- WIF has surged by 53.72% over the past month.

- Market sentiment suggested that dogwifhat could reach a five month of $3.5.

After a monthly long surge, dogwifhat [WIF] has experienced a sharp decline over the past week. At the time of writing, WIF was trading at $2.64. This marked a 5.53% decline in weekly charts.

Prior to this, dogwifhat had been on an upward trajectory, hiking by 53.72% on monthly charts.

Despite the decline on weekly charts, the past 24 hours have shown some signs of life, especially with trading activity. In fact, WIF’s trading volume has surged by 79.29% to $402.14 million.

Therefore, current market conditions raise questions over the memecoin’s future trajectory.

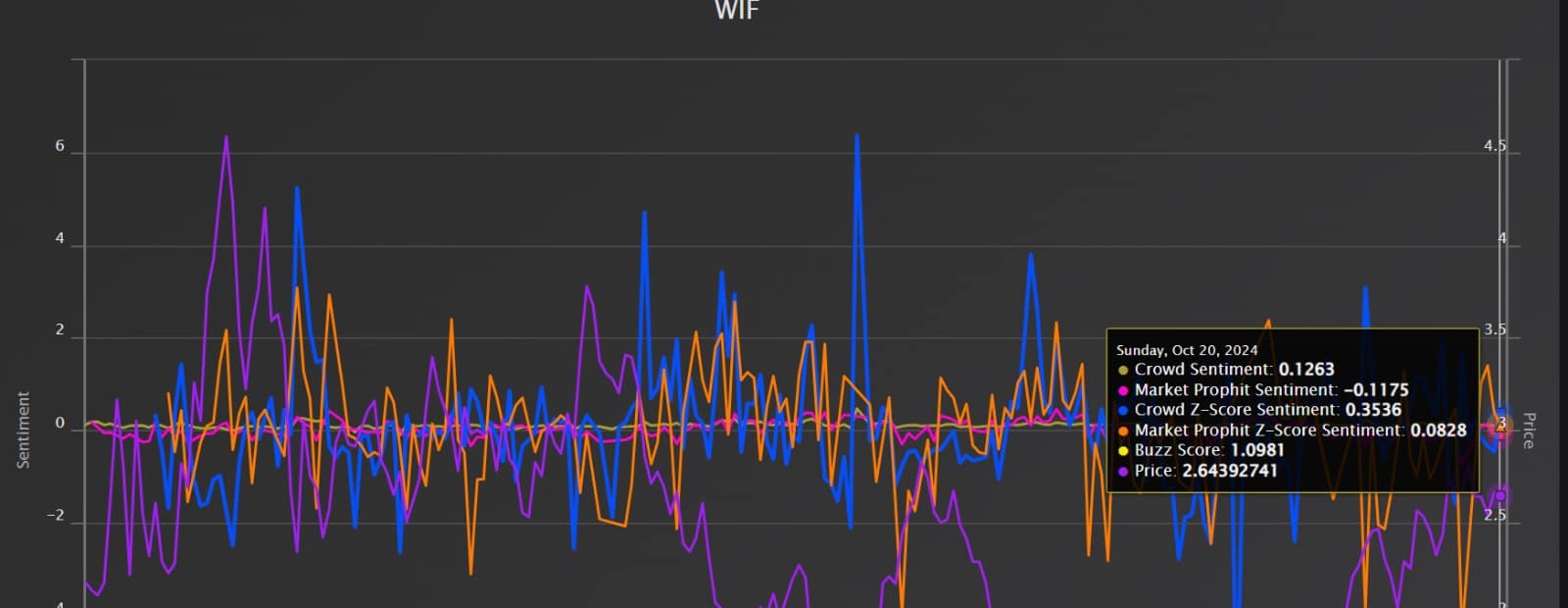

Source: Market Prophit

AMBCrypto’s analysis showed that dogwifhat was experiencing strong and positive market sentiment at press time.

Inasmuch, Market Prophit data showed that WIF’s crowd sentiment was positive at 0.1263 while its Buzz Score is 1.098. Likewise, the memecoin had a positive crowd Z score sentiment and market Prophit Z score sentiment.

So, despite the recent downside, most investors remain optimistic and anticipate prices to rise in the near term.

What WIF’s charts say

As observed above, WIF is experiencing favorable market conditions that could set the memecoin for further gains on price charts.

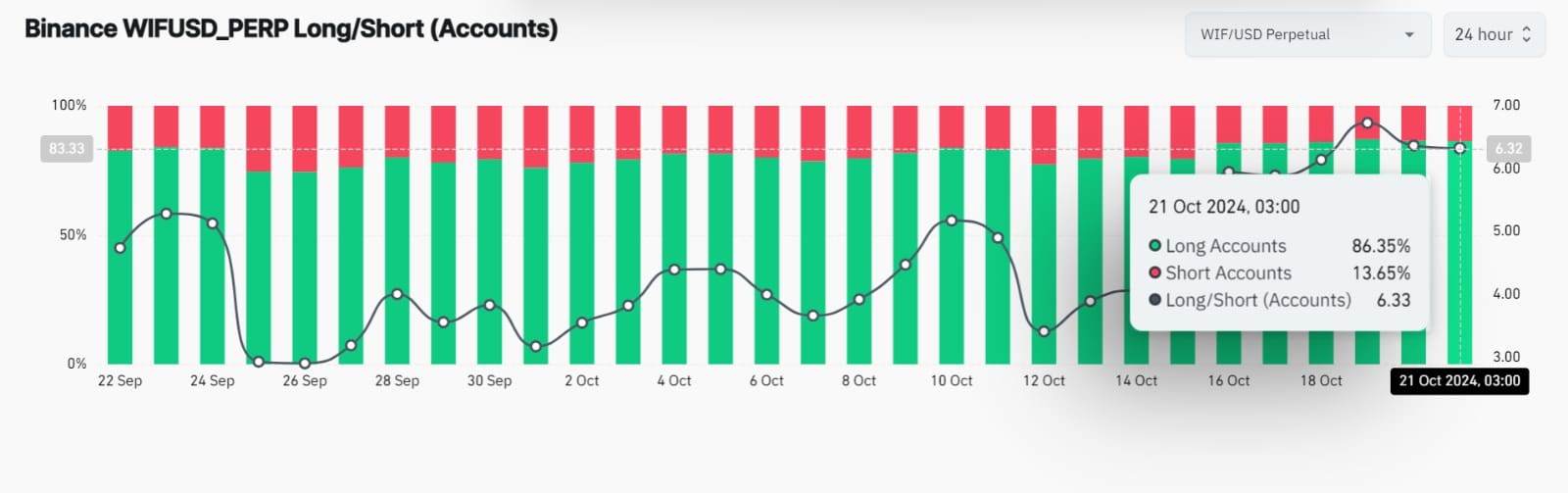

Source: Coinglass

For example, dogwifhat’s Binance perpetual futures show that the majority of investors are taking long positions. This is indicated by the fact that 86.35% of accounts are longs while short are 13.65%.

Such market conditions show a strong bias towards long positions in the perpetual Futures market thus, reflecting investor’s confidence.

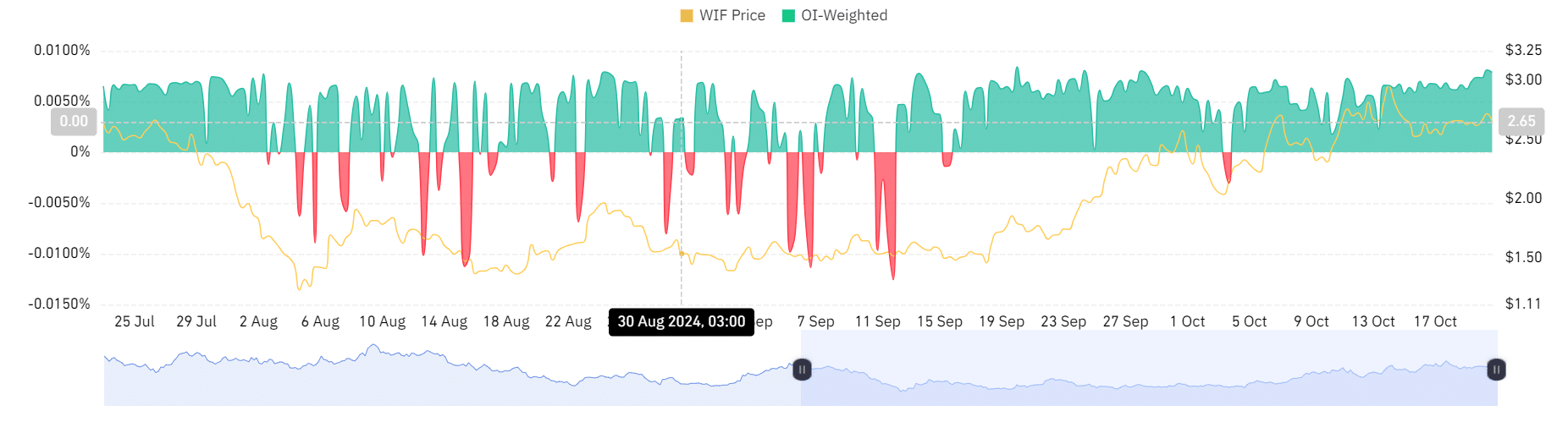

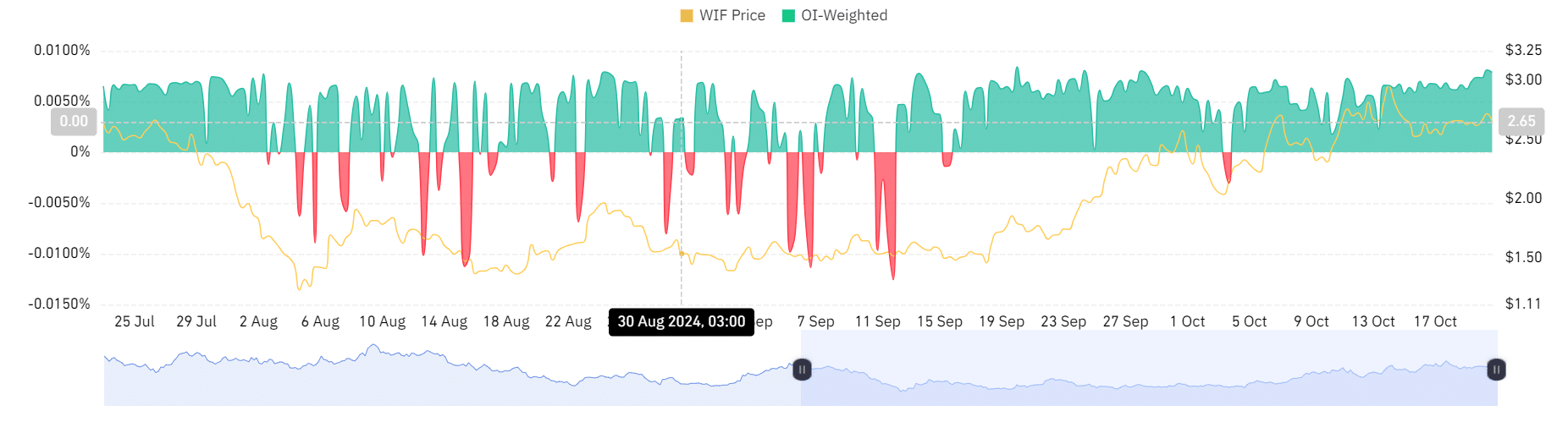

Source: Coinglass

This demand for long positions is further strengthened by a positive OI-Weighted Funding Rate.

Read dogwifhat’s [WIF] Price Prediction 2024 – 2025

This has remained positive over the past three weeks, suggesting that long position holders have been paying shorts to hold their trade.

Such market behavior implies that most investors are bullish and anticipate further gains on price charts.