- WIF could soon rebound as the TD Sequential indicator presents a buy signal.

- The recent surge in the Whale Index suggested that whales are starting to accumulate WIF.

The cryptocurrency market, with its inherent volatility, often presents opportunities for traders who understand the underlying technical indicators.

Recently, dogwifhat [WIF] has had key signals pointing to a potential price rebound.

Signs of momentum shifting for WIF

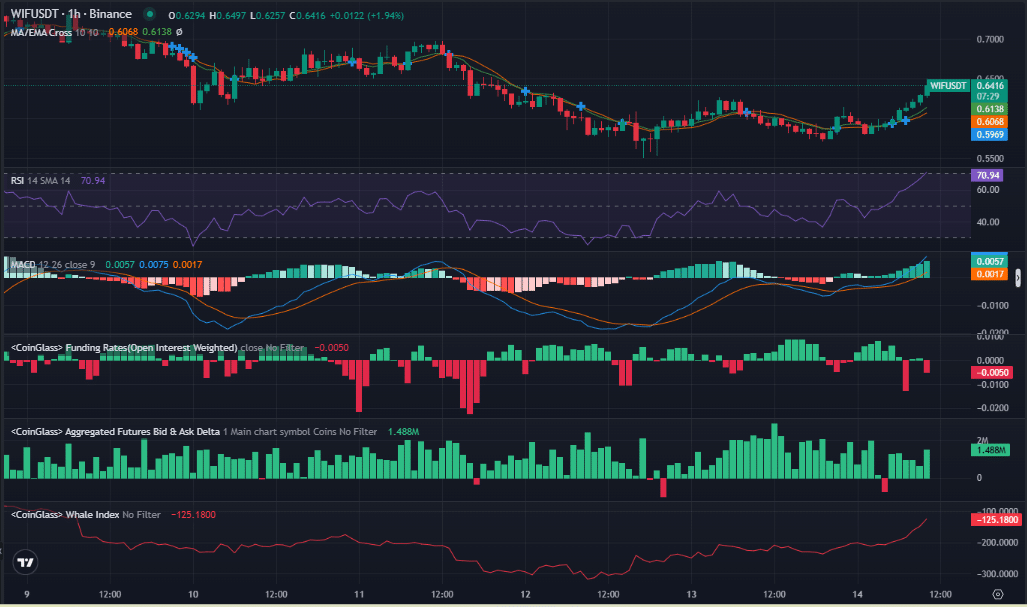

Analysis from the 1-hour chart shows a dip in WIF’s price, followed by a slight recovery.

This price action shows that the asset is testing its support levels, with the RSI at 14 indicating an oversold condition.

Source: Coinglass

Such conditions frequently precede price rebounds. Furthermore, the MACD is showing a bullish crossover, which is a classic sign of a potential uptrend.

The RSI’s oversold condition and the MACD crossover suggest that WIF might be ready for a price rebound, aligning with the broader bullish sentiment.

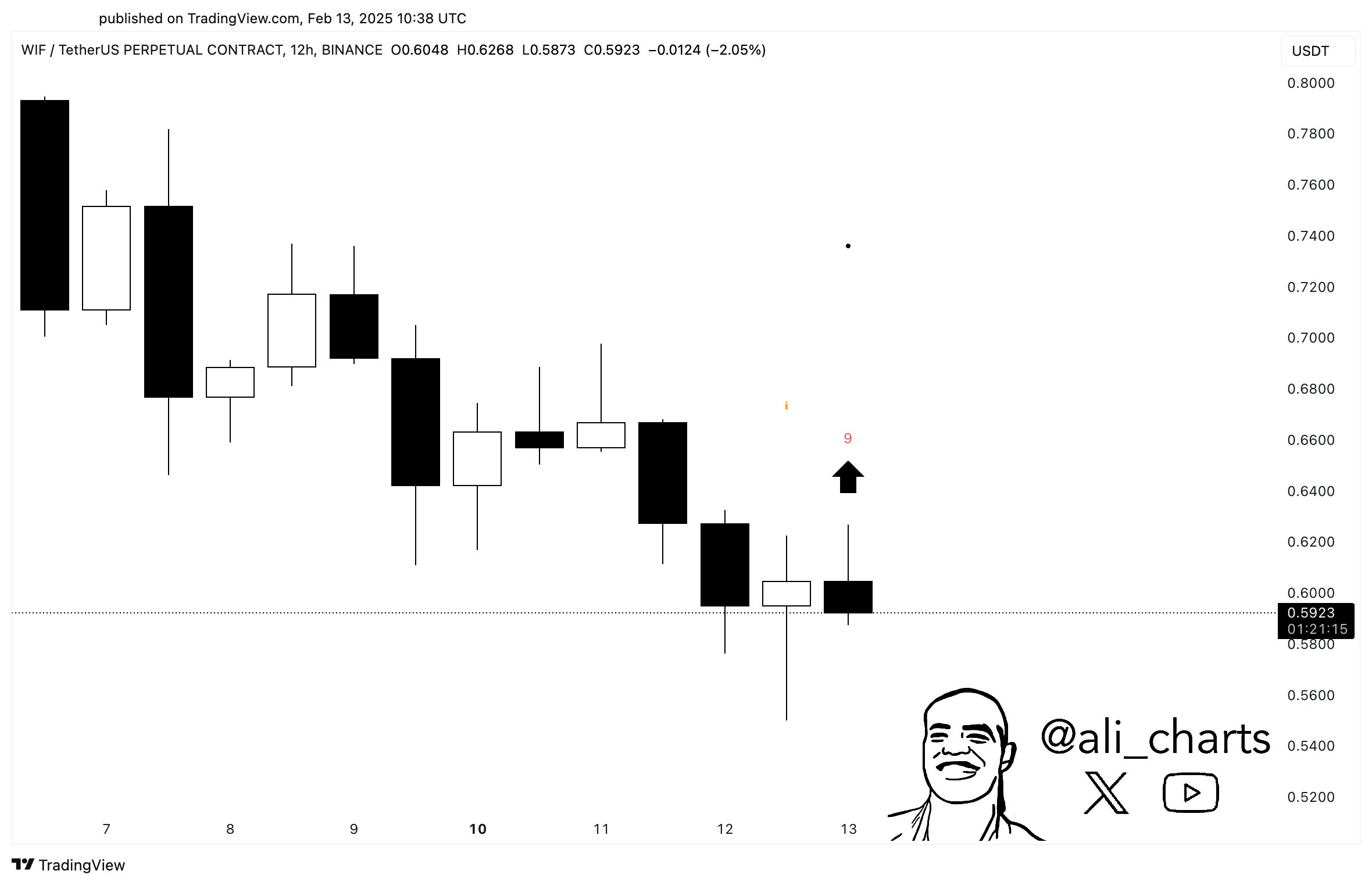

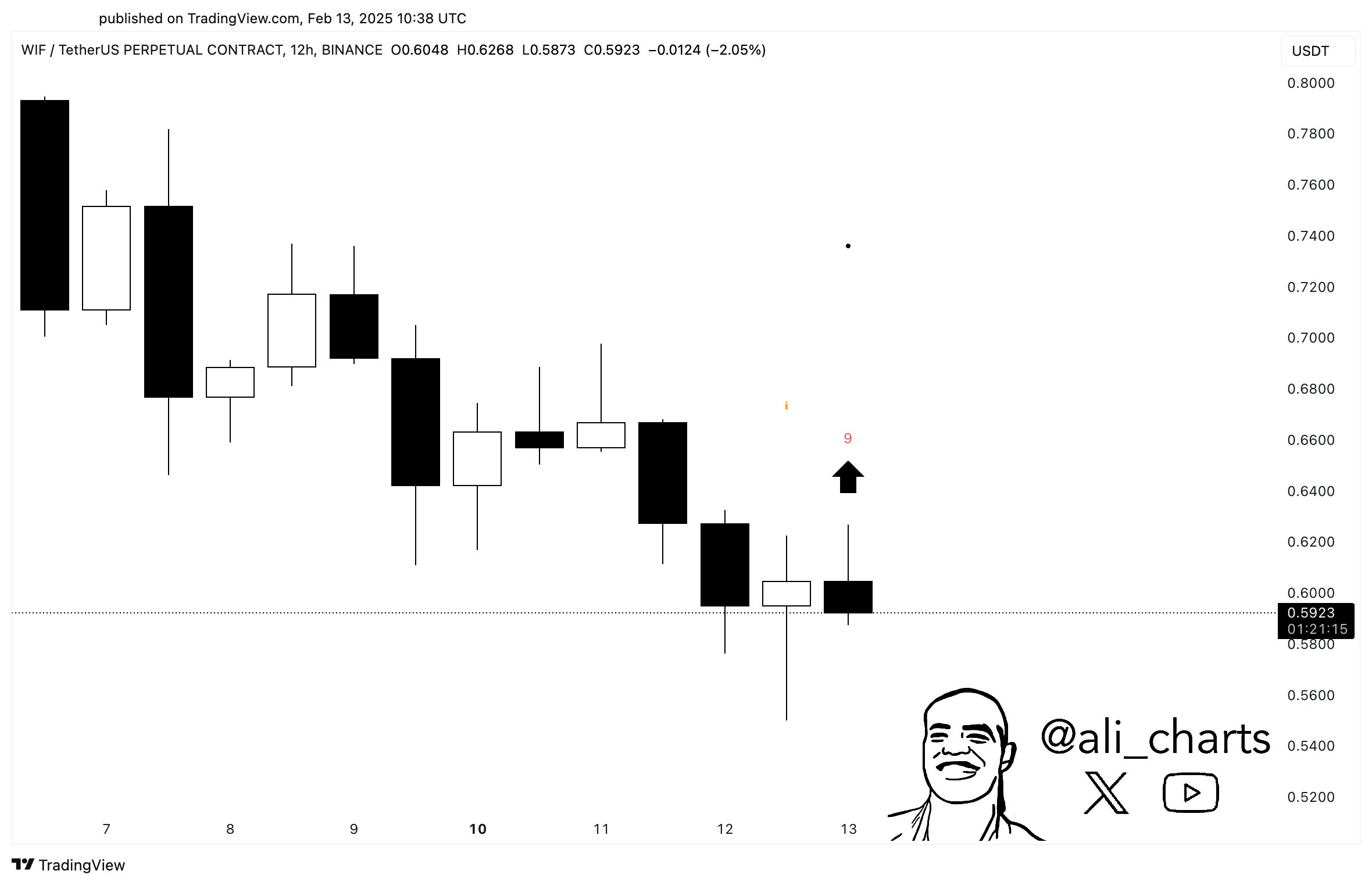

TD Sequential’s buy indicator

The TD Sequential indicator on the 12-hour chart has flashed a buy signal for WIF, a notable development. The TD Sequential is known for identifying exhaustion points in a trend.

Source: X

A buy signal on a longer timeframe, such as the 12-hour chart, is particularly significant as it indicates that the downtrend may be nearing its end. This aligns well with the price action analysis that suggests a shift in momentum.

This is a clear indication of a potential rebound, reinforcing the expectation that $WIF might soon experience an upward movement.

Positive shifts in buying pressure

Further analysis shows that the Funding Rate for WIF is slightly negative, indicating shorts are paying longs. This suggests market sentiment leans toward expecting a price increase as traders balance positions.

Additionally, the bid-ask delta shows positive spikes, indicating increased buying pressure. This buying pressure, coupled with the negative Funding Rate, implies the market is preparing for a possible price rise.

These signals collectively suggest that WIF could be gearing up for a rebound.

Are large holders positioning for a rise?

The Whale Index for WIF reveals that large holders (whales) are showing signs of accumulation.

The recent surge in the Whale Index suggests that whales are starting to accumulate WIF, a behavior that often precedes price increases.

This pattern mirrors earlier price action, where the price is recovering from a low point.

Whale activity supports the idea that these large investors expect a price rebound, which could push the price of WIF higher in the short term.

The analysis of WIF’s recent technical indicators presents a strong case for a potential rebound. Additionally, market sentiment, as indicated by the Funding Rate and bid-ask delta, points toward a price increase.

Whale activity aligns with these expectations, as large holders accumulate WIF in anticipation of a price rebound.