- Per Amberdata, ETH could rally higher if the U.S. spot ETH ETF staking is approved.

- The options market is positioned for a $6K upside ETH target by December 2025.

Ethereum’s [ETH] recent 70% run-up from April lows may be the beginning of a larger uptrend targeting $3.5K-$6K, according to crypto options analytics firm Amberdata.

In its weekly market report, Amberdata’s Greg Magadini wrote,

“There’s a good argument for ETH ‘catching-up’ as spot ETFs with staking rewards could be a catalyst for institutional participation and sentiment turns around. No reason to be ‘calling tops’ right now.”

ETH catalysts

The SEC has postponed its decision on staking applications for spot ETH ETFs from Grayscale and Hashdex, pushing the review period to between June and October.

But most analysts, including Magadini, believe this extra staking yield (3% per year) could be a key catalyst for demand for spot ETH ETFs, eventually rallying ETH.

In fact, the executive pointed to recent strong bullish inflows targeting $3.5K and $6K by year-end, suggesting traders are positioning for such a scenario.

“ETH block trades last week saw some very bullish flow in EOY December options. $3,500 / $6,000 call spreads traded for 30,000x contracts through 10 distinct trades. The total premium spent here was a little over $7 million.”

Call options are bullish bets or protection for the upside, reflecting bullish sentiment for future price action. Puts, on the contrary, refer to the opposite and downside protection, underscoring a bearish bias.

Simply put, traders expected ETH to rally between $3.5K and $6K by December 2025.

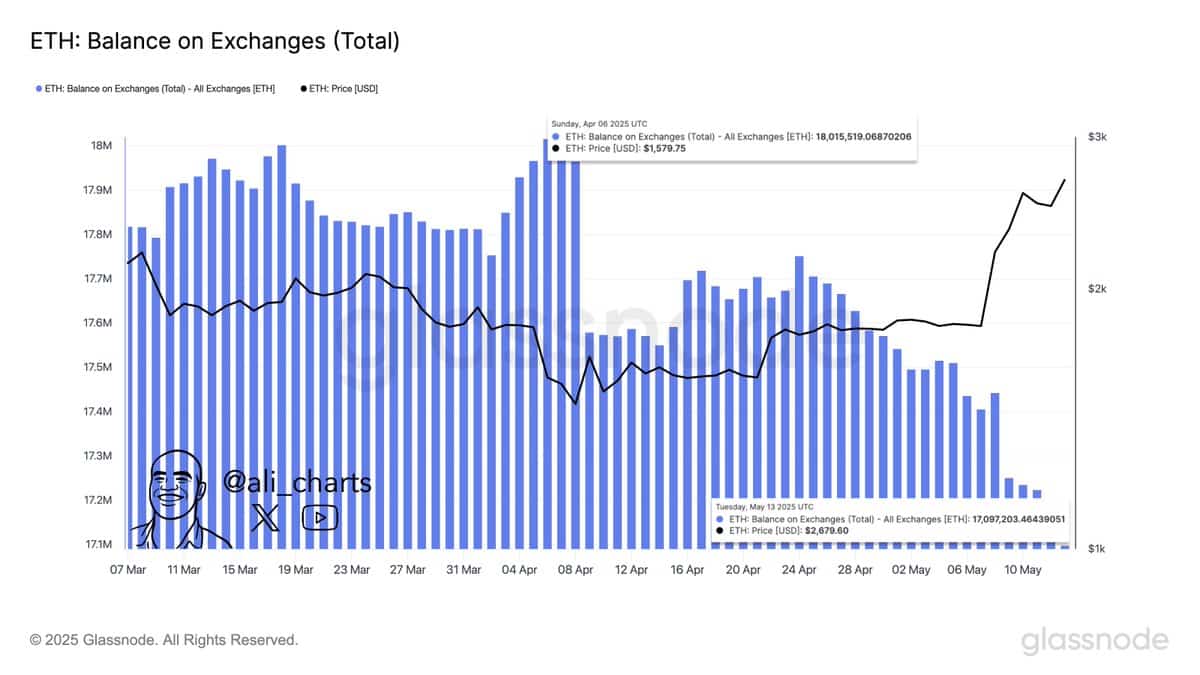

On-chain data also supported the continued uptrend thesis. Since April, over 1 million ETH (about $2.38 billion) have been moved from exchanges between April and mid-May.

This mirrored broader accumulation amid the renewed altcoin surge.

Source: Glassnode

That’s a significant reduction in selling pressure that could further boost the rally. Despite the mid-term bullish outlook, ETH’s short-term momentum weakened slightly at press time.

According to crypto trader and analyst, Income Sharks, ETH’s On Balance Volume (OBV) retreated, suggesting reduced volume that could drag the rally.

Source: Income Sharks/X

Besides, he added that the formation of a bearish head and shoulder pattern could drag ETH lower if validated.

On the daily price chart, however, ETH flashed a golden cross, a formation that sometimes precedes massive rallies.

Source: ETH/USDT, TradingView