- FTM’s price surged by 85% after a successful reversal from its $0.64 support level

- Metrics pointed to a short-term correction before a potential rally to $1.68

Fantom (FTM) has seen a strong bullish run following its breakout from a key bullish pennant pattern on the weekly chart. In fact, after rebounding from the pennant’s support level at $0.64, FTM recorded an impressive 85% surge to its press time trading price.

This rally also pushed the altcoin past its critical weekly resistance level at $1.08 – A sign of growing market confidence.

Source: TradingView

FTM is breaking barriers on the daily chart

On the daily chart, FTM further extended its gains by breaching the recent resistance level of $1.20.

The immediate resistance beyond this now lies at the $1.68 key weekly resistance level. This target is a critical zone for further gains, given the recent momentum in the broader market.

Source: TradingView

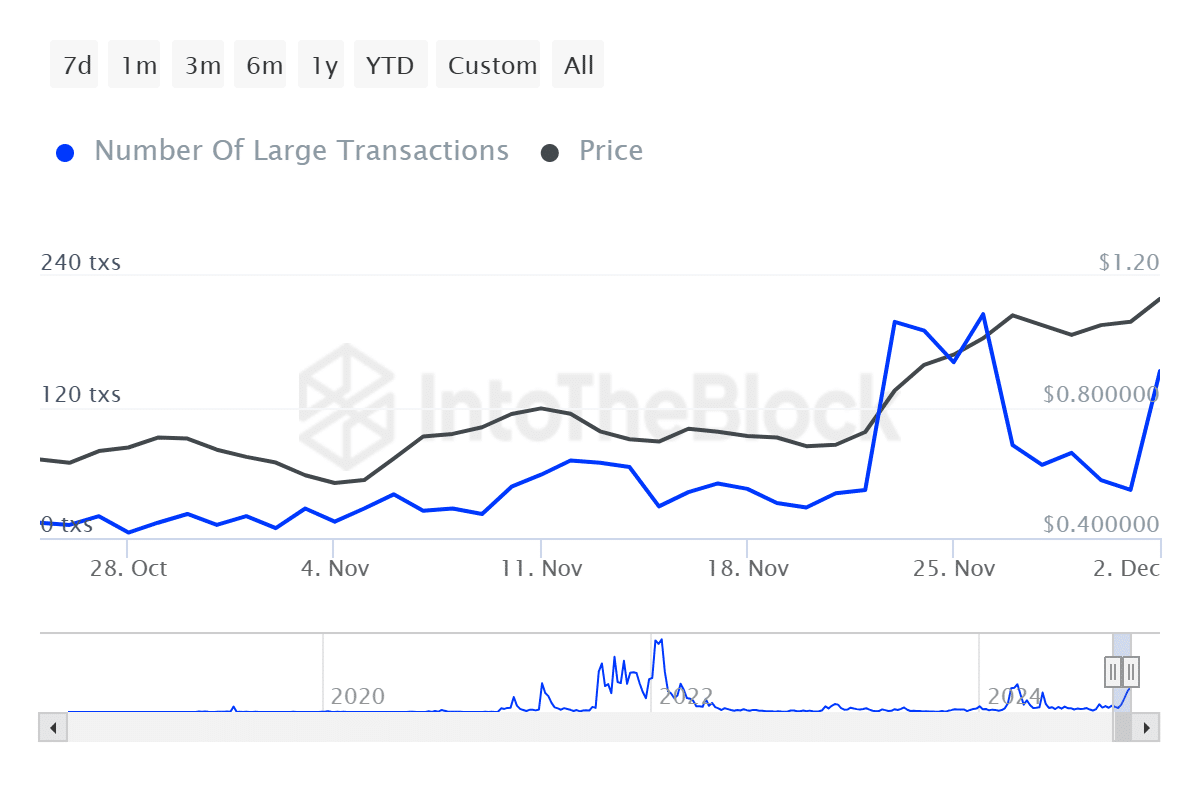

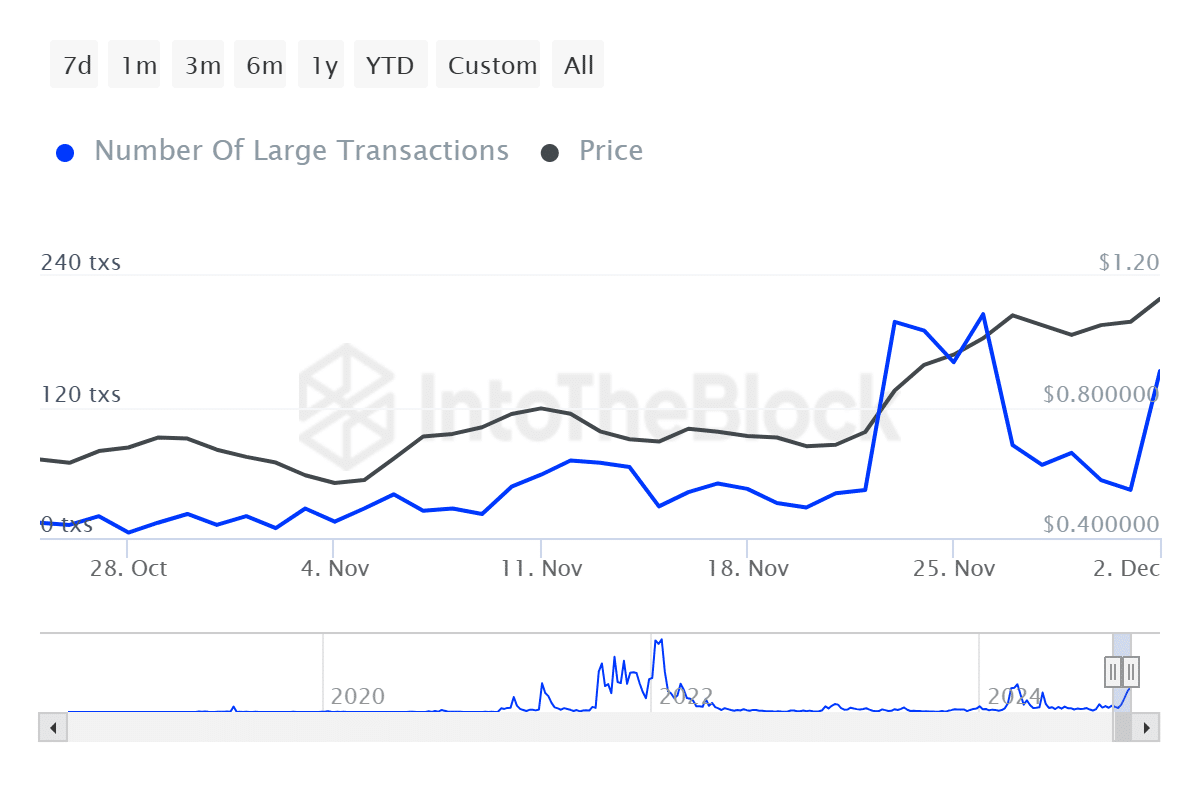

FTM whales make moves as exchange outflows shrink

Fantom’s rally has coincided with a surge in whale activity. According to data from IntoTheBlock, large transactions climbed by 500% over the last 24 hours—A sign of growing interest from high-net-worth investors.

Source: IntoTheBlock

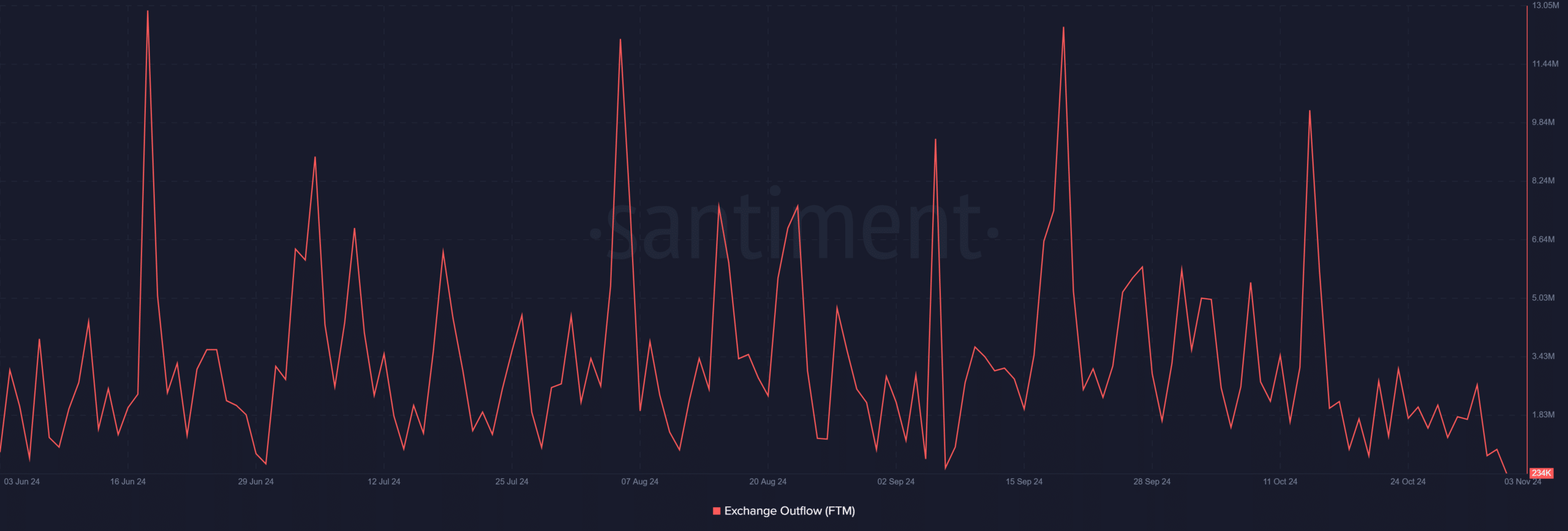

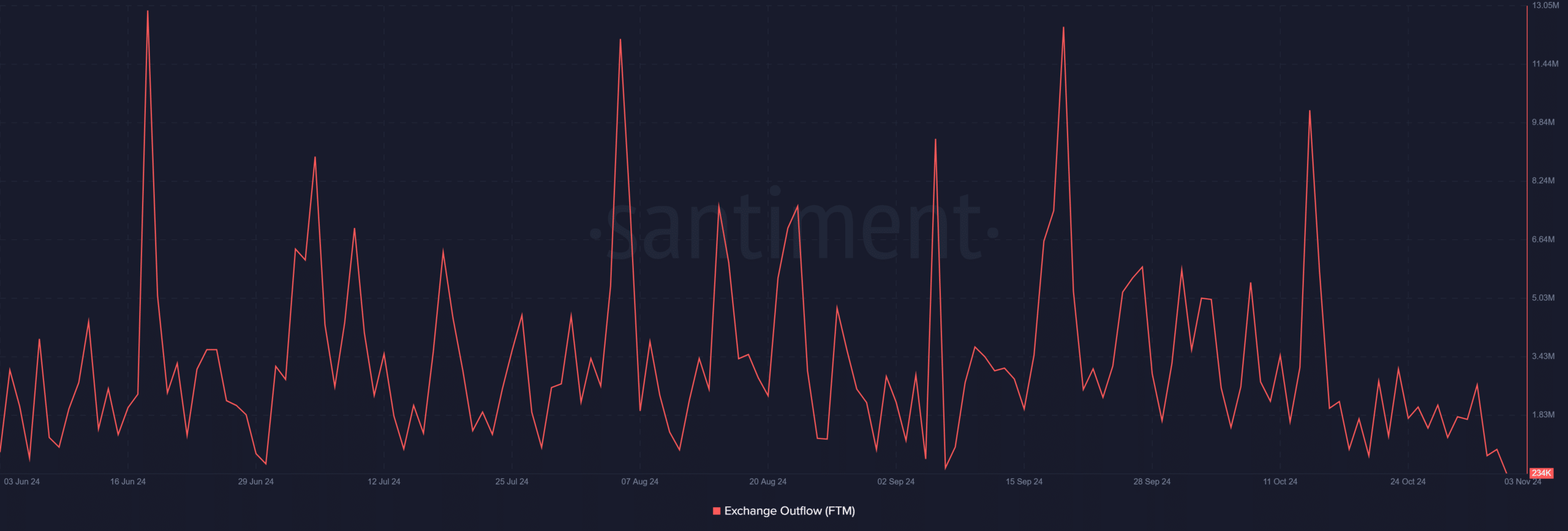

On the other hand, exchange outflows fell to their lowest level since 03 June. FTM’s outflows pointed to greater demand, with the same likely to push its price higher on the charts.

Source: Santiment

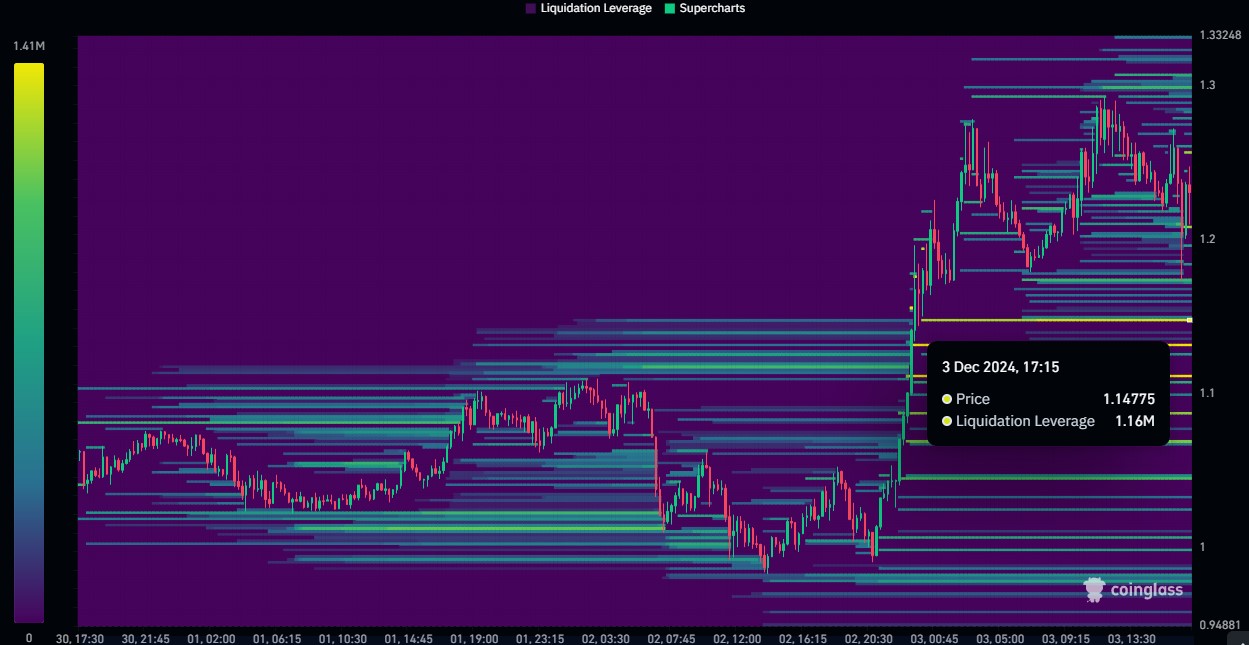

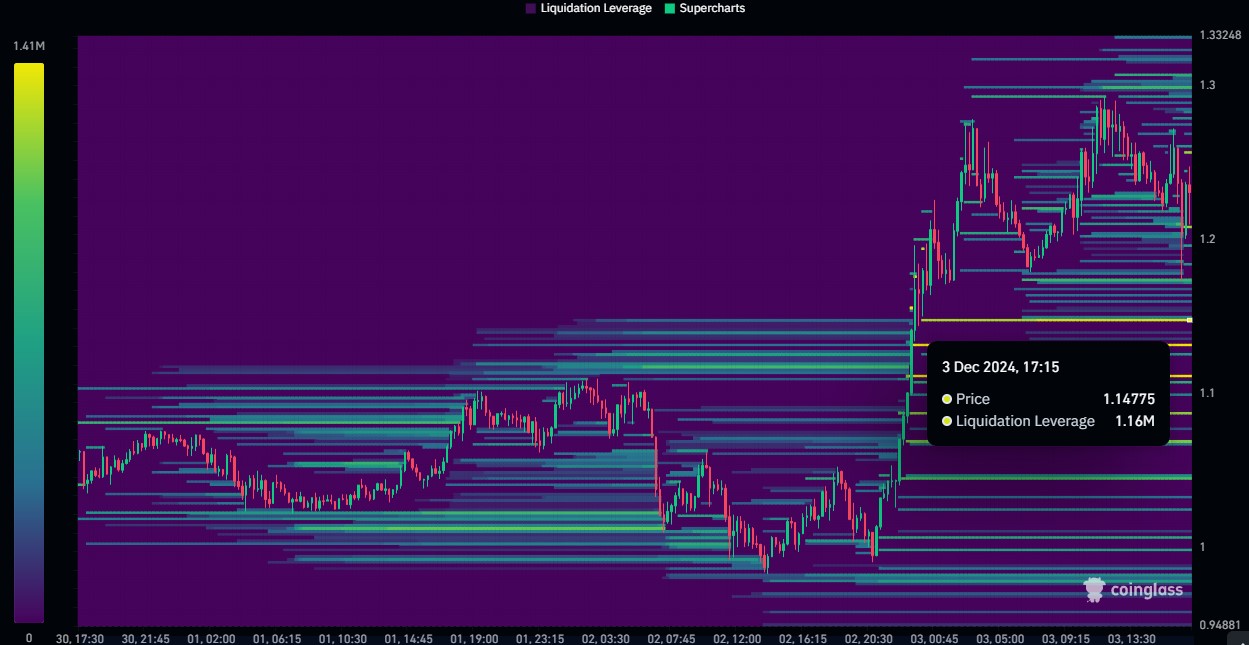

Liquidity data hints at a short-term correction

Finally, AMBCrypto’s analysis of Coinglass’s liquidity data revealed interesting insights into the short-term price dynamics. A liquidation pool of 1.14 million at the $1.15 psychological level suggested that FTM could face a short-term pullback, before resuming its upward rally.

This seemed to be in line with the broader market trend, especially since minor corrections often precede extended rallies.

Source: Coinglass

FTM’s breakout above several resistances and the resulting surge in whale activity have strengthened its bullish case. However, the price could see a potential correction near the $1.15-level, before the altcoin targets the $1.68 resistance zone.

In light of interesting liquidity levels, backed by a hike in investor interest, FTM’s uptrend might continue for the next few weeks, barring unforeseen market shifts.