- Solana saw a bullish week, with $3 billion in stablecoins driving liquidity through the memecoin effect

- Important questions about its future are rearing their heads now

At the time of writing, among high-caps, Solana led the market with a 27% weekly gains. Make no mistake, it hasn’t led by chance. The ‘Trump pump’ sent SOL’s demand soaring, with $3 billion in stablecoins flooding the network – Clearly, FOMO drove investors in. The memecoin mania sparked a liquidity surge. However, with the hype possibly fading, what’s next for Solana?

Is it becoming too hype- driven?

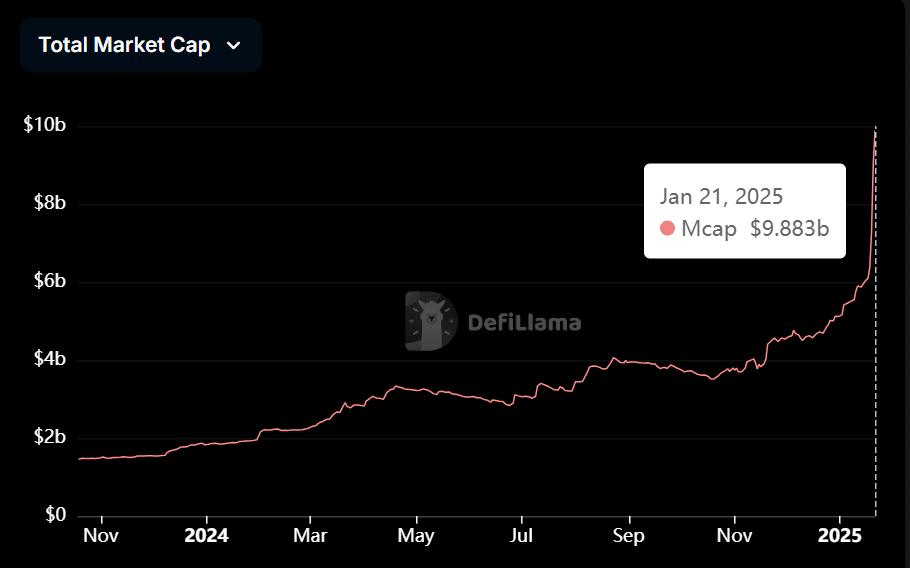

One day before TRUMP‘s launch, Solana stablecoins had a $6.10 billion market cap. Now? Figures for the same have soared to $9.88 billion – A 61% jump in under three days. USD inflows hit a record high of $1.757 billion too – The largest ever.

Source: DeFiLlama

As investors rushed to catch the memecoin wave, the network minted stablecoins to keep up. Solana followed suit, spiking by 19.53% in a single day, breaking free from a slump and surpassing its post-election rally price.

In just three days, stakeholders were enjoying serious profits. No doubt, after two months of patience, HODLers cashed out fast. Just two days later, however, SOL shed over 12% of its gains, with selling volume surging to a five-month high of $25.07 million.

Beyond the numbers, SOL’s recent dip signals a deeper shift. Is the network too reliant on memecoin “hype”, chasing short-term gains instead of long-term “value”? While the hype sent Solana to new heights, the real question now is – Will FOMO make a comeback, now that the memecoin frenzy has cooled off?

Solana’s real test begins

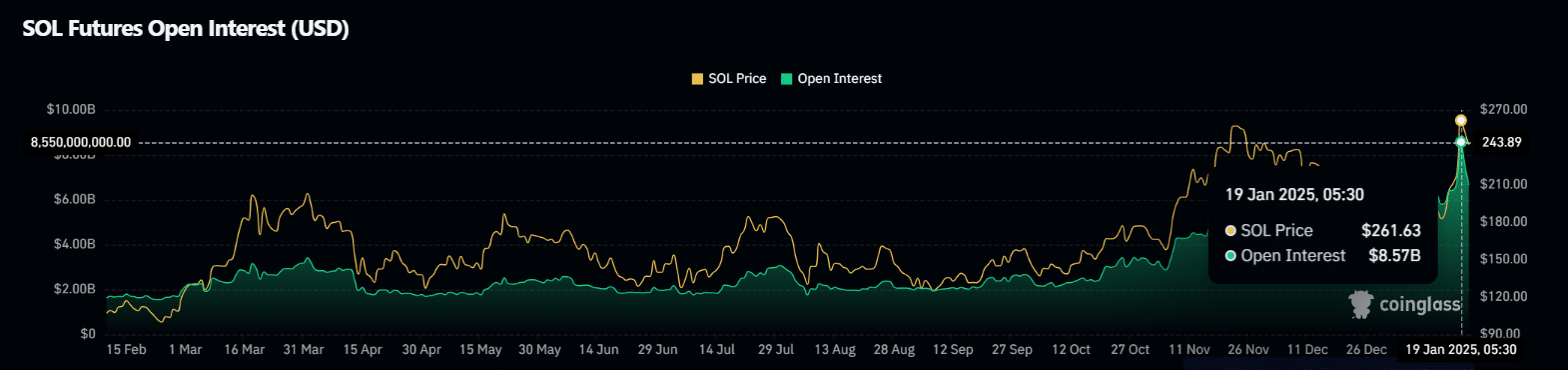

Two days ago, $384.79 million worth of SOL, priced at $261, was sent to exchanges. At this level, Open Interest surged to an all-time high of $8.79 billion.

Source: Coinglass

The aftermath? A brutal long squeeze that wiped out over $21 million in just 24 hours. Imagine the millions lost in the last 36 hours. With Futures traders reeling, FOMO’s return feels like a tough gamble.

Read Solana’s [SOL] Price Prediction 2025-26

However, on the psychological front, the MACD remained bullish for the SOL/BTC pair, hinting at a potential retail comeback as Bitcoin enters ‘high-risk’ territory and market volatility picks up.

Still, without fresh accumulation, profit-taking looms large. Over 80% of HODLers are still sitting in the green. Solana now faces its real test – Can it sustain its momentum, or is it relying on fleeting trends for a rebound?