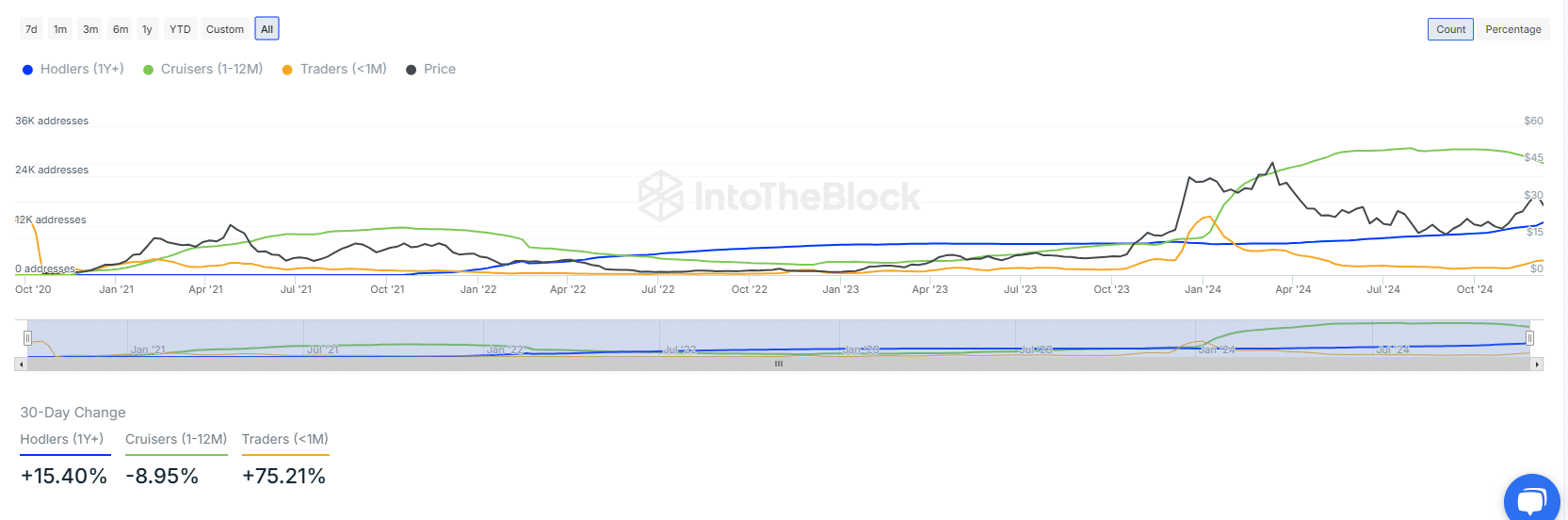

Data from IntoTheBlock showed that long-term holders have steadily increased in the past thirty days as the number of addresses holding INJ for more than a year has risen by 15.40%, signaling strong long-term confidence.

Source: IntoTheBlock

Read Injective’s [INJ] Price Prediction 2024–2025

On the other hand, short-term traders have surged by 75.21%, indicating increased speculative activity and price volatility.

Despite short-term traders’ dominance, long-term holders remain steady, reflecting confidence in INJ’s future.