- Whale activity and bullish patterns suggested DOGE may challenge its key $0.415 resistance

- Rising active addresses and shifting sentiment hinted at potential upside momentum for Dogecoin

Dogecoin [DOGE] caught the attention of the crypto community today after 90,000,000 DOGE, worth over $36 million, were transferred to Binance. This significant whale movement has fueled speculations about its possible impact on the memecoin’s price action.

At press time, DOGE was trading at $0.3957, following a 1.17% decline in the last 24 hours. In light of this momentum shift, traders are now keen to know if DOGE can break through its current consolidation phase and stage a bullish rally.

Can DOGE overcome its key resistance?

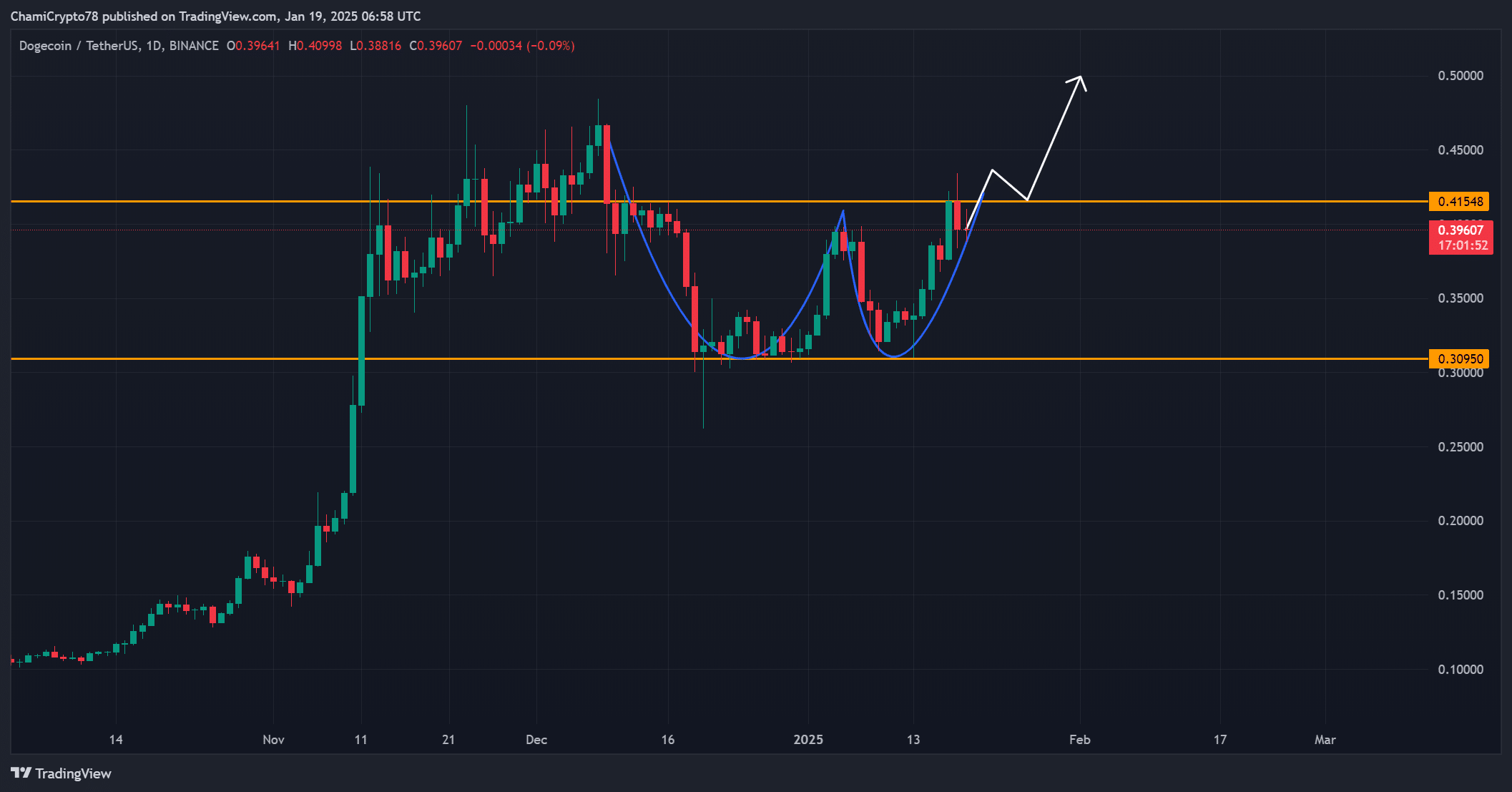

Dogecoin’s daily chart revealed a bullish cup-and-handle formation, indicating a potential rally if the resistance at $0.415 is broken. This level has served as a barrier in previous attempts too, while $0.3095 has emerged as a critical support level.

Furthermore, the chart hinted at a possible upside towards $0.50 if DOGE maintains its buying pressure. However, a failure to breach $0.415 could trigger short-term profit-taking and a pullback to lower levels.

Therefore, traders should monitor these levels closely to anticipate Dogecoin’s next move.

Source: TradingView

What does the MVRV ratio tell us?

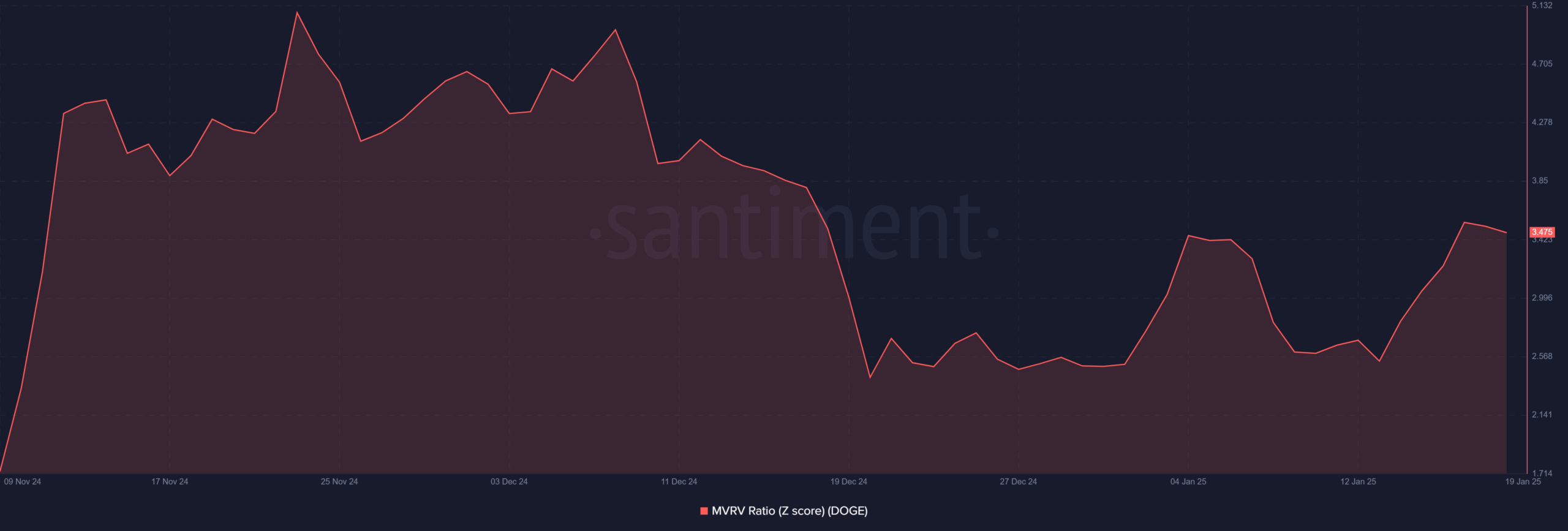

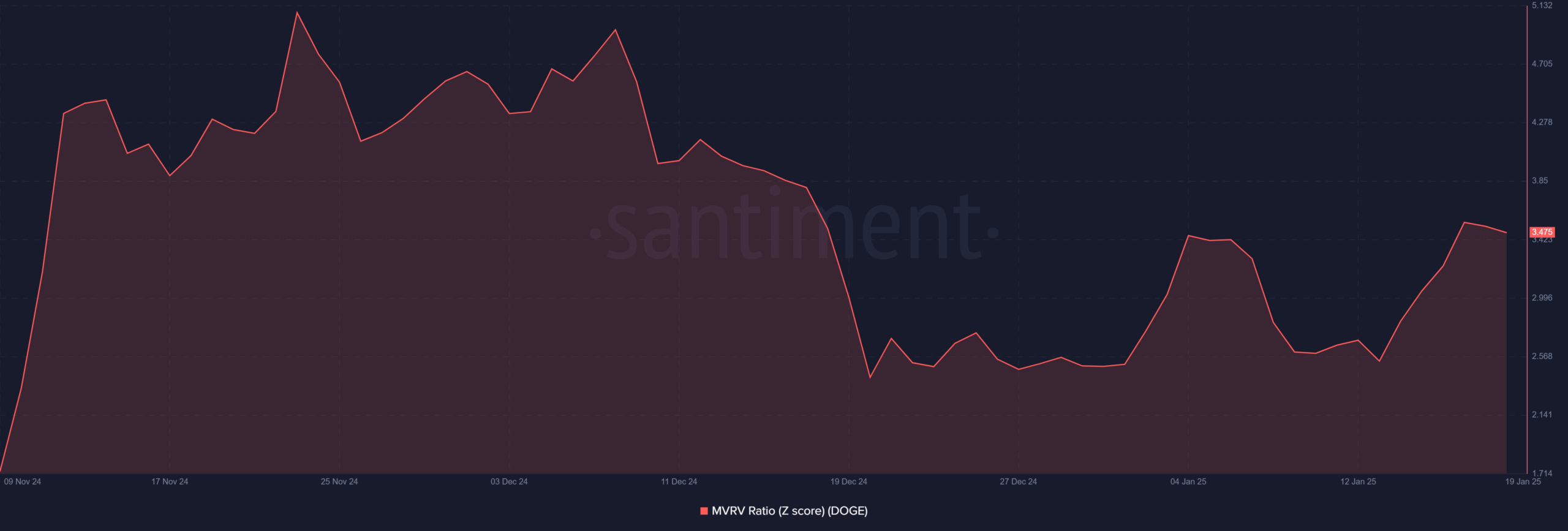

At the time of writing, the MVRV Z-score for DOGE was 3.47, signaling that holders remain moderately profitable. This metric’s finding pointed to a balanced market, one where neither overvaluation nor undervaluation pressures have been dominant so far.

Additionally, the steady MVRV suggested that most investors are holding onto their assets for now, rather than selling.

However, for bullish momentum to build, a significant hike in profitability or new buying activity will be necessary. Therefore, the MVRV ratio can be interpreted to imply cautious optimism among DOGE holders.

Source: Santiment

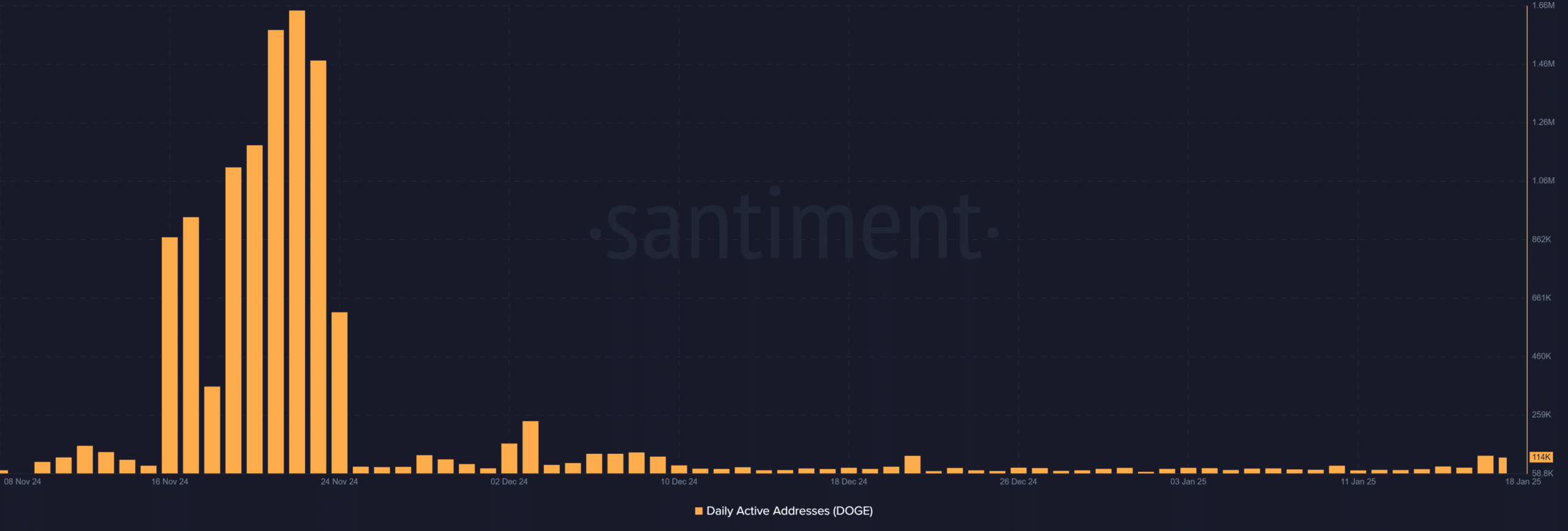

Increasing active addresses – A bullish indicator?

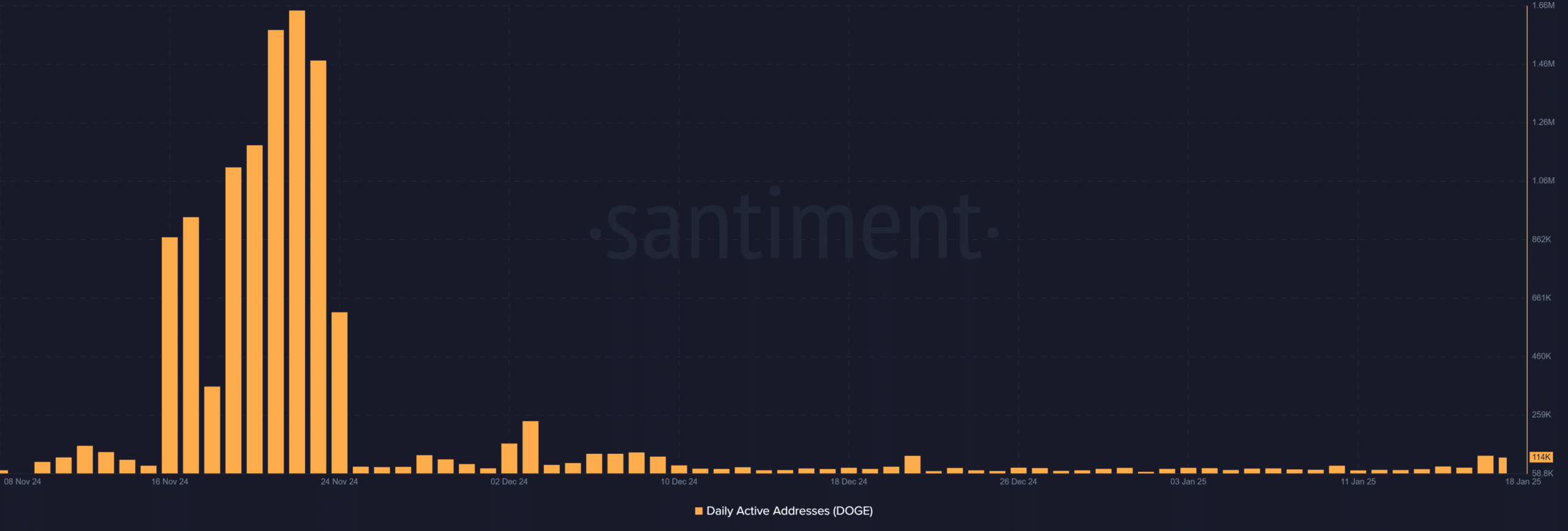

Daily active addresses rose sharply, with 114,650 wallets transacting recently. This hike underlined the scale of heightened network activity and growing interest in DOGE.

Additionally, a surge in active addresses often correlates with greater liquidity and demand, which could support a price rally. However, sustained activity levels will be crucial for validating a bullish breakout.

Therefore, traders should watch this metric as a potential early indicator of market direction.

Source: Santiment

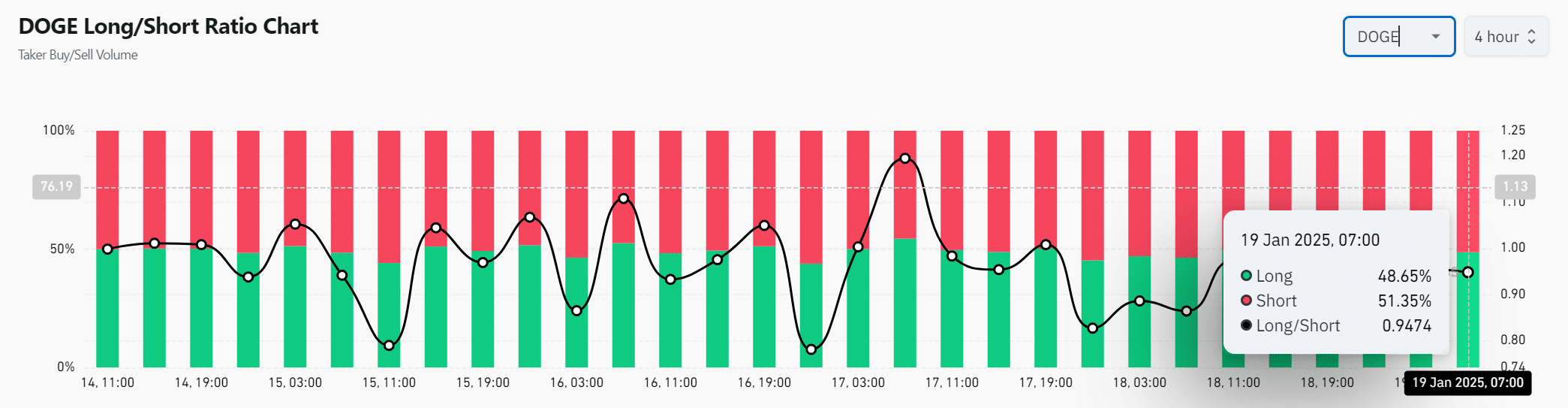

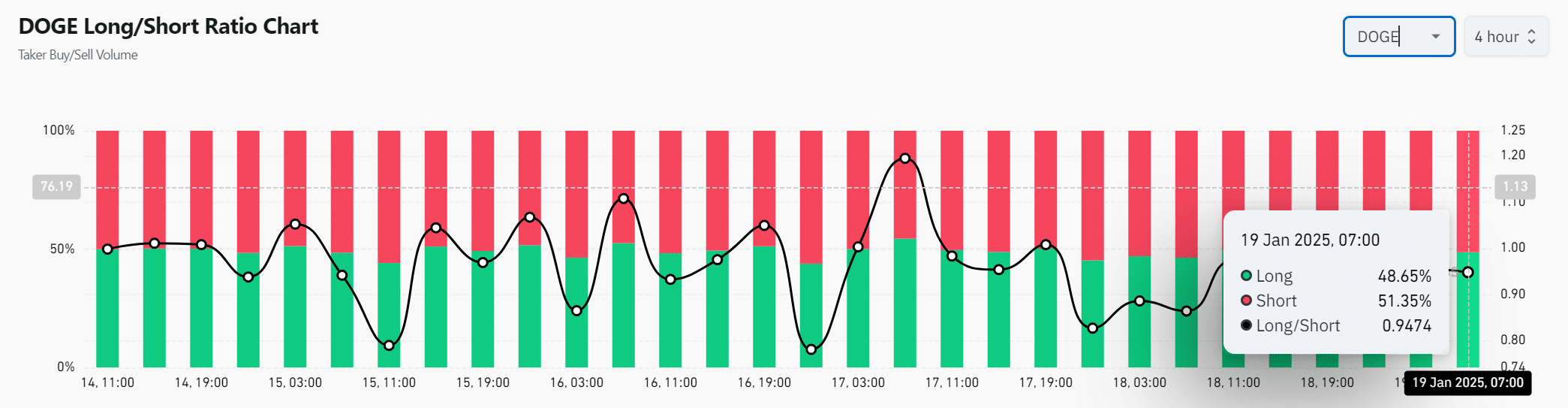

Does the long/short ratio favor bulls?

DOGE’s long/short ratio slightly favored shorts at 51.35%, signaling cautious sentiment among traders. However, this marginal advantage also suggested the market remains undecided, rather than outright bearish.

Additionally, a shift in this ratio toward longs could trigger short squeezes, driving the price higher. Therefore, observing changes in this ratio is critical for anticipating DOGE’s next move.

Source: Coinglass

– Is your portfolio green? Check out the Dogecoin Profit Calculator

Dogecoin’s whale activity, rising active addresses, and bullish chart patterns hinted that an imminent breakout is possible.

However, the critical $0.415 resistance must be cleared to confirm upward momentum. If this level holds, DOGE is likely to rally towards $0.50 on the charts.