- Ethereum’s Q1 struggles have sparked a debate about its long-term value

- Despite recent losses, Trump’s backing may signal confidence in Ethereum’s potential for future recovery

As Ethereum [ETH] faces its most challenging quarter in years, with a delayed upgrade and a sluggish market performance, one detail stands out – 91% of President Trump’s crypto holdings are anchored on the Ethereum blockchain.

As the network grapples with its current hurdles, this significant investment has ignited speculation about Ethereum’s long-term prospects. Could Trump’s backing be a signal of untapped potential, or is Ethereum’s struggle just the beginning of a deeper downturn?

Ethereum – A rocky start to 2025

Source: X

ETH has been recording one of its worst Q1 performances in recent years. In fact, at press time, March’s returns stood at -10.95%, following a steeper decline of -31.95% in February – Significantly below the average March returns of +19.48%.

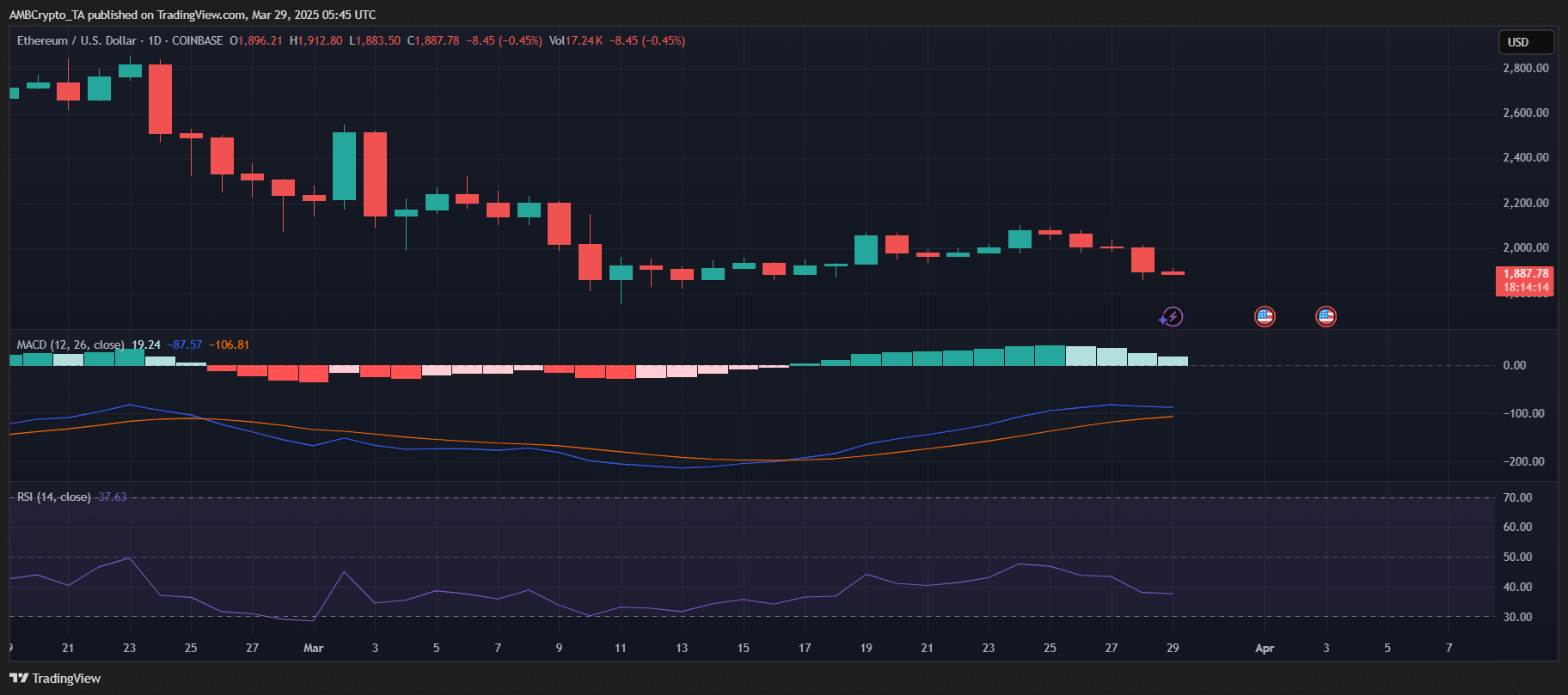

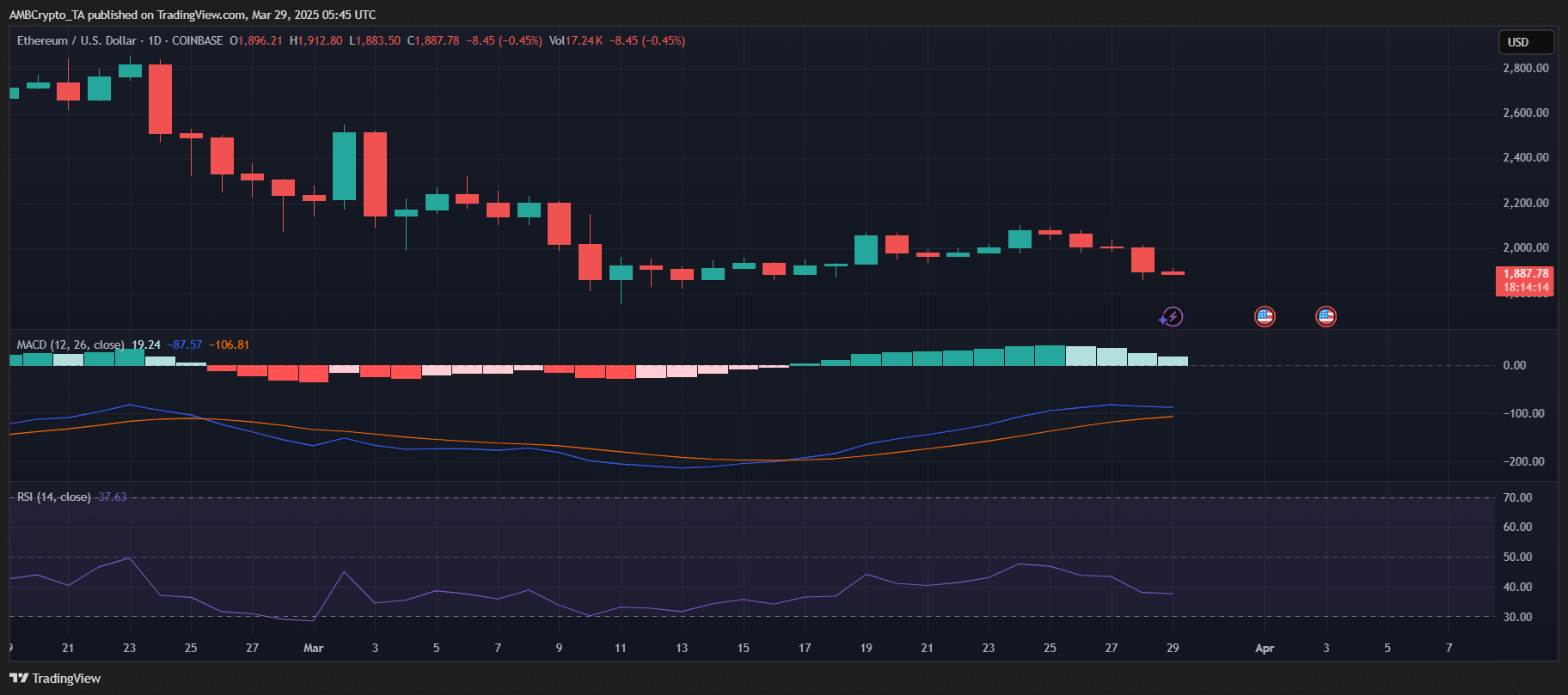

Source: TradingView

Technical indicators highlighted this bearish trend, with ETH trading at around $1,887 at press time. The MACD revealed growing bearish momentum, while the RSI was near 37 – Indicating oversold conditions. A series of red candles on the daily chart underlined sustained selling pressure throughout March.

Adding to the uncertainty, the ecosystem remains in limbo as traders anticipate upcoming upgrades. Sentiment remains cautious, with ETH’s price action continuing to reflect the broader market’s skepticism too.

Trump’s crypto holdings – What we know

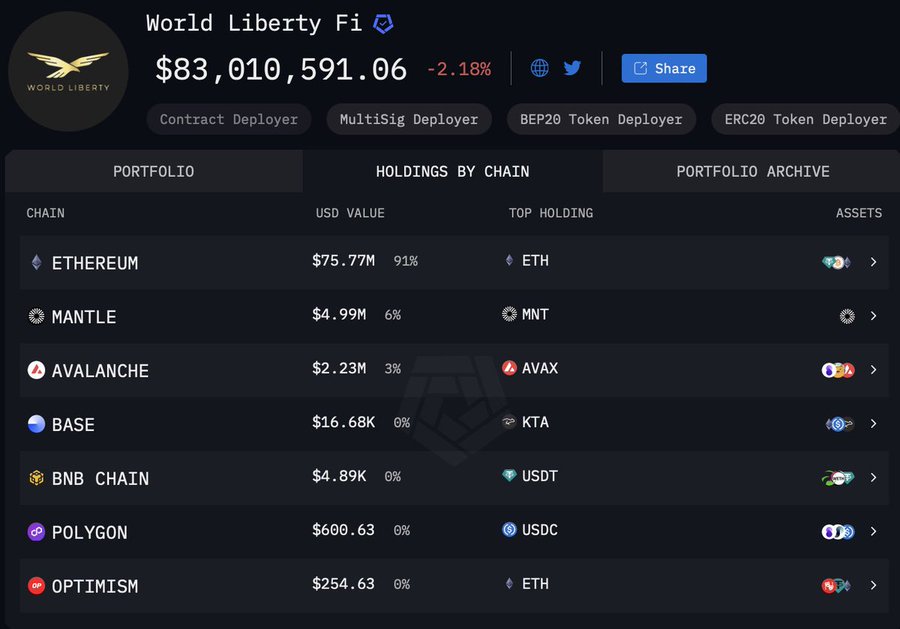

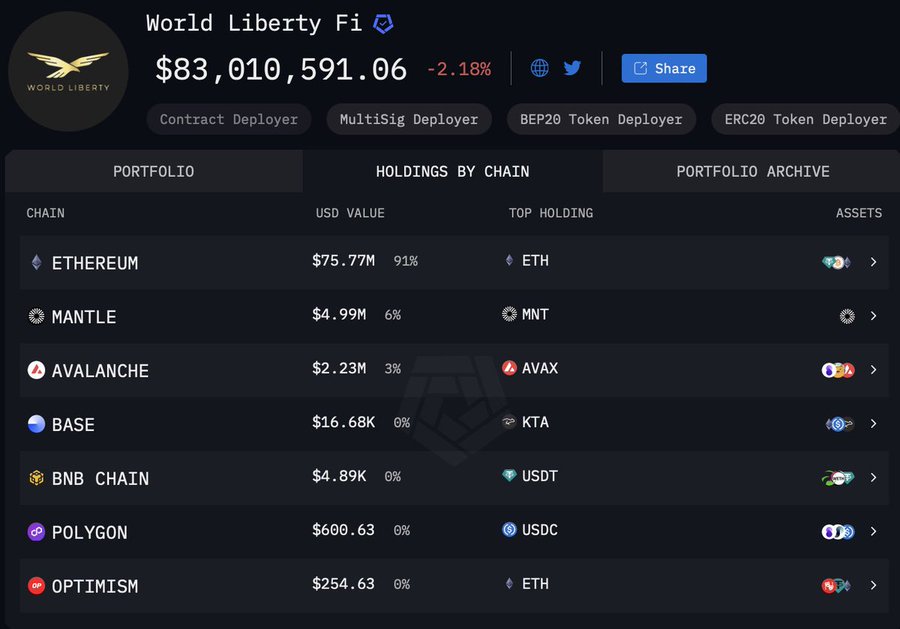

President Donald Trump’s financial footprint in the crypto world is larger than many might expect. Through his family’s significant control over World Liberty Financial (WLFi), it’s clear that Ethereum plays a central role.

Recent data revealed that 91% of WLFi’s crypto portfolio – worth approximately $75.77 million – is anchored in Ethereum right now.

Source: X

This substantial commitment to ETH raises questions about Trump’s influence on the network’s future, especially amid Ethereum’s ongoing struggles. While market sentiment remains shaky, Trump’s indirect endorsement could reflect confidence in Ethereum’s long-term value proposition.

Given the scale of his holdings, any shifts in Trump’s crypto position could ripple through the market, influencing both ETH’s valuation and broader public perception.

The case for undervaluation

Some market observers argue that ETH might currently be undervalued, seeing the Trump family’s significant stake as a vote of confidence in the asset’s resilience. This perspective pertains to historical data – Like Ethereum’s downturn in 2020 – where bearish cycles eventually gave way to recovery. This could be a sign that current struggles may mirror past patterns.

However, not everyone is convinced.

Skeptics believe that ETH’s sustained decline could lead to new lows, risking prolonged bearish momentum. Bitcoin’s persistently negative 1-year percentage change might also impact ETH, dragging it further down. Additionally, concerns over reduced liquidity and waning investor confidence present potential risks that could challenge the asset’s stability.

Balancing these perspectives, Ethereum’s trajectory may depend on broader market dynamics and whether financial endorsements like Trump’s truly signal strength or a fleeting vote of confidence.

What’s next for Ethereum?

ETH’s future recovery may be driven by several factors. One potential catalyst is the implementation of sharding, which aims to enhance scalability and reduce fees. Institutional interest is also growing, with Deutsche Boerse’s Clearstream planning to offer custody and settlement services for ether, boosting participation.

Finally, the potential approval of Ether-based ETFs could attract significant capital inflows, especially as the Trump administration maintains a pro-crypto position. In the DeFi space, Ethereum remains foundational despite market challenges, with its role in decentralized applications intact.

However, regulatory clarity around staking and Ethereum-based tokens will be vital, and the administration’s supportive approach could strengthen investor confidence and foster further adoption.