- Despite its recent subdued performance, the Litecoin price prediction showed a potential rally, aiming to revisit its July high of $76.78.

- Caution is advised, however, as current liquidation data pointed to a possible decline before any upward movement materializes.

Over the past periods, Litecoin [LTC] has shown modest gains, with increases of 6.67% on a weekly basis and 2.27% monthly. The daily figures paint a grim picture, showing a decline of 1.22%.

AMBCrypto’s analysis suggested that while the possibility of further losses looms in the ongoing trading session, signs of an impending recovery are becoming apparent.

Litecoin price prediction

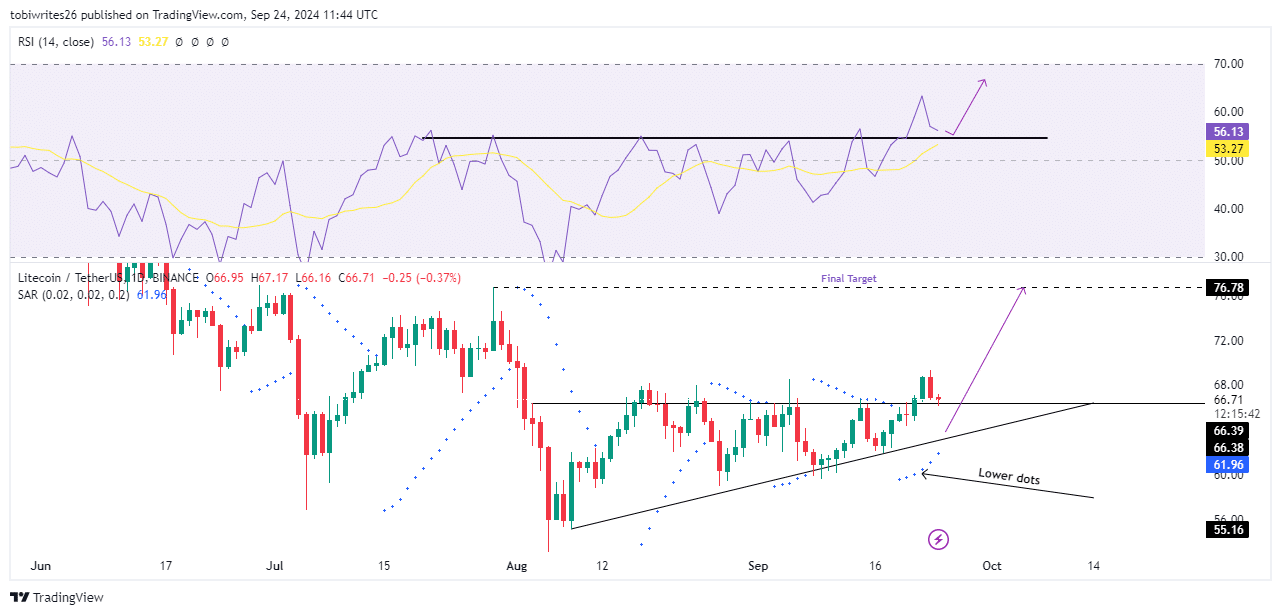

Litecoin is anticipated to rally, potentially reaching a trading price of $76.78.

This forecast comes in the wake of what AMBCrypto identifies as a stop hunt—a tactic where major players manipulate prices to trigger stop-loss orders before capitalizing on the resultant movements.

Recently, SUI’s price momentarily surpassed the upper resistance of its ascending triangle pattern in a classic stop-hunt scenario.

This maneuver led to a brief price surge, which allowed larger investors to sell at beneficial prices before the market resumed its original downward trend.

Should this pattern hold, LTC is expected to revert to the support level of the ascending triangle.

If the momentum at this level is sustained, LTC could climb to a new high of $76.78, a level associated with a high level of liquidity, indicating a strong recovery trajectory.

Source: TradingView

Bullish trends persist in market analysis

Current market indicators suggest that bullish momentum remains active. As of this writing, both the Relative Strength Index (RSI) and the Parabolic SAR (stop and reverse) indicated continued bullish activity.

Analysis of the trend line associated with the RSI predicted a potential dip for Litecoin (LTC) to the trendline support at $54.63 before it rebounds upward.

This anticipated drop aligned with technical forecasts, suggesting a short-term decline prior to a significant upward movement.

Concurrently, the Parabolic SAR continued to signal bullish conditions, which is showcased by LTC prices trading above the indicator’s dots.

Source: Trading View

This positioning confirmed that buyers maintained control, and the current price retracement is likely just a temporary market correction before a further ascent.

Market liquidations indicate short-term declines

Liquidation, which is the mandatory closure of a trader’s position due to inadequate margin when prices move unfavorably, is pointing towards short-term downturns.

In recent developments, long traders have faced significant liquidations, with this group accounting for $64.23k of the $77.74k lost.

This surge in liquidations suggests the LTC market is bracing for further price declines.

Source: Coinglass

Read Litecoin’s [LTC] Price Prediction 2024–2025

The current data indicates that Litecoin will see a temporary drawdown back to the support level of the ascending triangle.

However, this is likely to be followed by a massive rebound, reinforcing the cyclical nature of market movements.