- Bitcoin’s recent gains have been met with skepticism as exchange inflows surge, suggesting profit-taking.

- Historically, Bitcoin’s performance in September has been poor, causing market jitters.

Bitcoin [BTC] price was trading at $56,864 at press time after a 3.6% gain in 24 hours. The gains followed a 31% increase in trading volumes, per CoinMarketCap.

The renewed optimism comes despite September being one of the worst months for Bitcoin. However, despite the upsurge, several signals are yet to turn bullish, creating concerns that BTC might not be out of the woods yet.

September bears haunt traders

The general market sentiment is still bearish, with the Bitcoin Fear and Greed Index at 33, suggesting that traders were bracing for a potential repeat of previous price dips in September.

In fact, a recent report by U.S. fund manager NYDIG noted that the market could be,

“Stuck in a seasonal slog for the next month.”

The report also stated,

“On average, Bitcoin has fallen 5.9% in September and the median return is -6.0%. That’s not much solace given that September is just starting.”

The sentiment will likely change towards the end of the month. According to Rekt Capital, Bitcoin could be headed for three straight months of positive upside in the last quarter of the year.

As past price declines in September haunt traders, Bitcoin’s upside potential remains capped.

Exchange inflows reach 7-day high

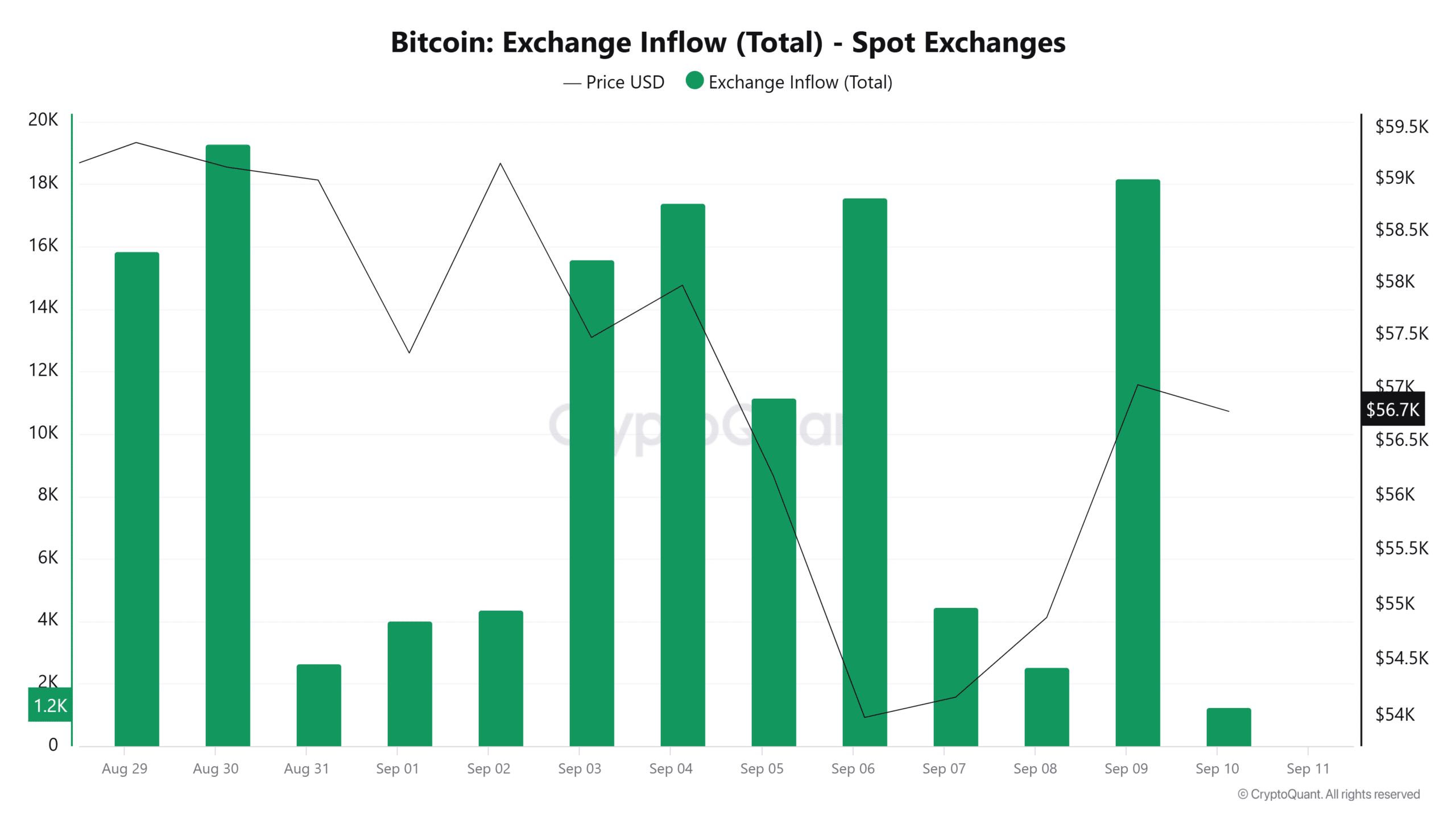

Another key signal showing that a bearish trend is in play is exchange inflows.

Data from CryptoQuant shows that on 9th September, Bitcoin inflows to spot exchanges reached 18,193, a massive jump from the 2,535 BTC posted the previous day. This was also the biggest level of inflows in seven days.

Source: CryptoQuant

The surge in inflows coincided with a recovery in BTC prices, suggesting profit-taking. It signals that traders are anticipating a bearish trend ahead as they choose to trim losses.

Such selling activity indicates that traders do not anticipate a major breakthrough in price, and Bitcoin’s uptrend might continue to face resistance.

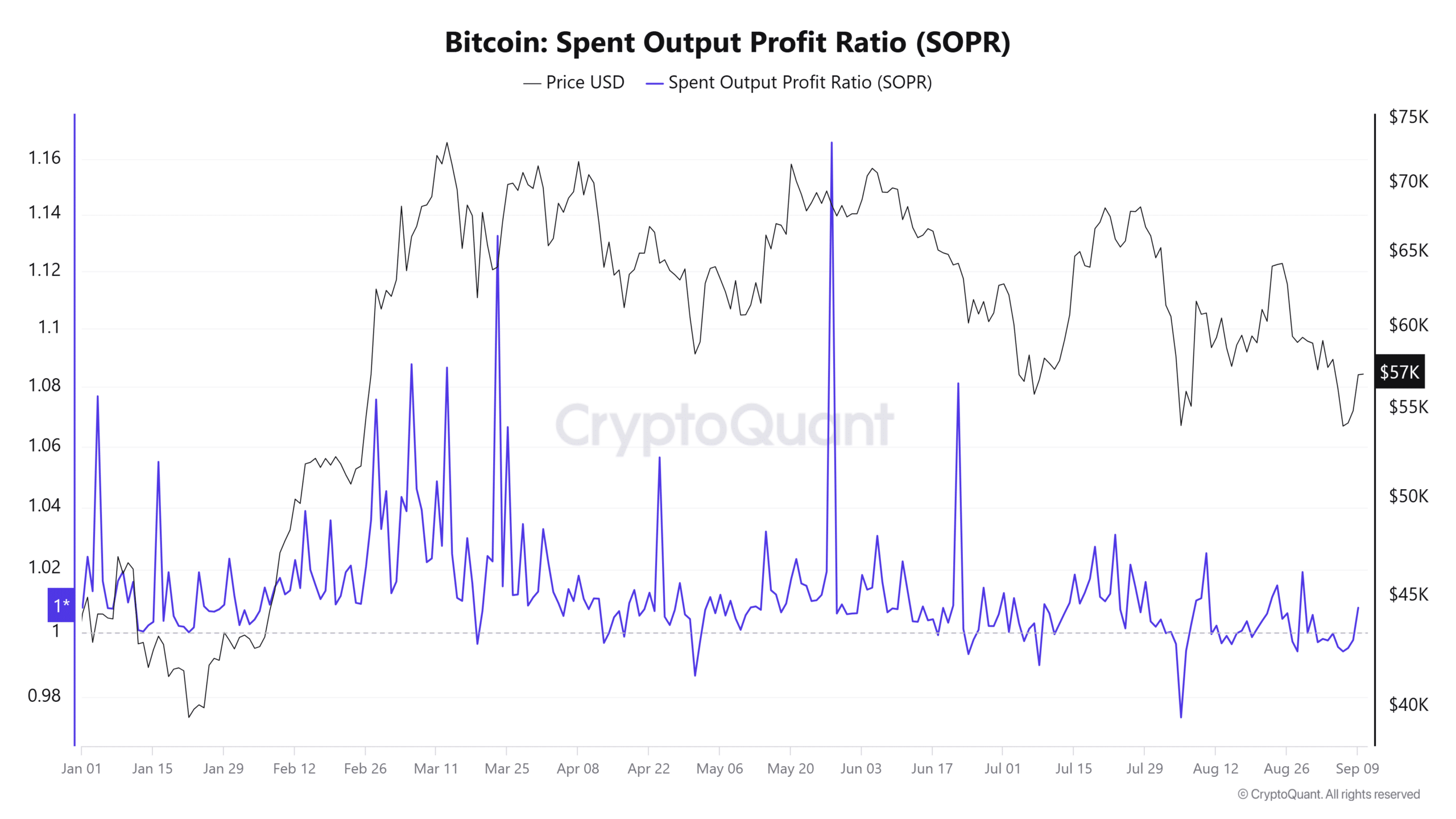

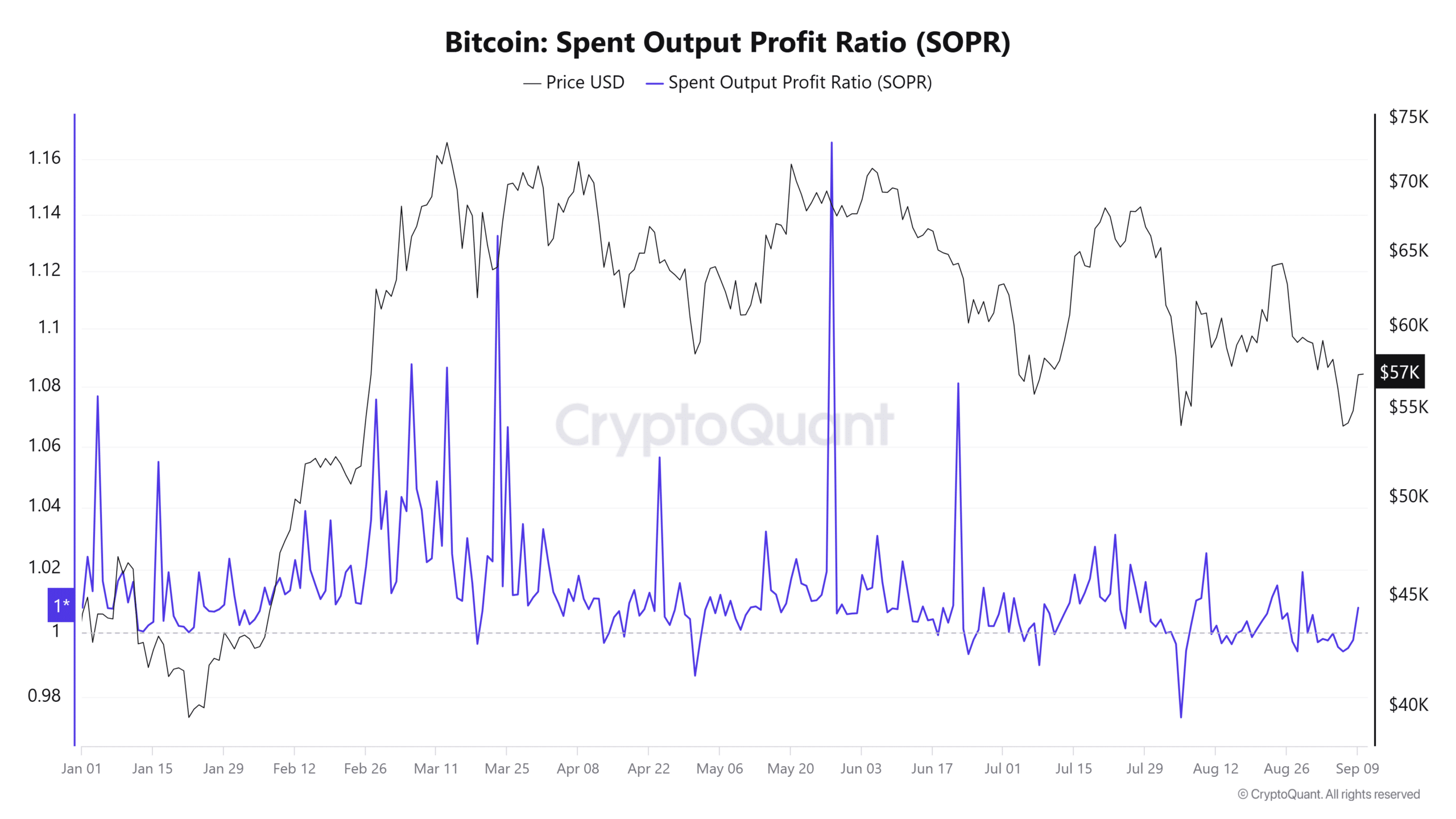

The profit-taking behavior is further seen in the Spent Output Profit Ratio (SOPR) ratio on CryptoQuant which has shifted above 1 suggesting that traders are selling to realize gains.

This can put a brake on Bitcoin’s gains.

Source: CryptoQuant

Buyers hold back

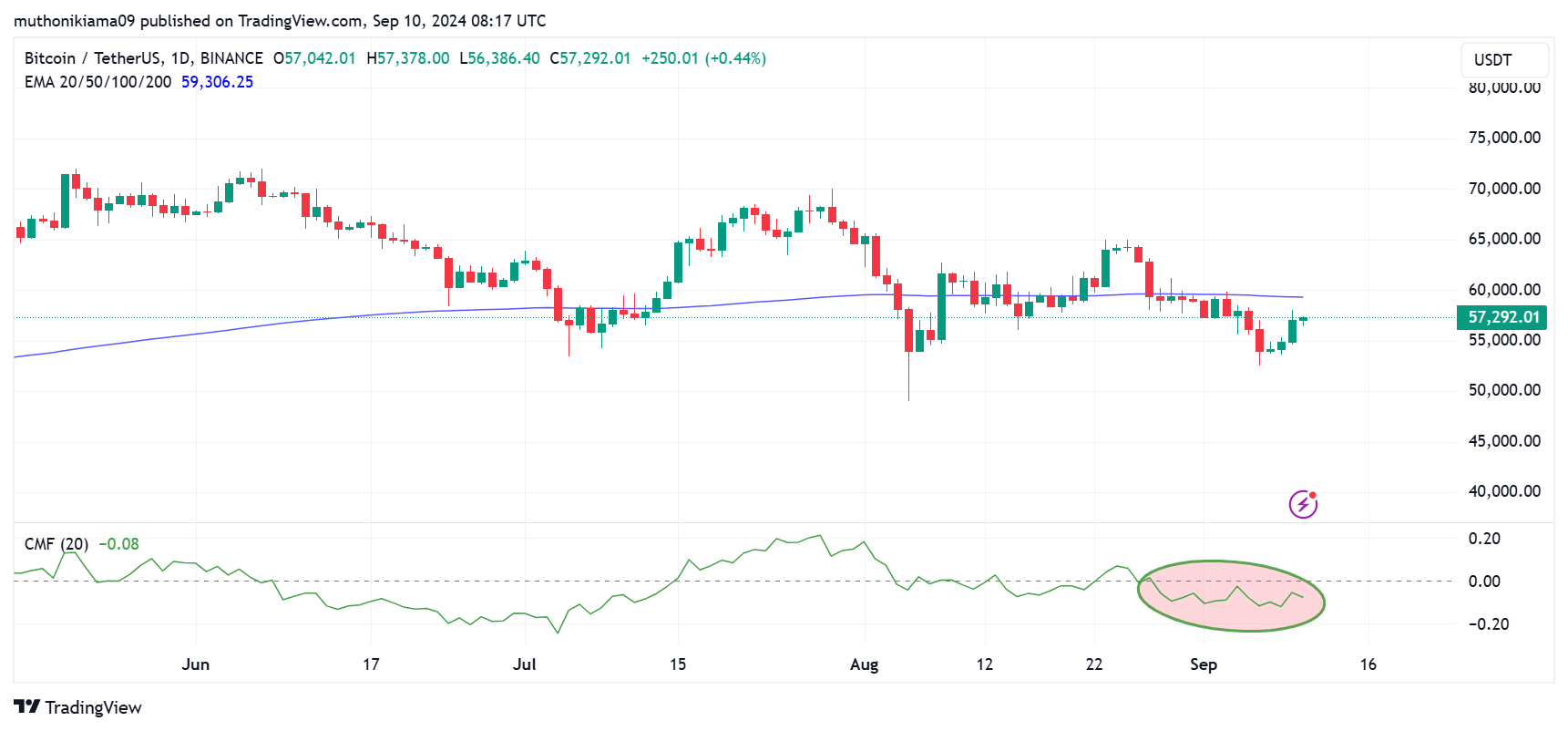

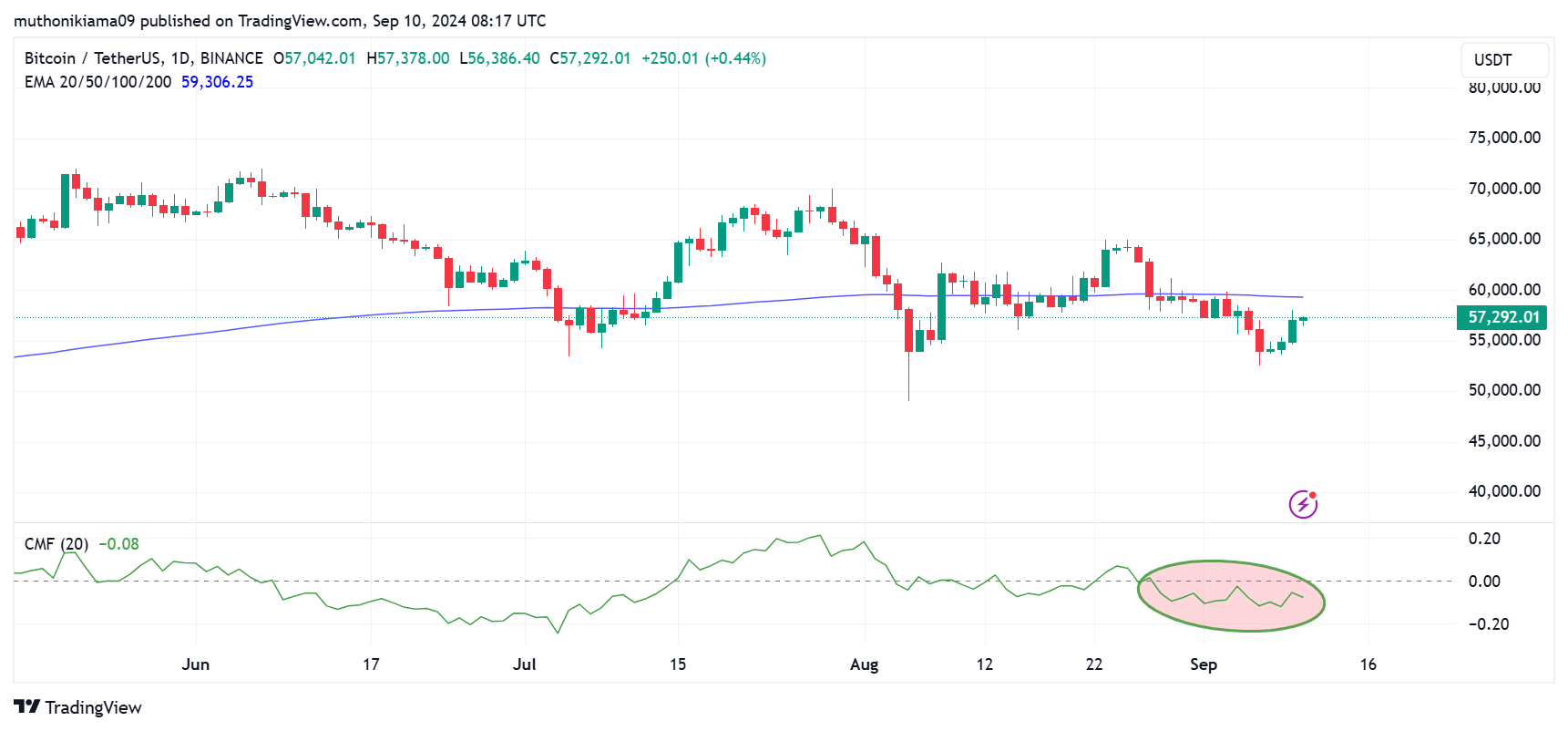

In a typical crypto bear market, buying activity remains relatively low. This trend has appeared on the Bitcoin daily chart.

The Chaikin Money Flow has been negative since the 27th of August. Despite some bouts of buying activity, this indicator has not flipped positive for two weeks.

This shows that Bitcoin has experienced more selling than buying within this period.

Source: TradingView

Moreover, BTC has traded below the 200-day Exponential Moving Average for two weeks now. This shows that the general market sentiment is negative.

The inability of BTC to reclaim the 200-day EMA also indicates a lack of confidence among traders in a near-term price recovery.

Upcoming CPI data

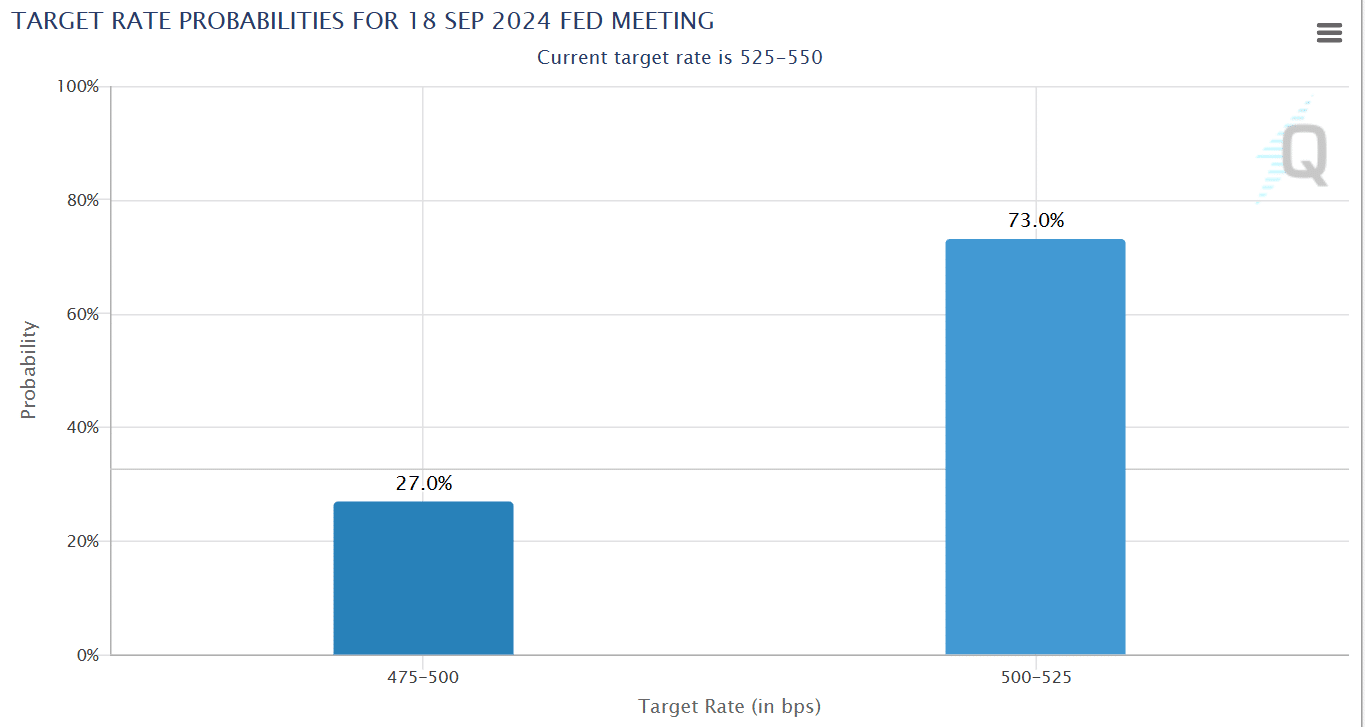

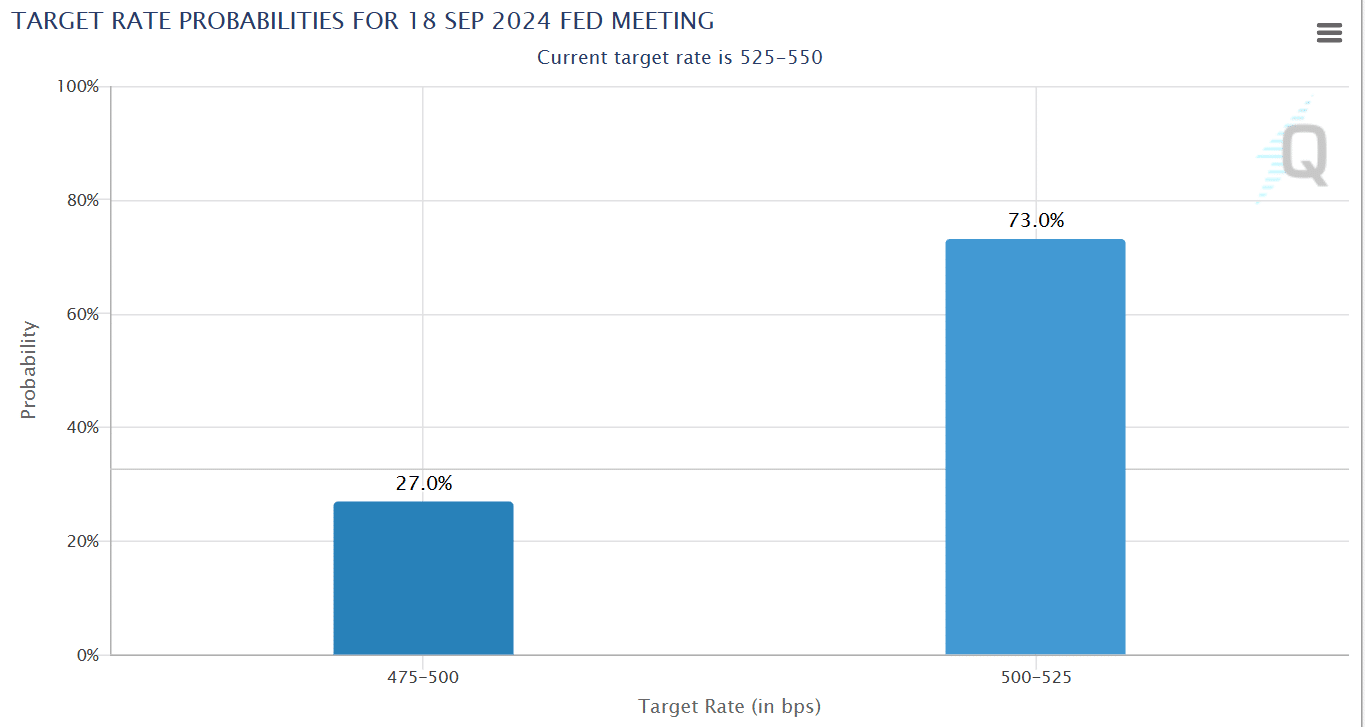

Crypto traders are also turning their attention towards the US Consumer Price Index (CPI) data that will be released on Wednesday.

According to Marketwatch, investors expect the August CPI print to come in at 2.6%, a drop from the previous month’s 2.9%.

Positive inflation data will strengthen the case for the Federal Reserve easing interest rates next week.

Per the CME FedWatch Tool, 73% of investors price in a 25 basis points rate cut, while 27% of investors anticipate an even steeper cut of 50 basis points.

Source: CME FedWatch Tool

Last week, U.S. Treasury Secretary Janet Yellen, heightened expectations of rate cuts after saying the economy was healthy and headed into a recovery.

The Fed easing rates for the first time since 2020 will boost appetite for risk assets such as crypto, which might lower the odds of a crypto bear market.

A positive sign emerges

While bearish signals are dominating, a positive sign emerged when spot Bitcoin exchange-traded funds (ETFs) flipped positive for the first time since late August.

On the 9th of September, inflows to spot Bitcoin ETFs came in at $28M per SoSoValue data.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

However, the two largest Bitcoin ETFs by net assets saw negative outflows. The BlackRock iShares Bitcoin Trust (IBIT) and the Grayscale Bitcoin Trust (GBTC) saw $9M and $22M in outflows, respectively.

If the Bitcoin ETF data comes in positive for the rest of the week, it will renew optimism among crypto traders and alleviate fears of a bear market.