- A MKR whale cashed out $7 million in the last 24 hours

- Altcoin’s price soon lost the gains it made in the previous trading session after declining by over 2%

Activity seen in a notable Maker (MKR) wallet over the last four months could be a sign of a strategic approach to depositing significant volumes of MKR tokens into exchanges. In fact, an analysis of these transactions suggests that the timing of these deposits closely aligns with the price trends of MKR – Implying a calculated decision-making process.

Maker whale makes more deposits

According to data from Lookonchain, a significant Maker (MKR) wallet has been actively depositing MKR tokens into Binance since April 2024. Most recently, this wallet deposited 2,500 MKR tokens, valued at approximately $7 million, based on current market prices. Since April, this wallet has deposited a substantial total of over 20,000 MKR to the exchange – Collectively worth over $55 million.

At the time of writing, the wallet still retained around 6,405 MKR though, estimated to be worth around $18 million.

The wallet’s ongoing activity, including substantial deposits over several months, highlights its potential impact on the liquidity and price stability of MKR on the exchange. Hence, it’s worth asking the question – How much impact did it have on the price?

How Maker has trended since April

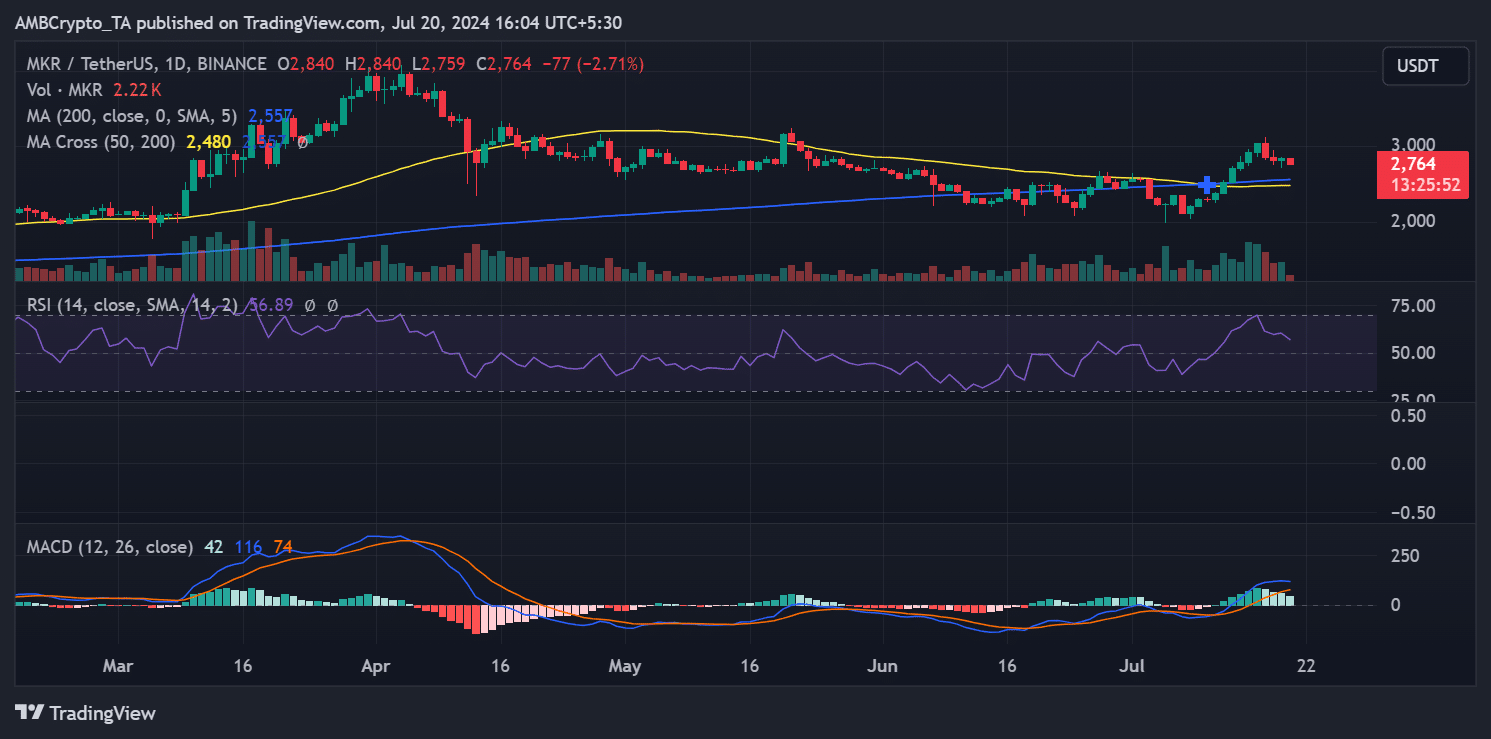

An analysis of Maker (MKR) on the daily timeframe chart over the last four months shows fluctuating prices with significant variations. According to data from Lookonchain, the wallet has strategically capitalized on these fluctuations, typically selling MKR at higher price points.

One notable instance of strategic selling by this wallet was first tracked on 24 April. On this day, MKR’s price showed considerable volatility, opening at around $2,900, peaking at over $3,000 during the session, and eventually closing at approximately $2,874.

Source: TradingView

MKR later registered a significant decline starting around 17 July. However, just a day before this downturn, MKR’s price briefly rose to over $3,000, marking its first ascent to this level since May.

This peak presented a strategic selling opportunity, and the notable Maker wallet continued its pattern of depositing and selling at profit during this period.

At the time of writing, MKR was trading at around $2,765, on the back of a 2% decline. This downturn in price could suggest a cooling-off period after the recent spike or a reaction to broader market movements.

MKR flow stays normal

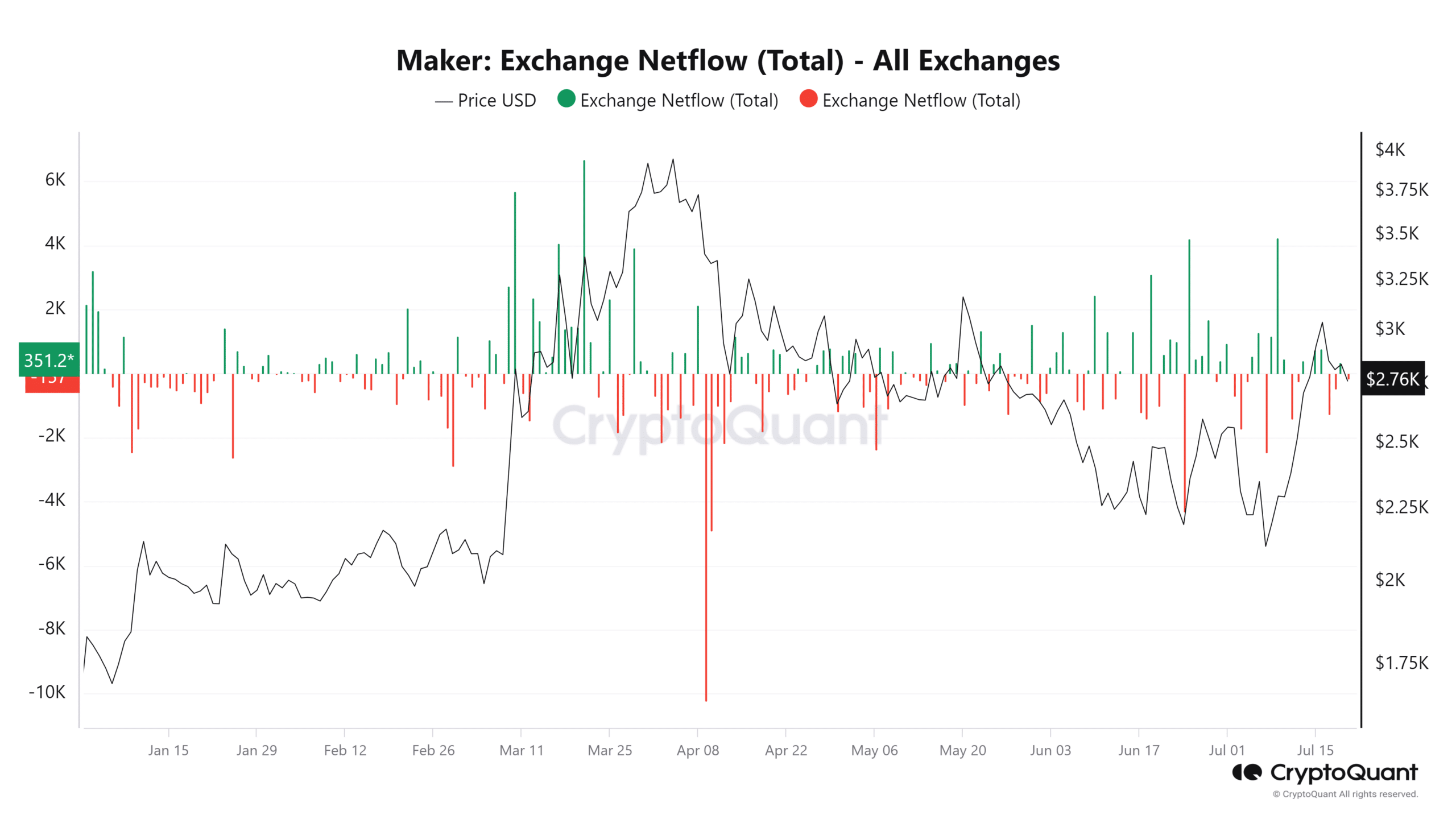

The whale’s recent activities might suggest significant market moves, yet the overall Maker netflow indicated a relatively stable trend over the last few days.

In fact, an analysis of CryptoQuant revealed that on 19 July, the netflow was positive, with an inflow of 351 MKR to exchanges.

Source: CryptoQuant

– Realistic or not, here’s MKR’s market cap in BTC’s terms

At the time of writing though, the netflow was negative at -150 MKR, reflecting a higher volume of withdrawals than deposits.