- The token’s price increased by over 16% in the last 24 hours alone.

- Selling pressure on ENA was rising, which could cause a price correction.

Ethena [ENA] showcased spectacular performance in the past 24 hours as the token’s price rallied by double digits.

Therefore, AMBCrypto planned to dig deep and find out how the token’s on-chain metrics were affected and what to expect next.

Tracking Ethena’s bull rally

CoinMarketCap’s data revealed that Ethena bulls pushed hard during the last 24 hours as the token’s value surged by 16%. In fact, the bulls dominated heavily last week.

ENA’s price increased by over 40% in the last seven days, which was a commendable number. At the time of writing, the token was trading at $0.4015 with a market capitalization of over $1.1 billion.

Despite such a major price rise, most of the investors were at loss.

AMBCrypto’s analysis of Intolock’s data revealed that only 6.29k ENA addresses were in profit, which accounted for 15% of the total number of ENA addresses.

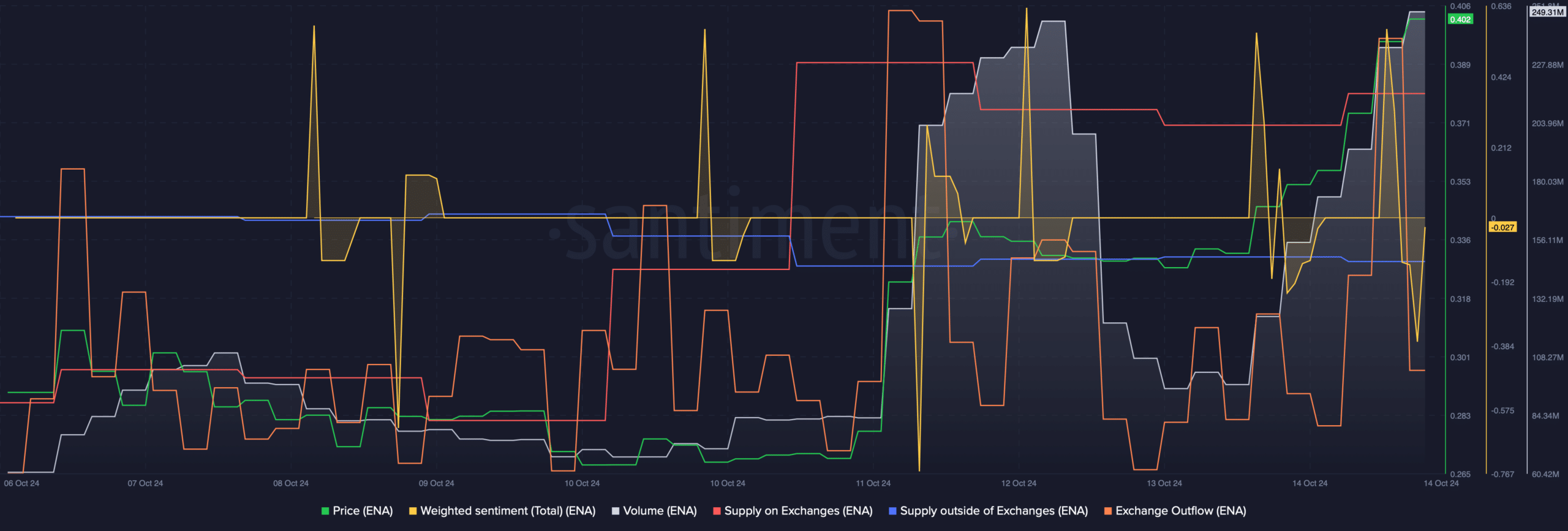

Things on the social front also didn’t look good. When we checked Santiment’s data, we found that Ethena’s Weighted Sentiment went inside the negative zone. This indicated that bearish sentiment was rising.

Source: Santiment

However, the token’s trading volume increased in the last few days, while ENA’s price surged. Though at first sight this might look bullish, there was more meat to the story.

Notably, while the trading volume increased, ENA’s supply on exchanges also increased. This indicated that investors were actually selling the token.

On top of that, Ethena’s supply outside of exchanges dropped, and its exchange outflow spiked. Both of these metrics clearly suggested that selling pressure on the token was high.

A rise in selling pressure often results in price correction.

Our look at Coinglass’ data revealed yet another bearish metric. Ethena’s Long/Short Ratio dipped, meaning that there were more short positions in the market than long positions.

Source: Coinglass

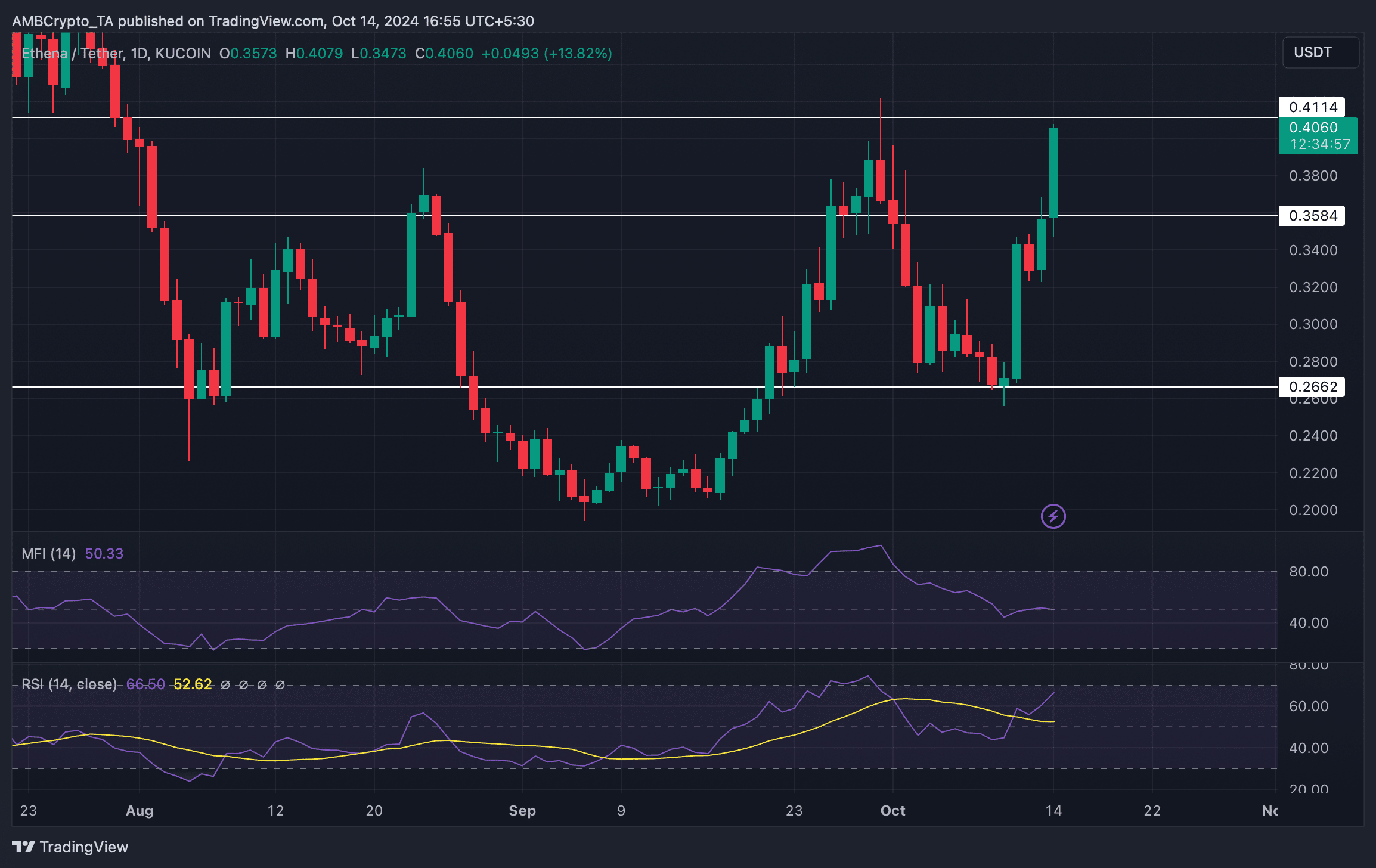

Tracking ENA’s upcoming targets

AMBCrypto then assessed the token’s daily chart to find out what market indicators suggested and ENA’s possible targets. We found that the Money Flow Index (MFI) registered a downtick.

Read Ethena [ENA] Price Prediction 2024-25

Ethena’s Relative Strength Index (RSI) was also about to enter the overbought zone.

Both of these metrics hinted at a price correction. If that happens. Then ENA might drop to $0.35. However, if the bull rally lasts, Ethena might successfully go above its resistance at $0.411.

Source: TradingView