- LTC has surged by 6.69% over the past 24 hours.

- With a bullish crossover, Litecoin seems positioned for recovery on its price charts.

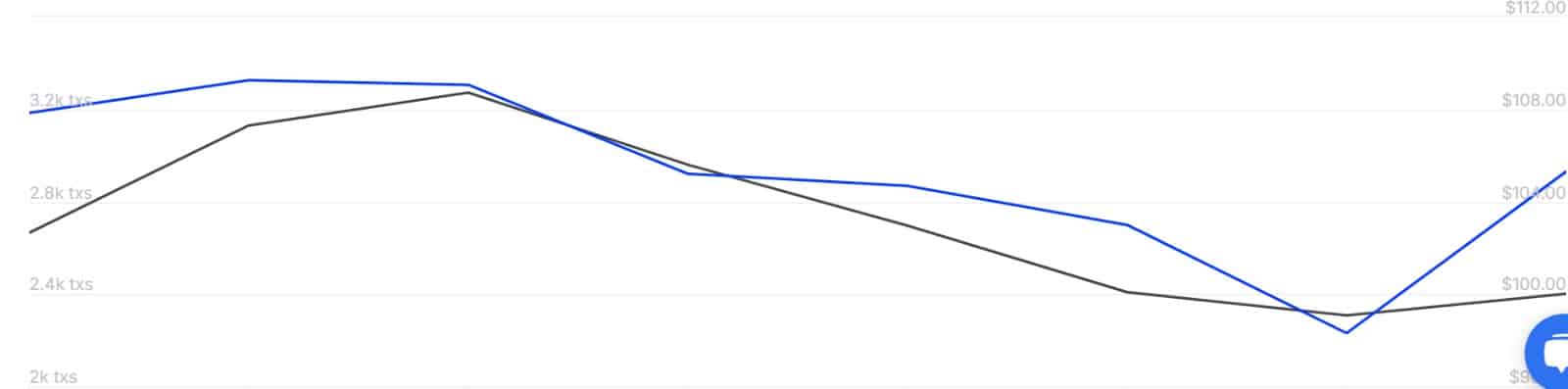

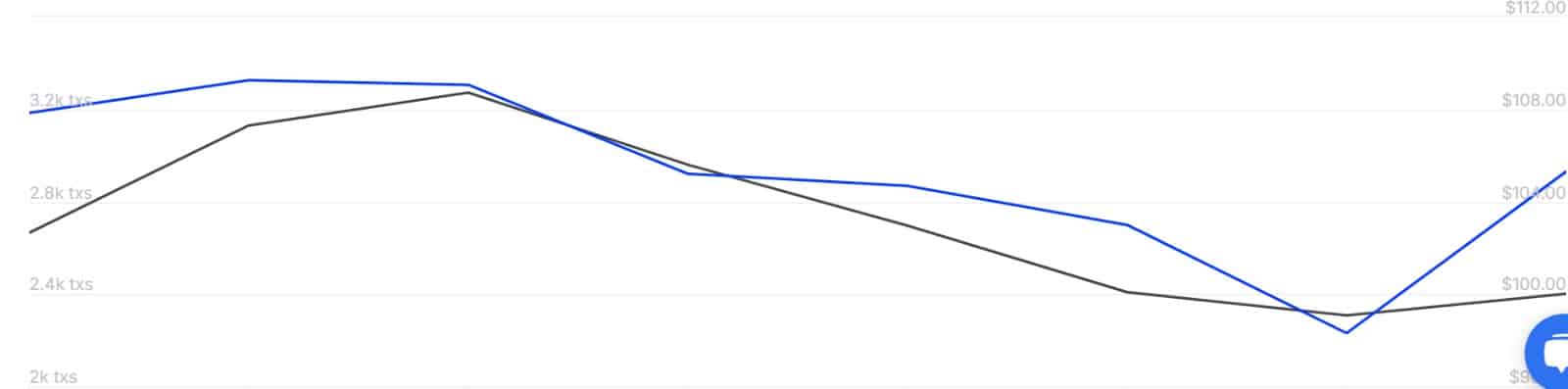

Over the past three days, Litecoin [LTC] has experienced a sustained uptrend, signaling potential recovery. After declining to a low of $96, Litecoin has surged by 9.38%. At the time of writing, Litecoin was trading at $105, marking a 6.69% increase over the past 24 hours.

Before these gains, LTC was on a downward trend, with declines of 3.4% on the weekly chart and 13.97% on the monthly chart.

The recent gains prompt questions about the altcoin’s future trajectory. Is LTC on the verge of a sustained recovery, or is this just a market correction driven by New Year speculations?

Is LTC ready for a sustained recovery?

According to AMBCrypto’s analysis, Litecoin was experiencing strong upward momentum amid increased buying pressure.

These market conditions could position Litecoin for further gains on its price charts.

Source: TradingView

To begin with, Litecoin has experienced a bullish crossover on its Stochastic (Stoch) indicator over the past 24 hours. This indicates that market momentum is shifting to the upside, potentially leading to a price increase. This crossover signals a buying opportunity for many traders.

Similarly, Litecoin’s Relative Strength Index (RSI) has also shown a bullish crossover, further confirming increased buying activity. With heightened buying pressure, demand could drive prices higher.

Source: IntoTheBlock

Looking further, this observed buying pressure is largely driven by whales. As such, large transactions have surged by 31.3% over the past day. With whales entering the market, it seems they are bullish and anticipate further gains.

Source: Coinglass

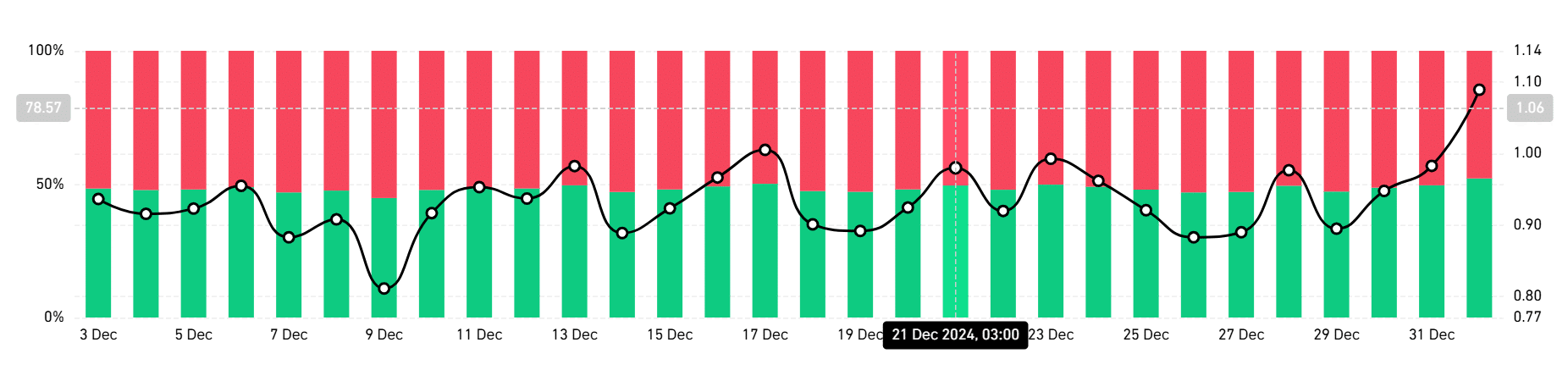

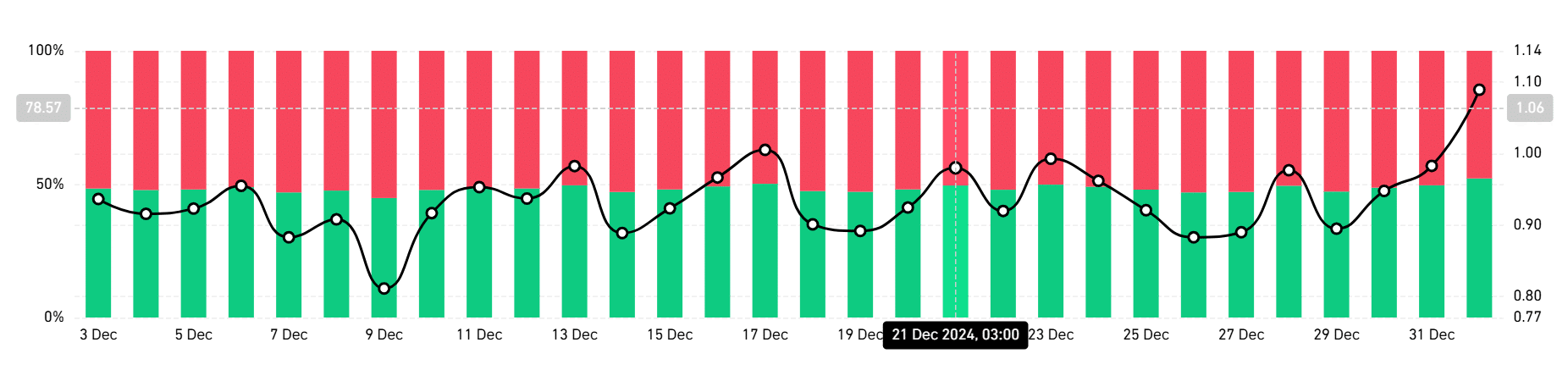

Additionally, this bullishness is further evidenced by increased demand for long positions. According to Coinglass, longs are dominating the market with 53% of the total. With longs dominant, it suggests that most traders anticipate LTC prices to rise.

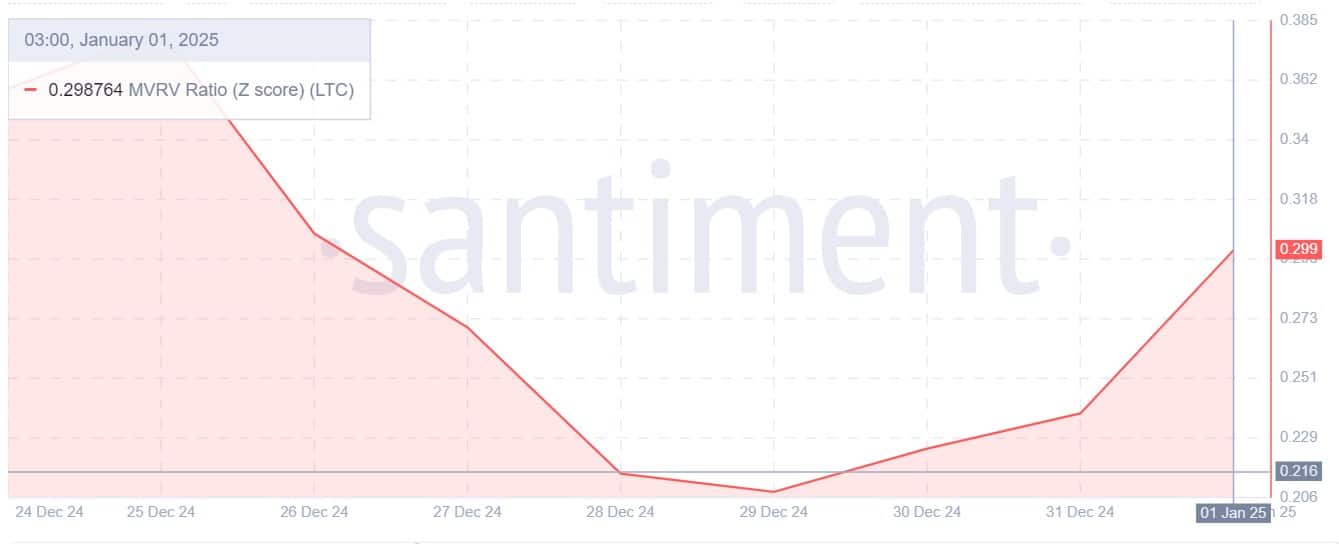

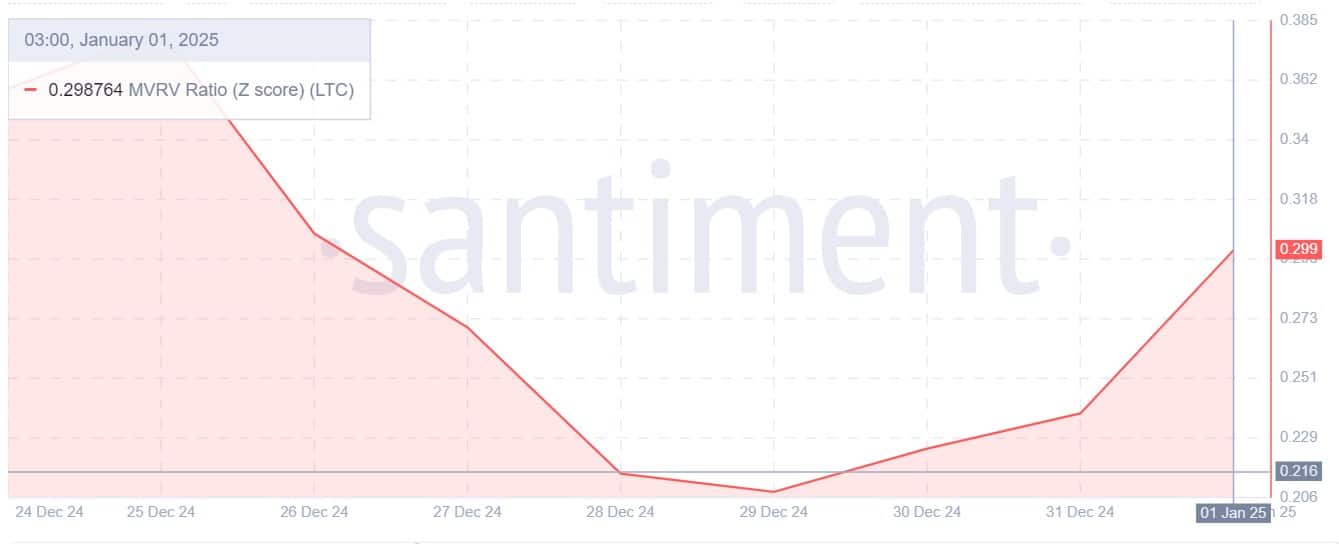

Source: Santiment

Finally, Litecoin’s MVRV ratio, which had previously declined to an extremely undervalued zone, is now indicating a potential upward reversal.

The MVRV ratio increased from 0.208 to 0.29. When the MVRV starts rising, it signals that an asset is recovering from undervaluation due to increased buying interest and decreasing selling pressure.

Is your portfolio green? Check out the Litecoin Profit Calculator

With the recent price upsurge, Litecoin’s long-term holders have become more confident as their profit margins rise while the overall market has turned bullish. With bullish sentiment dominating the market, LTC could see more gains on its price charts.

If this optimism is maintained, LTC will reclaim the $115 resistance level. A breakout from here will drive prices back to $130. Subsequently, if bulls fail to hold the market, we could see the altcoin dip to $96.