- Ethereum Classic rose by over 10% in the last 24 hours.

- Metrics signaled a potential bullish continuation for the altcoin.

Ethereum Classic [ETC] looks to have gained investor favor once again, as the asset continued its impressive rally, up over 10% in the last 24 hours.

The altcoin recent movement has positioned it just 10% away from the critical $35 resistance level, igniting discussions about its potential trajectory in the near future.

ETC signals further upside

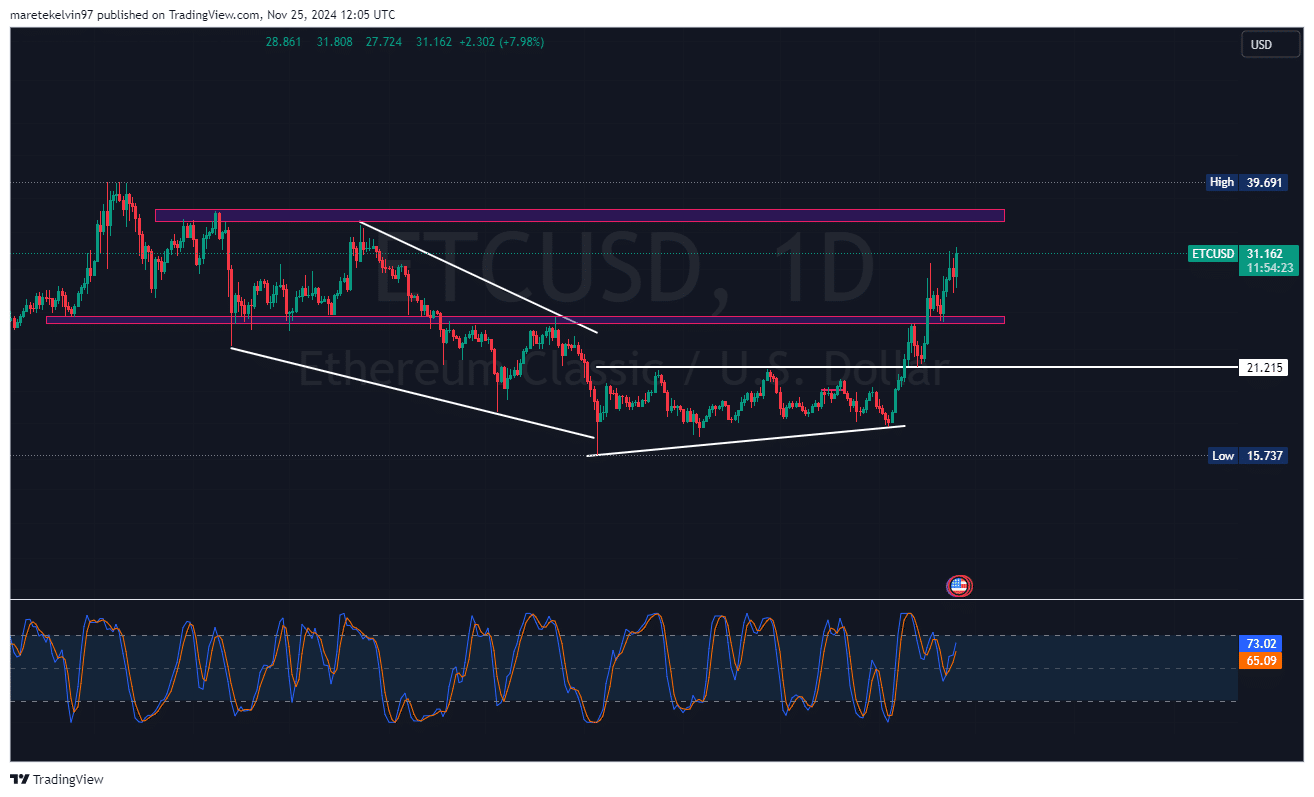

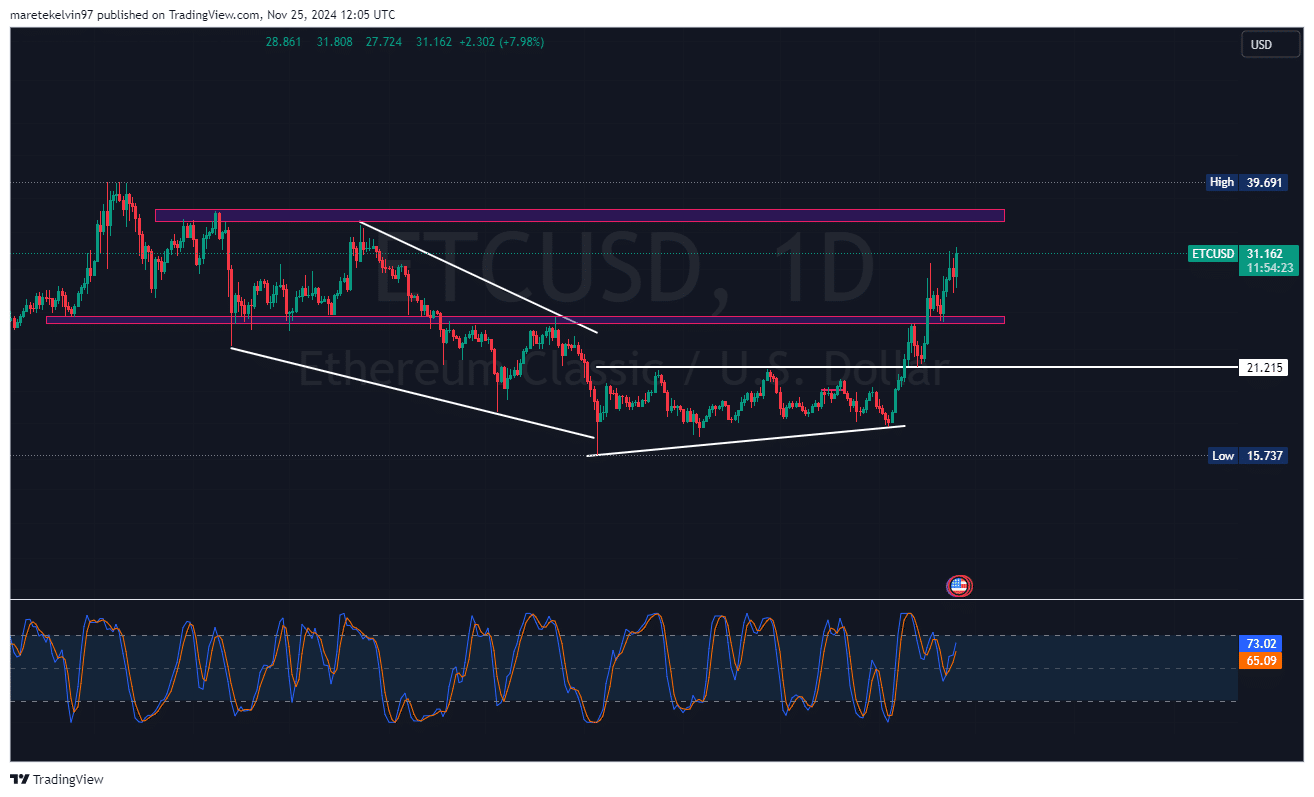

After correcting to the $25 support level, the altcoin has rallied more than 23% to a trading price of $31 at press time.

The breakout and afterward correction on the $25 price level suggested that bulls have regained control of the market momentum.

Source: TradingView

The asset’s successful defense of the $25 support level during recent corrections has established a solid foundation for the current upward movement.

Bullish run to continue?

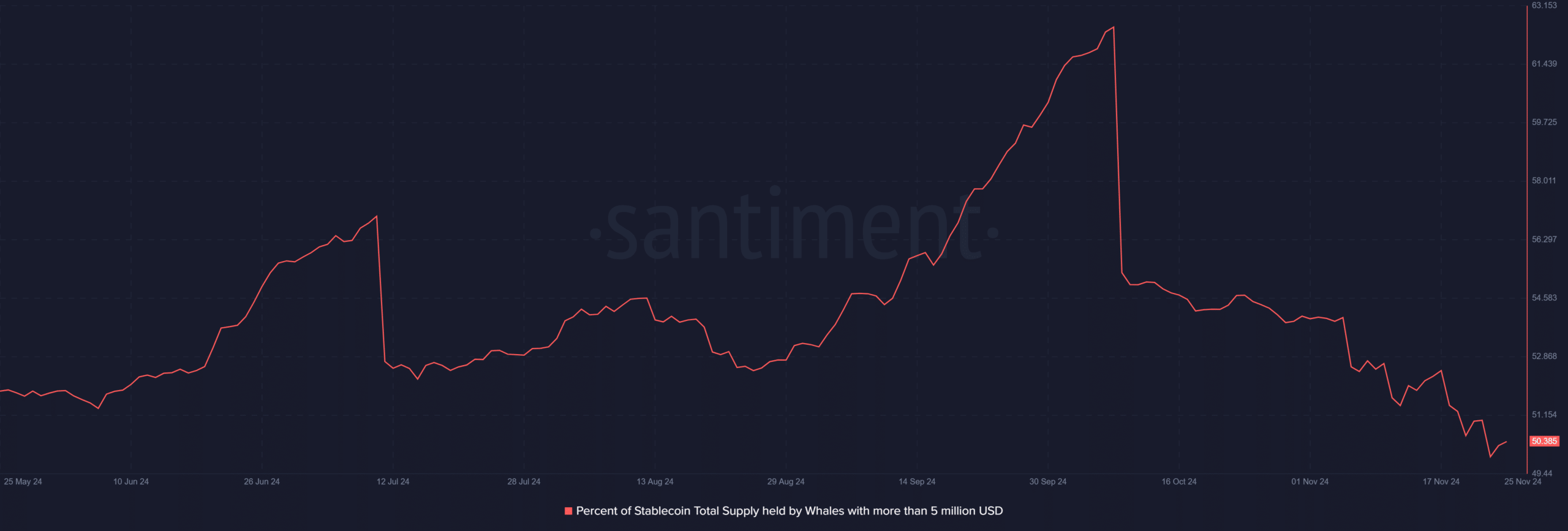

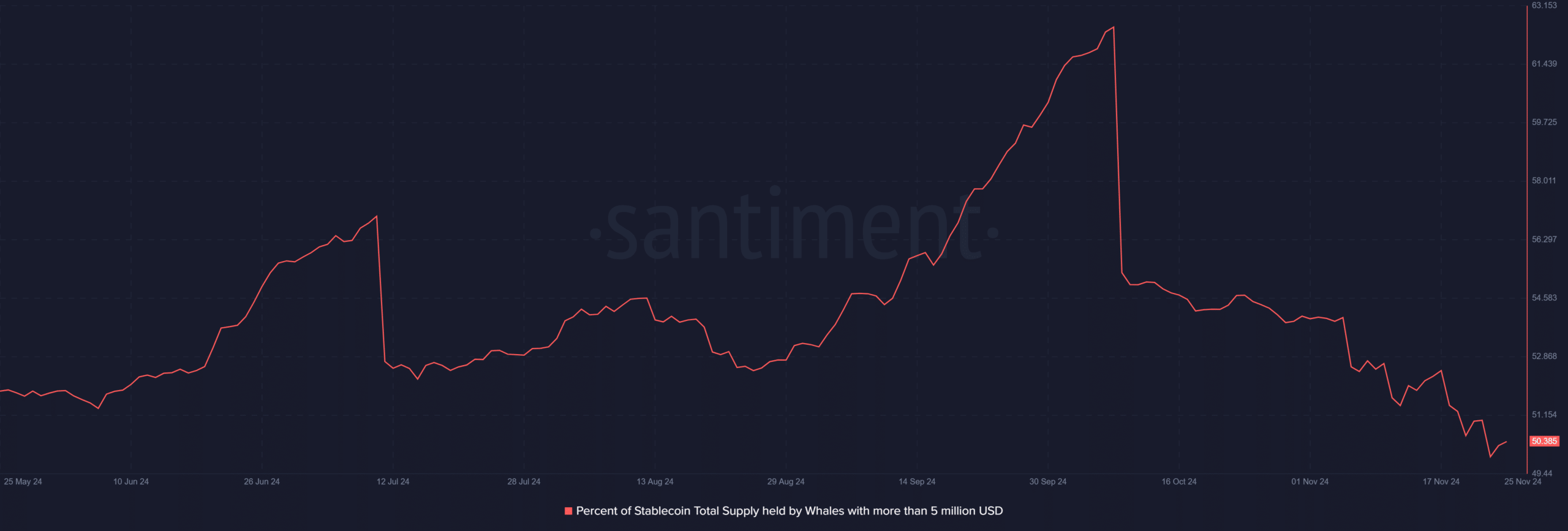

According to AMBCrypto’s look at Santiment’s data, there were significant shifts in whale behavior at press time. Large holders were showing renewed interest in ETC accumulation, as evidenced by the recent spike.

Notably, the percentage of stablecoin total supply held by whales with more than $5 million USD has witnessed a surge in the last 24 hours. This indicated a strategic positioning by major market players.

Source: Santiment

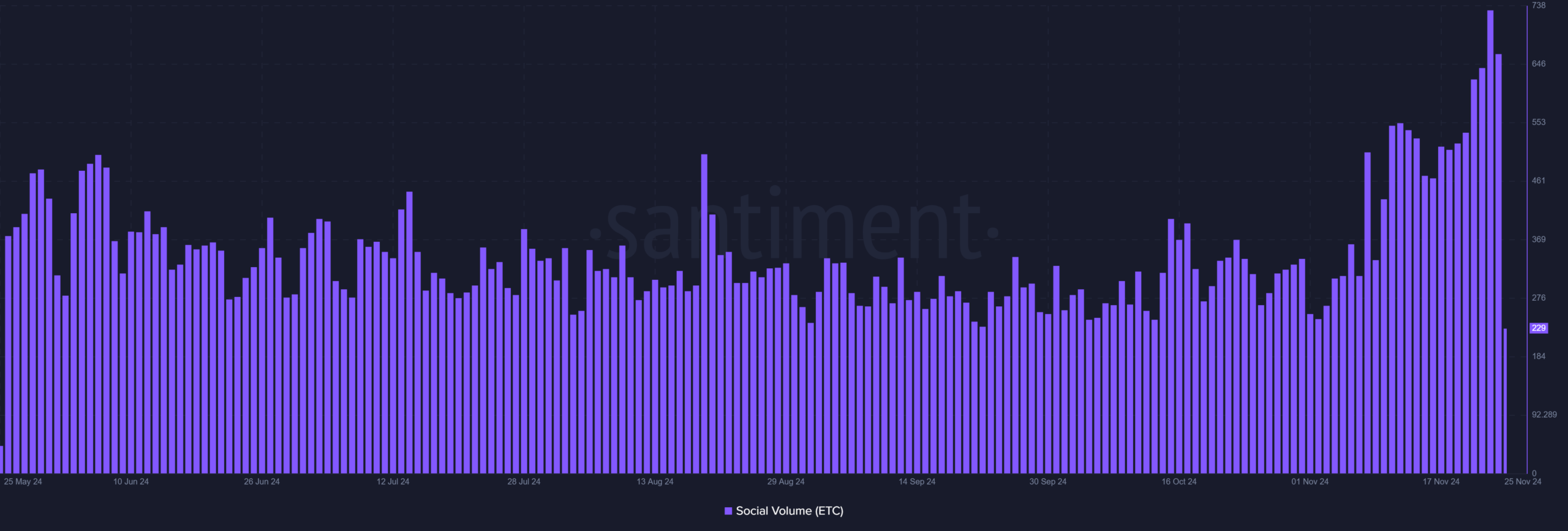

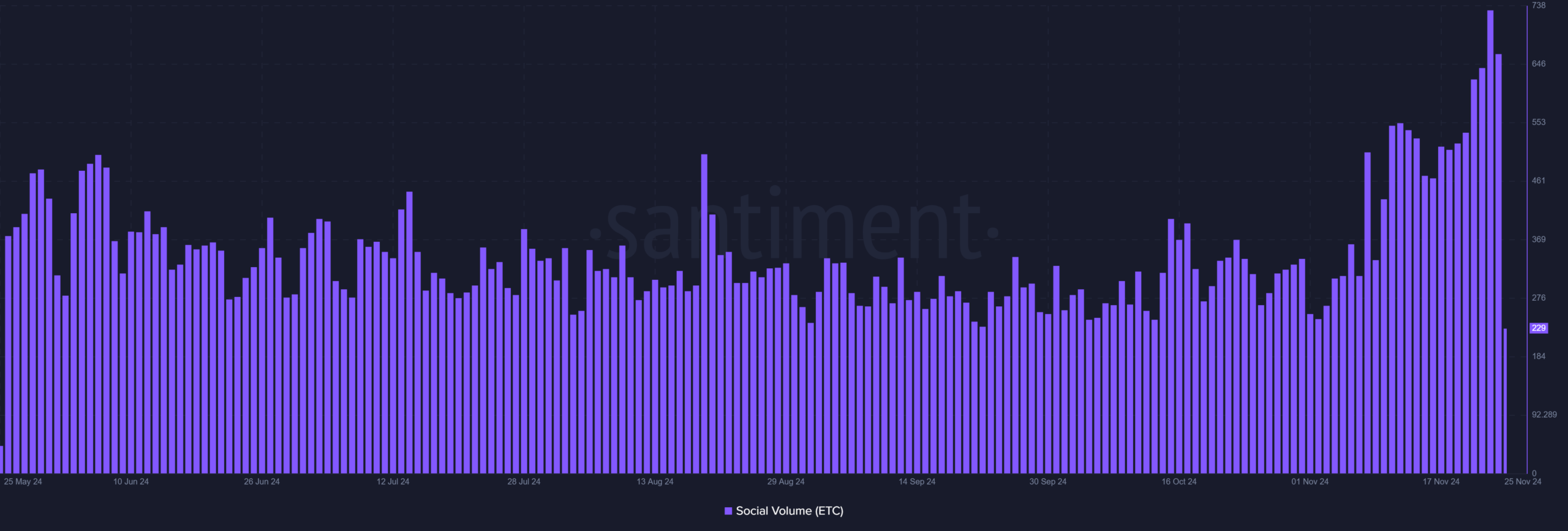

Besides, ETC’s social volumes have reached their highest levels since May 2024, suggesting growing retail interest in the asset.

Historically, this surge in social engagement often precedes significant price movements, and ETC is no exception. The gradually rising social volume could precede an incoming rally as well.

Source: Santiment

ETC near-term price targets

The immediate resistance level at $35 presented a crucial psychological barrier for ETC.

A successful breach above this level could trigger substantial buy orders, potentially propelling Ethereum Classic to test a higher resistance level.

Read Ethereum Classic’s [ETC] Price Prediction 2024–2025

The continuity of the current bullish rally will likely depend on broader market conditions and continued institutional interest.

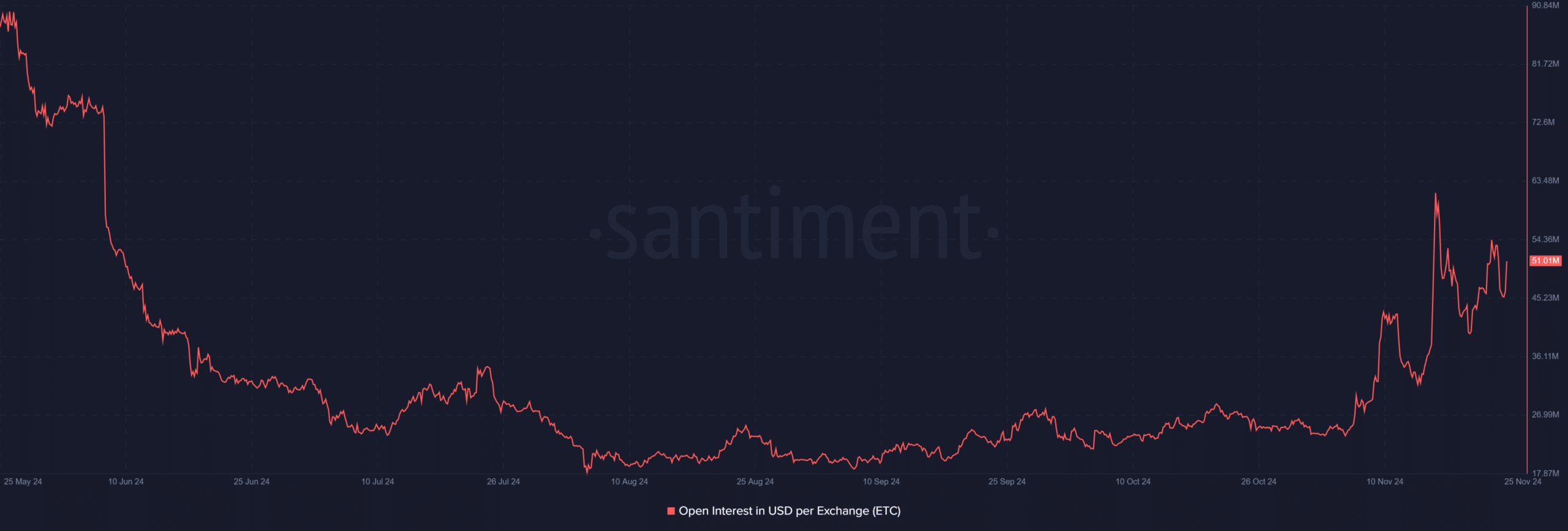

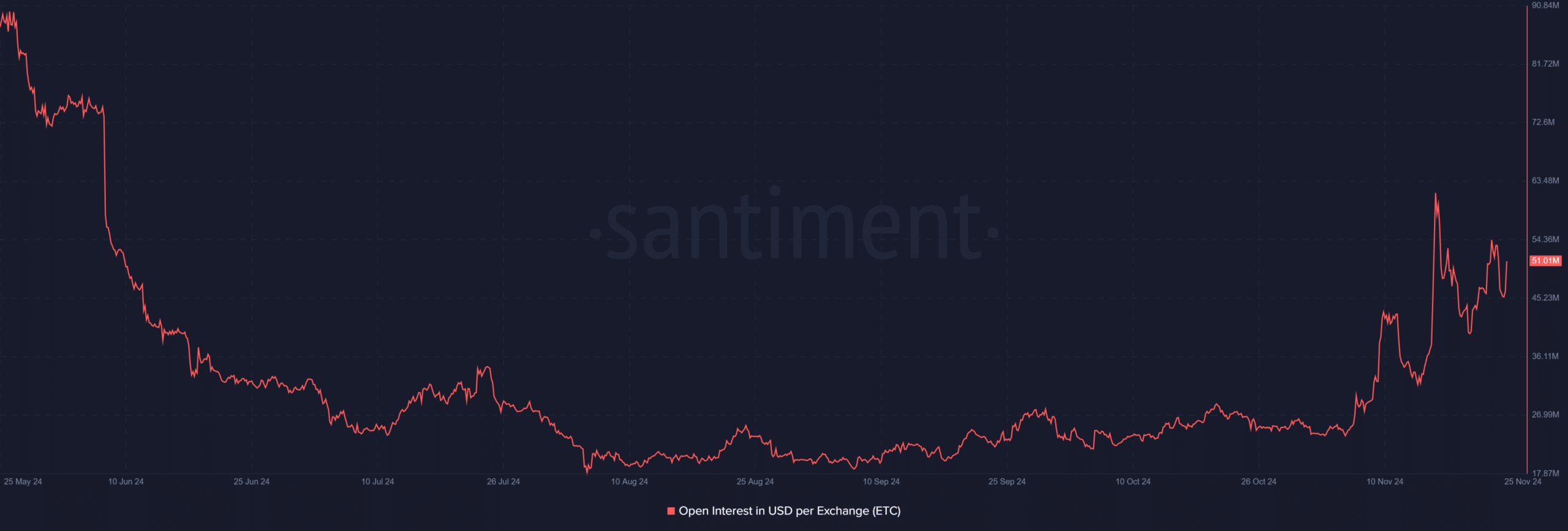

With Open Interest in USD per Exchange showing an uptick, the ETC market structure seemed supportive of further gains.

Source: Santiment