- Ethereum ETF outflows jump 39%, but BlackRock’s $1.8B ETH bet signals long-term conviction.

- Standard Chartered predicts XRP may surpass Ethereum by 2028, intensifying the race for the second spot.

As Ethereum [ETH] faces mounting pressure, ETF outflows have surged 39% in just one week, signaling shaken investor sentiment.

Yet, in a show of confidence, BlackRock has doubled with a massive $1.8 billion ETH position, reinforcing institutional faith in Ethereum’s long-term potential.

Just as the dust settles, Standard Chartered has stirred the pot, forecasting that Ripple [XRP] could overtake Ethereum within the next three years.

With market dynamics shifting, the race for crypto’s second spot is entering what looks like a high-stakes war zone.

ETH ETF outflows soar amid price pressure

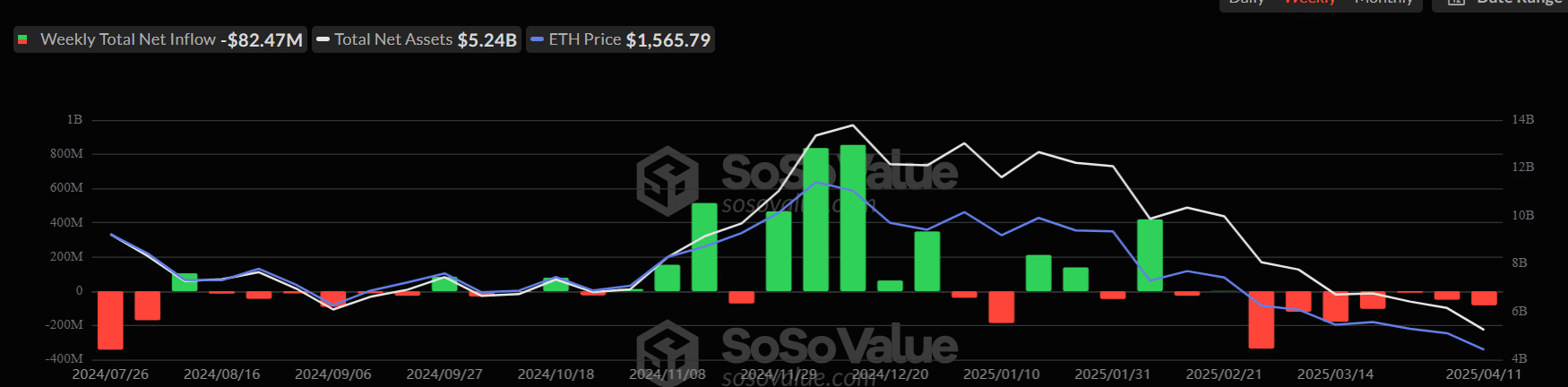

Ethereum ETFs recorded weekly net outflows of $82.47 million – marking the largest drawdown in recent months. The chart reveals a clear trend: consistent outflows since mid-February, aligning with Ethereum’s price drop to $1.5K.

Source: SoSoValue

Total net assets have also steadily declined, now at $5.24 billion, down from a peak above $12 billion in late 2024.

This suggests waning short-term investor confidence, even as macro conviction remains strong – evidenced by large institutions like BlackRock increasing exposure.

The disconnect hints at a pivotal moment for Ethereum’s market narrative.

BlackRock’s $1.8B ETH bet vs. XRP’s bold ascent

Despite mounting ETF outflows, BlackRock has solidified its conviction in Ethereum with a $1.8 billion ETH position. The portfolio shows steady accumulation through 2024, signaling a long-term belief in Ethereum’s value proposition.

However, a surprising twist enters the frame: Standard Chartered’s latest report forecasts XRP overtaking Ethereum in market cap by 2028. Geoffrey Kendrick, Head of Digital Assets Research, sees XRP rising to become the second-largest non-stablecoin asset, setting up a high-stakes rivalry.

The result is a fascinating divergence in institutional outlooks — one doubling down on ETH, the other betting big on XRP. The mixed signals reveal just how uncertain and dynamic the road ahead for crypto’s top contenders truly is.

Ethereum price outlook

Ethereum’s price hit $1,603 at press time, following a 2.47% daily drop. The broader trend since early 2025 has been decisively bearish, with ETH shedding significant value from above $3,000 levels earlier in the year.

The RSI hovered near 39, indicating oversold territory but not yet signaling a strong reversal.

Meanwhile, the MACD line sat just below the signal line, suggesting ongoing bearish momentum — although the gap is narrowing, hinting at potential bullish divergence.

Source: TradingView

Despite BlackRock’s conviction, technicals suggest ETH is still struggling to find solid footing.

Any short-term relief rally could face resistance near the $1,800 zone, while a drop below $1,550 could intensify selling pressure.