The Friedkin Group (TFG) has made significant progress in its bid to complete a takeover of Everton, just two months after dramatically pulling out of talks.

A deal to buy Everton owner Farhad Moshiri’s 94 per cent stake is close to being agreed, with the Texas-based group’s offer appearing to have moved ahead of a rival bid from fellow American John Textor.

It represents the latest twist in a long-running but ever-changing takeover saga. In that time, Everton’s external debt has risen to around £600million ($798m, €718m) as they have sought ways to finance everyday running costs and their new stadium project.

£200m ($266m, €239m) of that debt is owed to Friedkin, the owner of Italian side AS Roma. But when he pulled out of exclusive talks with Moshiri in July, with those close to the process citing concerns over Everton’s debt, Textor emerged as the new favourite.

The Athletic reported this summer that Textor, the owner of Lyon had entered into negotiations with Moshiri over a deal. That move, though, was complicated by his 45 per cent stake in Crystal Palace, with Premier League rules preventing parties from holding an interest in any two member clubs.

It also prohibited him from officially entering into exclusivity with Moshiri and thereby warding off the threat of rival bidders.

Speaking to Sky Sports this month, Textor said he was confident of completing a takeover of Everton but maintained that he could still be “gazumped” by a rival bid.

As a major lender to the club, TFG insisted on its £200m loan being repaid in full before another takeover could be completed, leaving them close to events as they played out.

TGG also walked away from talks initially prior to acquiring Italian side Roma four years ago.

Like Everton, Roma have had a turbulent start to the season. Fans protested after manager Daniele De Rossi was sacked just four games into the new campaign, with chief executive Lina Souloukou stepping down from her role on Sunday.

Estimates suggest TFG, which made money through its subsidiary Gulf States Toyota before branching into other spheres including film and entertainment, is worth around $6billion (£4.5bn, €5,4bn).

TFG will now hope to succeed where others have failed in completing a takeover of the Merseyside club. Moshiri has also previously entered into exclusive talks with the KAM Group, MSP Sports Capital and, most controversially Miami’s 777 Partners.

All of those deals collapsed, though, with 777 unable to meet all conditions for their takeover by the June deadline.

777, who are being sued for fraud in New York, have also lent Everton around £200m. What happens to that money is unclear.

Any deal for TFG to buy Everton remains subject to regulatory approval, which would usually be expected before the end of the year.

Everton have endured another difficult start to the season. Winless in their opening four games, they earned their first point of the season away to promoted Leicester City on Saturday but remain close to the foot of the table.

Representatives for Everton, Moshiri and TFG were all contacted for comment.

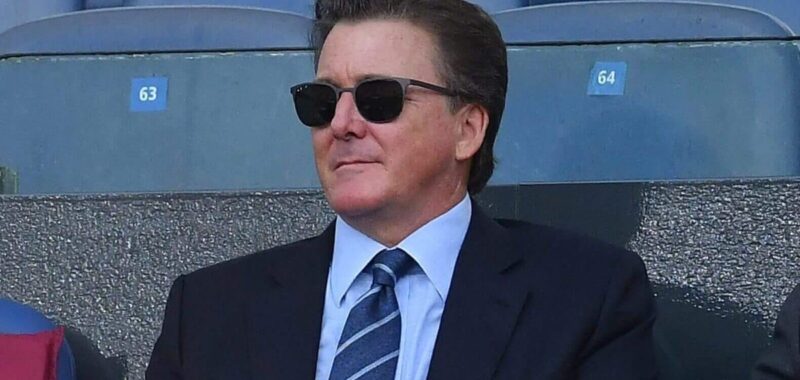

(Archivio Massimo Insabato/Mondadori Portfolio via Getty Images)