- Ethereum (ETH) seemed to be forming a bullish W-pattern on the weekly chart

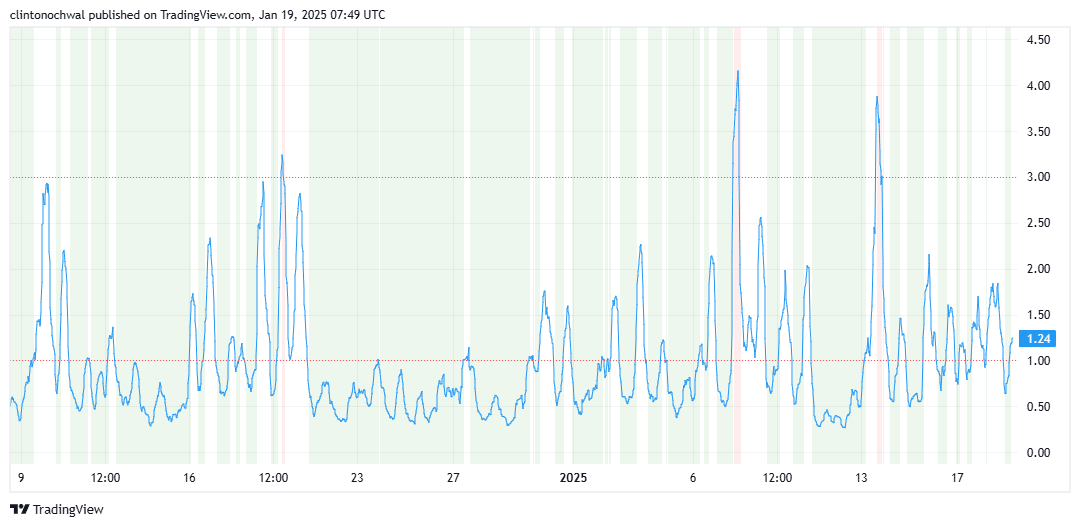

- Altcoin’s Market Value to Realized Value (MVRV) ratio highlighted its fair valuation

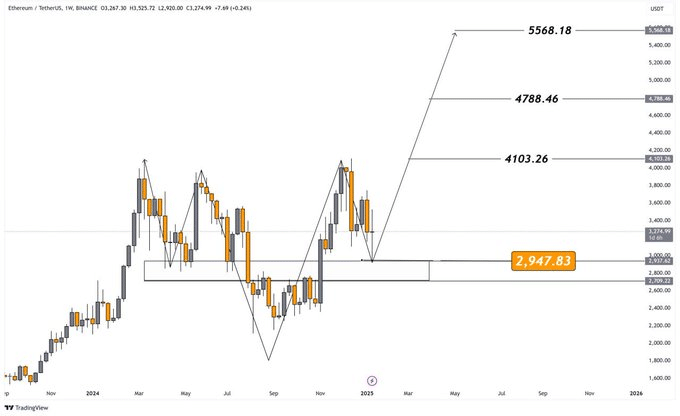

Ethereum (ETH), at the time of writing, was forming a bullish W-pattern on the weekly chart, signaling a potential trend reversal and significant upside. In fact, the altcoin seemed to be holding above the critical $2,947 support – A level that is now serving as the neckline of this formation.

This support zone is pivotal in determining Ethereum’s trajectory, with price targets set at $4,103, $4,788, and $5,568, as highlighted on the chart. A breakout above the neckline resistance would confirm the bullish trend, opening the door for significant gains.

Source: TradingView

This W-pattern can be interpreted to underline Ethereum’s resilience, highlighting a shift from bearish to bullish momentum. In fact, the altcoin’s price chart revealed that maintaining support above $2,947 would be crucial for this pattern to play out.

A confirmed breakout above $3,200 could pave the way for rapid upward movement towards the $4,100 resistance.

Gauging Ethereum’s momentum

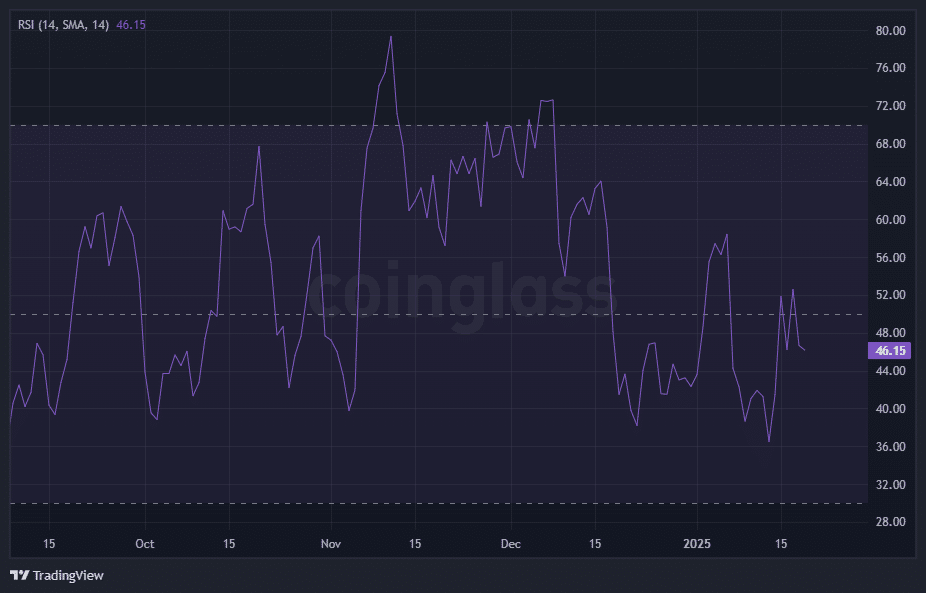

From the perspective of momentum, the Relative Strength Index (RSI) had a reading of 46.15 at press time. This neutral level hinted at a balance between buyers and sellers in the altcoin’s market.

Source: Coinglass

However, the RSI’s stabilization near its midline hinted at waning bearish pressure. A decisive move above 50 could signal renewed bullish momentum, aligning with a potential price breakout.

Conversely, a drop below 40 might be a sign of further downside, jeopardizing the $2,947 support level.

Assessing Ethereum’s valuation

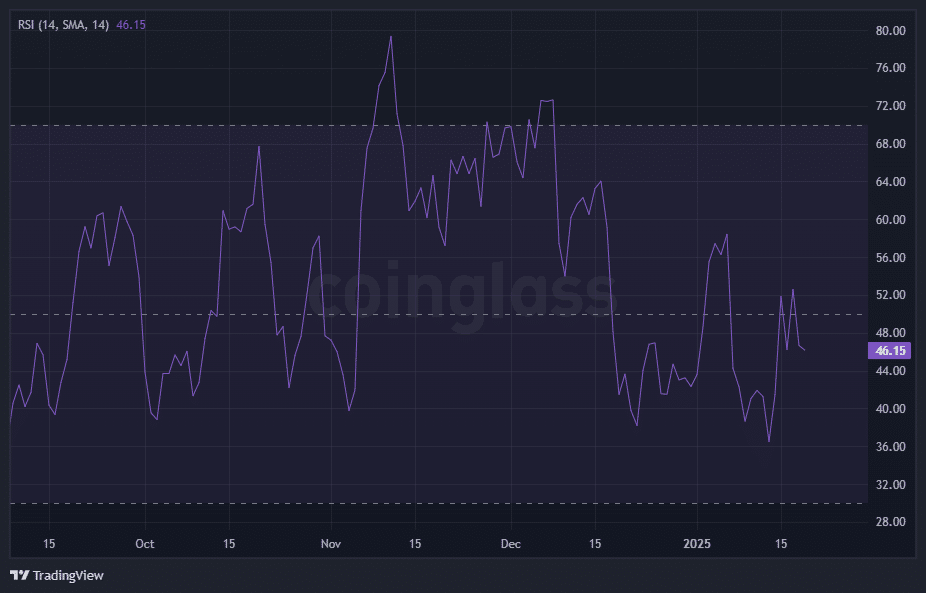

For additional insights, it’s worth looking into Ethereum’s Market Value to Realized Value (MVRV) ratio too. At the time of writing, it’s reading reflected fair valuation. The ratio was hovering near its neutral levels – A sign that ETH was neither overvalued nor undervalued.

Source: TradingView

Historically, MVRV values above 1.2 have triggered some selling pressure, while values below 0.8 have attracted buyers. As ETH approaches higher targets, the ratio could enter the overvaluation territory, prompting caution among long-term investors.

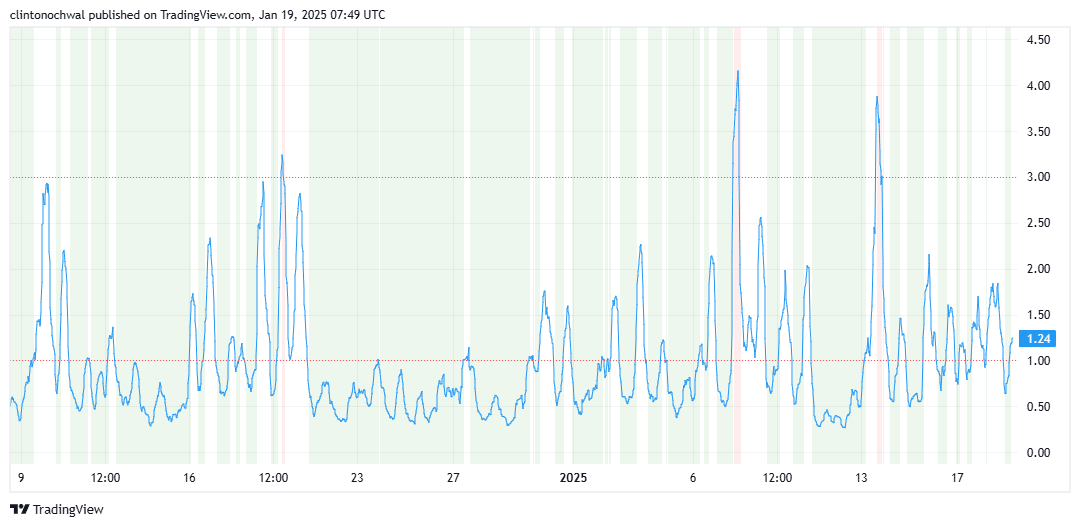

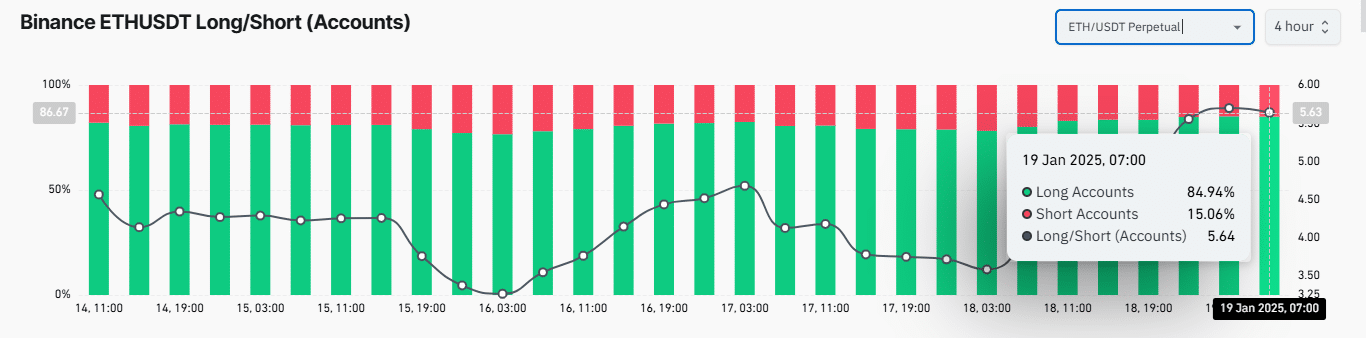

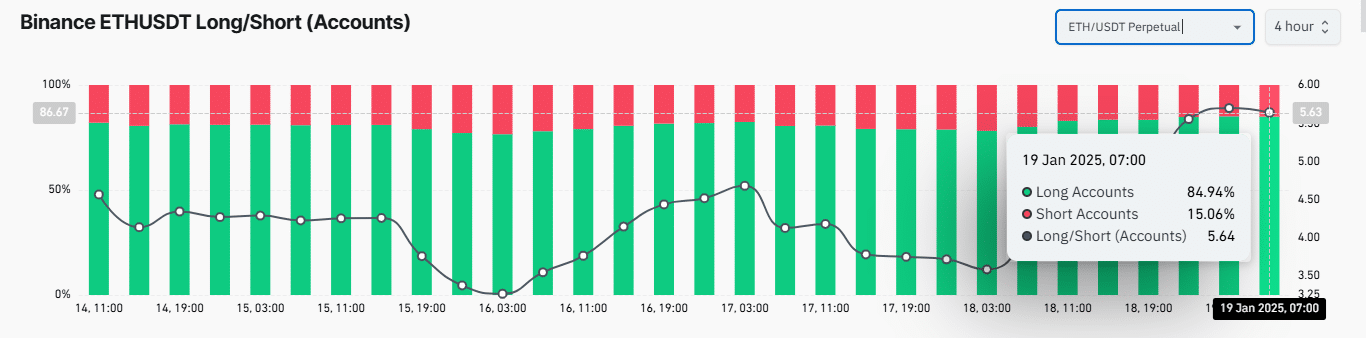

Finally, the long/short ratio revealed that 84.94% of accounts were long – A sign of strong bullish sentiment for Ethereum.

Source: Coinglass

This high imbalance alluded to potential upward price momentum as buyers have dominated the market so far. However, overwhelming long positions may also introduce the risk of sharp price corrections. Especially if the market sentiment shifts or long liquidations occur during volatility.

Both Ethereum’s weekly chart and technical indicators hinted at a pivotal moment for the cryptocurrency. The W-pattern, combined with a neutral RSI and a balanced MVRV ratio, highlighted Ethereum’s potential for a bullish breakout if key levels hold.