- Analyst Master Kenobi labels ADA as a “cult coin,” arguing it enriches its founder without delivering value.

- Comparison shows BNB outperforming ADA in market cap, development activity, and overall success.

Cardano [ADA], a proof-of-stake blockchain known for its support of decentralized applications (dApps) and smart contracts, has been a topic of debate within the crypto community.

Despite its position among the top cryptocurrencies by market capitalization, a well-known crypto analyst, Master Kenobi, has labeled Cardano’s native token, ADA, as a “cult coin.”

Kenobi compared ADA to Binance’s native token, BNB, to support his view, highlighting what he sees as stark differences in the approaches and outcomes of the two projects.

ADA against BNB

Kenobi’s criticism centers on the perceived lack of progress by Cardano compared to Binance.

In a post on X, he stated, “Nothing VS Everything in 2330 Days,” pointing out that while Cardano has focused on what he considers “brainwashing sessions” through its long AMAs (Ask Me Anything sessions), Binance has emphasized utility, performance, and industry compatibility.

According to Kenobi, BNB’s strategy, which includes adaptive technology and marketing, has made it a true store of value. In contrast, ADA is seen as a coin with more talk than substance.

The analyst particularly noted:

“IMO BNB is the only coin that can be considered a true store of value due to its utility. ADA is just a cult coin.”

A comparison of market performance and fundamentals

When comparing the market performance of ADA and BNB, there is a noticeable difference. BNB currently holds a market capitalization of $80.2 billion, whereas ADA’s market cap stands at $11.9 billion.

In terms of recent price movements, ADA has experienced a decline of 5.1% over the past day and 2.1% in the past week. BNB, on the other hand, has been less volatile, declining by only 0.8% in the past day and showing an 8.1% increase over the past week.

These figures suggest a significant divergence in the market perception and adoption of these two assets.

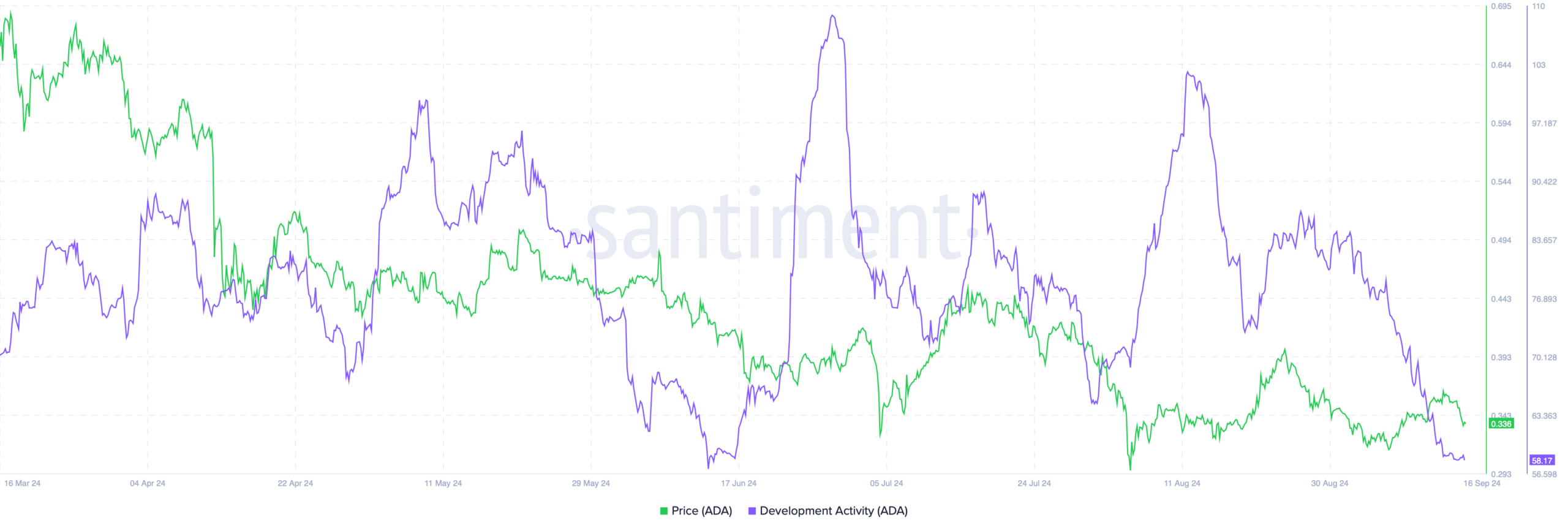

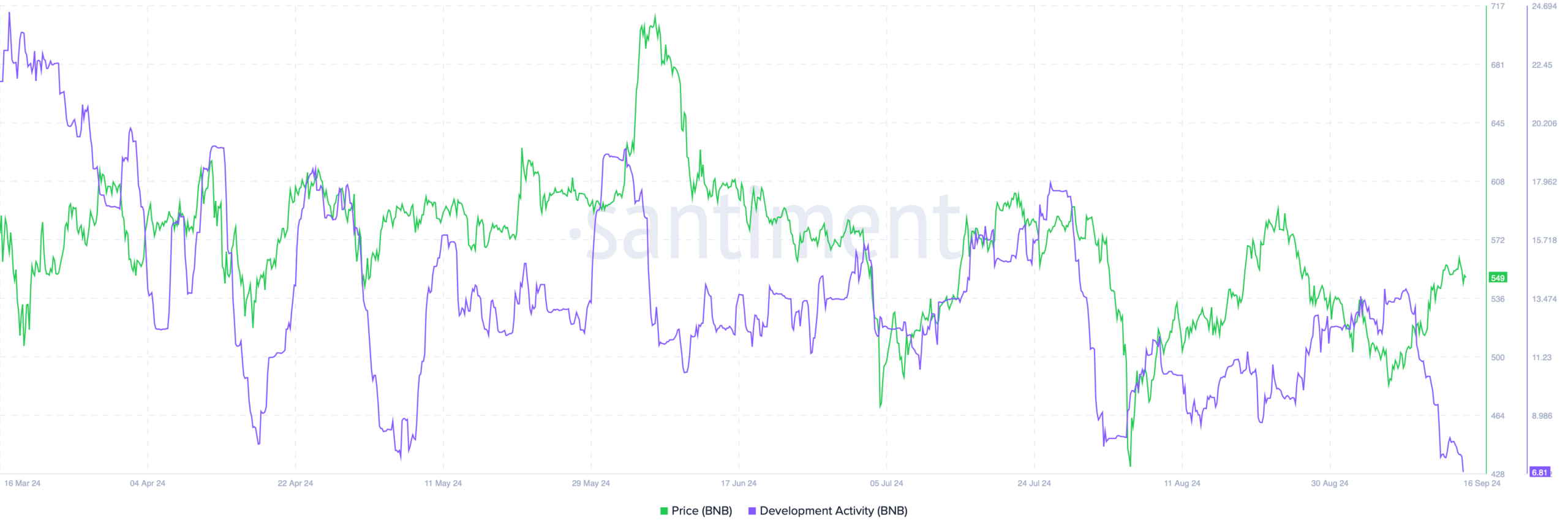

To gain a deeper understanding of this disparity, examining the fundamental aspects of both assets is considered. When looking at development activity, data from Santiment reveals a steady decline for both ADA and BNB.

Source: Santiment

However, ADA’s development activity is currently at 58.17, a sharp contrast to BNB’s much lower figure of 6.81. This suggests that, despite the criticism, Cardano may still have a relatively active development community compared to Binance.

Source: Santiment

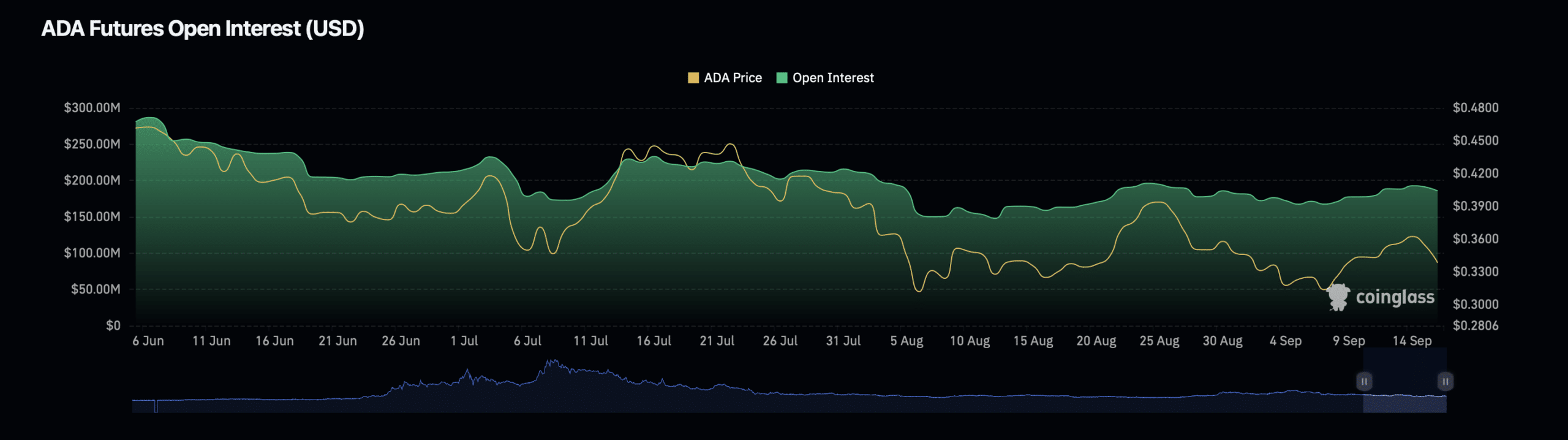

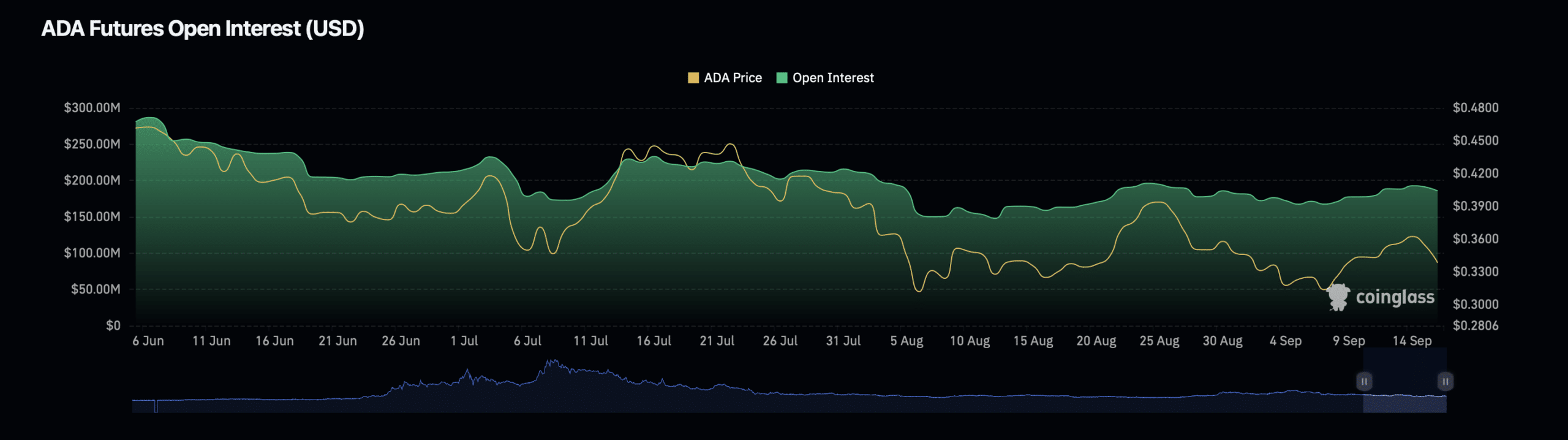

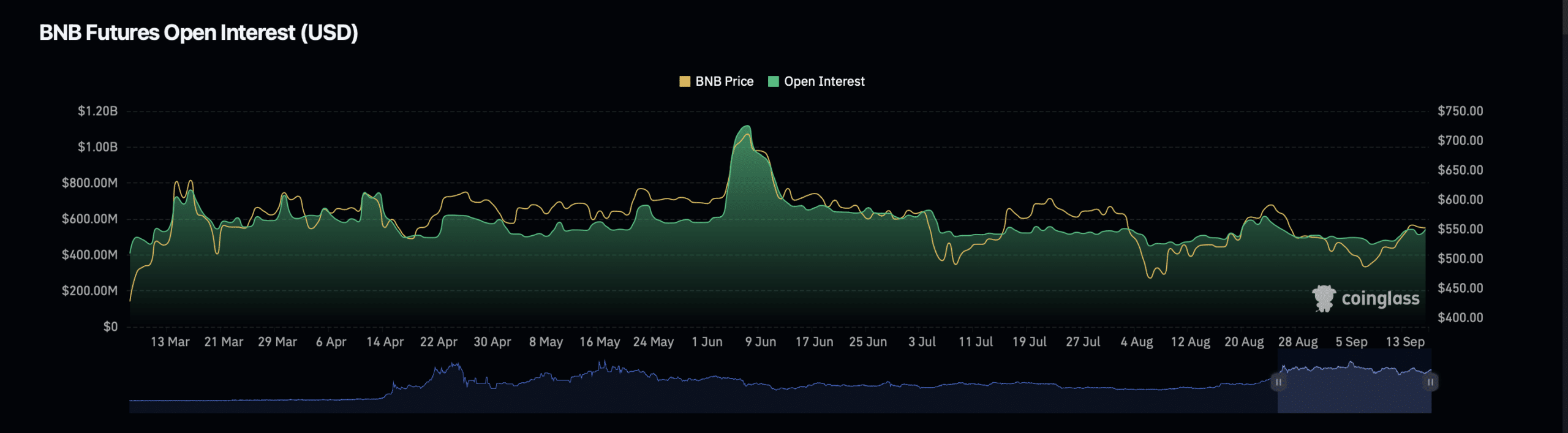

Another key metric to consider is open interest, which reflects the number of outstanding derivative contracts, such as futures and options.

Coinglass data showed that ADA’s open interest has dropped by 2.79% to $185.99 million, while its open interest volume has risen by 75.51% to $291.46 million.

Source: Coinglass

Is your portfolio green? Check the Cardano Profit Calculator

This rise in open interest volume could indicate increased trading activity or speculation around ADA.

On the other hand, BNB has seen its open interest grow by 4.15% to $532.67 million, with a notable increase in open interest volume by 201% to $735.12 million, indicating robust market activity and investor interest.

Source: Coinglass