- Experts believe that ETH might dip to the lower end of the falling wedge, currently around $2,200

- Significant buying pressure can be seen around this zone too

Despite favorable developments like the introduction of an Ethereum Spot ETFs in the U.S, the world’s largest altcoin is yet to hit new all-time highs.

In fact, over the past week, ETH has declined by 6.62% on the charts. No wonder then that a crypto analyst is predicting that this downtrend could extend itself. Especially as ETH seeks some stability before a possible rally.

Falling wedge – Temporary decline, potential for massive upswing

According to analyst Carl Runefelt’s daily chart analysis, ETH is currently trading within a falling wedge – A pattern often leading to a significant rally after a period of decline.

This ‘decline-to-rally’ pattern typically emerges when the asset hits its lowest point within the wedge — The support level. For ETH, this key level appears to be around $2,200. This is a level the analyst marked on the chart, one where substantial buying pressure can be observed too.

The analysts believes that if ETH rebounds from this support level, it could see an 80.47% hike. This could potentially push the altcoin to $4,000, with further gains likely too.

Source: X

He added,

“Once a breakout occurs, there’s a strong possibility #Ethereum could rise back to $4K.”

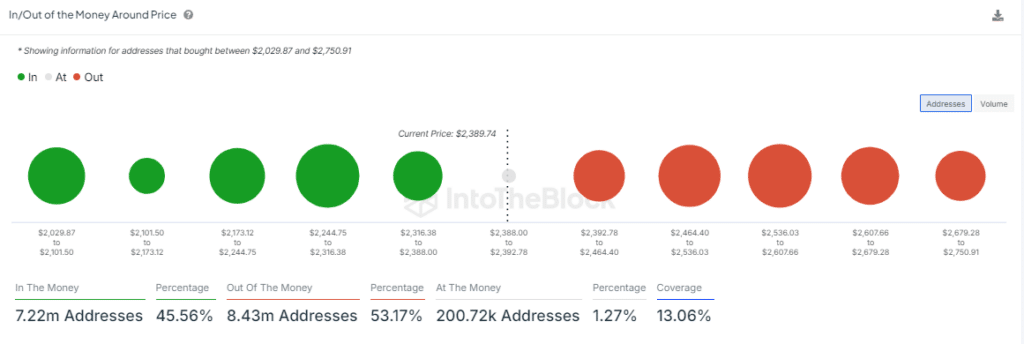

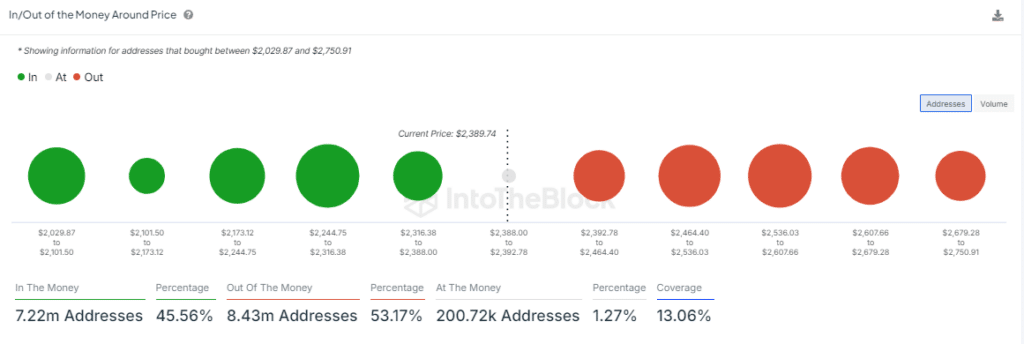

To verify the strength of the $2,200 support, AMBCrypto conducted an analysis of its own.

‘In-the-Money’ traders expected to drive the rally

AMBCrypto’s analysis using IntoTheBlock’s In and Out of Money Around Price (IOMAP) tool, which identifies key support and resistance levels by highlighting where significant asset holdings are concentrated, revealed that the $2,200 zone is a key area for buying pressure.

According to the IOMAP, a major support level is at $2,218.93, where over 1.59 million ETH is held in profit by addresses. This could act as significant buying pressure if ETH’s price drops to this level.

Source: IntoTheBlock

However, the IOMAP also suggested that ETH might not fall as low as $2,218.93, before reversing. There’s a strong possibility of a reversal around $2,281, where over 2.17 million buyers hold a combined total of 1.01 million ETH.

Additionally, Hyblock’s cumulative liquidation level delta revealed a negative delta. Simply put, a higher number of short positions compared to long positions, indicating a bearish market trend.

Further decline likely for ETH

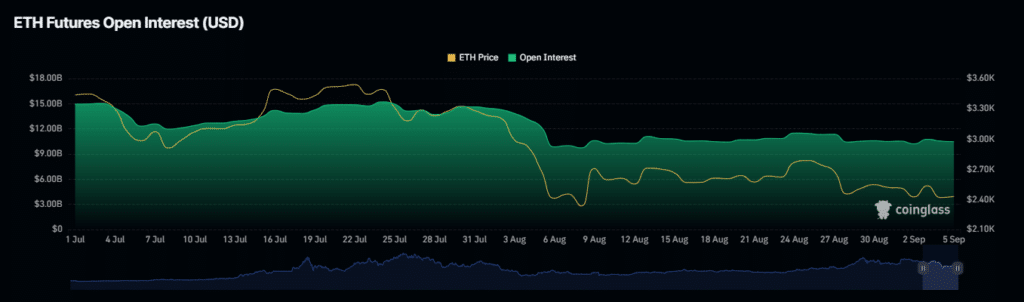

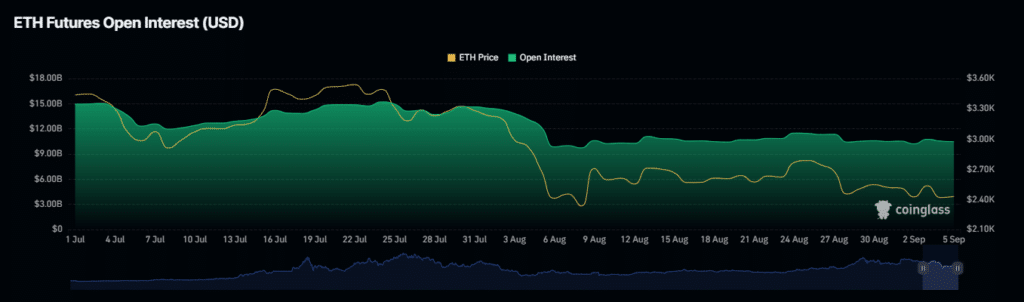

Taking a step further, AMBCrypto’s analysis suggested that ETH may be approaching a decline.

This assertion can be supported by a notable drop in the OI-weighted funding rate — recorded via Coinglass. It fell from 0.0043% on 4 September to 0.0023% at press time.

Source: Coinglass

The OI-weighted funding rate adjusts the funding rate based on the asset’s Open Interest, indicating that retail investors are willing to drive ETH’s price lower.

If this decline continues, a fall to the $2,200 support zone will become increasingly likely.