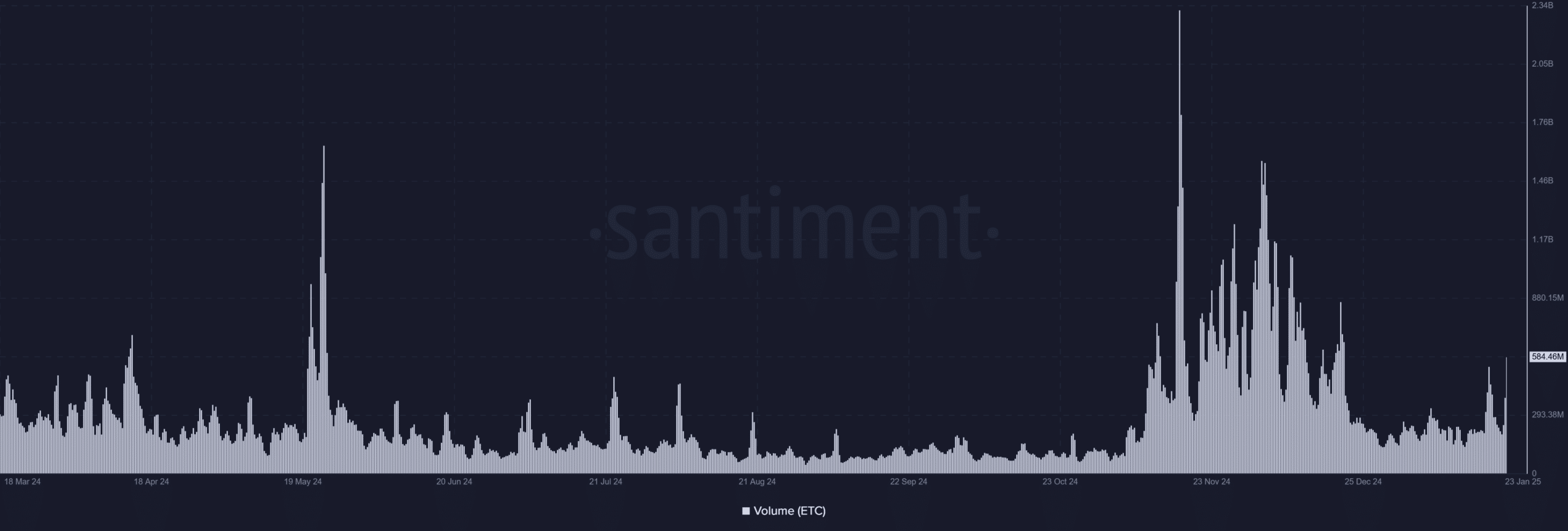

- Ethereum Classic’s trading volume surged to 584.46M, signaling rising investor interest amid ETH’s declining strength.

- ETC held above the key $22.50 support while ETH struggled below its 50-day moving average, raising questions about market shifts.

Ethereum Classic [ETC] has seen a slightly better trend than Ethereum [ETH] of late, leading to speculation that it could be absorbing the liquidity that the latter is losing.

With both assets showing contrasting price movements and volume trends, investors question whether ETC is emerging as a viable alternative to ETH.

Ethereum Classic’s price action: A mixed trend

Ethereum Classic traded at $24.54 at press time, reflecting a 1.72% intraday decline.

The price chart highlighted that ETC had entered a consolidation phase after a strong December rally, trading below its 50-day moving average of $26.87 and above the 200-day moving average of $23.15.

The fact that it remains above the 200-day MA suggests that ETC is still in a long-term uptrend despite short-term bearish movements.

Source: TradingView

ETC’s recent price action has been marked by lower highs, which could indicate waning bullish momentum. However, support at the $22.50 level remains strong, suggesting a bounce could occur if the broader market stabilizes.

ETH’s loss, ETC’s gain?

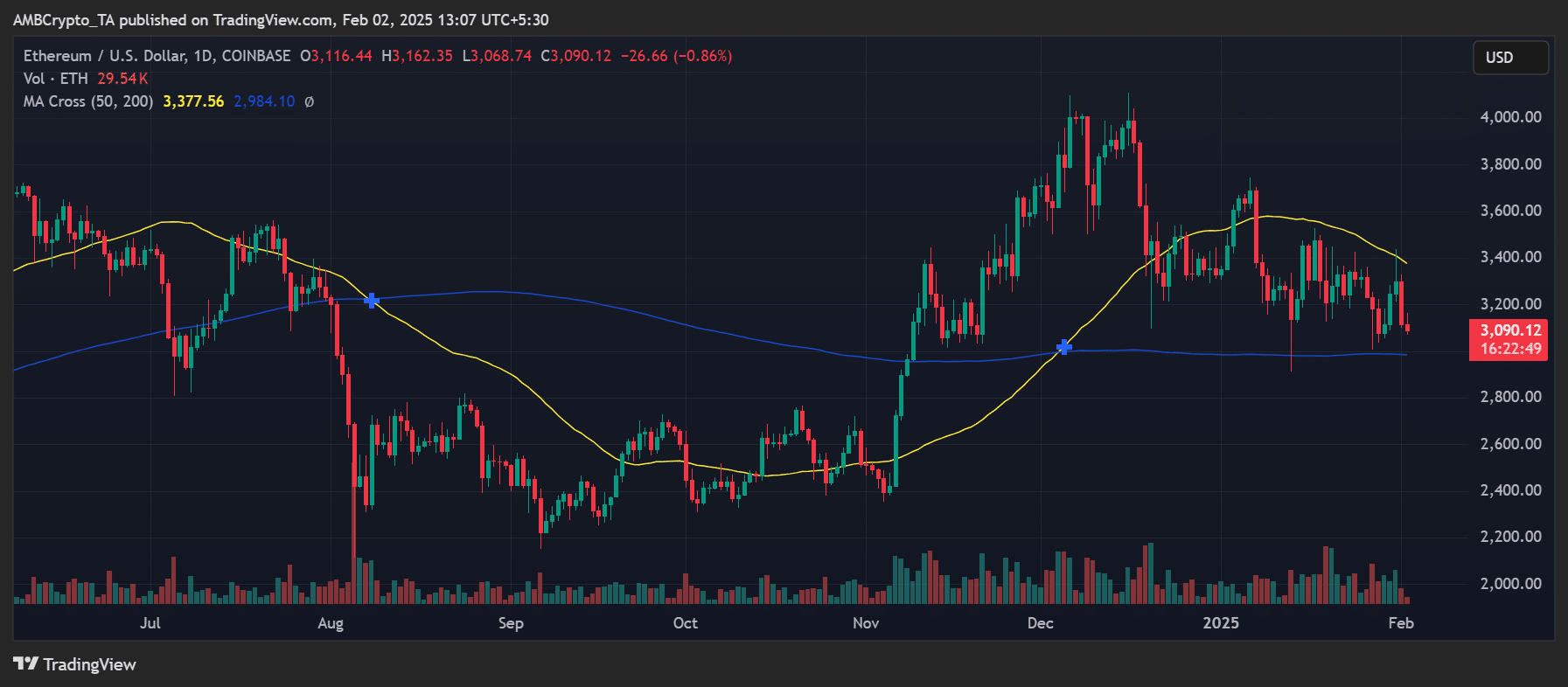

On the other hand, Ethereum traded at $3,090.12 at the time of writing, showing a 0.86% decline for the day. While ETH remained in a broader uptrend, it struggled to hold key support levels.

The 50-day moving average was $3,377.56, while the 200-day moving average was $2,984.10.

A breach below the 50-day MA signaled a potential loss of short-term momentum, making Ethereum vulnerable to further downside pressure.

Notably, Ethereum’s trading volume has been tapering off, with Santiment’s volume chart indicating reduced participation from traders.

This weakening interest could explain why some investors are shifting their focus toward Ethereum Classic, which has demonstrated higher relative strength.

Volume trends: ETC’s rising momentum

A closer look at Santiment’s volume chart revealed that ETC had been experiencing a steady increase in trading volume, with a recent high of 584.46M.

This uptick was a sign of renewed investor interest and growing confidence in Ethereum Classic as an alternative to Ethereum.

Unlike ETH, whose volume has been declining, ETC’s liquidity remained robust, potentially signaling a transfer of market interest.

Source: Santiment

Volume spikes in late January 2025 aligned with price movements, reinforcing the idea that traders are actively engaging with ETC.

This shift could be due to speculation that ETC offers a hedge against Ethereum’s weakening momentum, or due to expectations of network developments that could favor ETC.

Ethereum Classic’s next move

Looking ahead, ETC must maintain its current trading volume and hold above the $22.50 support zone to continue positioning itself as a strong alternative to Ethereum.

If Ethereum’s weakness persists, there’s potential for ETC to gain further traction. However, investors should watch for resistance near $27.50, where selling pressure has previously capped gains.

Is your portfolio green? Check out the Ethereum Classic Profit Calculator

On the macro level, Ethereum Classic’s correlation with Ethereum means that broader crypto market trends will play a role in its trajectory.

If ETH recovers, ETC might also benefit, though its independent volume surge suggests that traders are increasingly treating it as a standalone asset rather than a derivative of Ethereum.