- FET stayed flat in October, but bulls have kept it consolidating.

- Now, it’s primed for a breakout, if the right conditions align.

The market was buzzing with post-election hype, as investors diversified to mitigate risk. This has driven Bitcoin[BTC] to a new all-time high of $77K. AI tokens were also reaping rewards, posting impressive weekly gains, with many seeing double-digit increases.

However, Artificial Superintelligence Alliance [FET] remained consolidated despite a 15% gain this week. At press time, it was trading at $1.42, still below its target of $2.

Typically, a bull rally like the current one would position FET for a breakout from its four-month slump. However, its lagging performance has caught AMBCrypto’s attention.

Is FET set for a rebound?

Interestingly, FET has been on a downward trend since October. Despite Bitcoin’s 5% increase, closing the month near $72K, it had little to no impact on FET’s price movement.

One contributing factor has been the memecoin-led ‘supercycle’, with heavy liquidity flowing into meme-based tokens. DOGE, for instance, posted an impressive 11% daily gain.

Unlike previous cycles, this one is marked by more balanced capital allocation. Small-cap tokens are also seeing double-digit gains, a trend FET bulls may aim to leverage, according to CoinMarketCap data.

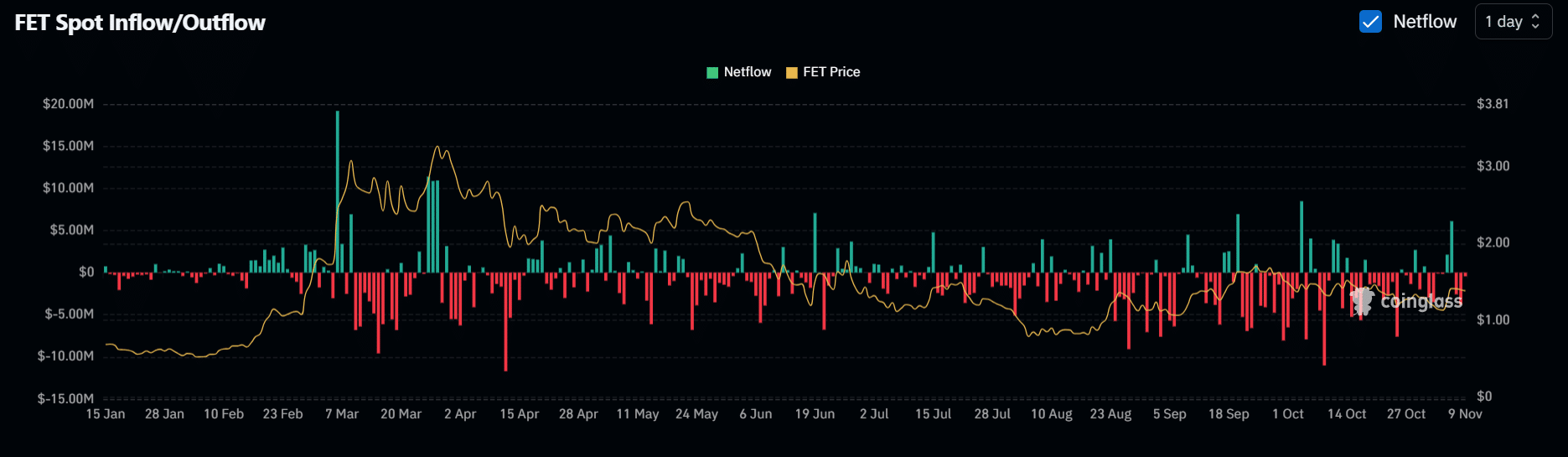

Source : Coinglass

Since mid-June, FET bulls have made four attempts to break the $0.17 resistance, entering an accumulation phase, as shown in on-chain data.

About a month ago, investors withdrew approximately $11 million in FET tokens from exchanges. This helped keep FET within a stable range and mitigate potential pullbacks.

However, despite these aggressive buyouts, the anticipated impact on FET’s price has yet to materialize – suggesting a possible third-party influence that may be counteracting bullish momentum.

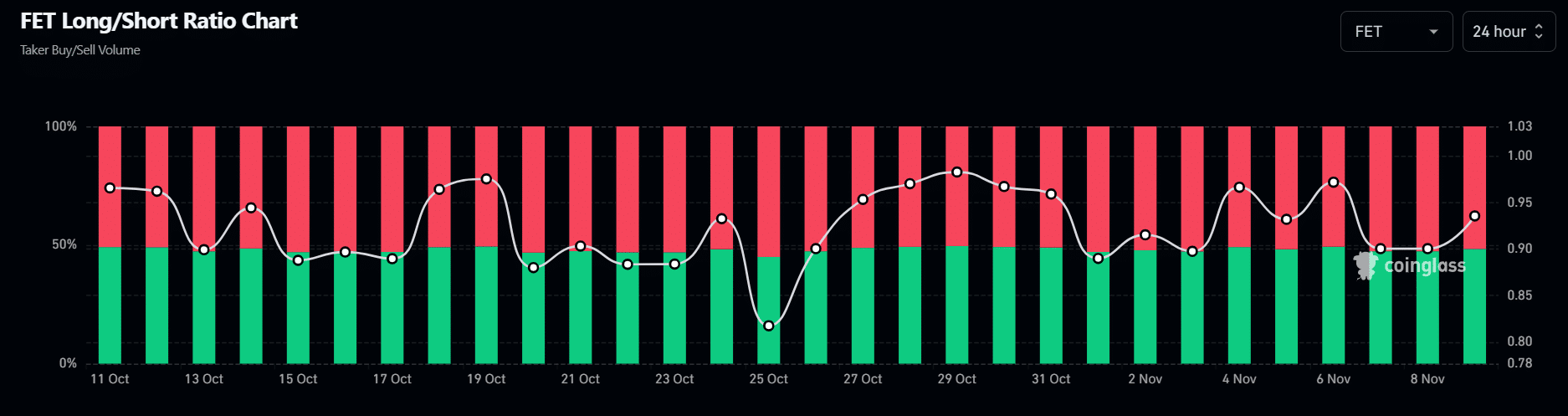

A short bias could derail the rally

Beyond the inconsistent order book activity from large holders, FET’s breakout hinges significantly on the derivative market, where there’s a marked bias toward shorts.

Since October, short-sellers have dominated the FET futures market, acting as a significant source of resistance.

However, there’s a twist: a large volume of short positions could quickly reverse if market momentum shifts against them. And there’s no better time than now.

Source : Coinglass

As mentioned earlier, investors were diversifying their portfolios, with many focusing on small-cap tokens. This trend is notable, especially as BTC approaches a high-risk zone.

Read Artificial Superintelligence Alliance’s [FET] Price Prediction 2024–2025

While spot traders targeting the dip is a bullish sign, it might not be enough to drive a breakout. For that to happen, large holders must avoid offloading their positions.

This would allow strong buying interest to trigger a short-squeeze and set the stage for a bullish rebound.

In other words, FET has the right ingredients for a potential breakout. With the RSI in a neutral phase, a few aligning conditions could push FET above its $0.17 resistance and set it on track toward a $2 target.