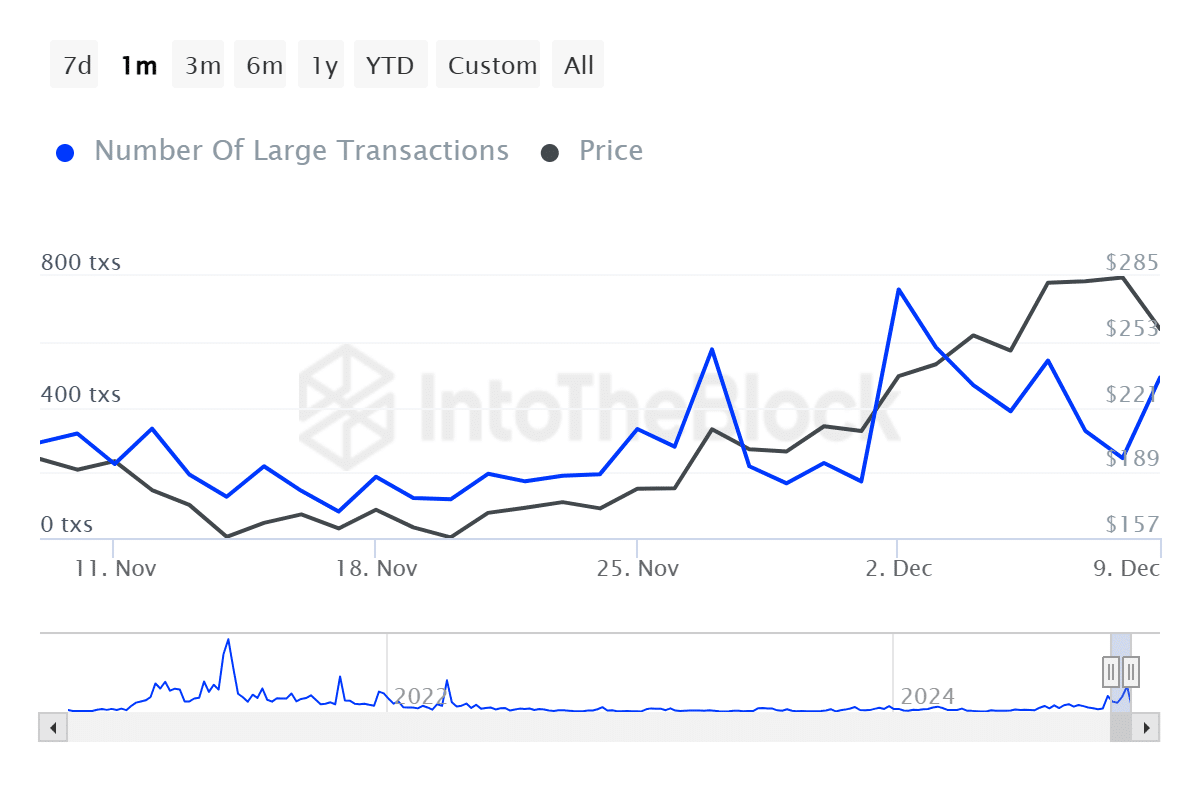

- AAVE’s large transactions have spiked by over 150% in the last 24 hours

- AAVE inflows to exchanges have risen over the last three days, indicating potential volatility ahead

Whales have taken notice of AAVE’s recent price action, with the altcoin’s large transactions skyrocketing by 150% over a single 24-hour period, according to IntoTheBlock’s data.

This hike in whale activity indicated that large players may be getting interested again, perhaps because of the recent drop in AAVE’s price. Whales tend to move the market, and their more active participation is often a sign of a potential trend reversal or acceleration.

Source: IntoTheBlock

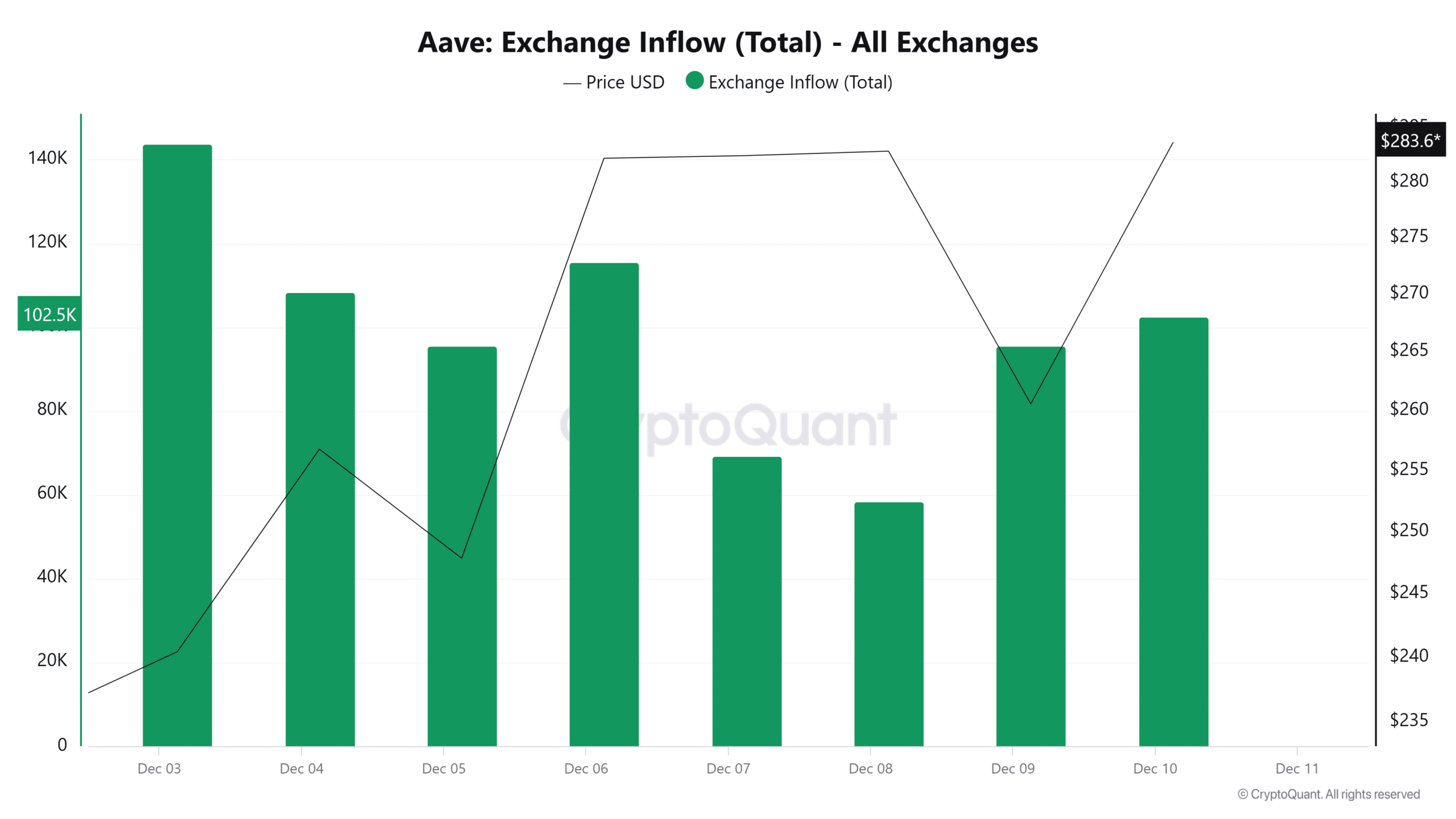

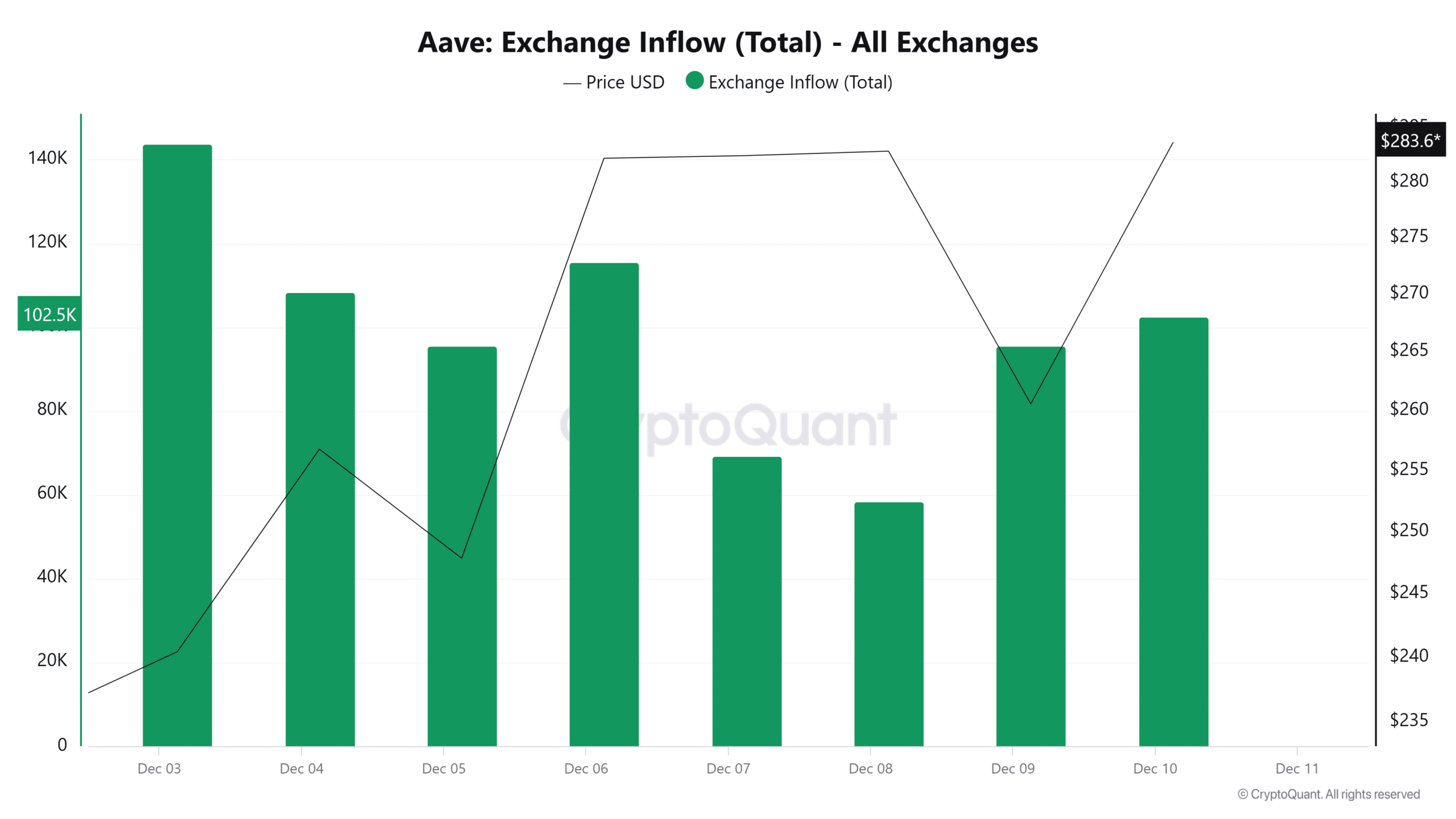

AAVE’s exchange inflows surges

This spike in whale activity coincided with a hike in AAVE inflows to exchanges. In fact, exchange inflows have risen steadily over the last three days, which could suggest that some traders are gearing up to liquidate or reposition their holdings.

Such moves usually come before a period of high price volatility and could signal a potentially significant move on cards.

Source: CryptoQuant

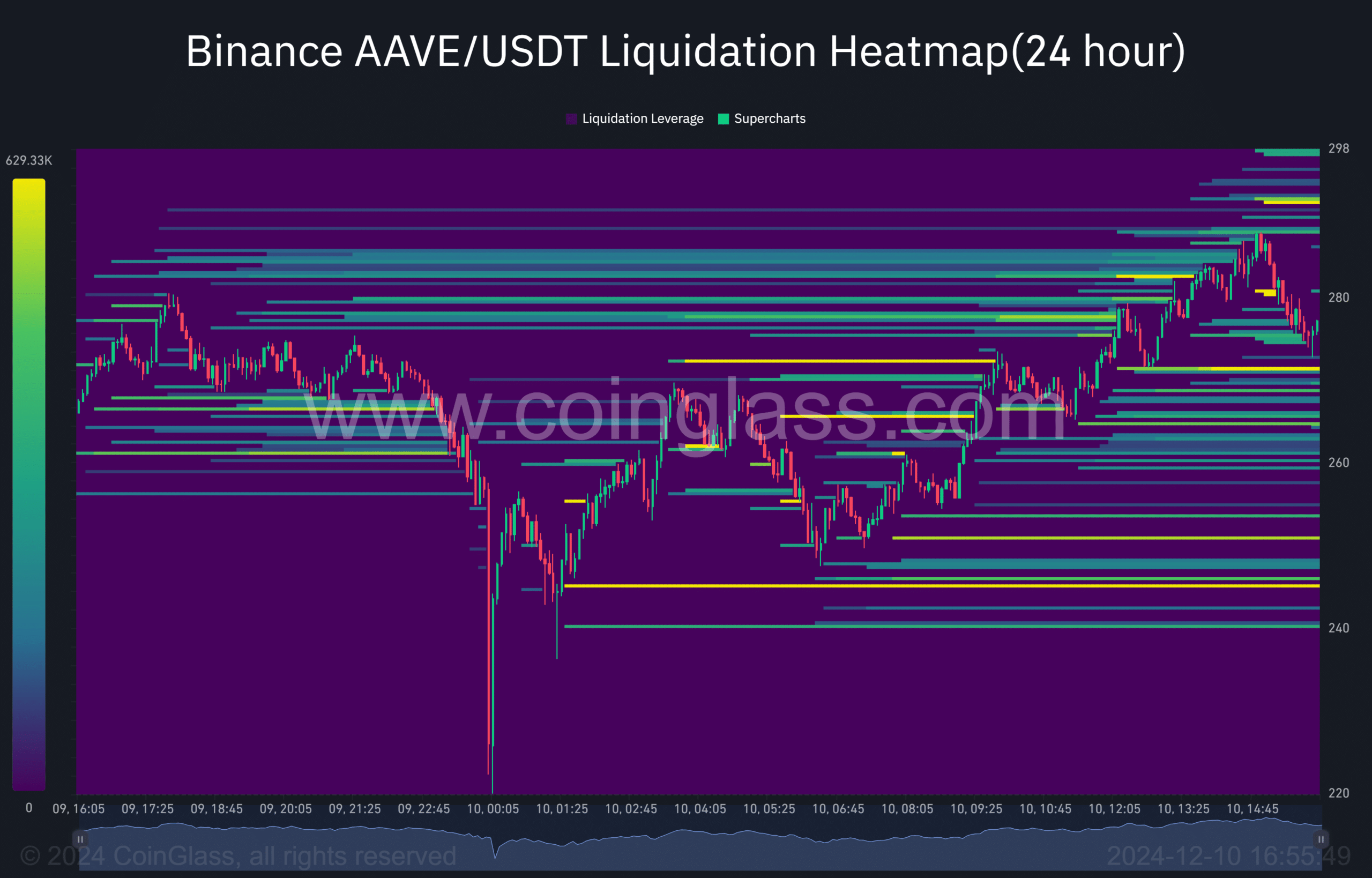

Bullish bias emerges at key levels

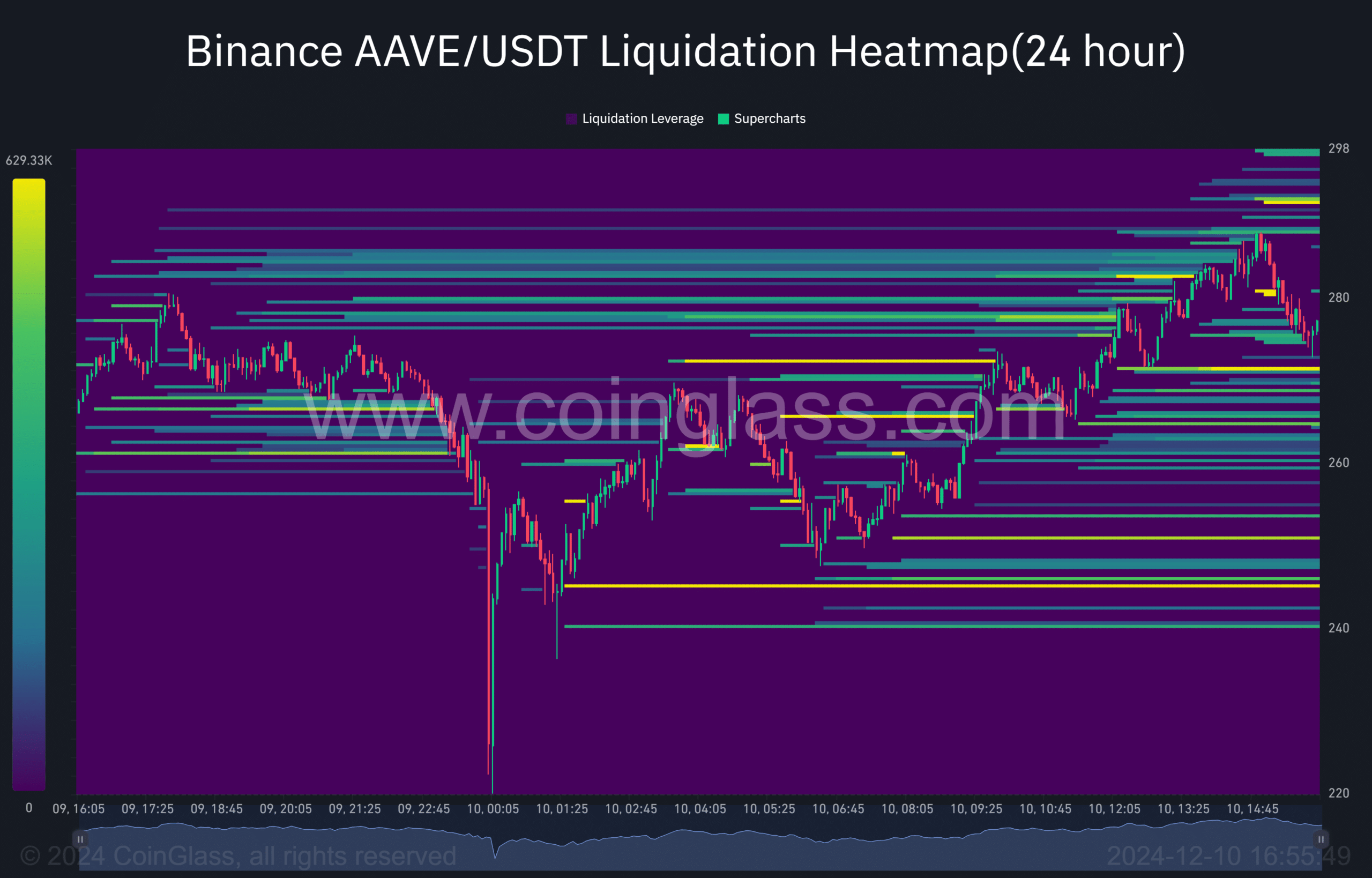

Besides the scale of such heightened activity, AAVE has been showing signs of a bullish bias too. At press time, the altcoin had a liquidation pool worth 583k at the $291-price level, a critical threshold for the market’s participants.

This pool represented leveraged positions that could cascade into a rally if broken, potentially pushing AAVE closer to the psychological $300-level. The concentration of liquidity at this level highlighted investors optimism. If the prevailing market momentum sustains itself, $291 may provide the springboard for further gains.

On the contrary, failure to breach this resistance might lead to short-term pullbacks as traders reassess their positions.

Source: Coinglass

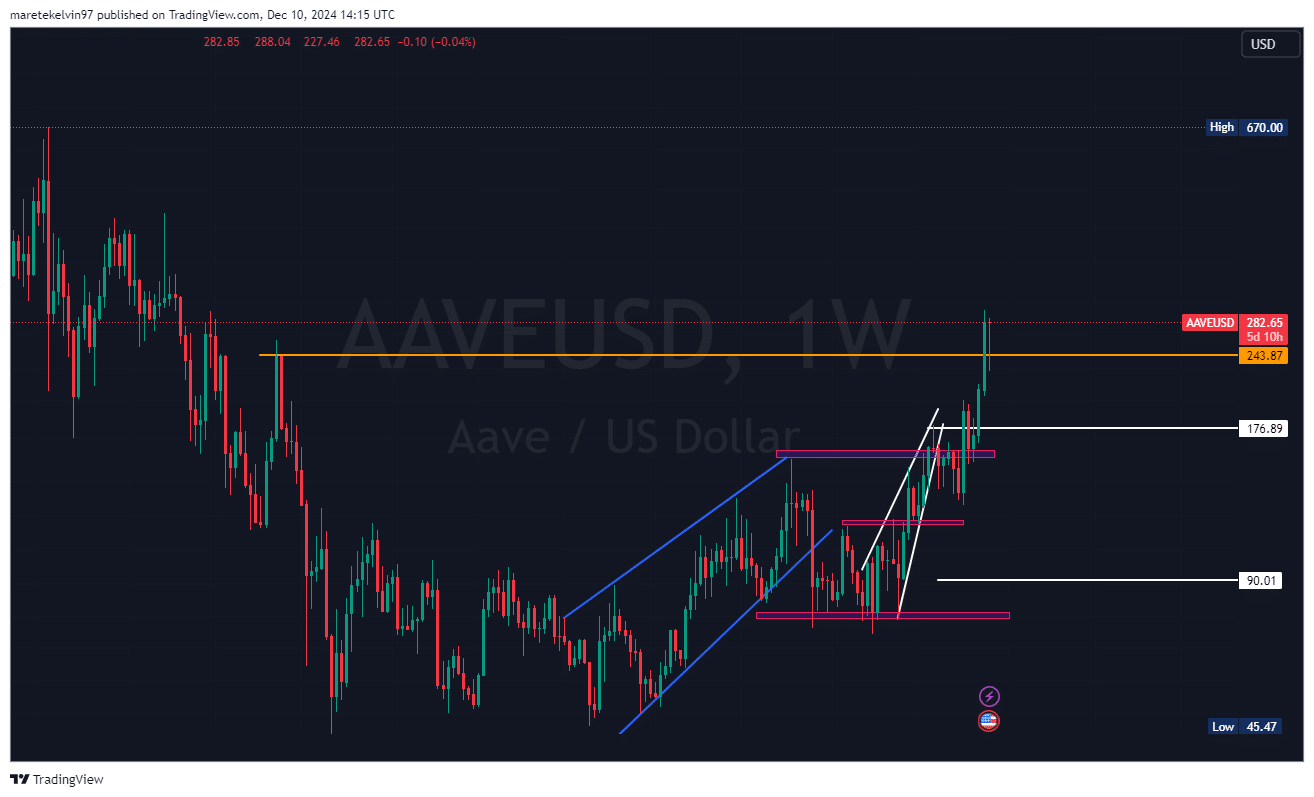

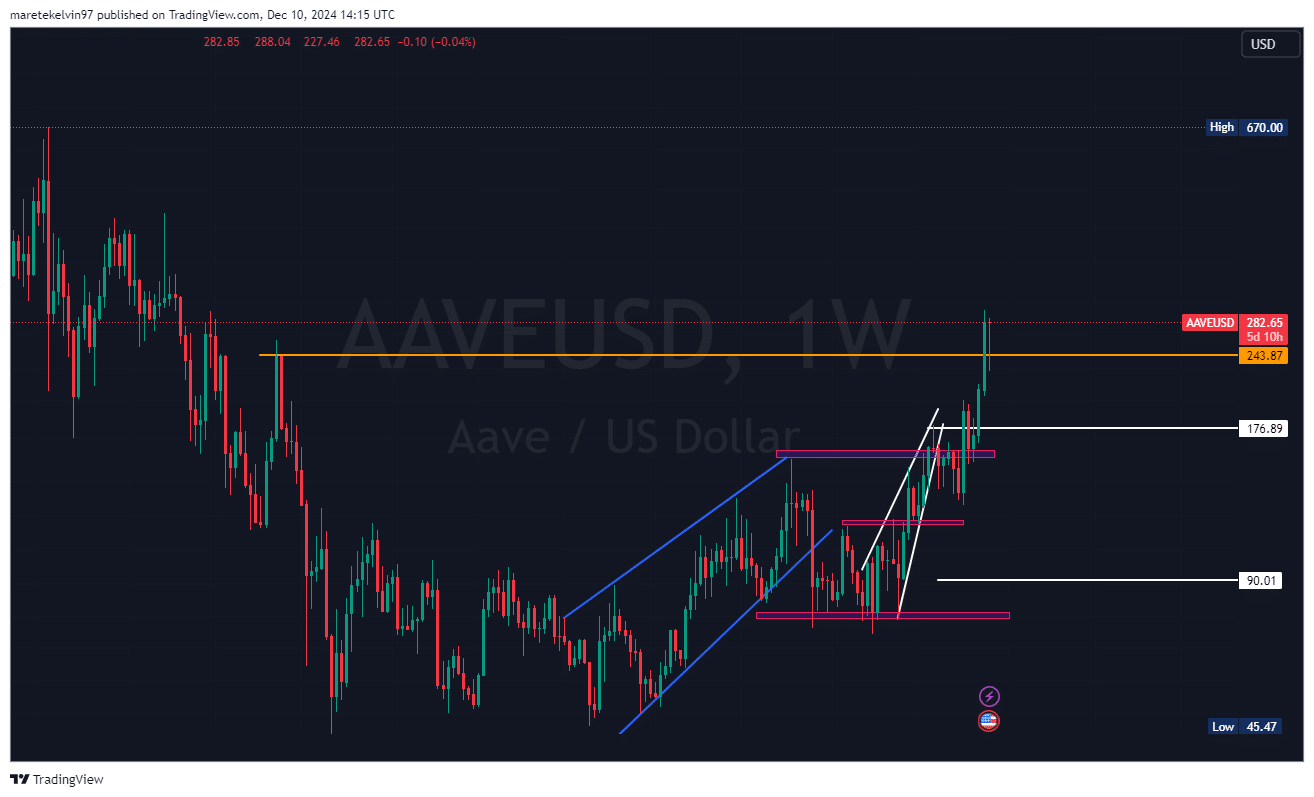

Technically, AAVE’s price registered a milestone breakout by surging past the $243 key weekly resistance level, before the recent short correction – Probably from the profit taking phase of the already 72% of investors already in profit.

Needless to say, the FOMO has encouraged many big players to invest in the dip. As it stands, the next key resistance target stands at the $300 price level.

Source: TradingView

The convergence of greater whale activity and inflows pointed to a potentially explosive move for the popular altcoin. If whales continue to buy and retail follows suit, AAVE’s price could test the aforementioned resistance level in the next few days.