- Dogecoin surged by 4.97% over the past month.

- Market fundamentals indicate buy signal as Dogecoin shows a bullish crossover.

Since hitting a recent high of $0.132, Dogecoin [DOGE] has struggled to reclaim its higher levels. As such, the memecoin has declined by 15.15% over the fortnight.

In fact, at press time, DOGE was trading at $0.112. This marked a 1.75% decline over the past week. Prior to this decline, DOGE had been on an upward trajectory, hiking by 4.97% monthly.

Despite these recent losses, the past 24 hours have shown some signs of life with increased trading activities. Thus, Dogecoin’s trading volume has spiked by 47.43% to $750.97 million.

These recent market conditions have left the wider crypto community talking. Among them are popular crypto analysts Ali Martinez and Trader Alan.

What market sentiment says

According to Martinez, the TD sequential signaled buying. The current downside was over, and it’s the best time for investors to enter markets to buy or take long positions.

Usually, new entrants cause higher demand thus resulting in higher buying pressure thus driving prices up.

Source: X

On the other hand, Alan has posited that DOGE has signaled a 20-SMA cross over the 100-SMA on daily charts. This suggests that the buying pressure is strong, and the prices are set to move upward in the near term.

According to him, the recent levels have moved above both 2024 highs and lows. This is significant because it indicates a breakout above the previous resistance (the highs) and below the previous support (the lows).

Therefore, with the buy signal allowing new investors into the market and a bullish crossover, DOGE suggests a move upward is imminent.

Can DOGE reclaim 2024 highs?

While the analysis above provides a promising outlook. Therefore, the prevailing conditions could set Dogecoin for more gains on price charts.

Source: Santiment

For starters, Dogecoin’s Open interest in USD per Exchange has experienced a sustained surge, rising from $140 million to $153.71 million.

This means that investors are opening new positions while holding existing ones. Such behavior implies confidence in the market’s future value.

Source: IntoTheBlock

Additionally, Dogecoin’s large holder’s outflow has declined over the past week from 163.41 million to 27.35 million.

Such a huge decrease in outflow means that large holders are choosing to hold onto their tokens.

Source: Coinglass

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

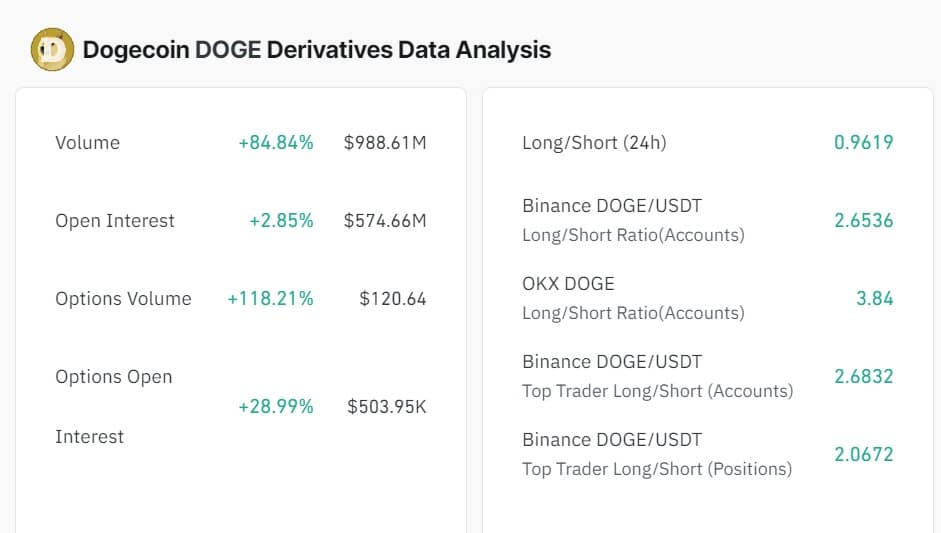

Finally, Dogecoin’s Options volume has surged by 118.21% to $120.64 million. This suggests that higher buying pressure as investors bet for prices to rise.

Equally, options Open Interest has seen a surge by 28.99% to $503.95k.