- ETH appeared to be forming an inverse head-and-shoulders pattern, which often precedes a significant upward move.

- Selling pressure was steadily increasing, potentially delaying any price recovery.

Over the past month, Ethereum [ETH] has struggled, losing 12.08% of its value. While it briefly rebounded with a 2.69% gain last week, this momentum seems to be fading.

The combination of chart patterns and current market sentiment—highlighted by a spike in ETH inflows to exchanges—suggests that its recent 0.35% decline in the past 24 hours could extend further.

A bullish pattern is emerging, but…

According to analyst Ali Charts, Ethereum is forming an inverse head-and-shoulders pattern on the daily chart. This pattern consists of a left shoulder, a head, and a right shoulder.

The inverse head-and-shoulders is a classic bullish pattern. It typically signals a prolonged period of price consolidation before a significant upward move.

ETH is currently developing the right shoulder of the pattern. This mirrors the left shoulder, with the price trending lower along a descending line. If this trajectory continues, ETH could drop further to the $2,800 region.

At this level, it may consolidate for up to 37 days, like the left shoulder, before breaking through the descending resistance line.

Source: TradingView

A successful completion of this pattern could lead ETH to its first major resistance zone between $3,850 and $4,100. Beyond this, ETH could aim for a new all-time high, potentially exceeding the $6,750 mark, as indicated on the chart.

AMBCrypto also noted that the current market sentiment suggests ETH’s near-term downside risk remains high.

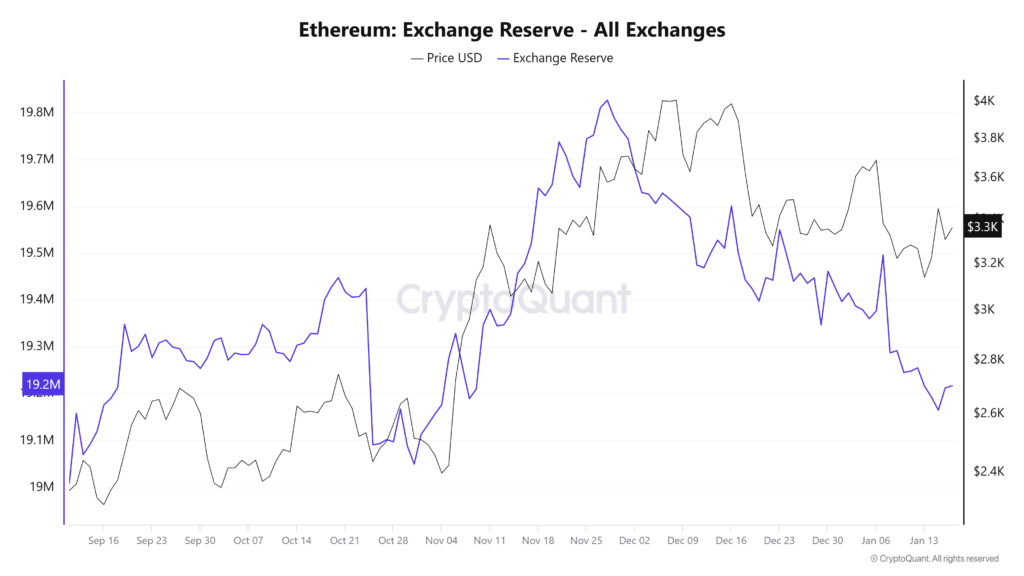

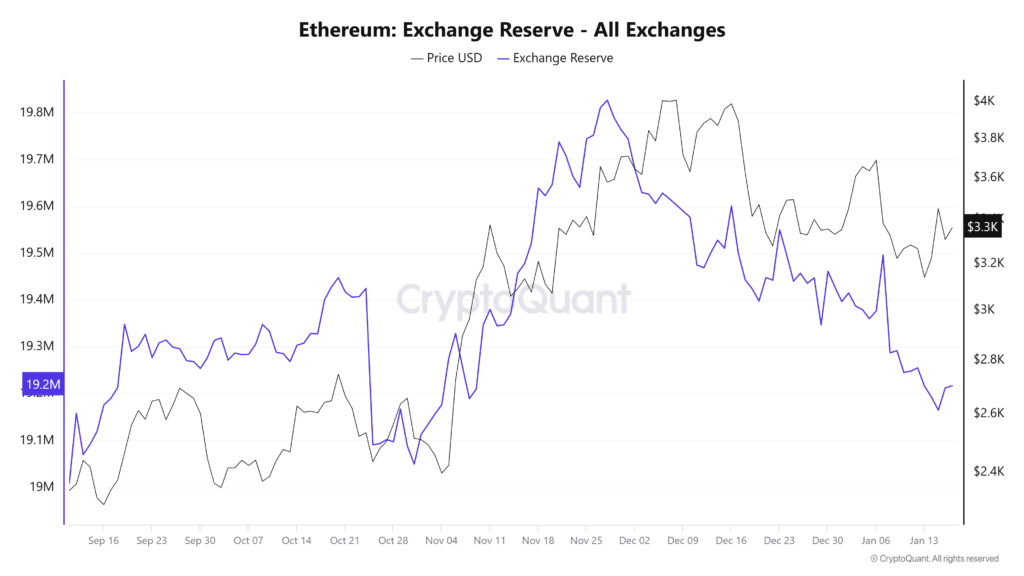

Rising exchange supply could trigger ETH’s decline

The supply of ETH on cryptocurrency exchanges has been steadily increasing, raising concerns about potential price pressure.

On the 15th of January, the amount of ETH held on exchanges grew significantly, rising from approximately 19,164,848 to 19,214,253 ETH, at press time—an increase of 49,405 ETH.

Source: CryptoQuant

Such a surge in exchange-held assets typically implies growing selling pressure. Traders may be preparing to offload their holdings.

Exchange netflow data, which tracks the balance of inflows and outflows on exchanges, supports this outlook.

Over the past 24 hours, ETH recorded a positive netflow of around 47,761 ETH. This trend indicates a likely increase in market sell-offs, potentially driving ETH’s price downward.

If selling pressure persists, ETH could decline toward the $2,800 region, as suggested by recent chart patterns.

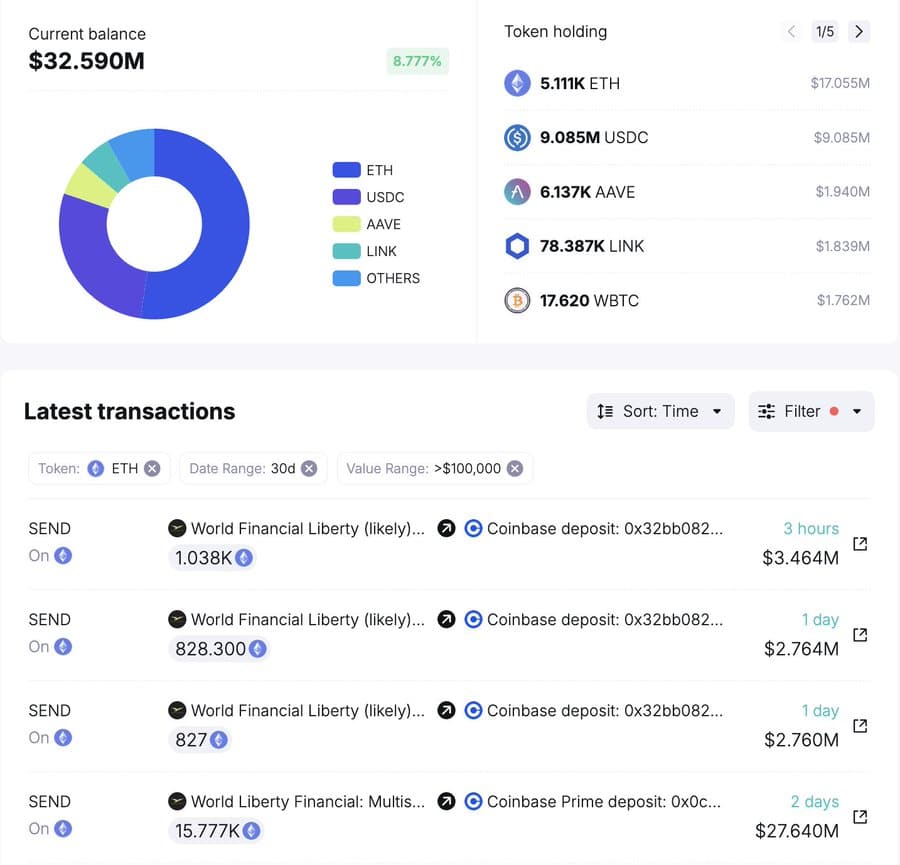

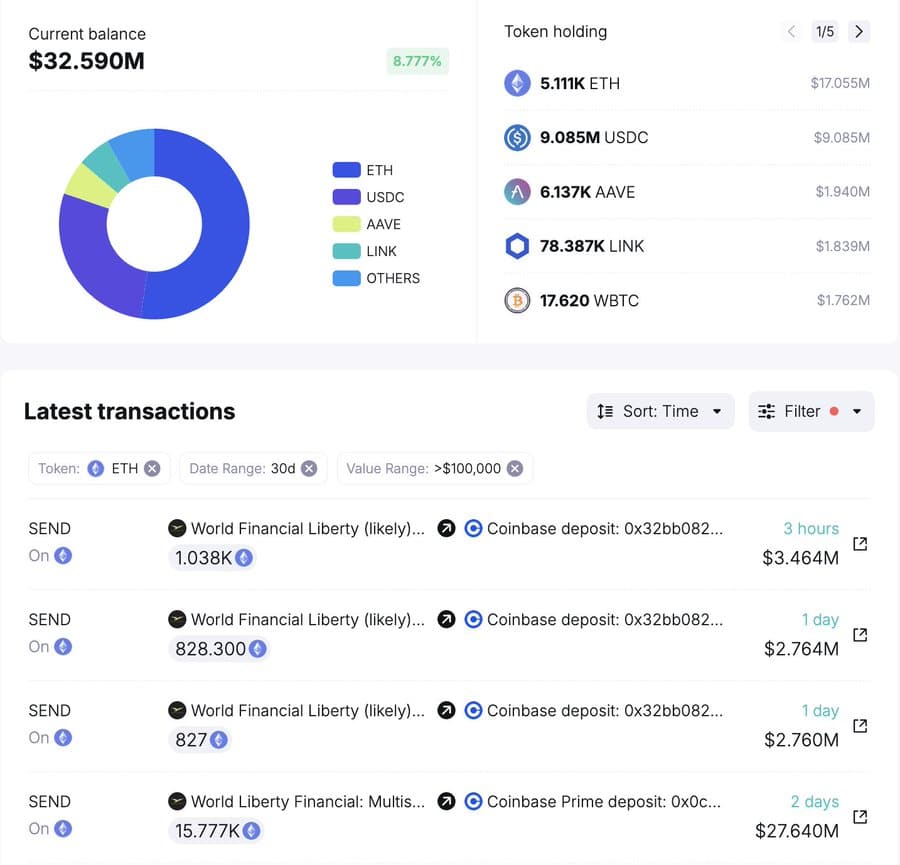

Institutional selling adds pressure

Institutional investors have contributed to the growing selling pressure on ETH, with World Liberty Finance leading the charge by transferring a significant amount of Ethereum to exchanges.

In its latest activity, World Liberty Finance moved 1,038 ETH—valued at $3.44 million—into Coinbase, reducing its total ETH holdings to 5,111 ETH, worth approximately $17.21 million.

Source: SpotOnChain

Read Ethereum’s [ETH] Price Prediction 2025–2026

This follows a larger transaction over the past two days, where the same institution deposited 18,536 ETH into Coinbase. The cumulative transfers underlined a potential sell-off strategy, which could intensify downward pressure on ETH’s price if executed.

As institutions adjust their positions and market sentiment remains fragile, ETH’s price could face further declines in the short term.