- WIF formed a symmetrical triangle pattern, which suggests the possibility of a rally beyond its all-time high.

- Technical indicators support the likelihood of an upcoming rally, while other metrics suggest that the downside risk is minimal.

dogwifhat’s [WIF] bullish momentum gained traction after a massive weekly gain of 48.19%, and this rally has extended into the daily timeframe, where the price has surged by another 27%, setting the stage for further upward movement.

However, a variety of metrics offer differing views on the extent of the rally, providing multiple insights into the asset’s price trajectory.

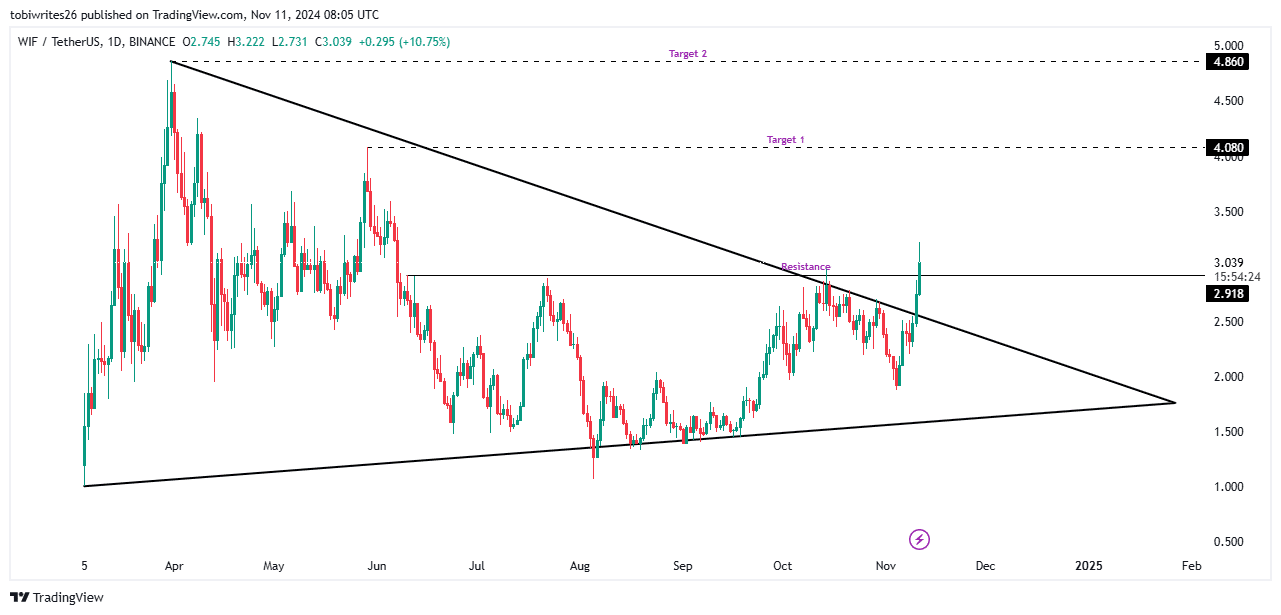

Symmetrical triangle gives WIF an edge

WIF is currently trading within a symmetrical triangle pattern, a formation often seen as a bullish catalyst, typically followed by a price move toward the peak of the channel—and potentially beyond.

In this case, the channel’s peak is projected at $4.860. For the rally to fully materialize and trigger a significant upswing, WIF must first break through the resistance line at $2.918, which could potentially turn into a support level.

From this point, the short-term target is $4.080, with a secondary target of $4.860, paving the way for a potential breakout that could establish new highs for WIF.

Source: Trading View

Further analysis by AMBCrypto suggests that a rally is likely for the asset in the near term.

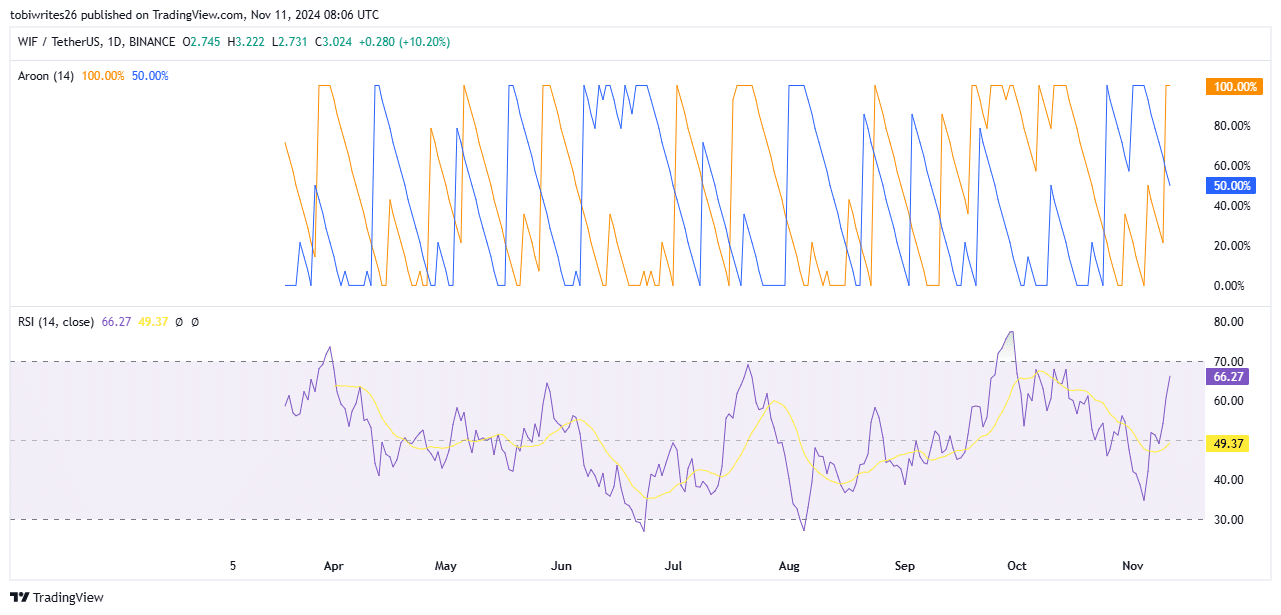

Indicators signal continued upside for WIF

Using the Aroon Line, AMBCrypto has identified a predominantly bullish market trend, which could further fuel WIF’s rally.

The Aroon Line is a technical indicator used to assess both the strength and direction of a trend. It consists of two components: the Aroon Up (orange) and Aroon Down (blue).

When the Aroon Up line is above the Aroon Down line, it signals a bullish market sentiment. Currently, the Aroon Up line is at 100.00%, while the Aroon Down is at 50.00%, suggesting that the market is likely to maintain its bullish momentum.

Additionally, the Relative Strength Index (RSI), which measures the speed and change of market momentum, is trending higher and remains in the positive zone.

With a current reading of 66.27, the RSI indicates strong bullish sentiment, positioning WIF for further upward movement should this trend continue.

Source: Trading View

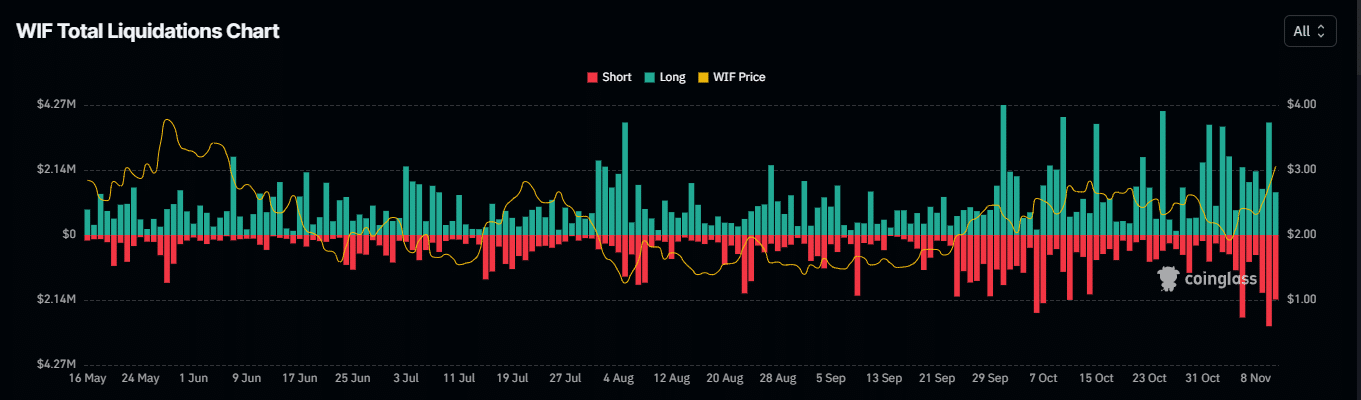

Mixed sentiment, but mostly neutral

Open Interest, which tracks the number of unsettled derivative contracts in the market, has seen a significant rise, with a 23.27% increase, positioning it in a favorable state.

This positive positioning suggests that long positions have been aggressively opened over the past 24 hours, bringing the total value to $549.55 million.

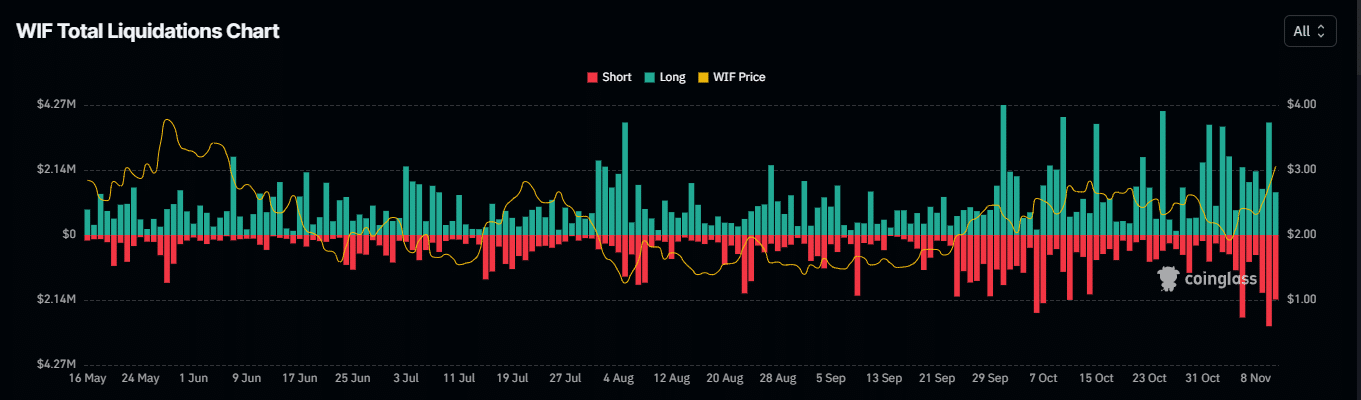

On the other hand, liquidation data reveals that long and short liquidations are nearly equal, indicating a neutral market sentiment.

Is your portfolio green? Check the dogwifhat Profit Calculator

Long liquidations were recorded at $4.30 million, while short liquidations stood at $4.52 million. Additionally, the long/short ratio is at 0.9786, which is close to the neutral zone.

Source: Coinglass

A shift in these metrics toward a more bullish skew could position WIF for a significant rally.