- Bitcoin as an institutional asset for Nvidia makes complete sense for two key reasons

- Its brand positioning as a forward-thinking asset is set to enhance if this happens

Crypto Twitter is abuzz with speculation that Nvidia may be considering a strategic allocation of Bitcoin [BTC] to its corporate treasury.

According to AMBCrypto, this thesis isn’t far-fetched though. In fact, key macro and market dynamics suggested this could be a calculated move to diversify balance sheet exposure and hedge against fiat depreciation.

If confirmed, such an allocation could act as a significant bullish catalyst for Bitcoin. In fact, it has the potential to attract more institutional investors into the market.

Strategic sense behind Bitcoin’s role in Nvidia’s treasury

The U.S. economy is only halfway through Trump’s re-election cycle and yet, top public company stocks have fallen by over 20% in Q1. Nvidia, ranked among the top three public companies with a market cap of $2.72 trillion, is no exception.

At press time, its stock valuations were down 24.44% from its Q1 opening of $138. However, this could just be the beginning of a larger decline.

Source: TradingView (NVDA)

As a tech giant deeply invested in Artificial Intelligence (AI), Nvidia is squarely positioned at the intersection of the U.S.-China trade war. This exposes the company to potential geopolitical risks that could further pressure its stock price.

Moreover, with rising inflation eroding the purchasing power of the U.S Dollar, Nvidia could face higher operational costs, particularly for components and supply chain logistics.

Given these macroeconomic pressures, it’s no surprise that more publicly traded companies are turning to Bitcoin to hedge against these risks.

In fact, Metaplanet recently issued 3.6 billion JPY in 0% ordinary bonds to acquire additional Bitcoin. It is positioning itself as part of the growing trend of companies adding crypto assets to their corporate reserves.

Proof is in the numbers

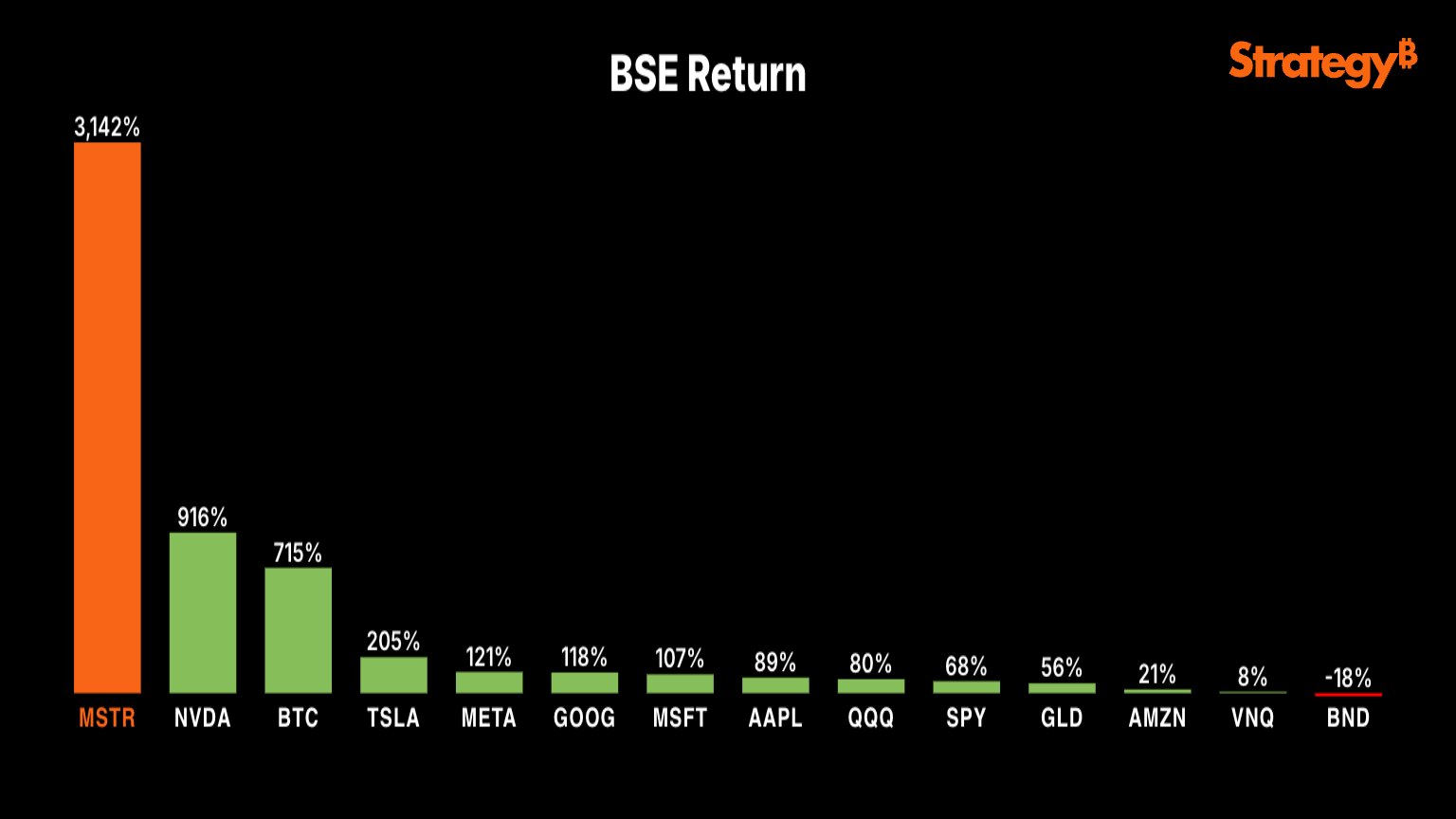

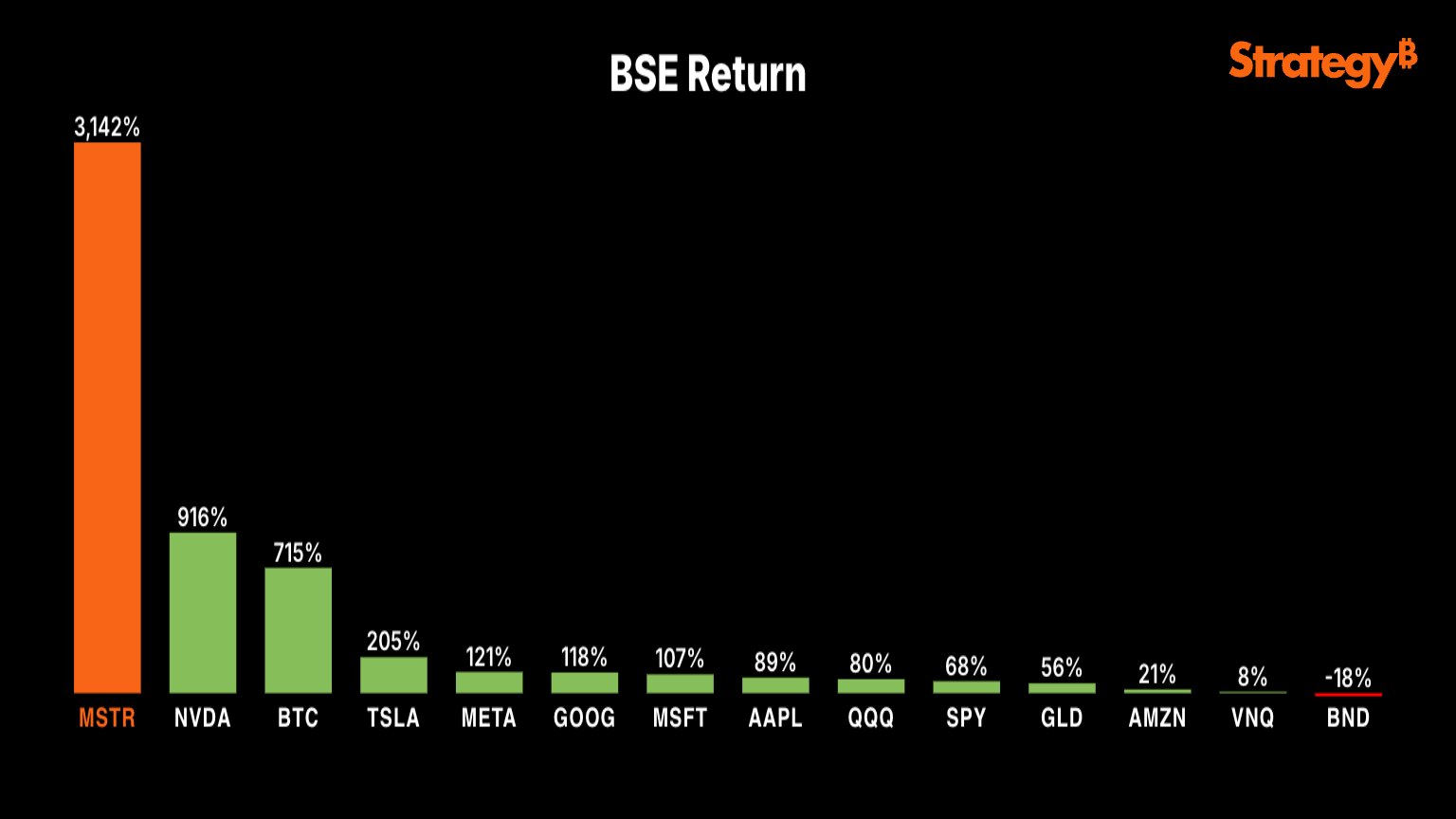

MicroStrategy’s [MSTR] stock has seen a staggering 3,000% return over the past five years, largely driven by its Bitcoin exposure. It has significantly outperformed most tech equities. This has translated to an annualized growth rate of 600%.

In comparison, Nvidia’s stock posted returns of “just” 916%. Even though it trails MicroStrategy by a significant margin.

Source: X

This stark divergence highlights the outsized impact of Bitcoin on MicroStrategy’s performance.

Bitcoin’s surge from $10,000 in 2020 to $96,172 at press time, reflecting a year-to-date price gain of 715%, further substantiates its role as a critical driver of portfolio returns for firms like MicroStrategy.

With results like these, it’s no wonder that other big players might soon jump on the bandwagon. And guess what? Nvidia looks like it’s next in line to make that bold move!