- ETH exchange balance has hit a new low, signaling an upcoming supply crunch.

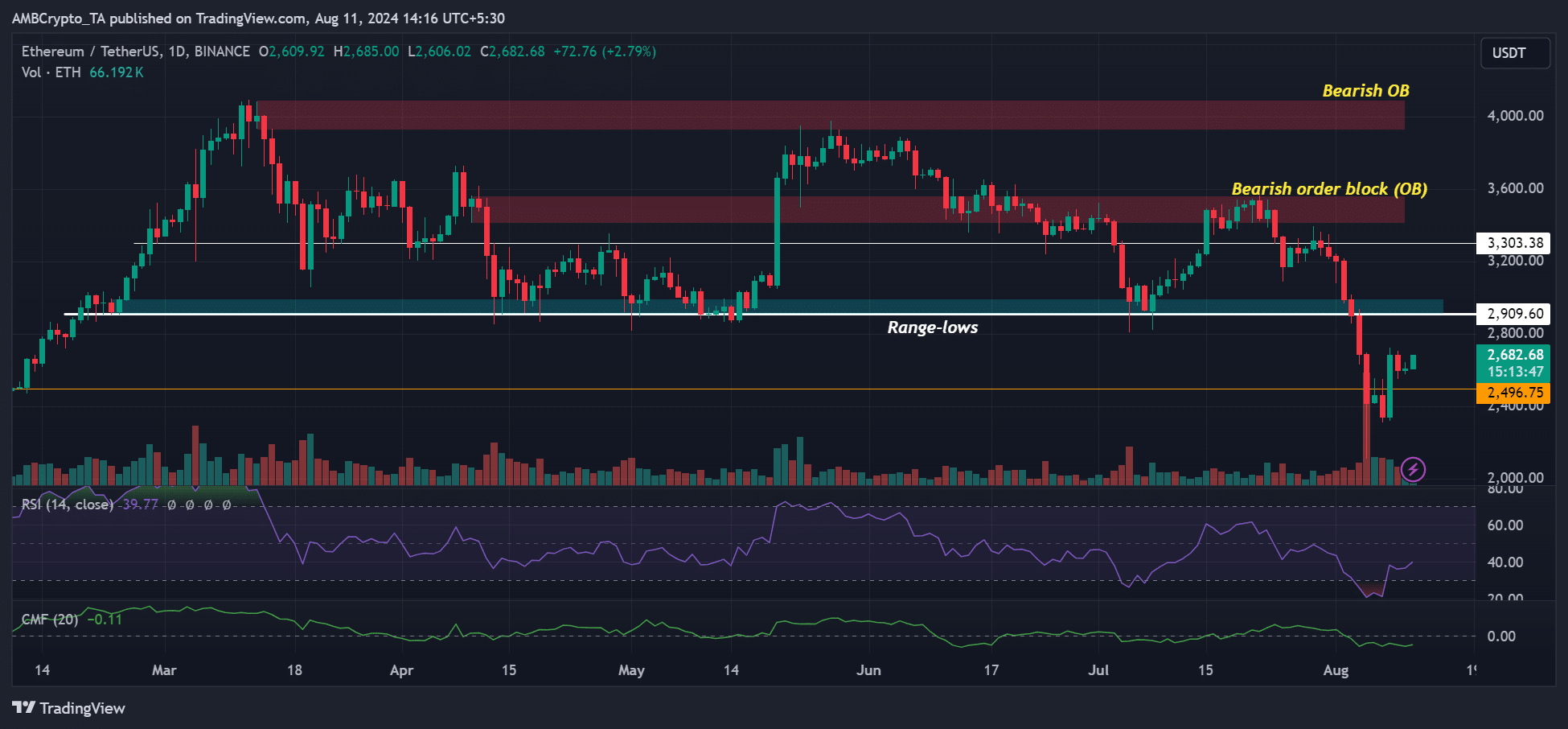

- ETH could target the previous range-low if improved market sentiment persists.

Ethereum [ETH] exchange balances have hit a new low, reinforcing a supply shock for the world’s largest altcoin. And yet, ETH whales have ramped up accumulation despite the recent dip, according to on-chain analyst Leon Waidmann.

‘Despite the dip, whales keep stacking #Ethereum! The #ETH Exchange Balance just hit a new LOW’

Source: Gassnode

The percentage of Ethereum balance has dropped to 10% as of 10 August. That translated to about 12 million ETH on exchanges, a declining supply trend that would theoretically set the pace for a rally in ETH prices.

This meant that the available ETH supply on centralized exchanges dipped to record lows. This further underscored that investors were moving their ETH holdings off CEXs for accumulation or self-custody.

In most cases, this can be viewed as a bullish cue for ETH.

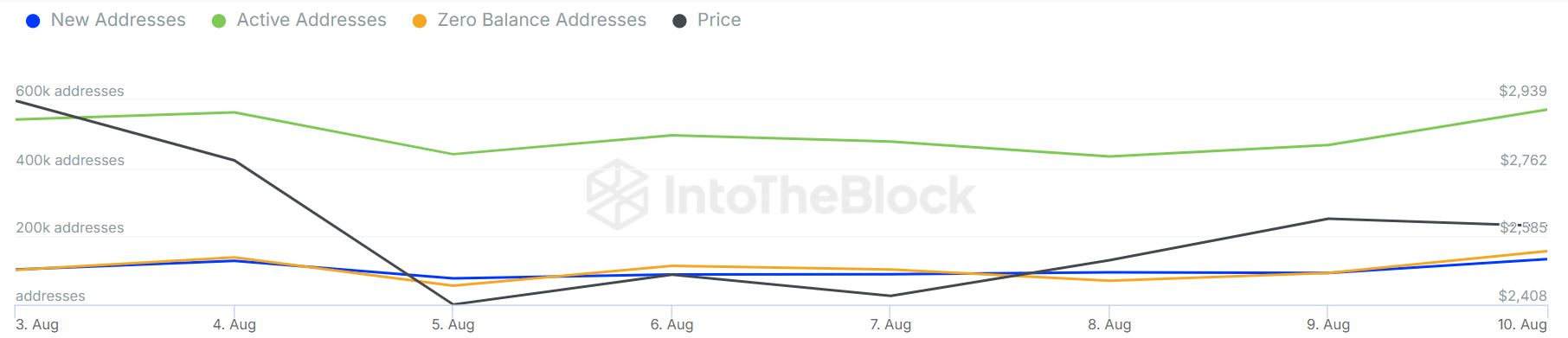

ETH network effects surged

Meanwhile, during the rebound from the price lows of $2.1k on 5th August, ETH active addresses surged by over 130K, increasing from 440K to 571K by 10th August.

Over the same period, new addresses also surged by over 60K, underscoring a strong ETH network growth.

Source: IntoTheBlock

However, weekly ETH demand from US investors was mixed, especially based on ETH ETF flows. Last week, the products saw positive flows of $48.7 million and $98 million on Monday and Tuesday. They scooped the dip.

However, ETFs saw a negative streak from Wednesday to Friday, totaling $42 million in outflows.

ETH price action

Source: ETH/USDT, TradingView

On the price charts, ETH’s overall recovery had hit nearly 30%, jumping from $2.1K to over $2.6K as of press time. It reclaimed the crucial $2.5K level, but the previous range-lows at $2.9K was yet to be retested or reclaimed.

As a result, the range lows were a key level to watch if the recovery extended into the new week. However, any retracement of the recovery gains would force bulls to attempt to defend the $2.5k level.