- Justin Sun deposits $37.3M in EIGEN, signaling confidence in its future.

- EIGEN’s price has risen 11.69%, in the last 24 hours.

EIGEN has registered impressive market activity lately, with its price climbing by 11.69% over the last 24 hours, hitting $5.23. The cryptocurrency fluctuated between a low of $4.69 and a high of $5.23 during this period, reflecting some price volatility.

Despite these fluctuations, however, EIGEN’s market capitalization stood at $1.08 billion at press time – An uptick of 6.72%, reinforcing its appeal to investors. In fact, the cryptocurrency saw its all-time high of $5.38 just four days ago on 12 December 2024.

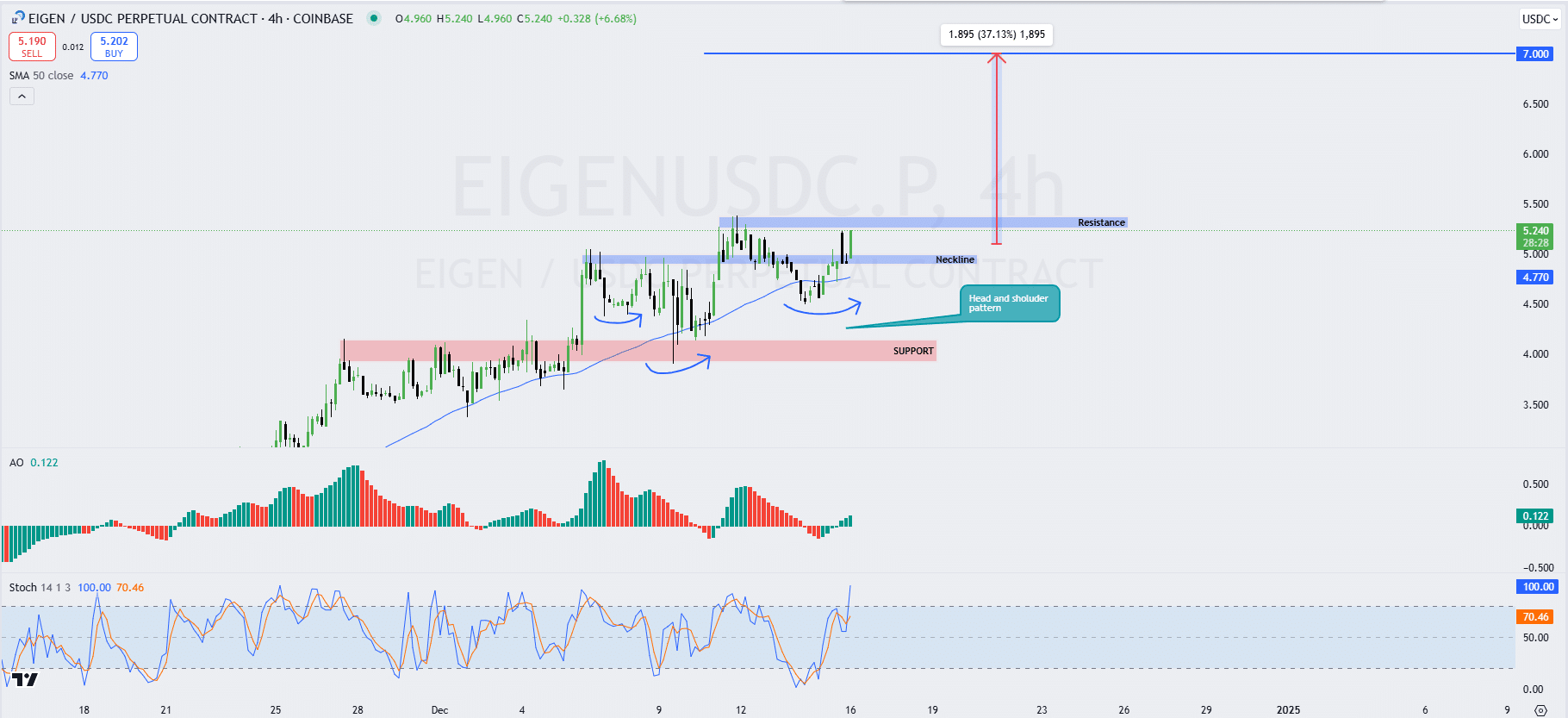

Head and Shoulders signal EIGEN’s potential for sustained growth

On the price charts, EIGEN clearly flashed a head and shoulders pattern, one which often signals a continuation of the upward trend.

The neckline of this pattern seemed to be near the $5-mark, and if the price breaks above the resistance level at around $5.38, there may be potential for a hike to $7 – Representing a 37.13% surge from its press time levels.

Additionally, there was a solid support zone around the $4.77 neckline, offering a level of stability in the market.

EIGEN 4hr chart source: Tradingview

The Stochastic Oscillator’s reading of 70.46 indicated that EIGEN has been in overbought territory. Hence, a pause or correction could be on the horizon soon.

And yet, despite this, the Awesome Oscillator’s reading of 0.122 supported the prevailing bullish sentiment, indicating positive momentum.

Can EIGEN sustain momentum with rising investor engagement?

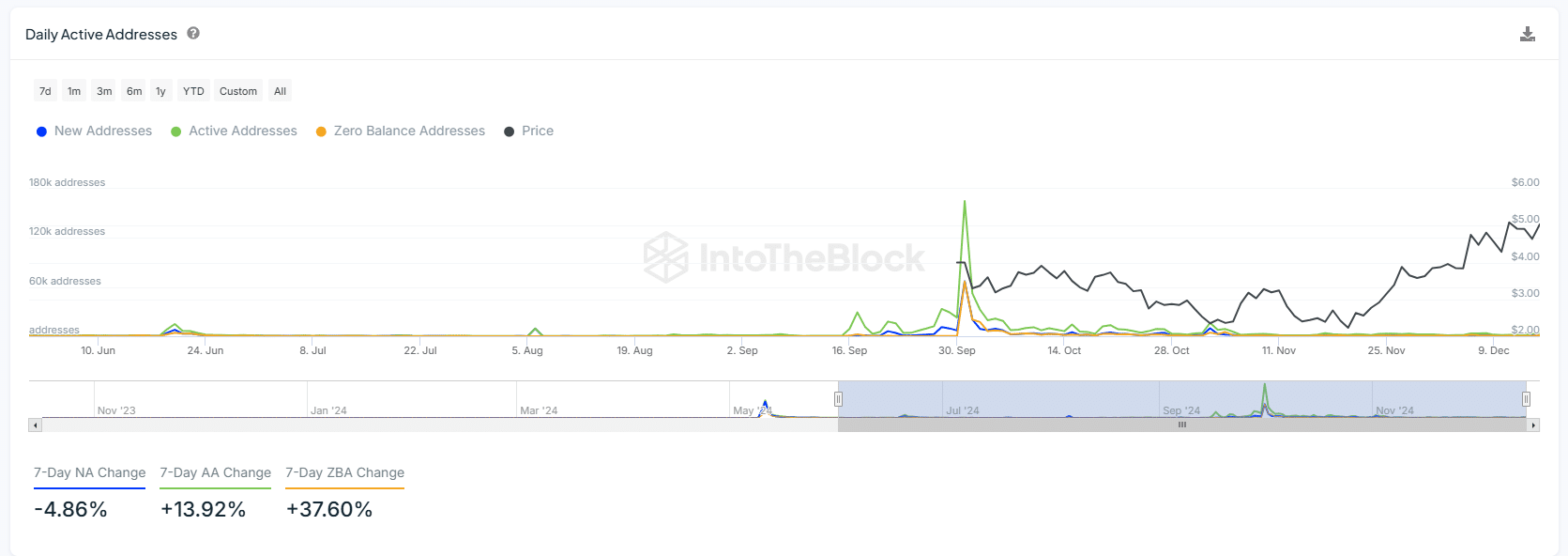

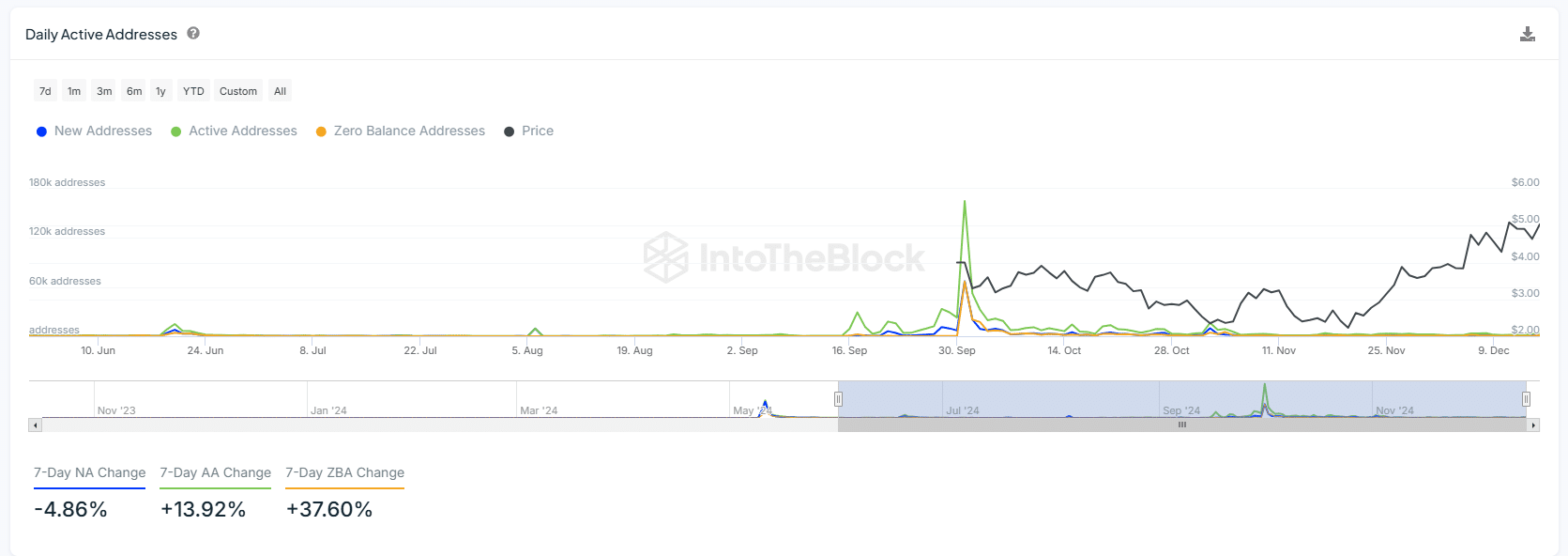

Around September 2024, a significant price hike to approximately $6 drove a surge in both new and active addresses, indicating heightened user engagement. However, in December 2024, as EIGEN’s price stabilized around $5, there was a slight decline of over 4.8% in new addresses.

Soon after, however, active addresses rose by 13.92% – A sign of growing engagement from existing users.

Source: IntoTheBlock

At the same time, zero balance addresses climbed by 37.60%, signaling that many users are holding their positions without engaging in active trading, likely awaiting further price movements.

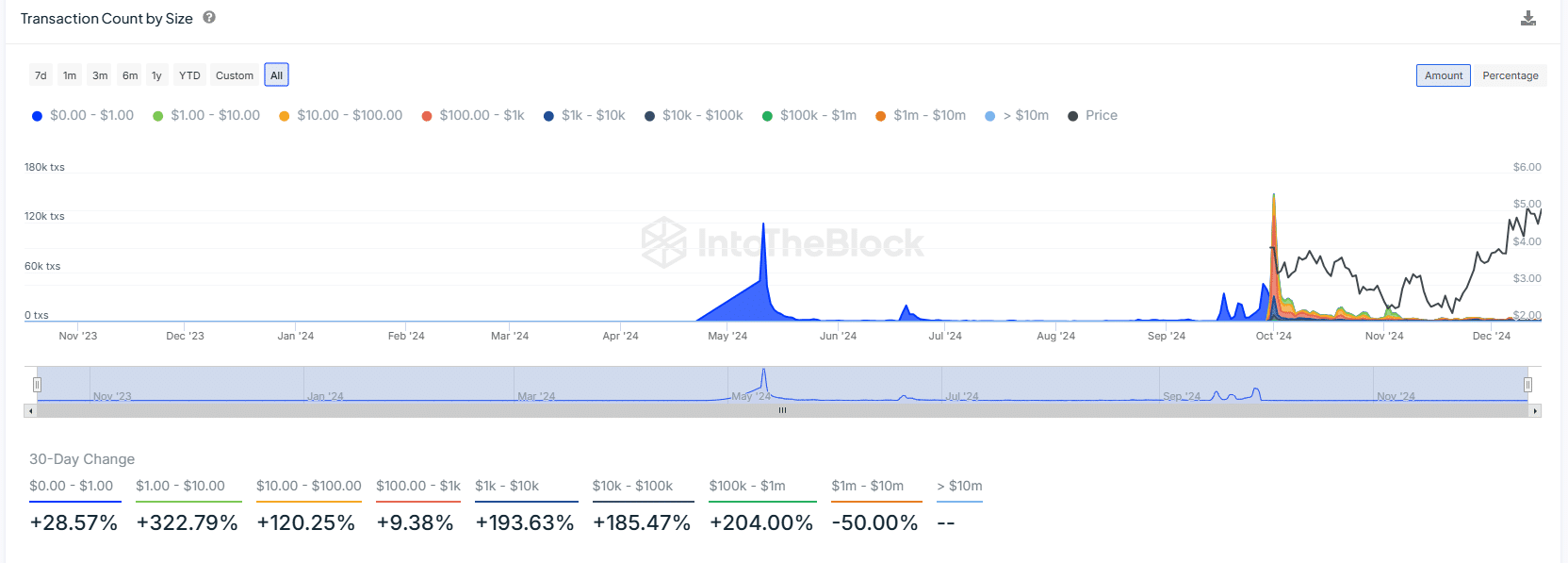

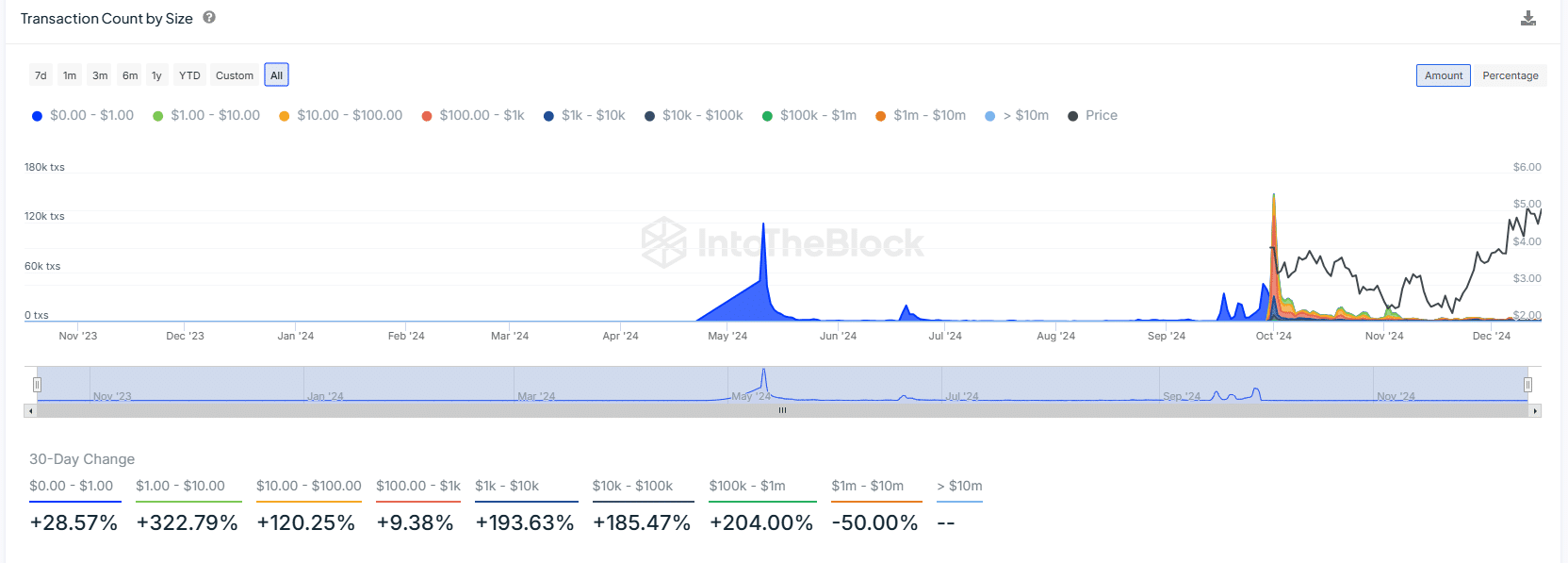

Transaction activity over the past 30 days also reflected growing interest across different market segments. Small transactions in the $0-$1 and $1-$10 categories saw significant upticks, with the $1-$10 range growing by 322.79%.

This surge has been likely driven by retail traders responding to EIGEN’s price action. Larger transactions in the $100-$1k and $1k-$10k ranges also saw major growth, with hikes of 120.25% and 193.63%, respectively.

Notably, the $10k-$100k transaction category grew by 185.47%, highlighting confidence among high-net-worth individuals and institutional players.

Source: IntoTheBlock

On the contrary, larger transaction categories such as those above $10M remain inactive, suggesting that institutional investors are yet to fully engage in large transactions.

This can be interpreted as a sign of broadening participation from both retail and institutional investors.

Justin Sun’s strategic moves underline confidence

On 10 December 2024, Sun deposited 196,380 EIGEN, worth $964K, into HTX.

This move is part of a larger strategy as since 1 October 2024, Sun has claimed and deposited 9.378 million EIGEN, worth $37.3 million, at an average price of $3.979.

As of December 2024, Sun holds 196,380 EIGEN, which has appreciated in value. His actions point to a pattern of strategic moves within the cryptocurrency market, and his ongoing accumulation of EIGEN is likely to influence market sentiment going forward.