- XRP made a moderate price recovery over the past day, hiking by 5.03%.

- Ripple whale inflow to Binance hits a 6-month-high.

Since hitting $2.9, Ripple’s [XRP] has experienced a strong market correction. Over the past days, altcoins have retraced, and XRP has also witnessed a significant decline, hitting a low of$1.89.

The current market conditions have left analysts deliberating over the factors behind it. Inasmuch, CryptoQuant analyst JA_Maartun has pointed out a potential shift in strategy among whales.

XRP whale inflow to Binance hit a 6-month high

In his analysis, Maartun observed that Ripple’s whale deposits into Binance have reached a six-month-high.

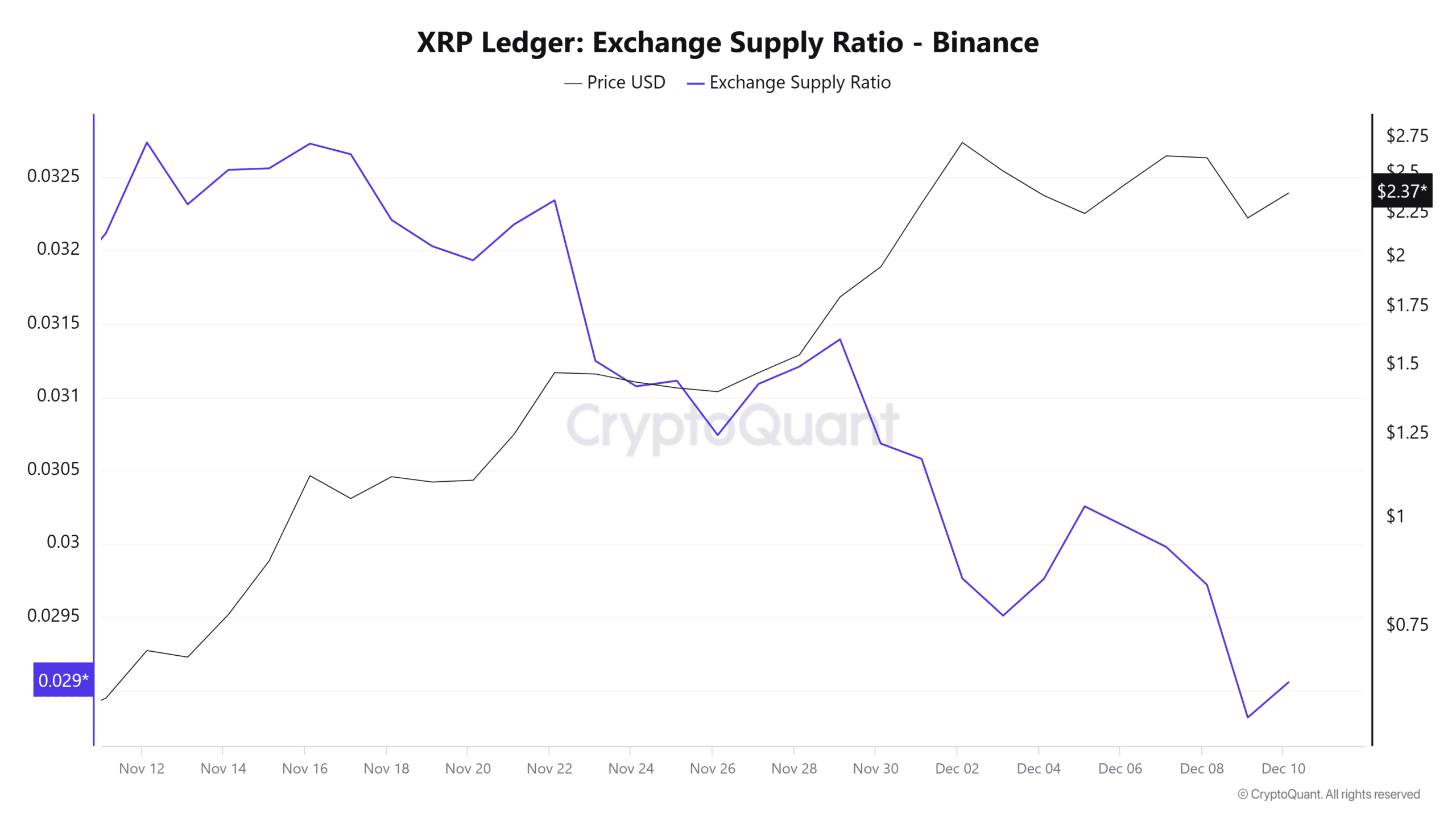

Source: CryptoQuant

According to him, the past thirty days have seen over 2.66 million XRP tokens transferred to exchanges.

It’s the first time since April that Ripple has experienced such massive transfers by large holders, signaling a sustained rise in whale activity.

These large inflows suggest that significant XRP holders are actively transferring their tokens over the network while interacting with exchanges, especially Binance.

Whale deposits usually signal shifts in strategy, since these players have considerable assets at their disposal. This shift could imply a move away from accumulation to selling.

When whales transfer massive amounts to exchanges, it implies an intention to sell, active selling, or increasing liquidity.

Impact on price charts

Large inflows to exchanges usually suggest potential intentions to sell. This could indicate bearish sentiment among major holders looking to capitalize on the recent rally while anticipating a price decline.

However, despite the massive transfers into exchanges by whales, XRP’s charts have not reflected a negative impact.

On the contrary, the altcoin has made moderate gains on the daily charts. At press time, XRP was trading at $2.33, marking a 5.03% increase on daily charts after a 10.23% decline on weekly charts.

This price recovery shows that, despite whale transfers, the XRP market remains bullish, and bulls are fighting to retake the market.

Source: CryptoQuant

AMBCrypto noticed this through a sustained decline in the exchange supply ratio over the past month. This suggests that, while whales are transferring, a large portion of investors are keeping their assets off exchanges.

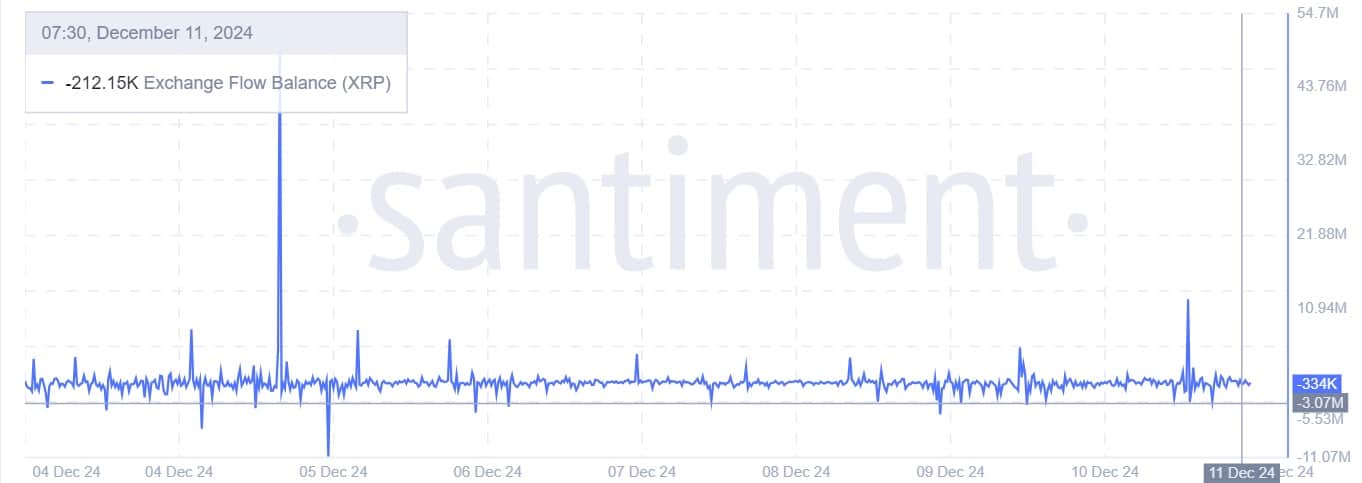

Source: Santiment

This phenomenon among the largest portion of investors is evidenced by the fact that XRP’s exchange-to-flow balance has declined to -334k. When the flow balance is negative, it means more assets are being moved out of exchanges than deposited.

This, eventually, reduces the supply available for trading, thus avoiding selling pressure.

Read XRP’s Price Prediction 2024–2025

Despite increased inflows into Binance by whales, XRP investors remain bullish, and bulls are attempting to regain control of the market.

If bulls outweigh bears, XRP could reclaim $2.6 levels and target $3. Conversely, if transfers into exchanges persist, causing panic selling, the altcoin will find support around $1.8. A breach below this will push it towards the critical support level of $1.5.