- Percentage of Litecoin wallets in profit has risen to its highest level since 2021 after recent gains

- A bearish reversal is likely after an inverse cup and handle pattern on the lower timeframe

Litecoin (LTC) has gained by more than 50% over the past month, mirroring the widespread gains across the altcoin market. However, despite this rally, some analysts actually believe that Litecoin may be dead.

In an X post, popular analyst Ali Martinez noted that LTC is now trading at the same price as back in 2017. Moreover, he argued that it now lacks strong fundamentals to drive any long-term growth.

According to him, while LTC might continue to register some short-term gains, it will still be stuck within a consolidation range.

Litecoin wallet profitability hits 2021 highs

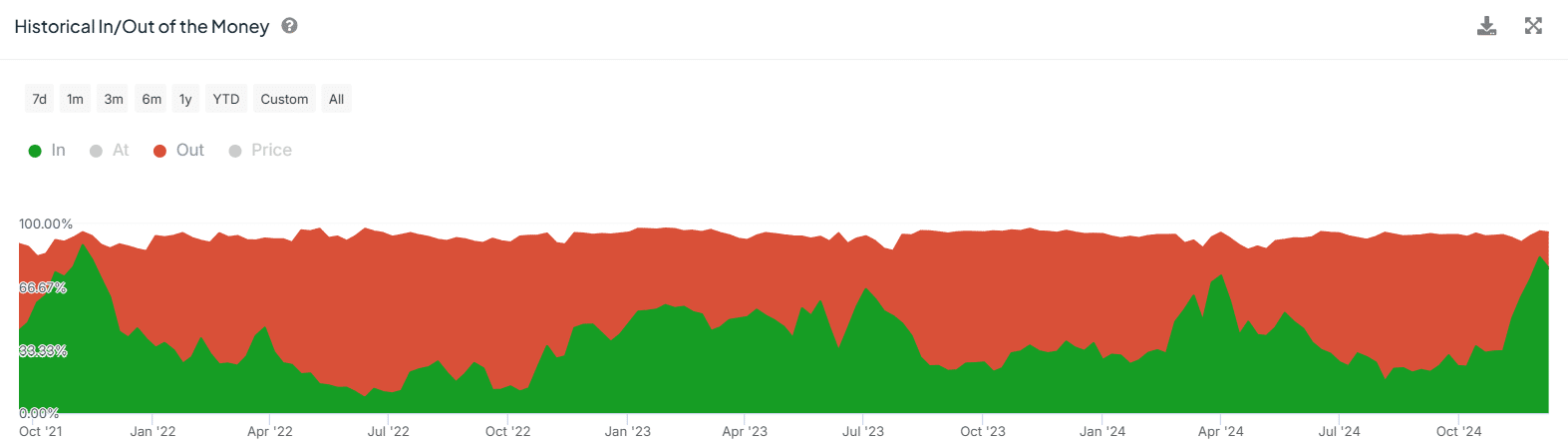

Despite this bearish outlook, however, Litecoin’s recent gains led to a surge in the number of wallets that are in profit to its highest levels since 2021. In fact, data from IntoTheBlock revealed that 78% of LTC holders, equivalent to 6.33 million addresses, are now profitable.

Conversely, the wallets that are in losses have dropped from 46% to 16% in just one month.

Source: IntoTheBlock

A spike in wallet profitability could increase market confidence and lead to a bullish outlook for Litecoin.

However, some traders who bought early and those who bought during the rally might start to take profits, causing the trend to weaken.

Is a high address count a positive indicator?

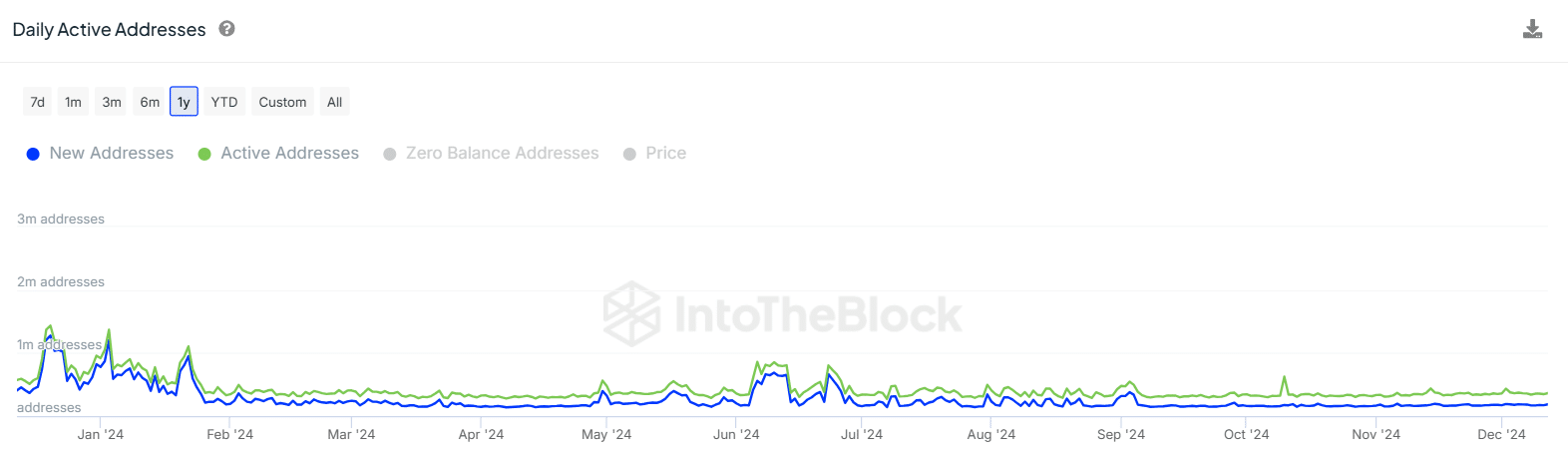

The number of active addresses on Litecoin stood at 364,000 at press time – A higher count than for most altcoins. For instance, Cardano (ADA), an altcoin with a market capitalization that is four times higher, has around 41,000 active addresses.

(Source: IntoTheBlock)

On the contrary, a look at the long-term picture revealed that Litecoin’s address count has been on a downward trajectory. Especially since at the start of the year, the active addresses stood at more than one million.

This suggested that Litecoin’s utility has dropped this year, which could have a negative impact on the price.

Litecoin price analysis as THESE bearish signs emerge

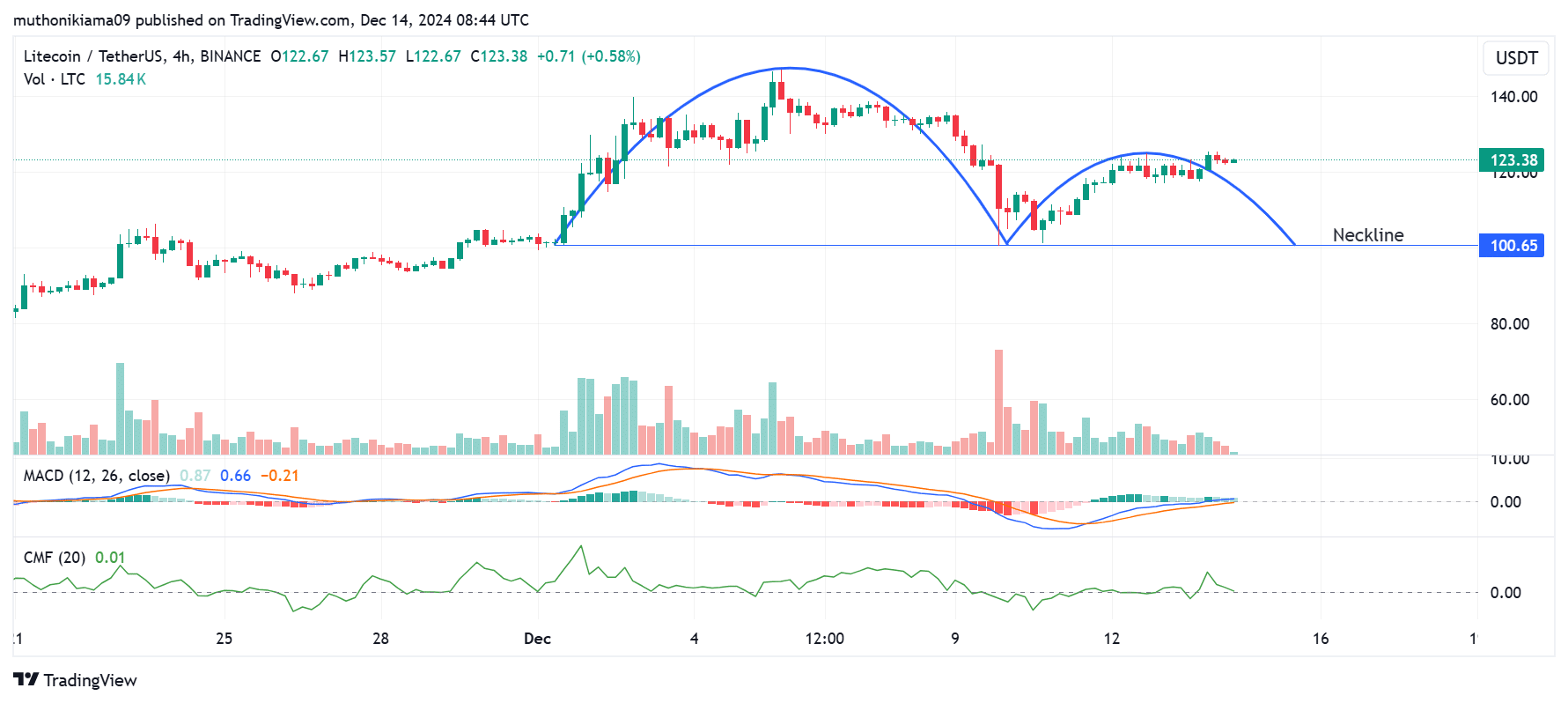

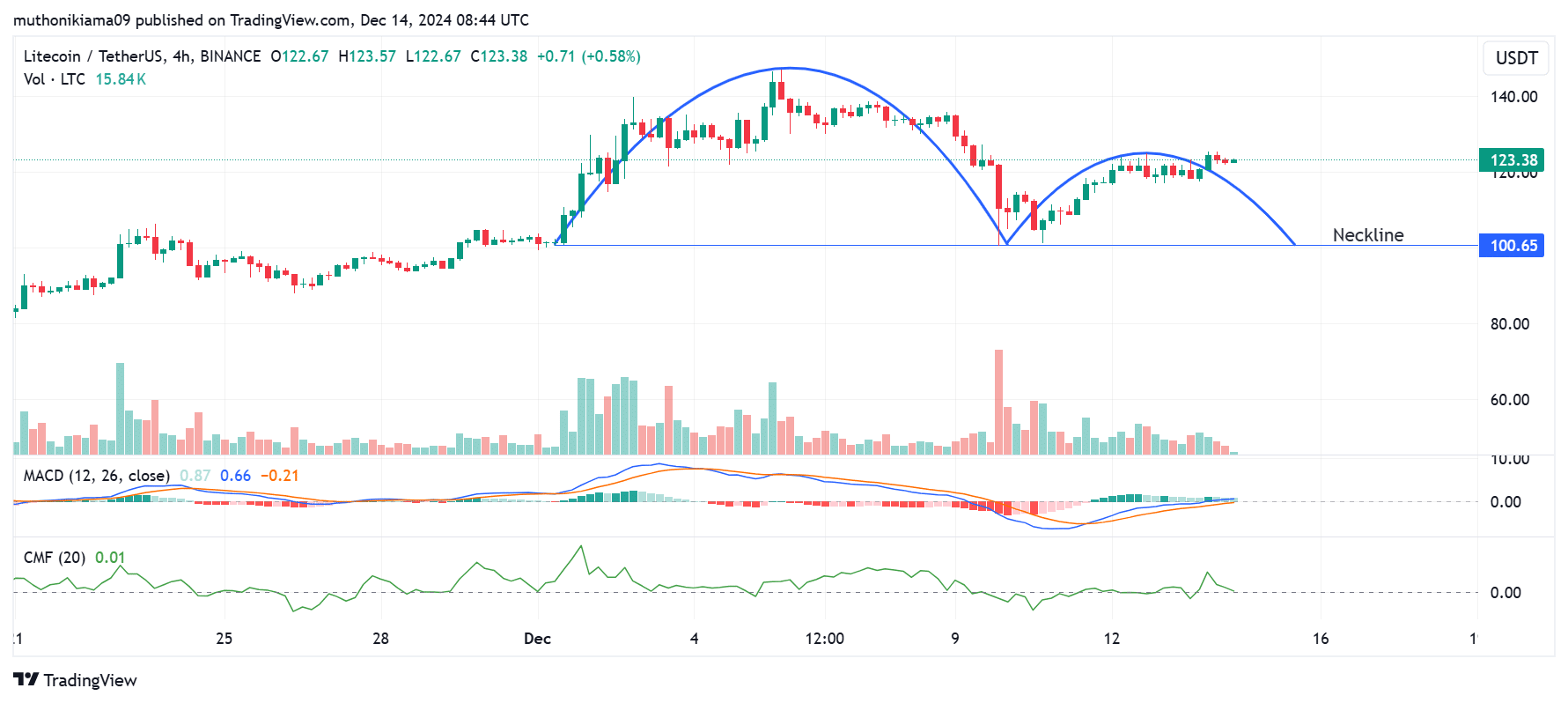

Litecoin, at press time, was trading at $123 after gains of 1.57% in 24 hours. This altcoin could be on the verge of a downtrend after an inverse cup and handle pattern appeared on its four-hour chart.

If Litecoin succumbs to this bearish pressure and the price reverses itself, traders should watch out for the neckline of this pattern at $100.65. Especially since a drop below could trigger more losses.

(Source: Tradingview)

The Chaikin Money Flow (CMF) implied that buying pressure has been weakening due to its drop to the zero line. If it flips negative, it could indicate a surge in selling activity that could lead to bearish trends.

At the same time, the Moving Average Convergence Divergence’s (MACD) histogram bars pointed to weak buying pressure. However, the MACD line on the lower timeframe was positive – A sign that momentum was still slightly bullish.

Litecoin’s Open Interest drops

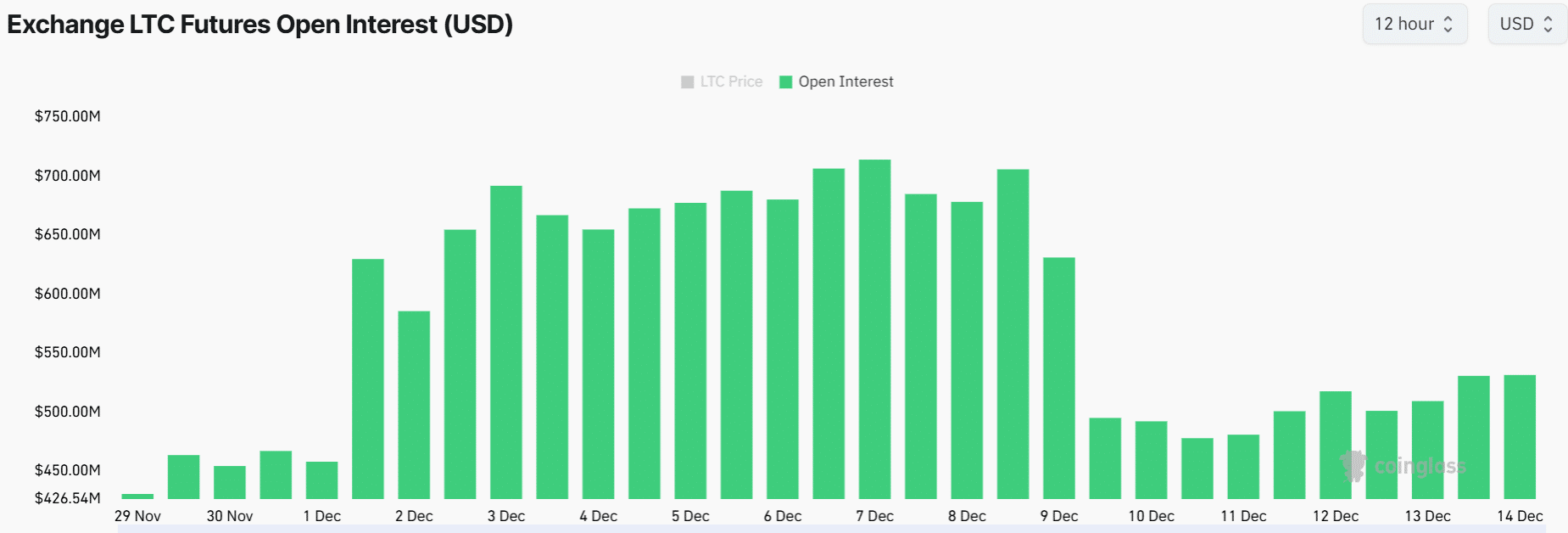

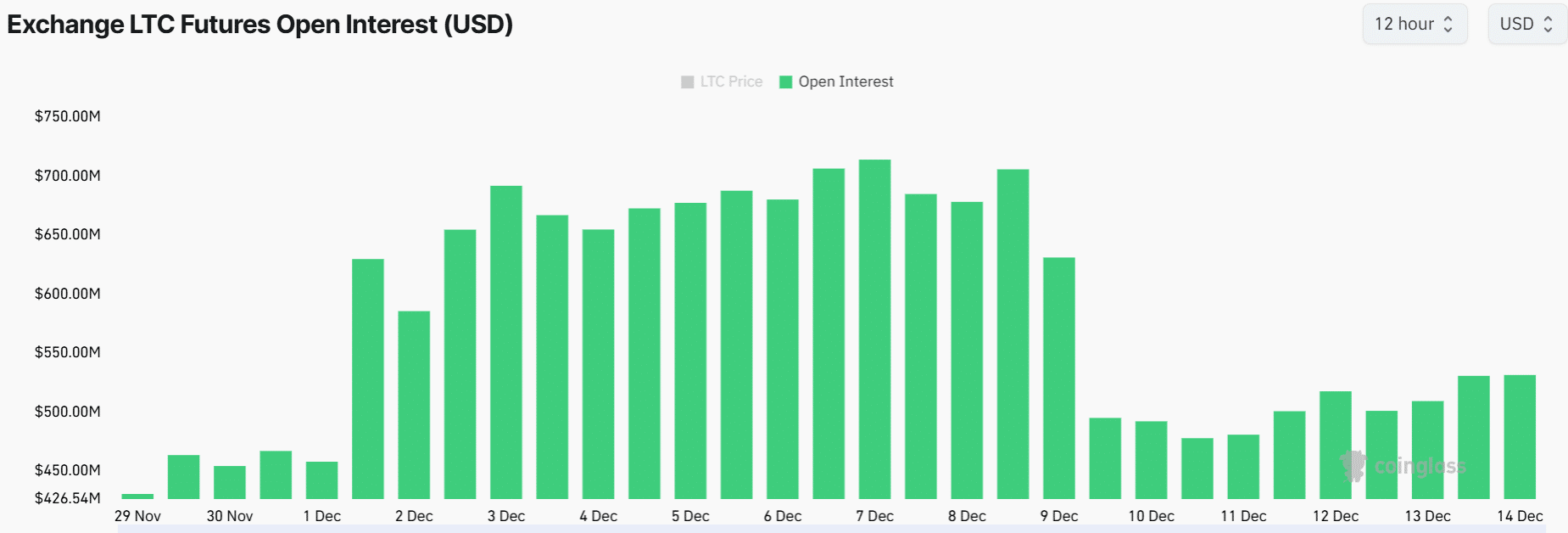

Finally, data from Coinglass indicated that speculative activity around Litecoin has dropped after hitting a multi-month peak earlier this month when the OI surged to $706M.

At press time, Litecoin’s OI had dropped to $531M – A sign that some traders had closed their positions.

(Source: Coinglass)

A drop in OI could mean bearish sentiment due to reduced market participation as traders become cautious and indecisive.