- FET nears $1.77 resistance after a 22% rally, with technical and RSI indicators signaling momentum.

- On-chain metrics show strong bullish signals, but increased exchange reserves suggest rising selling pressure.

Fetch.AI [FET] has surged over 22% after breaking out of its macro downtrend, approaching the crucial $1.77 resistance level. FET’s bullish momentum remains strong at $1.61, up 1.48% in the last 24 hours at press time.

The key question is whether this upward trend will hold and push the asset past this significant resistance level.

Price action analysis: Can FET break the $1.77 barrier?

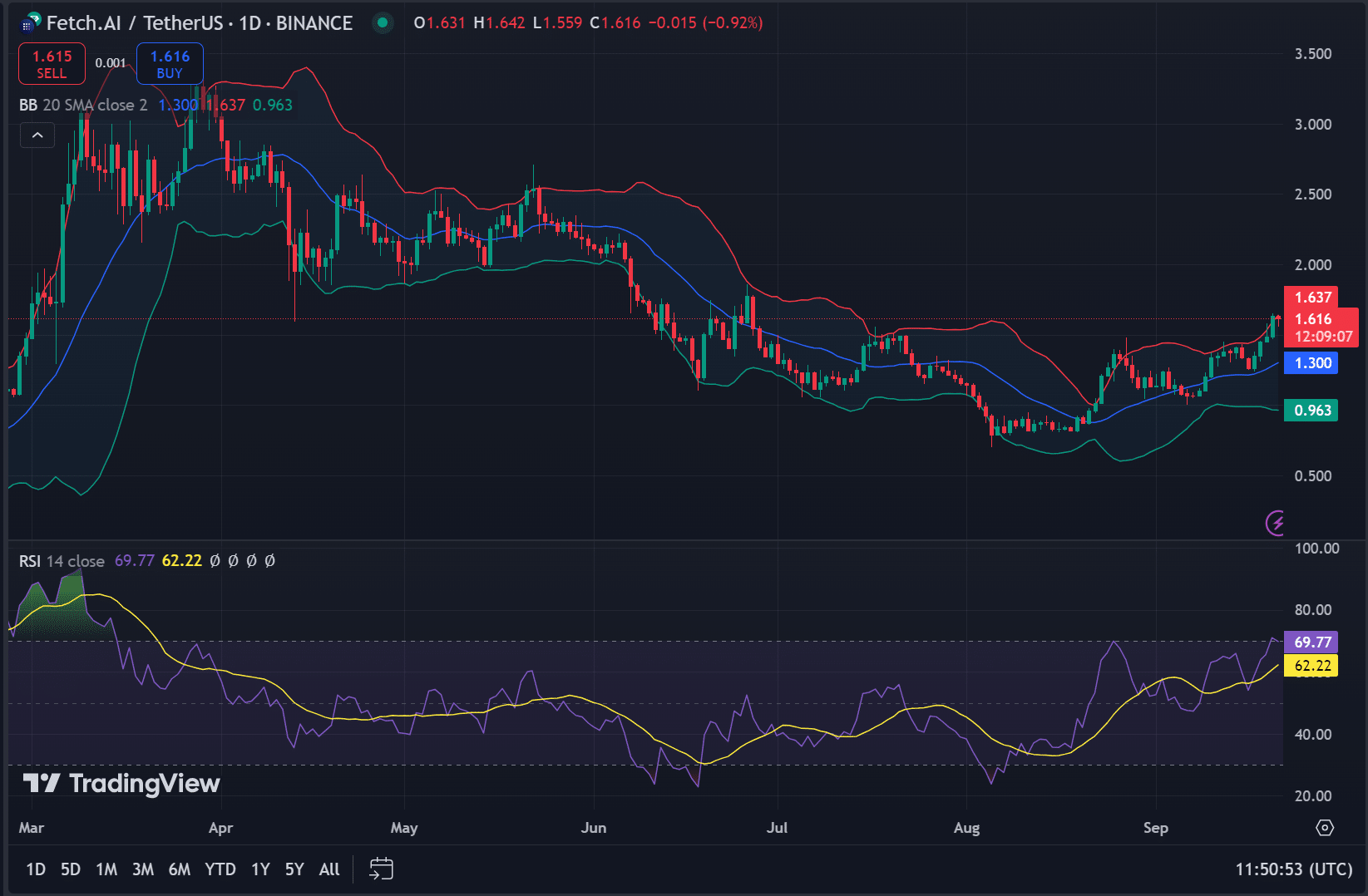

FET’s price action indicates that the token has reached the upper Bollinger Band at $1.637, typically a sign of an overbought condition. The RSI stands at 62.22, showing room for further gains while remaining close to the overbought zone.

With strong buying pressure, traders are closely watching the $1.77 resistance. A breakout above this could signal a push toward $2.00, while failure to breach may see FET revisiting $1.30 as support.

Source: TradingView

Exchange reserves increase – Is selling pressure rising?

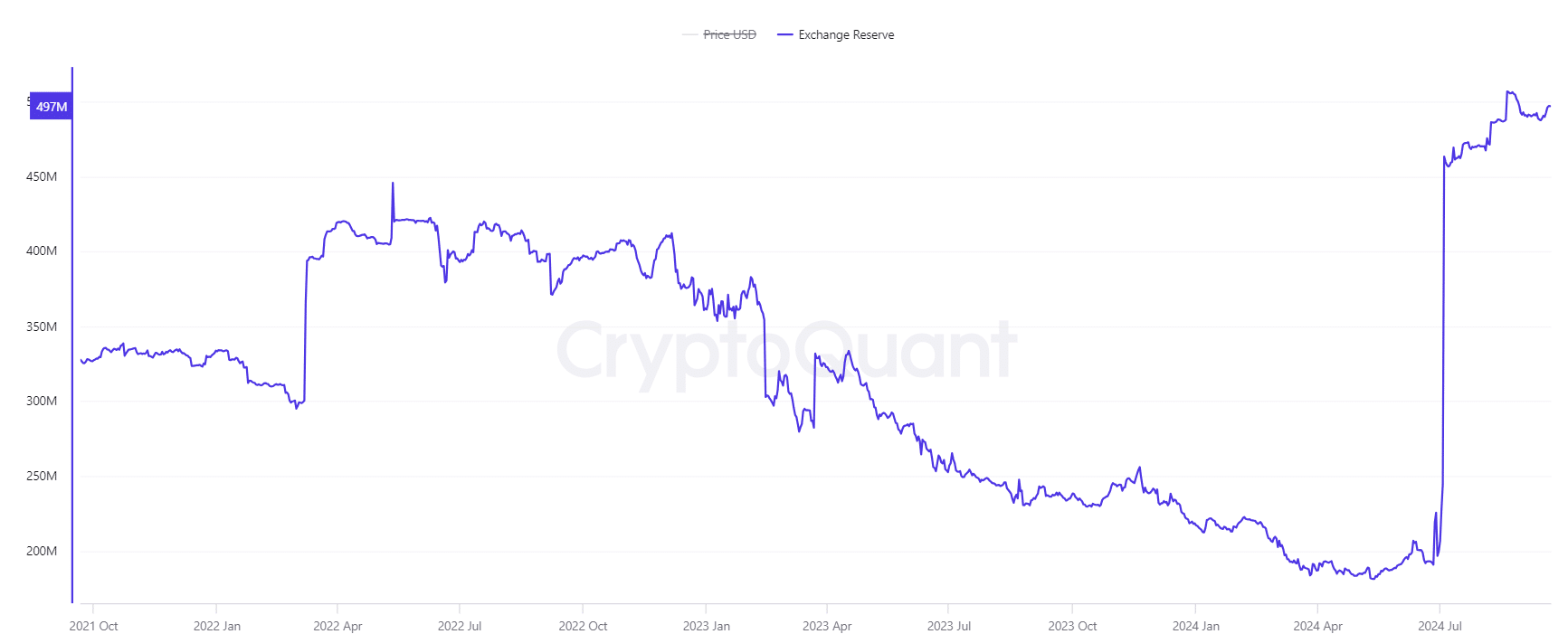

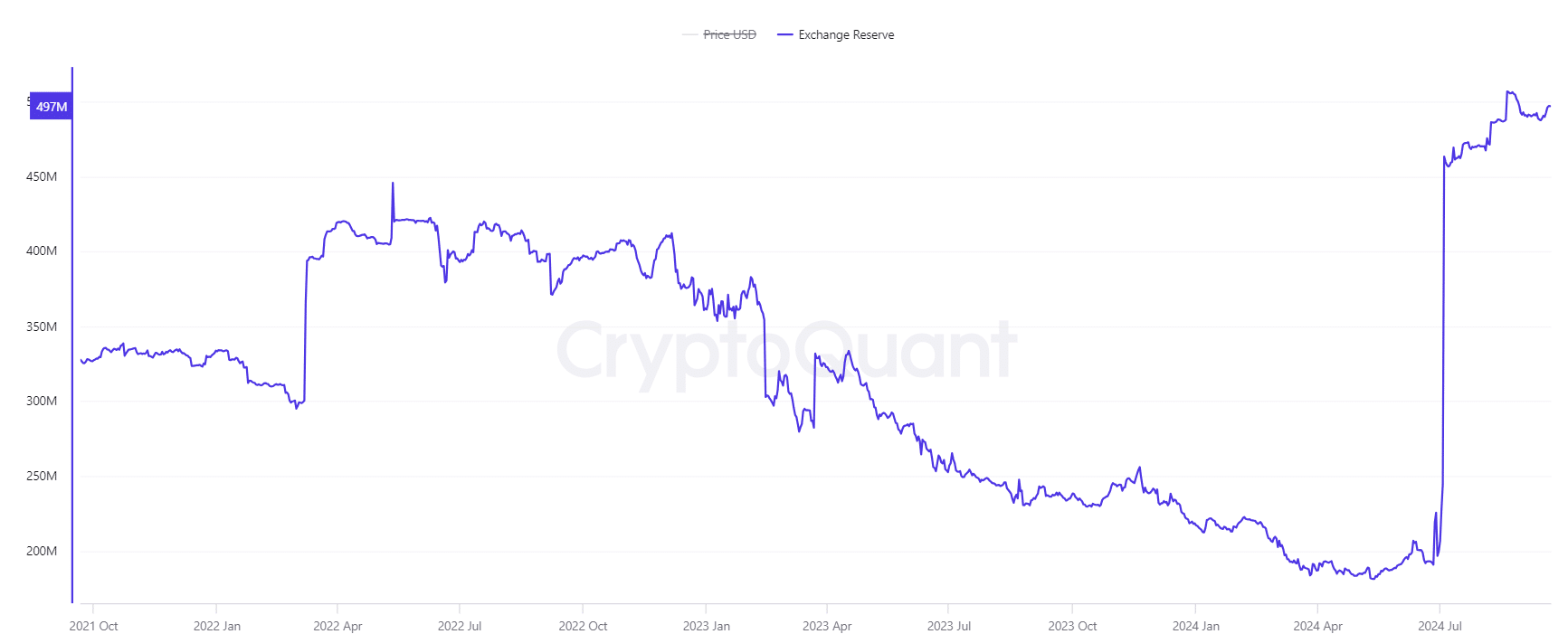

FET’s exchange reserves have risen by 0.24% to 497.0971 million tokens over the past 24 hours, suggesting a potential increase in selling pressure. When more tokens are held in exchanges, it often signals traders preparing to sell, which could affect price action.

This trend may lead to a short-term price correction if sustained, making it a key factor to watch.

Source: CryptoQuant

On-chain signals: bullish momentum still intact?

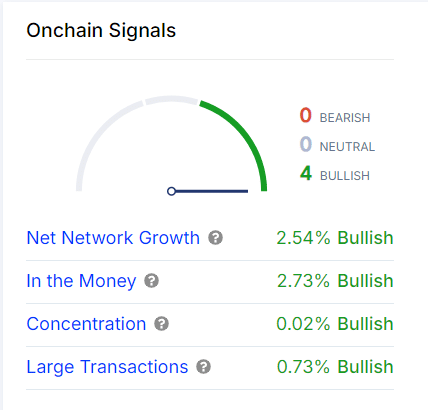

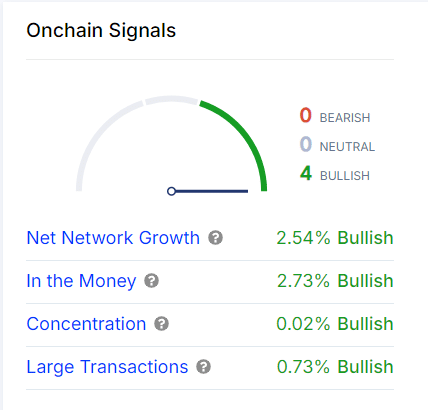

FET’s on-chain signals show robust bullish indicators. Net network growth has climbed by 2.54%, indicating expanding user activity, while “In the Money” has risen 2.73%, suggesting more holders are in profit.

Both concentration and large transactions have seen slight increases, pointing to continued investor confidence in FET’s potential upward trajectory.

Source: IntoTheBlock

FET open interest rises—what could it signal?

Open interest in FET futures has increased by 2.33%, now standing at $105.82 million at press time. This rise reflects growing market participation and anticipation of a significant price move.

Combined with strong on-chain data, rising open interest suggests FET could maintain its bullish momentum.

However, traders should remain cautious, as excessive leverage could lead to a sharp correction.

Source: Coinglass

Read FET Price Prediction 2024- 2025

FET’s bullish momentum hinges on breaking the $1.77 resistance. On-chain data supports further gains, but increased exchange reserves signal caution, as selling pressure may limit the rally.