- LDO’s breakout above $1.68 and 8.36% surge targets $2.50 and potentially $3.50.

- Market sentiment is bullish with strong metrics, including a 26.25% open interest increase.

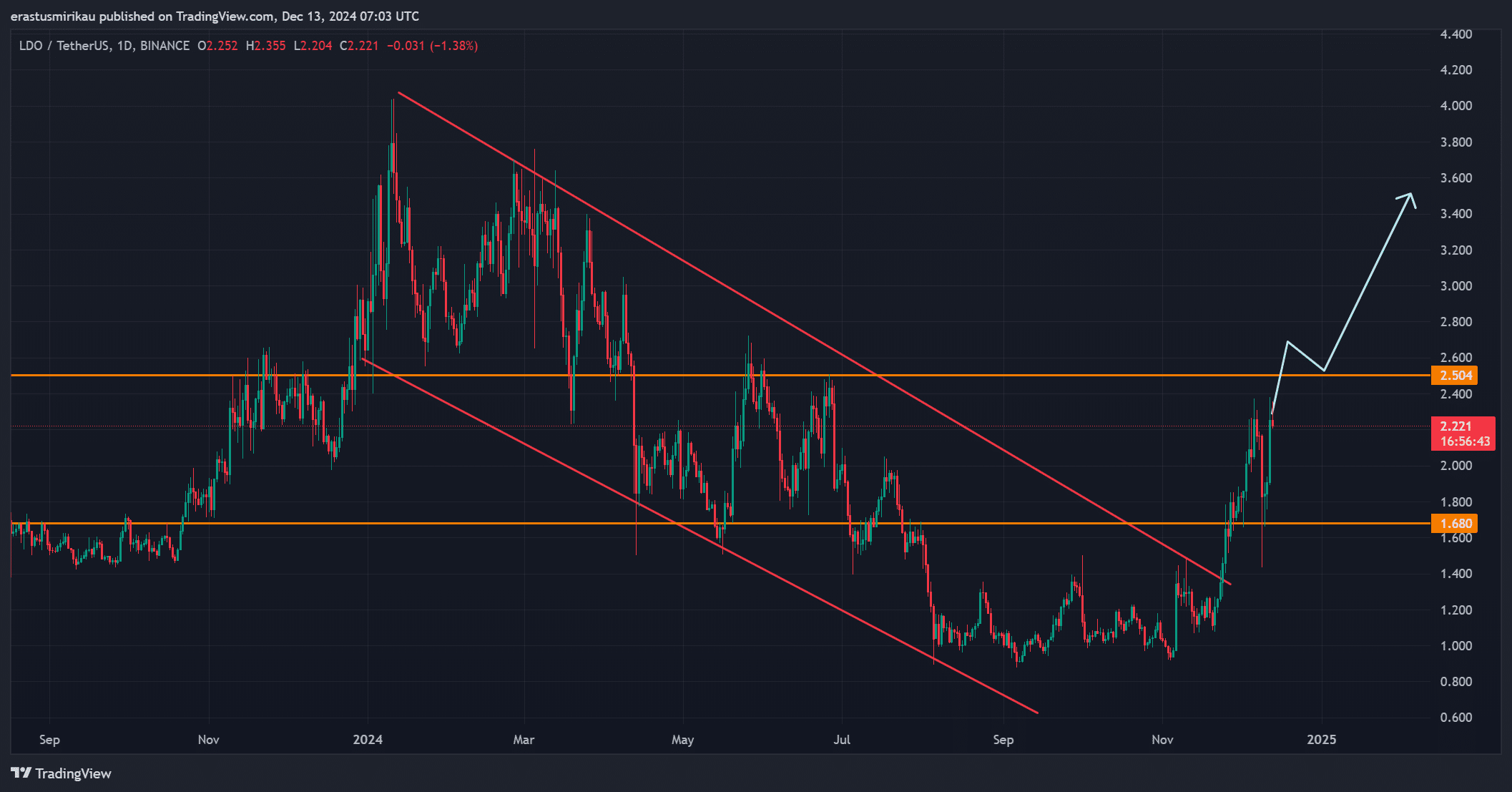

Lido DAO [LDO] has recently captured market attention after breaking free from a prolonged descending channel, showcasing significant bullish momentum. The token has surged by 8.36% over the past 24 hours and was trading at $2.22 at press time.

With this price rally, LDO now tests the critical $2.50 resistance level, positioning itself for further upward movement. However, the ability to maintain this trajectory remains uncertain as resistance levels could dictate the next trend.

Lido price movement and key resistance levels

LDO’s recent breakout above the $1.68 support level signifies a strong shift in market sentiment. The token has gained over 32% in the past week, demonstrating its potential to push higher.

Additionally, $2.50 now acts as a key resistance level, and a successful breakout here could set the stage for a rally toward $3.50. Conversely, failure to hold above $2.50 may trigger a period of consolidation or retracement, requiring cautious optimism from traders.

Source: TradingView

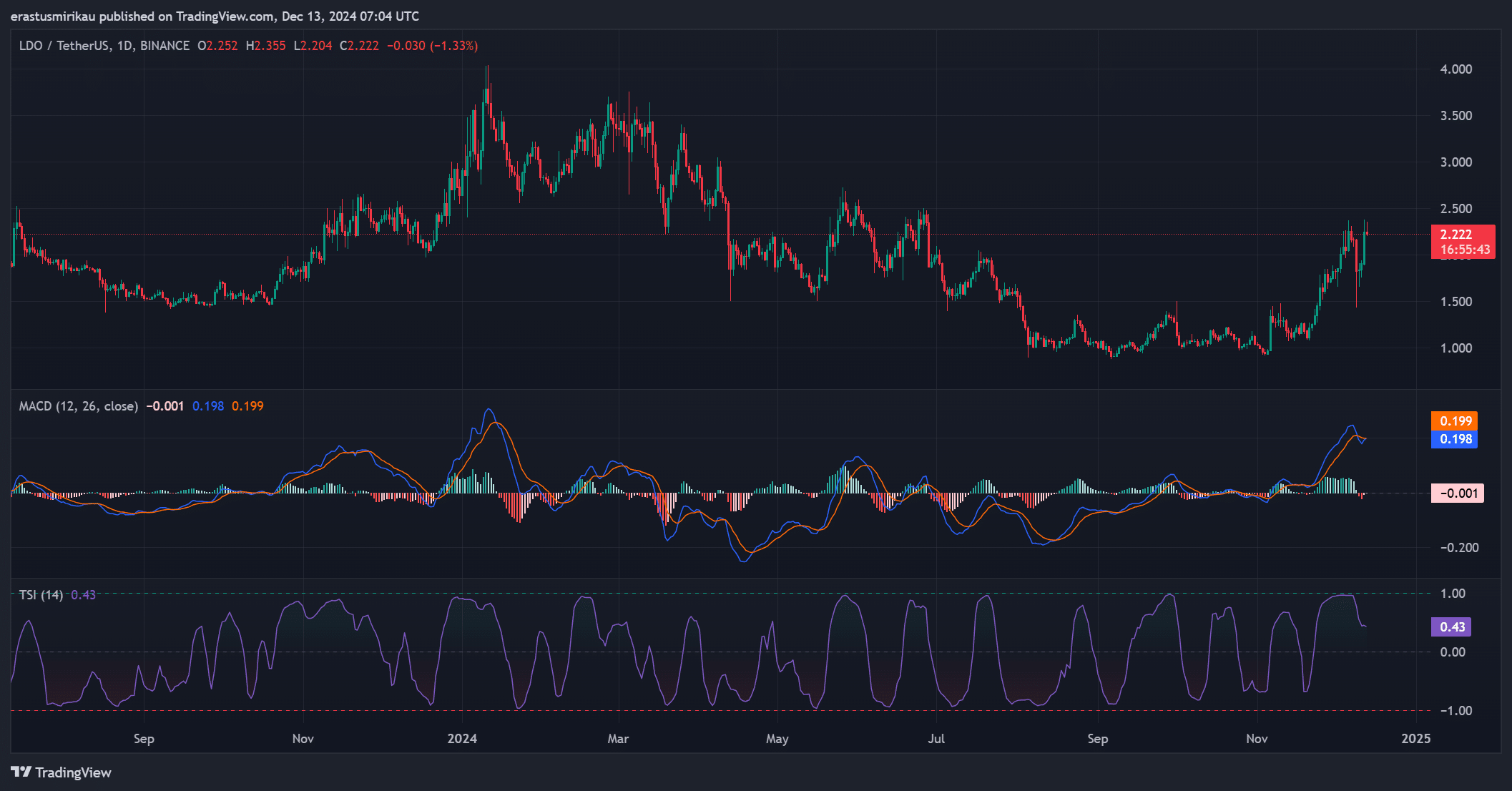

LDO technical indicators and momentum analysis

The technical setup strongly supports bullish momentum. For instance, the MACD histogram shows a positive reading of 0.198, indicating growing buyer interest. Furthermore, the True Strength Index (TSI) stands at +0.43, reflecting a strong uptrend.

These indicators confirm that market dynamics favor further price appreciation. However, traders should closely monitor any weakening in these metrics, as volatility remains a critical factor.

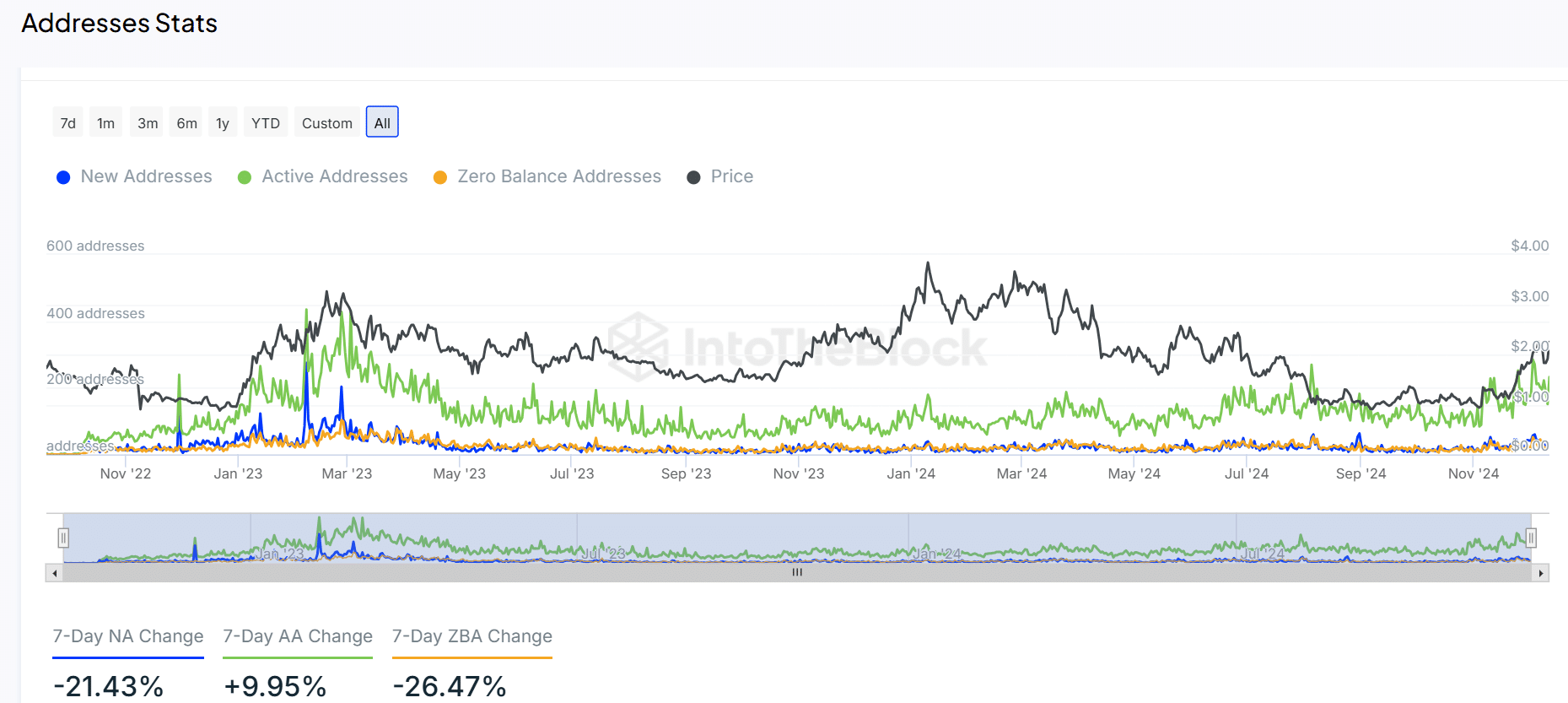

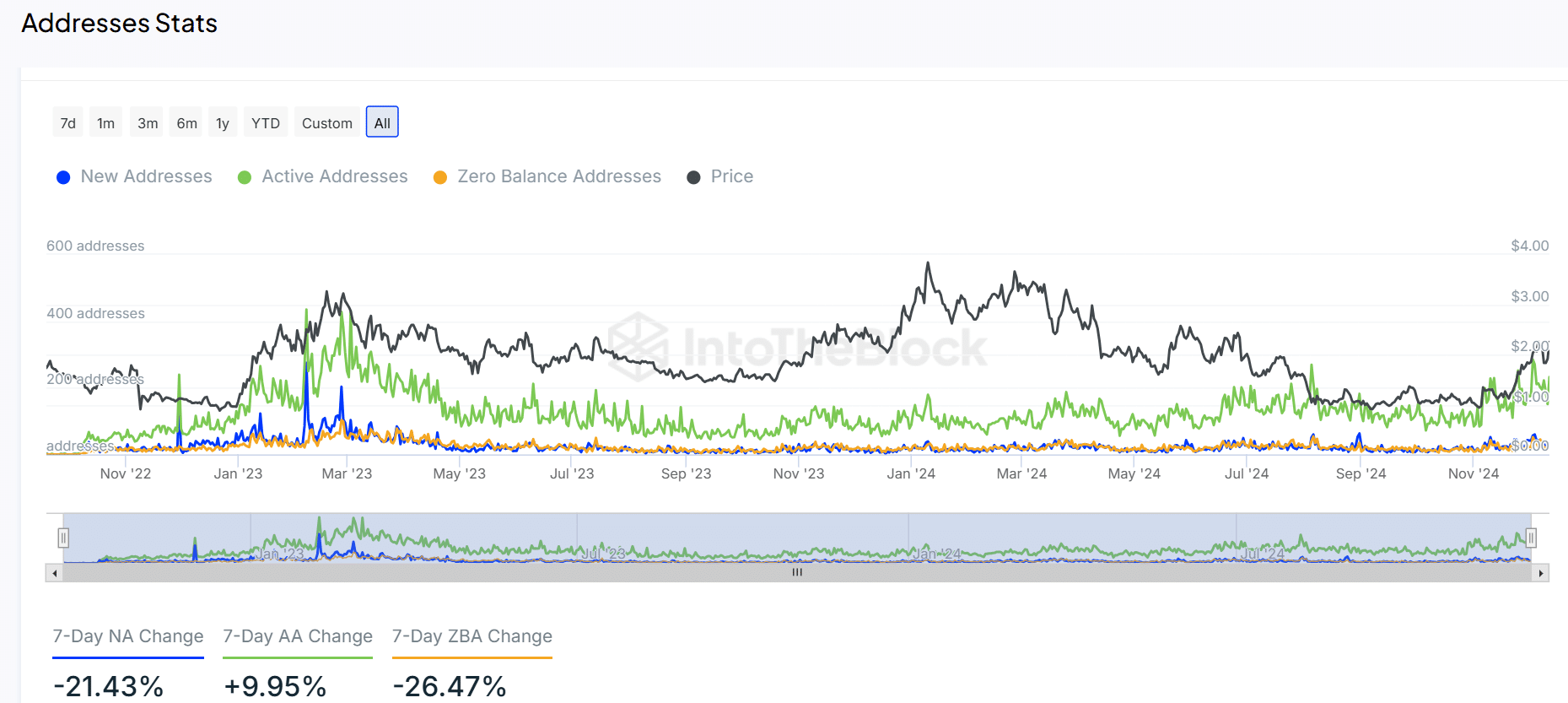

Network activity and address stats

On-chain data reveals interesting dynamics. Active addresses have increased by 9.95% in the last seven days, signaling heightened engagement from existing users.

However, new address creation has dropped by 21.43%, highlighting a cautious approach from new participants.

Therefore, while the current network is active, sustained price growth may require broader adoption and new entrants to the ecosystem.

Source: IntoTheBlock

Market sentiment and open interest

Market sentiment has also strengthened, with open interest in LDO futures spiking by 26.25% to $156.03 million. This growth in speculative interest highlights optimism around LDO’s potential to climb higher.

Additionally, the price and Daily Active Address (DAA) divergence remain aligned, indicating that network activity is backing the recent price surge.

Source: Coinglass

Read Lido DAO’s [LDO] Prie Prediction 2024-25

Lido DAO’s rally toward $3.50 appears achievable if bullish momentum continues and network activity remains strong.

However, breaking and holding above $2.50 is crucial for sustained growth. Traders should remain vigilant for signs of weakening momentum.