- Dogecoin may have tanked for seven consecutive days, but there is light at the end of the tumbling tunnel.

- We explored key metrics in the quest to establish the likelihood of an explosive breakout.

Dogecoin [DOGE] might be headed towards another major rally, one that could potentially turn out bigger than what we saw between February and April this year.

If that is the case, then its latest bearish retracement could be seen as a great opportunity.

The rally that Dogecoin achieved earlier this year confirmed that it can still command heavy demand. Nevertheless, DOGE bulls have struggled to regain dominance in the last three months or so.

This outcome might be leading to dwindling hopes for DOGE holders, but it’s all a matter of perspective.

While Dogecoin’s regular price chart offered a rather unimpressive picture, its logarithmic chart offered a different perspective.

According to the log chart, DOGE was within a massive breakout zone that could happen any day from now.

The same chart suggested that the memecoin might have a bigger bull run this time, than what we saw in the last 2 bull runs.

The log-based analysis suggested that a 7200% rally could be on the cards, possibly sending Dogecoin as high as $10.

Are buyers flocking in to buy Dogecoin?

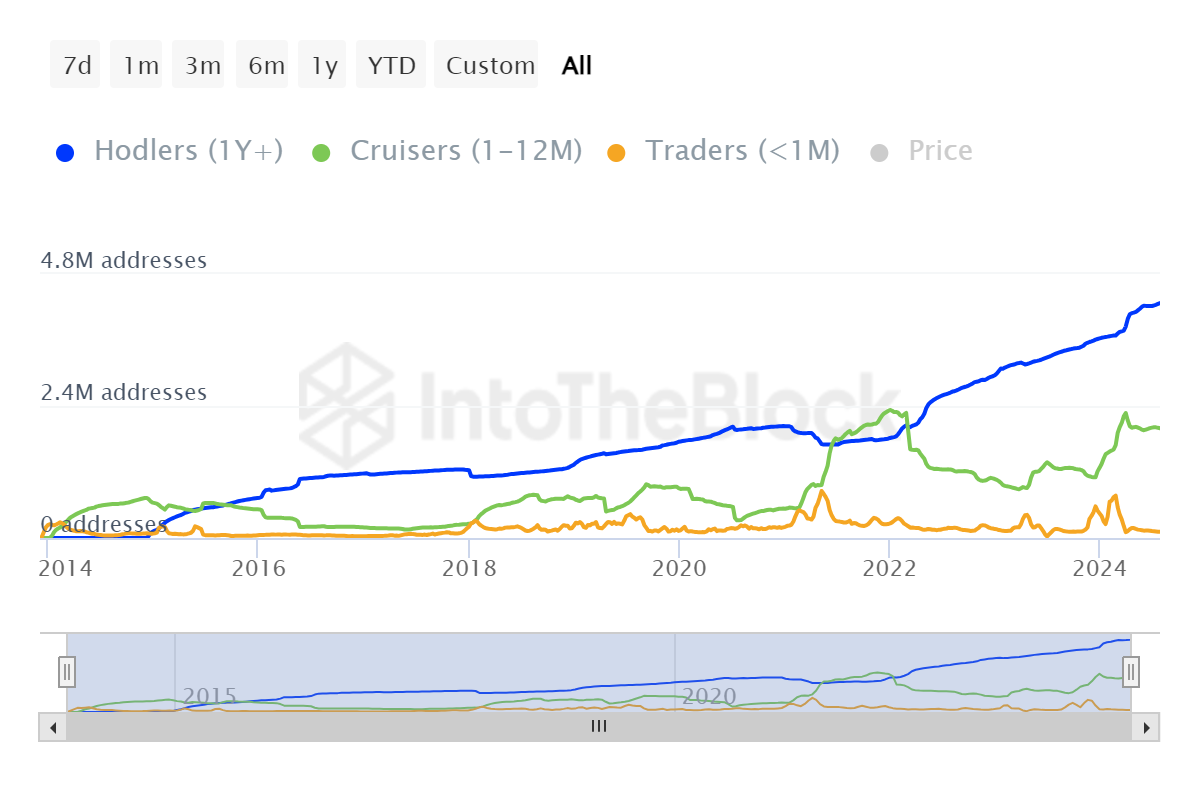

To answer this question, we decided to look at the different classes of Dogecoin holders and how they have performed in the last three months.

The logic was that doing so would provide a rough idea of who has been adding to their bags.

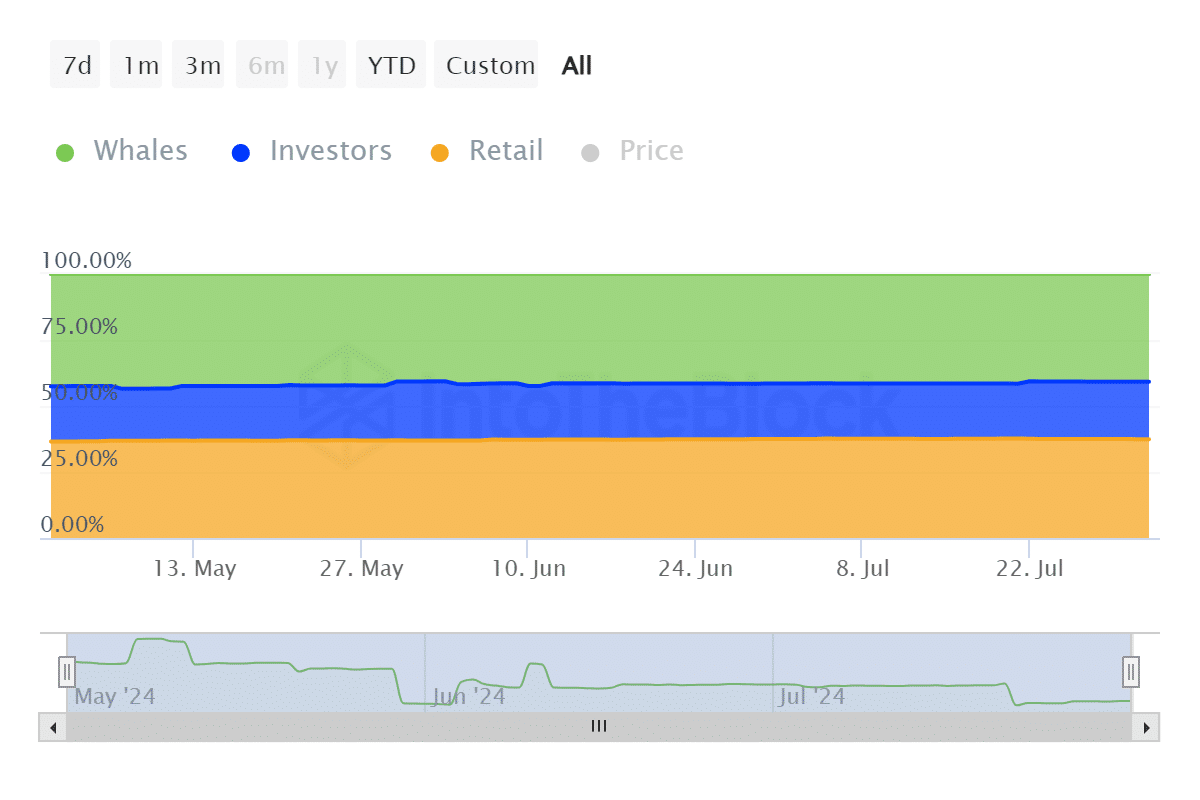

Whales held 64.84 billion DOGE at the start of May, which accounted for 42.57% of the supply. Their holdings fell to 63.47 billion DOGE, or 40.79% as of the 1st of August.

Investors had 31.81 billion or 20.88% of DOGE supply at the start of the 3-month period. Their holdings grew to 33.92 billion or 21.8% of the supply by the start of this month.

Source: IntoTheBlock

The retail category saw their Dogecoin holdings soar from 55.68 billion or 36.55% at the start of May. Retail’s DOGE holdings grew to 58.19 billion tokens, or 37.4% of the total Dogecoin holdings.

In other words, the market.

The data above confirmed that whales have been contributing to sell pressure. Meanwhile, retail traders and the investor class have been buying at discounted prices.

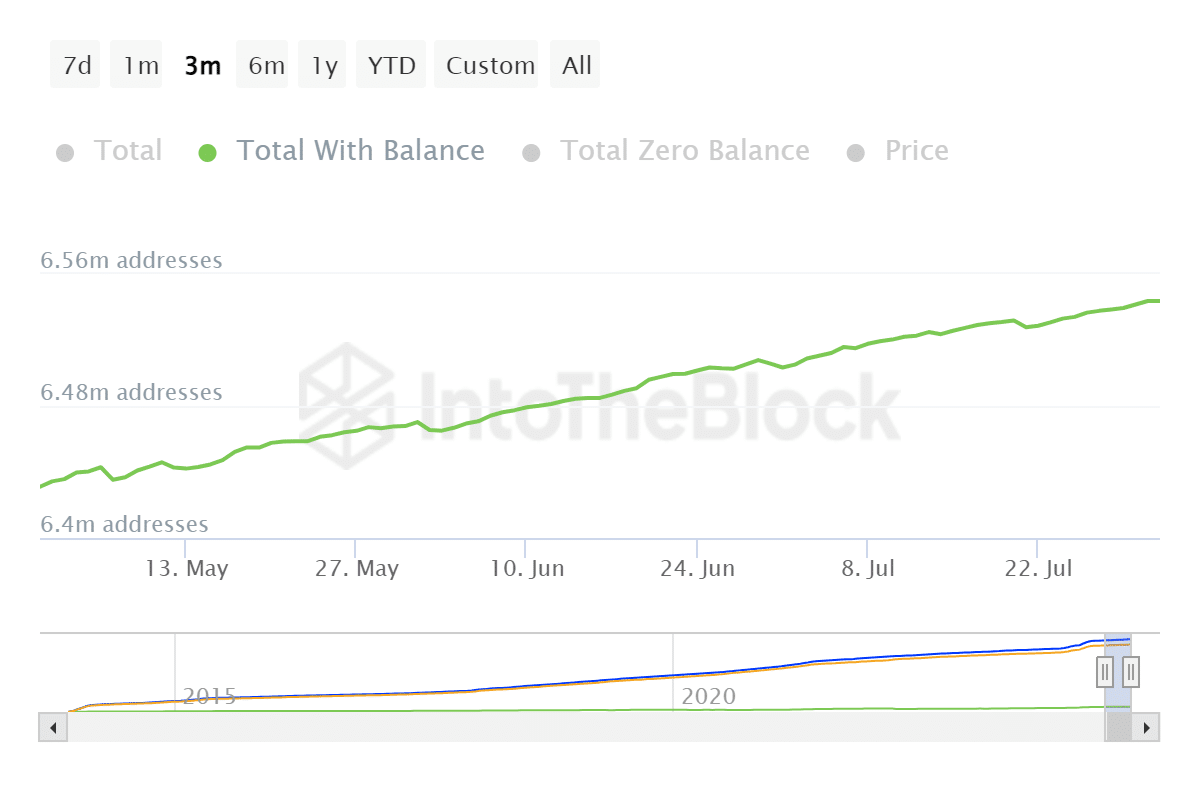

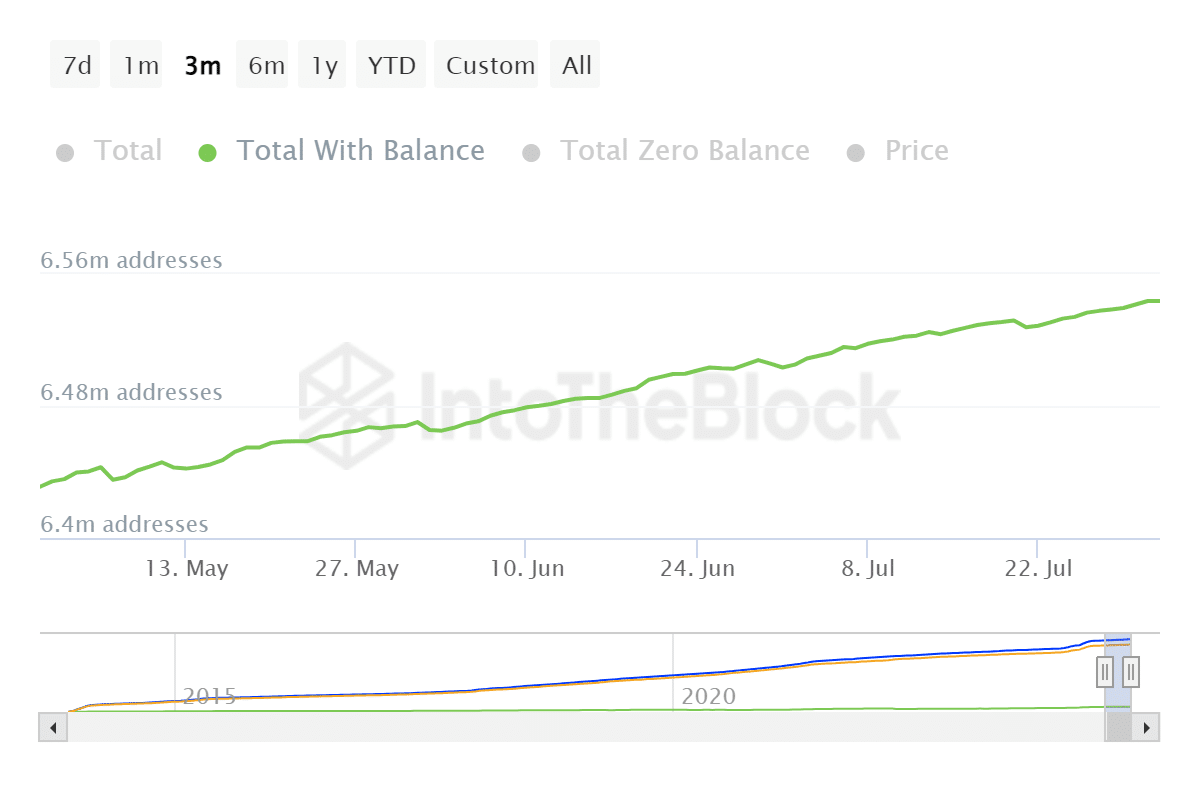

The total number of addresses holding DOGE also grew from 6.43 million to 6.54 million addresses during the 3-month period.

Source: IntoTheBlock

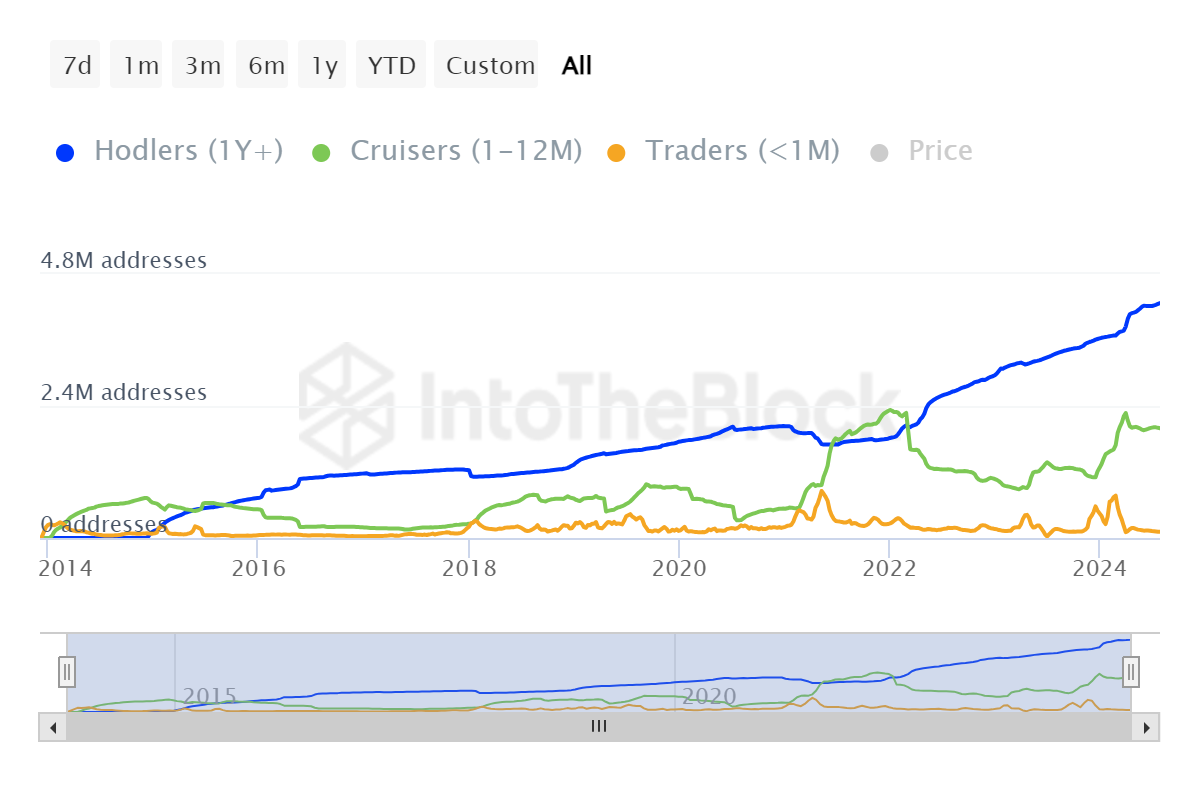

Here’s another interesting observation. The number of HODLers just reached an all-time high at 4.26 million addresses. Meanwhile, the number of traders declined considerably since February.

Source: IntoTheBlock

Is your portfolio green? Check out the DOGE Profit Calculator

These findings aligned with the expectations of explosive breakout. Fewer traders presented a chance for demand to push prices higher with lower sell pressure.

However, low participation from whales could be the missing ingredient for an explosive rally.