- Whale activity and historical trends pointed to potential for a strong bullish breakout near $0.40

- Rising network activity and solid metrics supported DOGE’s trajectory towards $0.50

Dogecoin [DOGE] has seen significant whale activity lately, with over 200 million tokens accumulated in just 48 hours. This surge in demand has reignited investor interest and optimism about DOGE’s potential for a breakout.

At press time, DOGE was trading at $0.3854, representing a 1.61% hike over the last 24 hours. Additionally, whale accumulation is often an early indicator of strong price movements, raising expectations for a bullish run in the coming days.

Bull run cycle – Will history repeat itself?

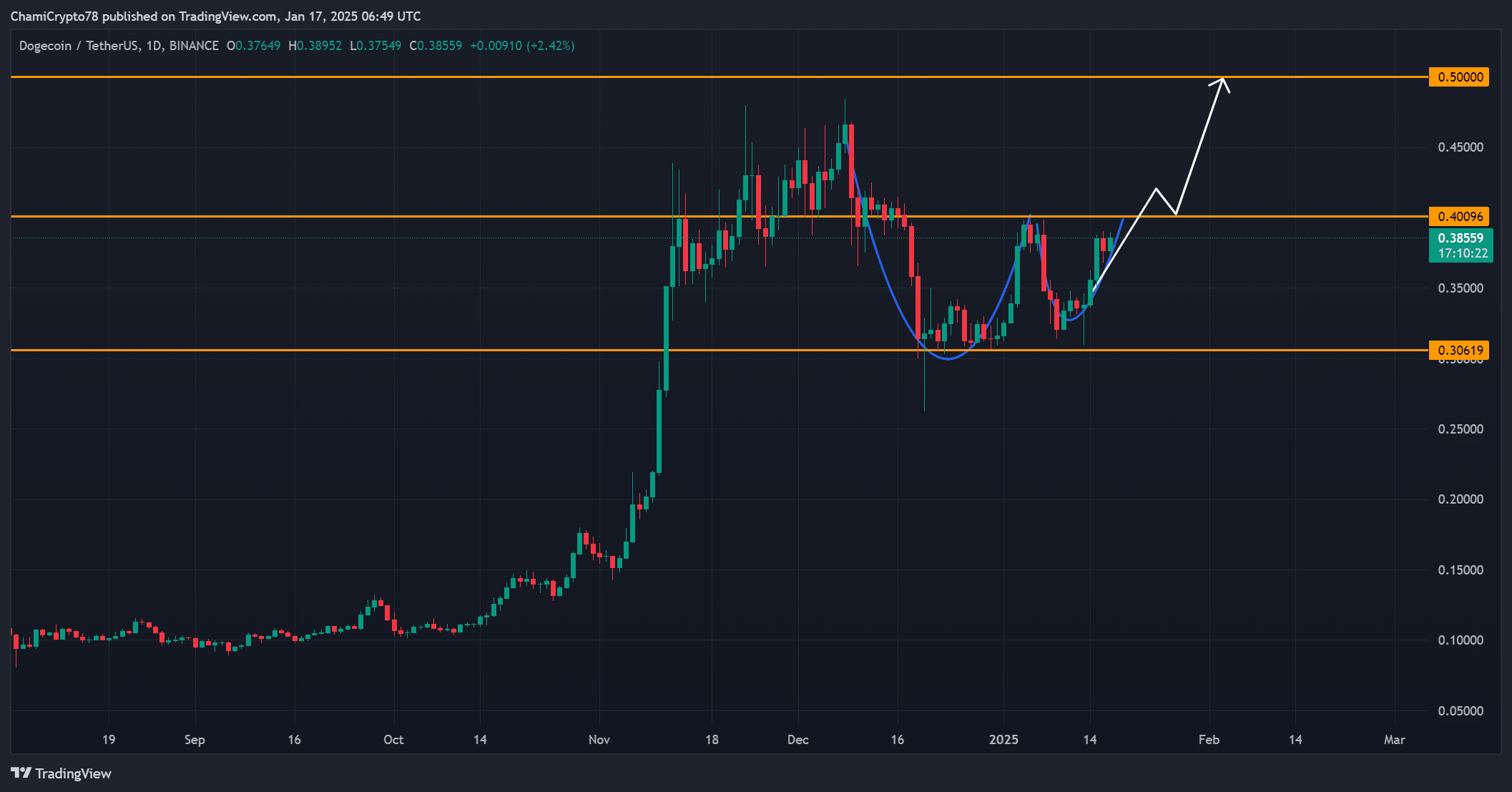

DOGE’s price history revealed that in January 2021, the memecoin saw a massive rally after a 56% correction. At the time of writing, Dogecoin seemed to be at the end of a 46% pullback, forming a similar pattern to its previous cycle.

As was the case in 2021, historical data seems to suggest that these corrections often pave the way for new price surges, especially during bullish phases. Therefore, if the cycle repeats itself, Dogecoin could see a significant upward leg as early as next week, with resistance levels at $0.40 and $0.50 becoming key milestones.

Source: X/Ali

DOGE price action – Where is it heading?

Dogecoin’s price has been displaying a classic cup-and-handle pattern – A reliable bullish formation. The breakout pushed DOGE towards the crucial resistance at $0.40, which, if cleared, could set the stage for a run towards $0.50.

However, if momentum slows down, the price might retrace to the $0.30 support level, allowing buyers to step in again. Therefore, the next few days will be pivotal in determining whether DOGE can sustain its upward trajectory or not.

Source: TradingView

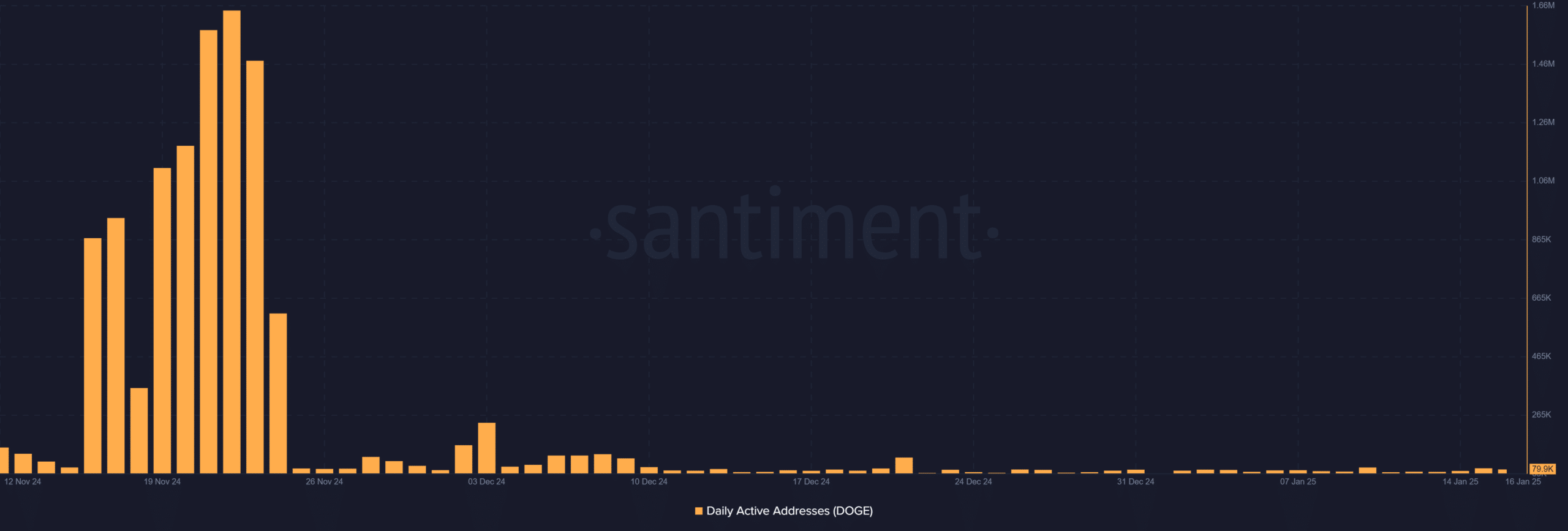

Daily active addresses – Growing network activity

Dogecoin’s daily active addresses are currently hovering near 80,000 – A sign of increased user activity and network engagement. This hike is a positive sign of growing interest, as higher activity levels often translate to better price stability.

Additionally, sustained growth in network participation could attract more investors, further strengthening Dogecoin’s bullish case. However, a drop in activity might dampen investor sentiment and slow down the momentum.

Source: Santiment

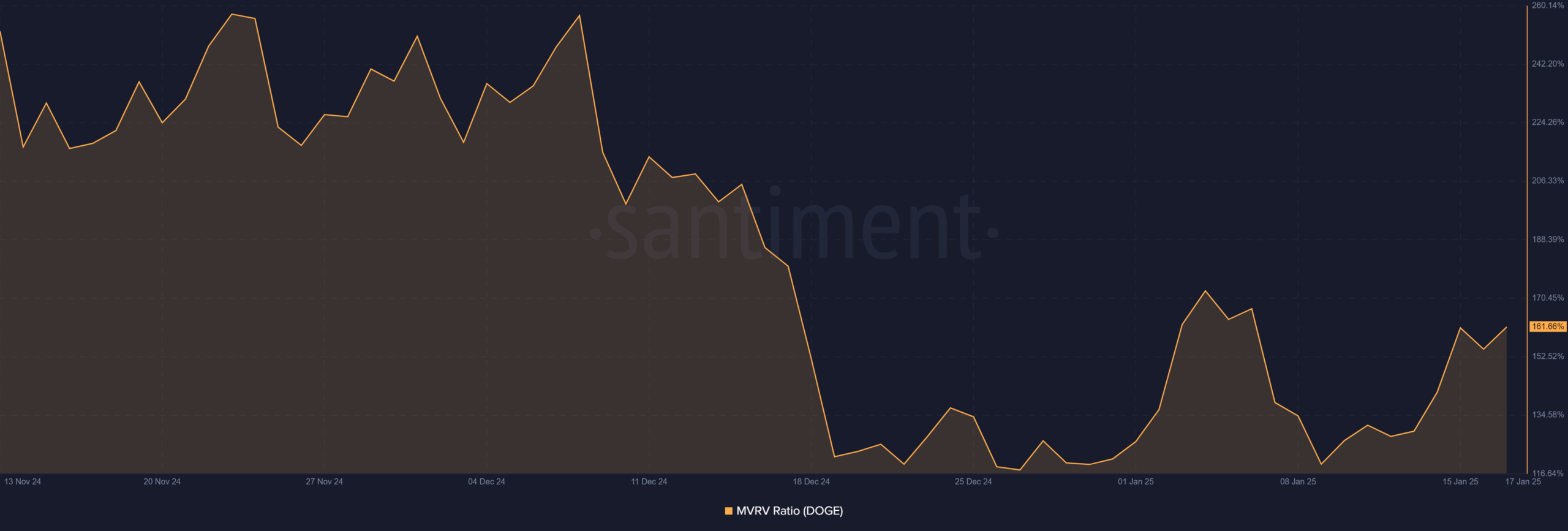

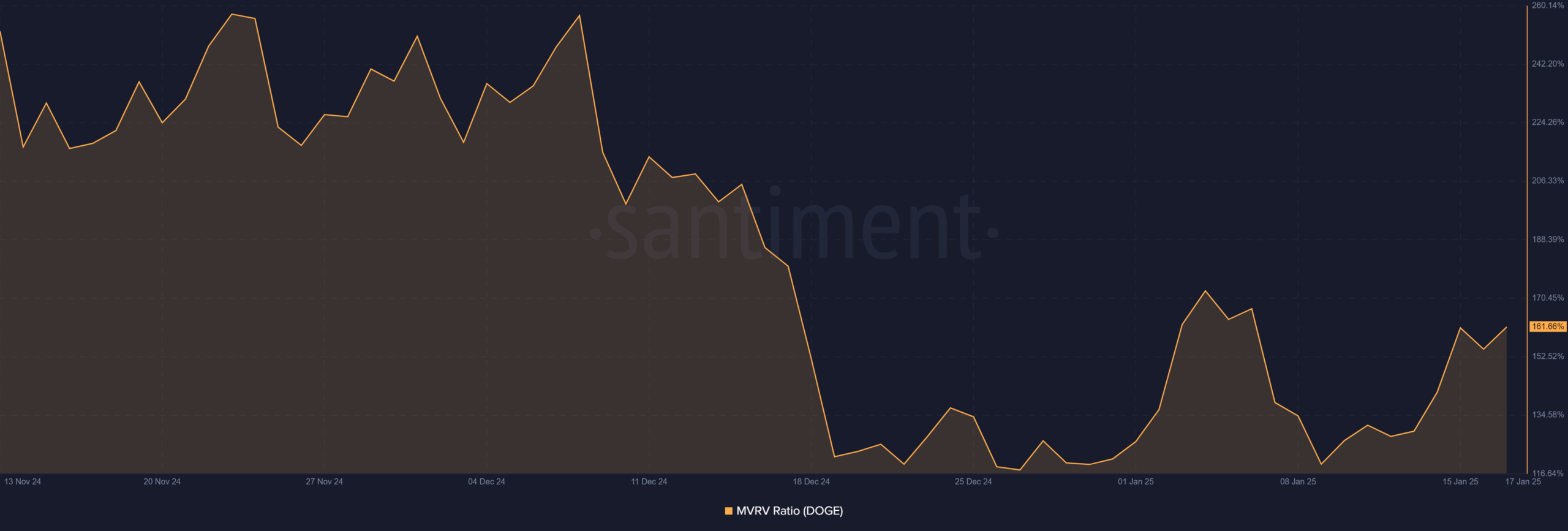

MVRV ratio – What it means for DOGE holders

The MVRV ratio had a reading of 161.66%, indicating that holders are sitting on considerable unrealized gains. While this alludes to potential profit-taking, whale accumulation and increased activity may limit selling pressure.

Additionally, if DOGE maintains its momentum, the profits could incentivize long-term holding. Therefore, the MVRV ratio will be a critical metric to watch out for in the coming days.

Source: Santiment

Is your portfolio green? Check out the Dogecoin Profit Calculator

Is DOGE ready for the next breakout?

Dogecoin’s strong whale activity, bullish price patterns, and rising network engagement suggested that it is well-positioned for a breakout. If the $0.40 resistance is breached, DOGE can target $0.50 and beyond in the near term.

Will the meme coin finally deliver a sustained rally? The next few weeks will reveal the answer.