- Ethereum whales appear to be executing a “buy-the-fear” strategy as ETH breaks through support levels

- Is a rebound imminent on the charts?

When big money pours into the market during a dip, it’s called a “buy-the-fear” strategy. In this case, Ethereum [ETH] whales seem to be doing just that, taking advantage of the panic to scoop up discounted assets in anticipation of a market recovery.

The mystery group “7 Siblings” made a bold move, investing $42.66 million to acquire 25,100 ETH at around $1,700, In a similar move, another whale borrowed 8.25 million DAI to purchase 5,227.3 ETH at around $1,578.

Hence, should you follow suit and buy into the fear?

Ethereum on whale alert

At press time, Ethereum seemed to be breaking through multi-year lows, with the altcoin trading 16.8% lower at $1,490 – Levels not seen in two years. The outlook looked murky, and expecting an immediate rebound would be premature.

Why? The “7 Siblings” group is currently facing a $5.27 million loss, equating to a $120 loss per ETH. Likewise, the other whale has been sitting on a $460k loss.

This highlighted that despite the aggressive accumulation, these whales are still under significant pressure. Especially as the market remains in a fragile state. Unless these big hands enter profit positions, the market would be susceptible to more sell-offs if these whales decide to break even.

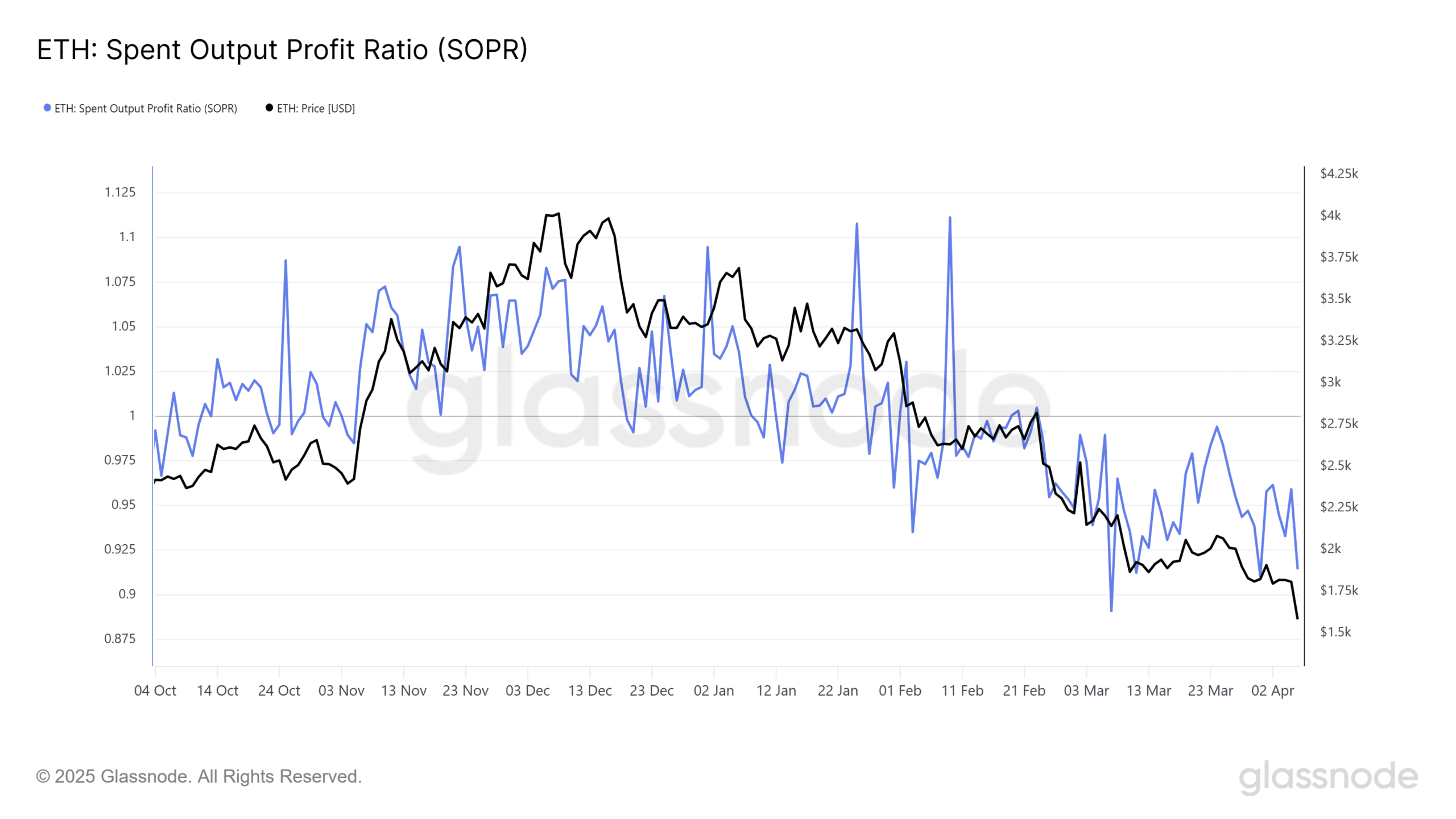

Looking at the SOPR (Spent Output Profit Ratio) chart underlined the likelihood of sustained sell-offs. Especially since the same fell to a six-month low.

The SOPR metric showed that a majority of market participants are facing losses, heightening the risk of further liquidations.

Source: Glassnode

To absorb the sell-side pressure, more big money needs to step in.

Small hands are either panic selling or waiting for Bitcoin to recover. Until larger players take control, the market would be vulnerable to further downside.

What’s next – A short squeeze or a speculative loop?

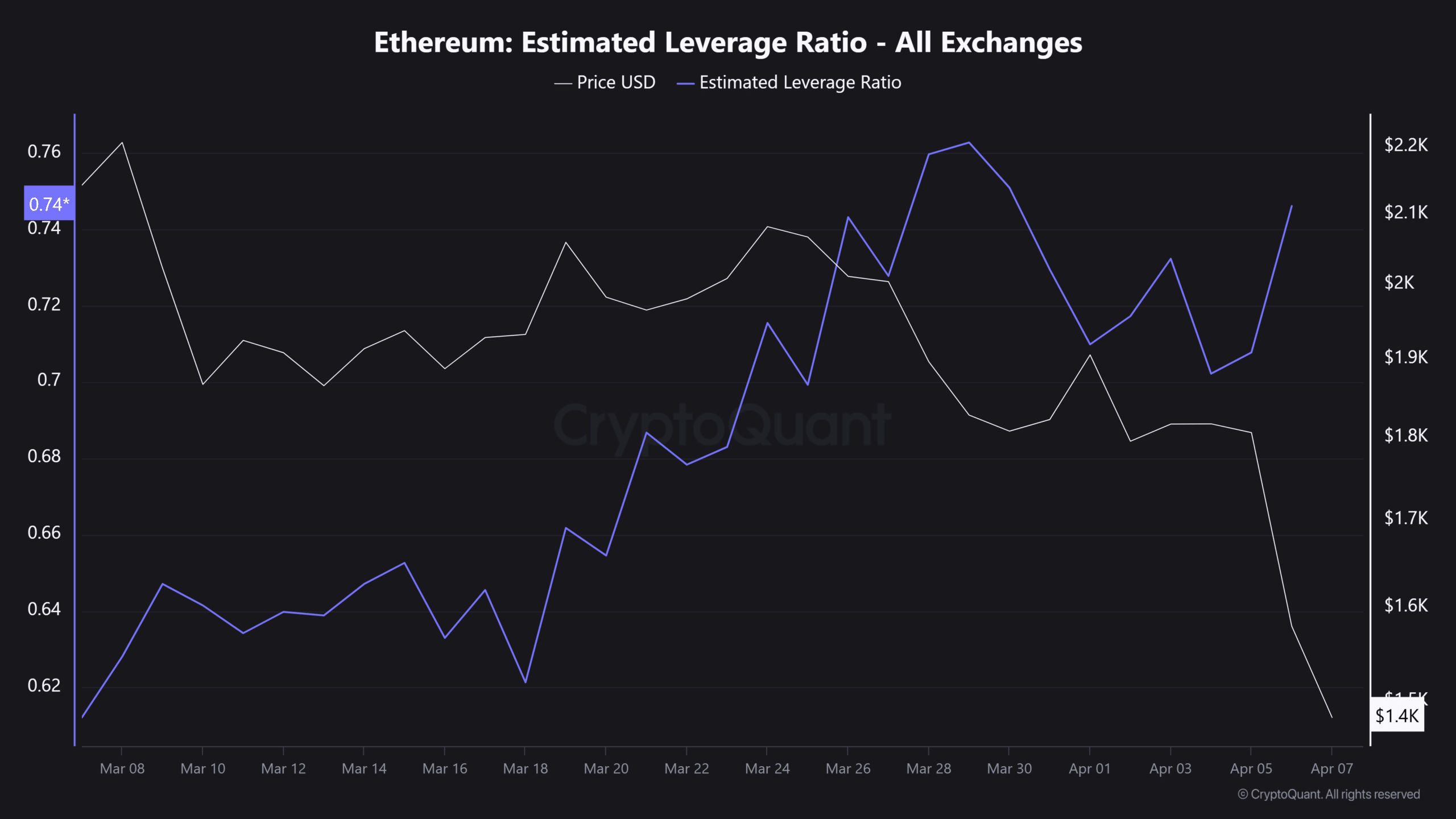

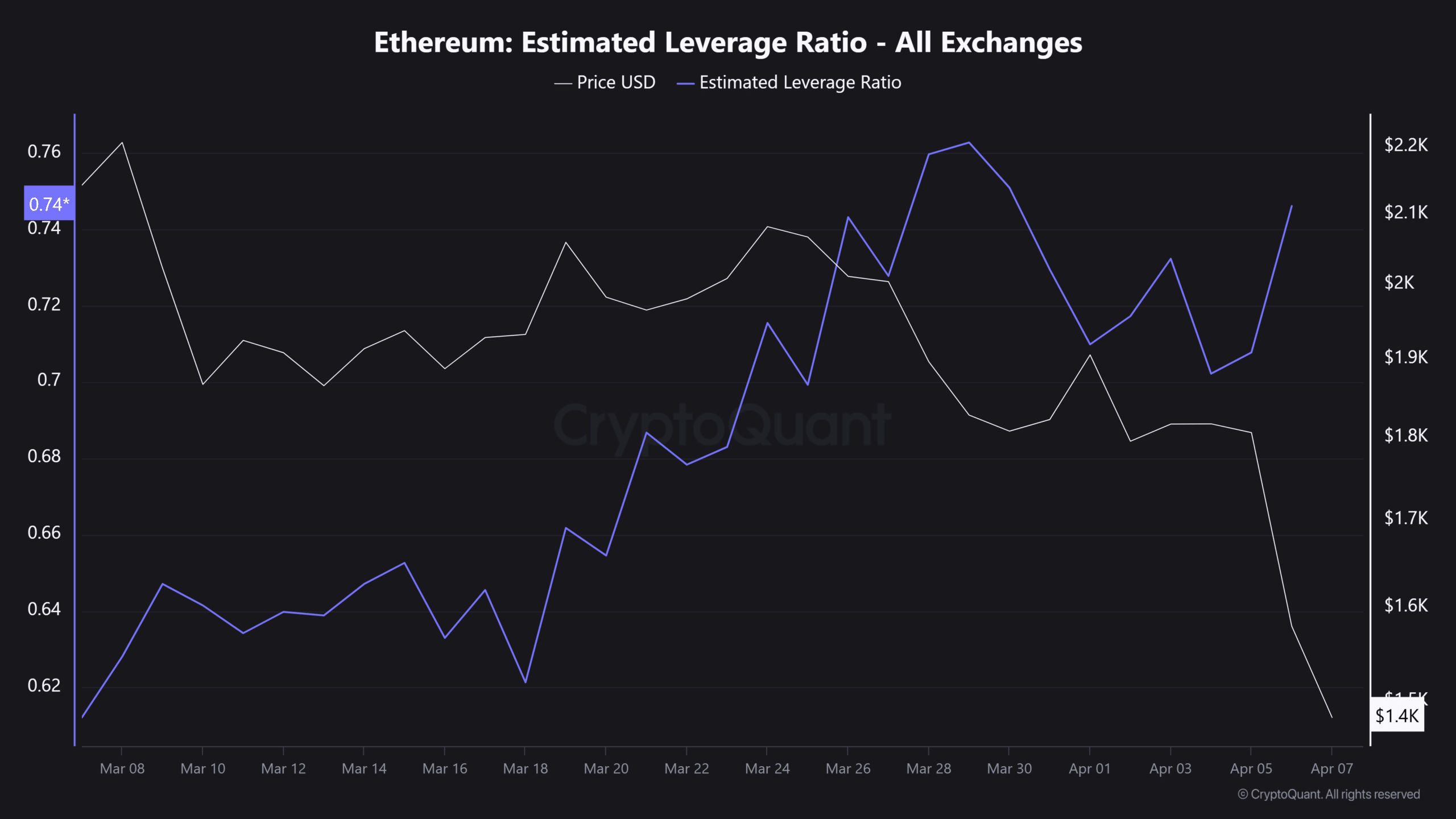

The unexpected crash caught Futures traders off guard, triggering a wave of de-risking with $349.59 million in long liquidations. Despite this, however, Ethereum’s Estimated Leverage Ratio (ELR) spiked – A sign that traders are still jumping into high-risk leveraged bets.

Source: CryptoQuant

This speculative surge, coupled with big money inflows, could set up a short squeeze if the market reverses.

However, in the context of a bearish trend, this could quickly flip. Why? Because Ethereum’s sell-side pressure is still significant, with ETH reserves climbing from 18.21 million on 1 April to 18.50 million, signaling elevated liquidity in the market.

Unless strong demand forms, Ethereum will stay stuck in a speculative loop, with whales “buying the fear and selling the greed.” This will keep the ELR high, while increasing the risk of more liquidations.