- Ethereum needs to flip $1895 for a potential rally to $2k.

- Conviction buyers have dominated the market, with the RSI holding at 80.

Over the past three days, Ethereum [ETH] has experienced a strong upswing, rising from $1.5k to surpass the highly awaited level of $1.8k.

Source: Glassnode

Conviction buyers primarily drive the latest uptick, according to Glassnode.

As such, Ethereum’s supply mapping shows that momentum buyers have not made any major move, while conviction buyers have been active since late March 2025.

This cohort has seen a huge uptick in its RSI, which still holds at 80, signaling strong dominance. By contrast, sellers—who peaked around the 16th of April, saw their RSI drop sharply to 50.

The positive imbalance here suggests that conviction buyers are currently holding strong and anticipate markets to rally to higher levels.

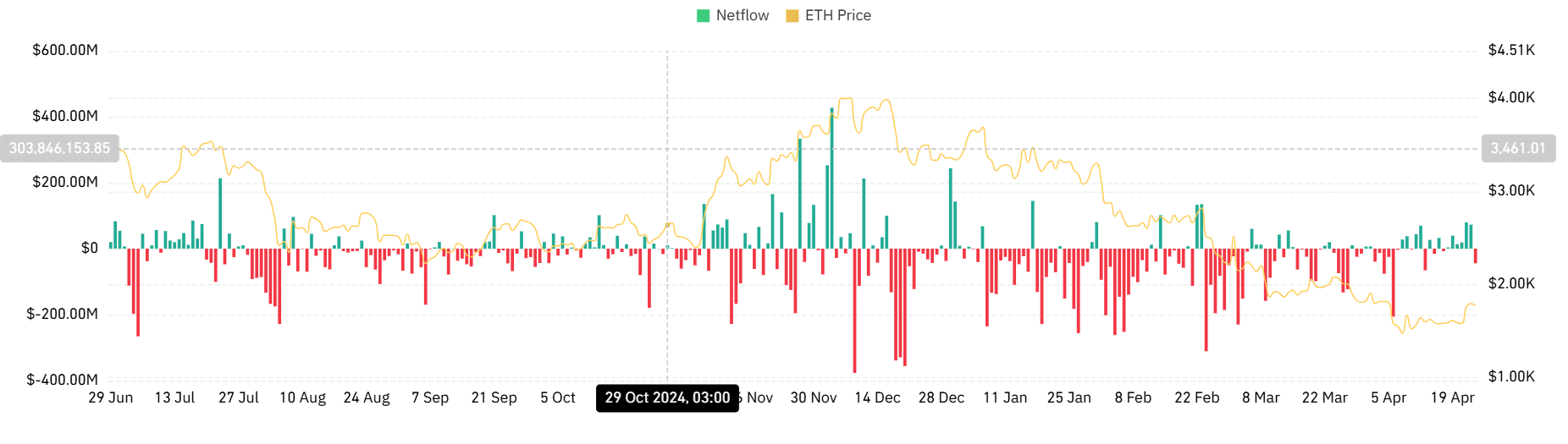

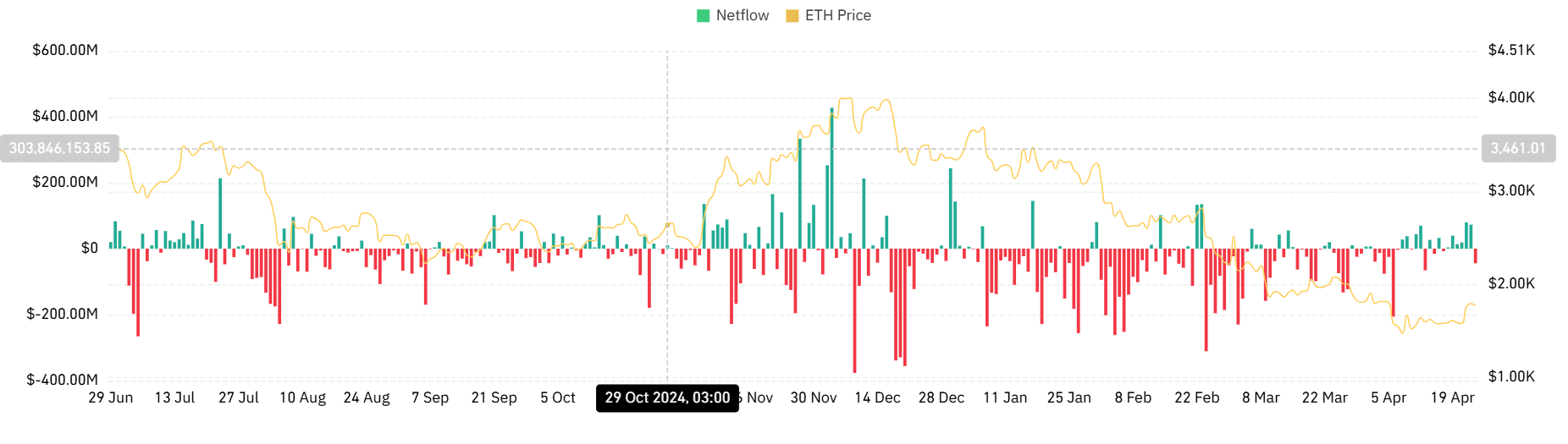

Source: IntoTheBlock

Market cap expands as resistance thins ahead

With conviction buyers pushing Ethereum above $1.8k, the altcoin saw an uptick in its market cap, rising by 12%, reaching $219 billion.

With this uptick, on-chain data shows only modest resistance ahead. The recent price pump has left analysts eyeing a major move. Inasmuch so, according to IntoTheBlock, the next significant sell wall is around $1860.

If that zone gives way, Ethereum could make a move back toward the psychological $2k level.

Is a move toward $2k plausible for ETH?

According to AMBCrypto’s analysis, Ethereum is seeing strong organic demand build, signaling a potential move to the upside.

For starters, looking at sellers in the market, they have almost disappeared and are outweighed by buyers.

In fact, signs of organic demand are everywhere.

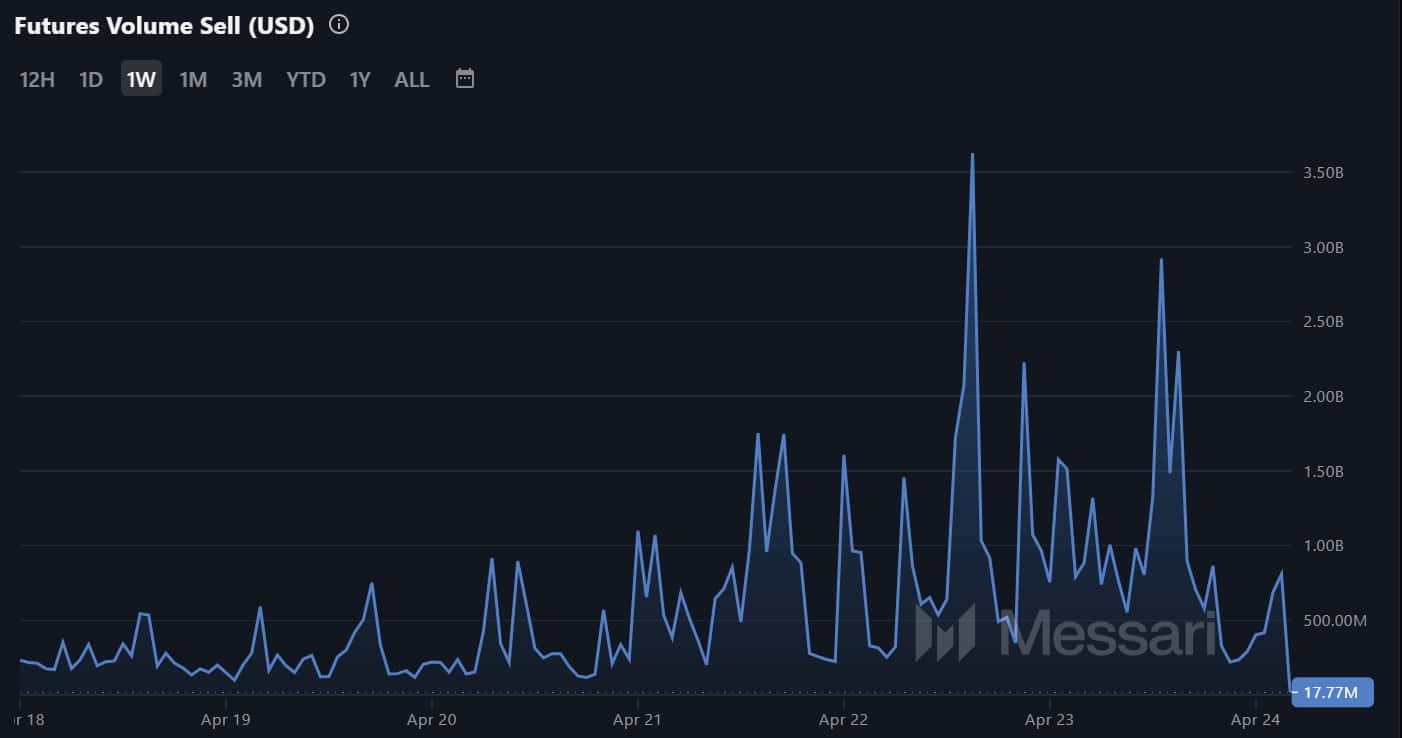

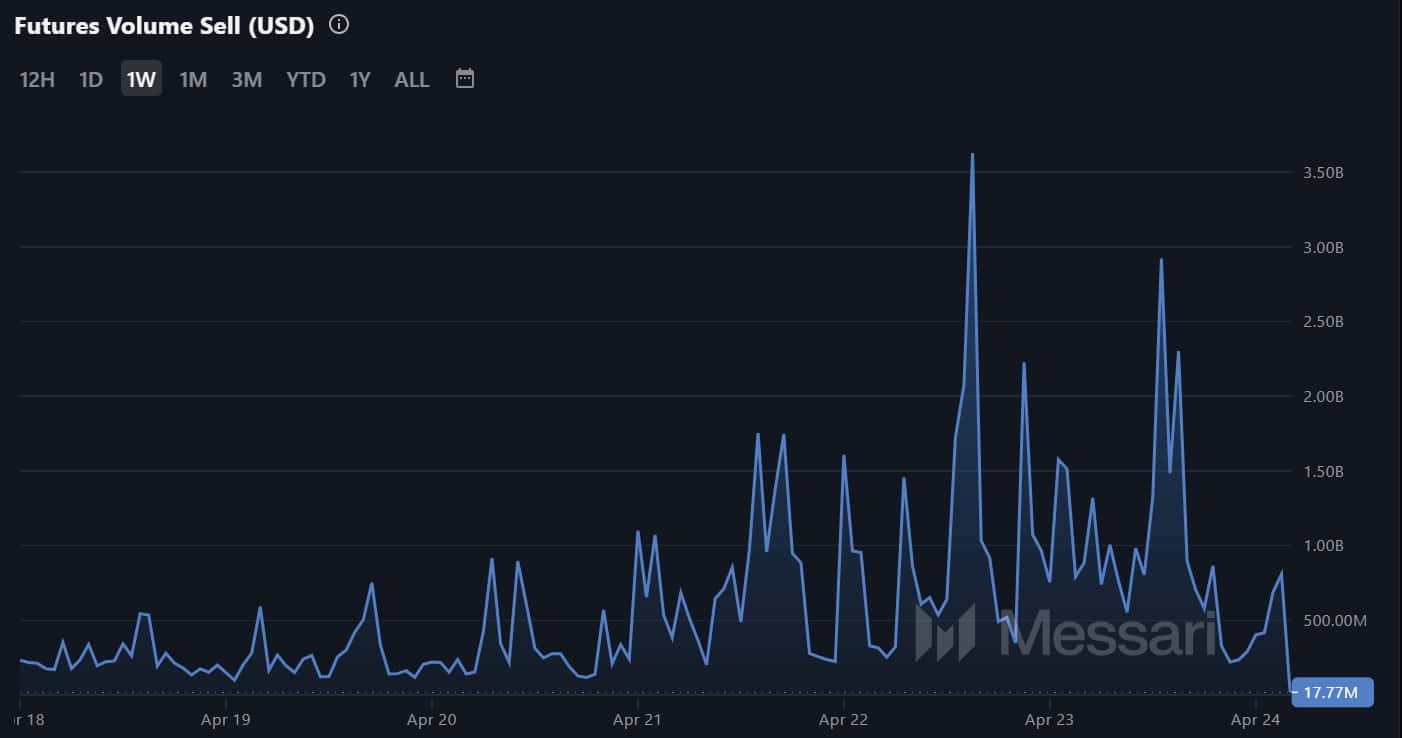

Futures Volume Sell has declined to $17.7 million over the past week, while buy volume is $20 million, a difference of $3 million.

Source: Messari

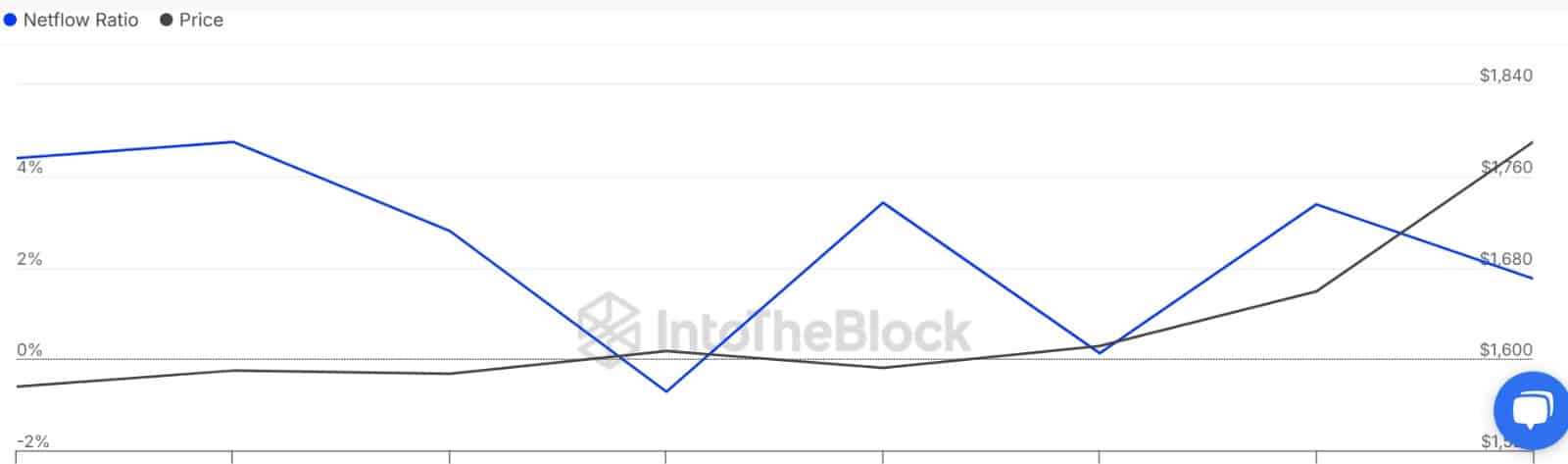

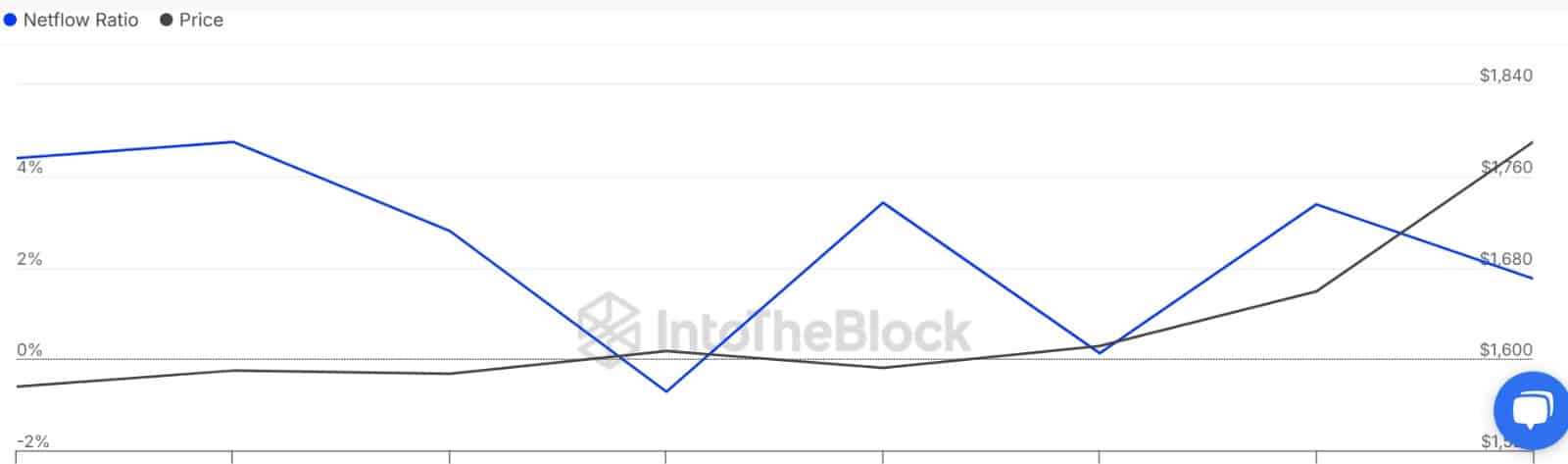

On top of that, whales aren’t exiting.

Because ETH Large Holders Netflow to Exchange Netflow Ratio has declined to 1.76%. A drop here indicates that whales are sending less ETH into exchange, reflecting accumulation behavior from large holders.

Source: IntoTheBlock

Finally, Ethereum’s Spot Market has cooled down and ETH is recording negative exchange netflow.

Over the past day, Netflow has dropped to -$44.4 million, after six days of consecutive positive netflow.

Such a huge shift suggests that investors are currently buying more than they are selling reflecting an accumulation trend.

Source: CoinGlass

ETH must reclaim $1.8K to keep the rally alive

Having said that, ETH still needs to hold above $1.8K for this bullish setup to stay intact.

According to Glassnode, if price flips the $1,895 cost-basis cluster—where 1.64 million ETH is concentrated—a clean run toward $2K is likely.

However, if bulls lose steam here, ETH risks revisiting the $1.6K support zone.