- Chinese authorities have moved 7,000 ETH to exchanges in the last 24 hours.

- These coins are part of the 542,000 ETH seized from a crypto Ponzi scheme in 2018, which could be dumped in the market.

Ethereum [ETH] traded at $2,401 at press time after a nearly 2% price drop in 24 hours. This drop coincided with a bearish sentiment across the broader cryptocurrency market, with the Fear and Greed Index plunging to a seven-day low of 39, suggesting that traders are in a state of fear.

However, Ethereum holders have more to be concerned about amid a possible sell-off of 542,000 ETH, valued at more than $1.3 billion, by Chinese authorities.

Ethereum’s “unexpected” supply overhang

According to onchain researcher ErgoBTC, ETH faces an unexpected supply overhang after 7,000 ETH was moved to exchanges. These tokens are part of the 542K ETH seized from the PlusToken crypto ponzi scheme in 2018.

This scheme had accumulated more than 194K Bitcoin [BTC] and 830K ETH by the time of its closure. Most of the Bitcoin was likely sold between 2019 and 2020. A third of the ETH was later sold in 2021.

The remaining balance of 542,000 ETH was consolidated in multiple addresses in August 2024. Per the researcher, some of these coins are now on the move.

On 9th October, 15,700 ETH was withdrawn from these addresses, and nearly half of it was deposited to the BitGet, Binance, and OKX exchanges.

According to the researcher, the transfers are following a similar pattern as when the authorities sold Bitcoin in 2020. This places ETH in a precarious situation where selling pressure could increase significantly in the coming weeks.

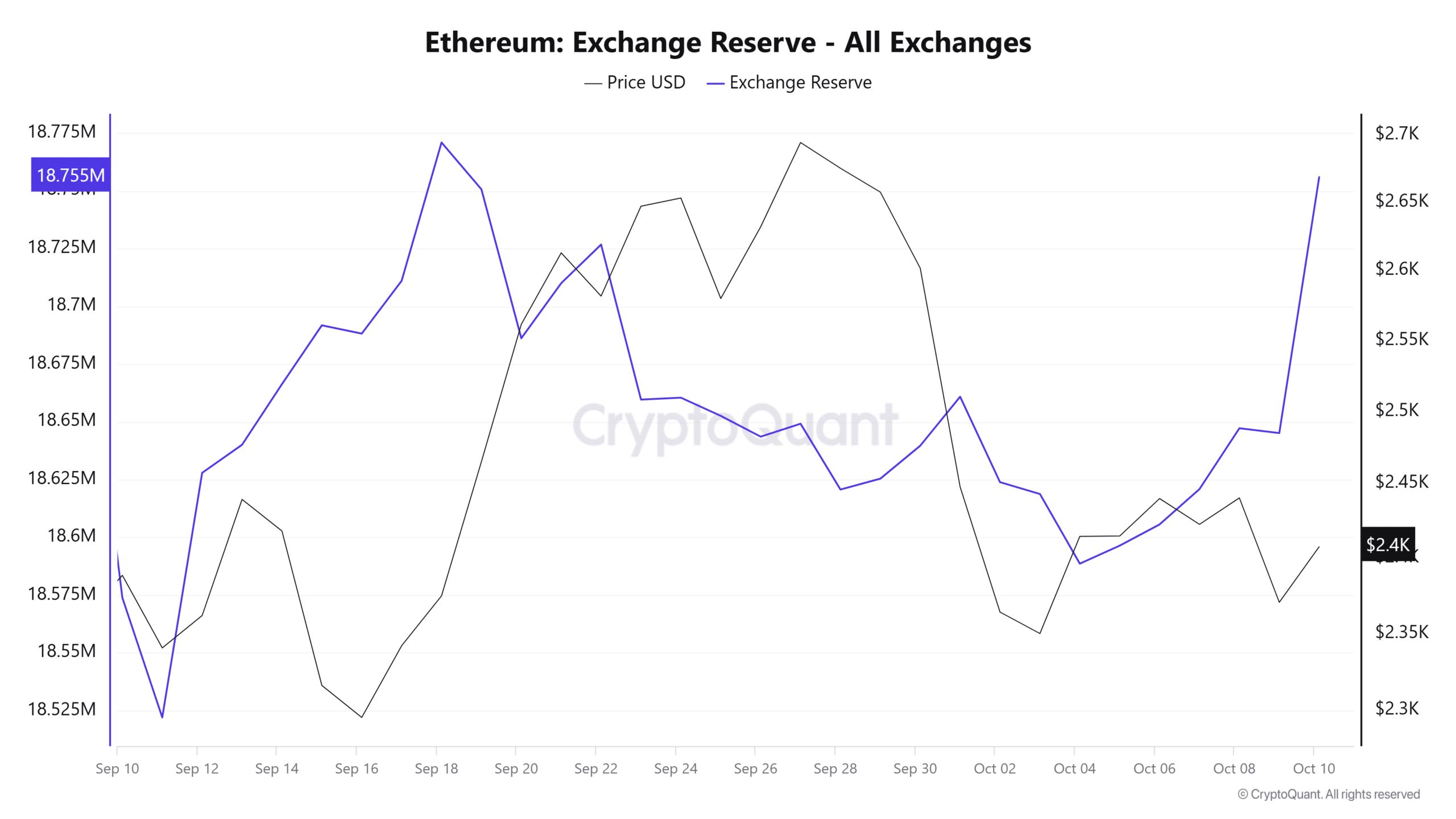

Ethereum exchange reserve hit a three-week high

These deposits have triggered a surge in Ethereum exchange reserves to a three-week high as seen on CryptoQuant.

In the last 24 hours, the total number of ETH held on exchanges has increased by more than 110,000 tokens to reach the highest level in three weeks.

Source: CryptoQuant

This data shows that many traders are moving their coins to exchanges with the intent to sell. Additionally, the highest increase in reserves happened on derivative exchanges. This could result in a spike in Ethereum’s volatility.

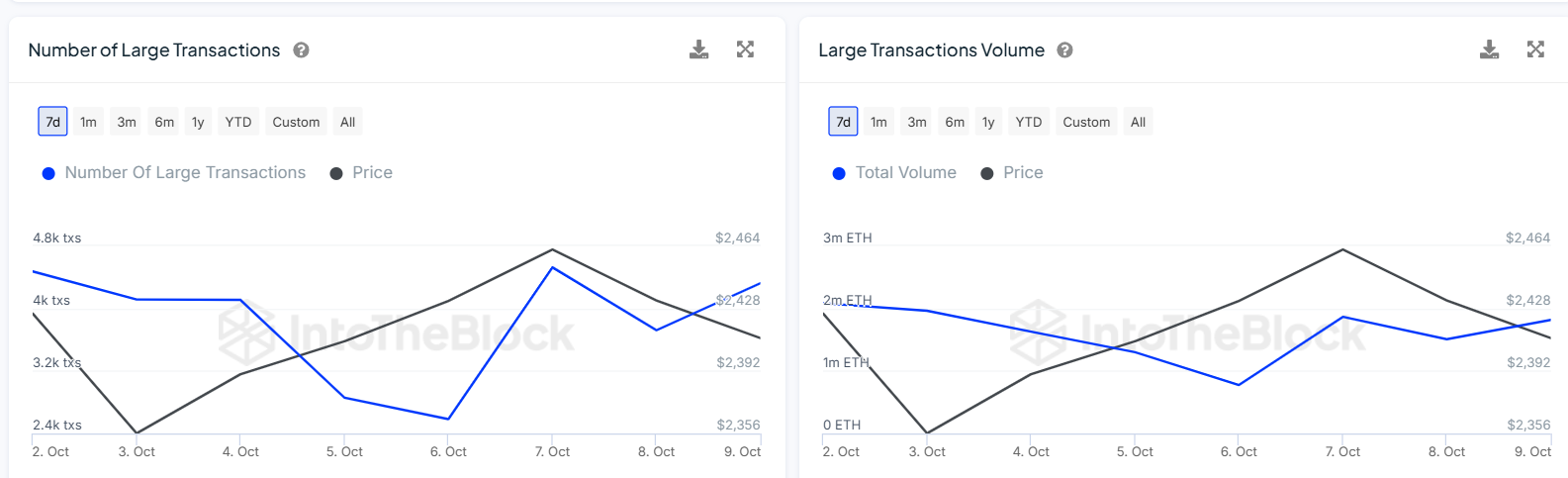

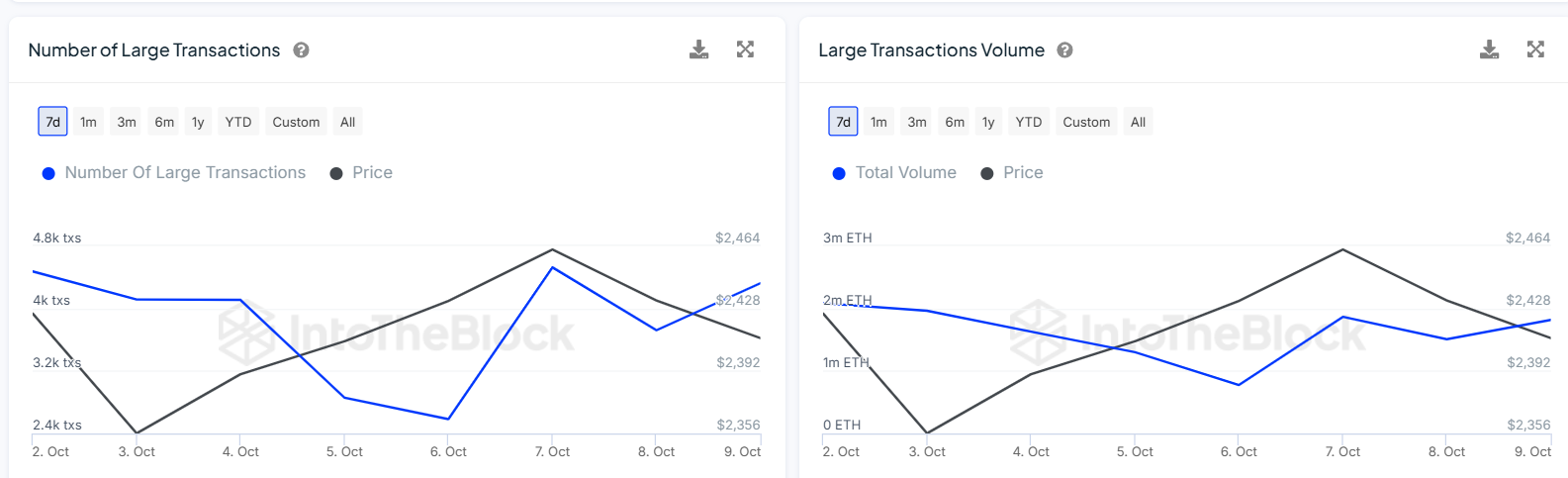

Data from IntoTheBlock also shows a spike in large transaction volumes suggesting that whale activity is on the rise. Given that Ethereum is not gaining despite a rise in large transactions, it could suggest that these transactions are on the sell side and not on the buy side.

Source: IntoTheBlock

Liquidation data shows that these high exchange deposits are having a bearish impact on Ethereum. According to Coinglass, more than $31 million worth of ETH was liquidated in the last 24 hours, with $27M being long liquidations.