- DOGE has been a major beneficiary of BTC’s latest cycle, thriving despite its high-risk, high-reward status.

- Now, as the market takes a U-turn, DOGE could still continue to benefit.

Over the past year, memecoins have taken center stage, with Dogecoin [DOGE] leading the pack by posting an impressive 10% weekly gain.

According to an AMBCrypto report, bullish sentiment surrounds DOGE, with a short-term target of $0.16. However, a significant resistance level lies around $0.20, a mark DOGE hasn’t tested in over 155 days.

Since Dogecoin’s performance is closely tied to Bitcoin [BTC], a hidden pattern identified by AMBCrypto could provide the support needed for DOGE to weather volatility.

If conditions align favorably, this pattern may propel DOGE into a parabolic rally.

A short-term correction for DOGE may be inevitable

The last time DOGE hit $0.14 was during the mid-July rally. After more than 150 days of slumping, Dogecoin has made a strong comeback, brushing off concerns that it was being overshadowed by new memecoins.

October has proven to be especially bullish for DOGE. While the initial momentum was fueled by BTC, the latter part of the month saw DOGE posting daily gains exceeding 5%, significantly outpacing BTC.

Historically, a recurring pattern has emerged where the end of the cycle often yields substantial gains for specific coins as capital begins to shift away from BTC, especially as it nears high-risk zones.

DOGE has certainly been a key beneficiary of this trend, managing to post a higher high by breaking through the previous resistance at $0.14.

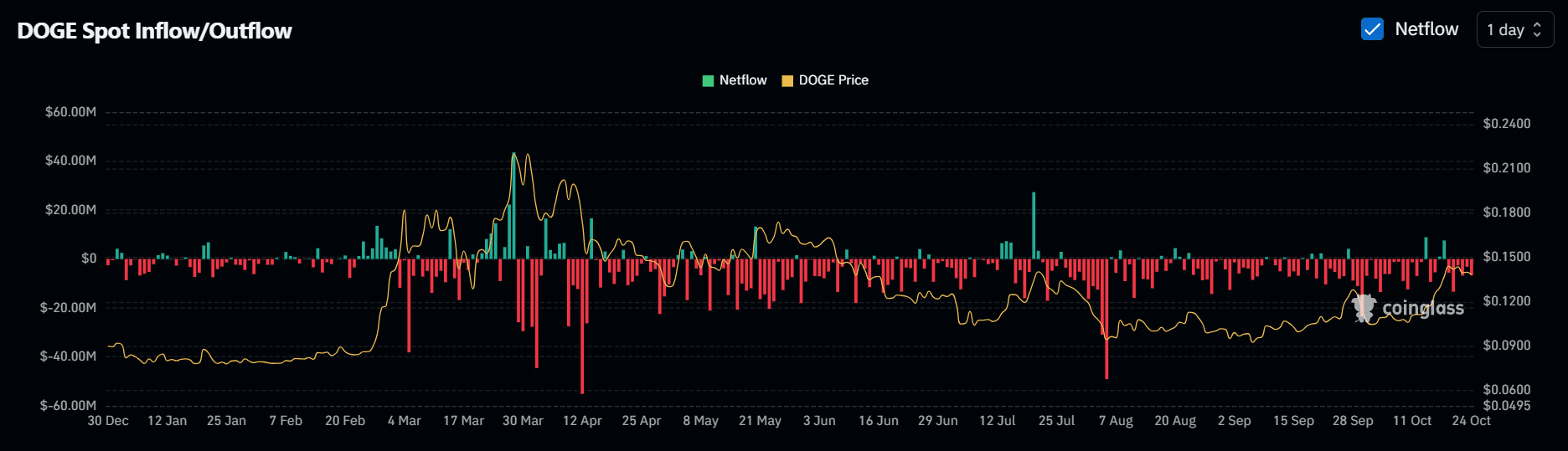

Source : Coinglass

Currently trading at $0.1384, a short-term correction from a peak of $1.40 was inevitable, especially as DOGE registered overbought conditions across various metrics.

With 84% of price movement in the last two weeks being upward, a trend reversal was imminent.

Now, the next dip opportunity might come around $0.12, the last resistance level. Four days ago, a pullback aligned with 7 million DOGE entering exchanges, signaling an overheated market.

However, accumulation began shortly after. Spot traders are eyeing the next dip, anticipating another rally, with much depending on BTC’s next move. So,

Should you buy the dip?

Unless Bitcoin experiences a price reversal, which is currently mirroring the late-September cycle when BTC faced resistance at $66K, this level remains crucial for Dogecoin holders to watch closely.

A BTC rebound could restore confidence in high-cap memecoins like Dogecoin.

However, given their inherent volatility, it might be wiser to wait until the market stabilizes before betting on them, especially from a psychological standpoint.

On the flip side, DOGE’s resilience during recent market downturns suggests that BTC investors might shift towards it, as DOGE has remained in the green, boasting a 10% weekly surge.

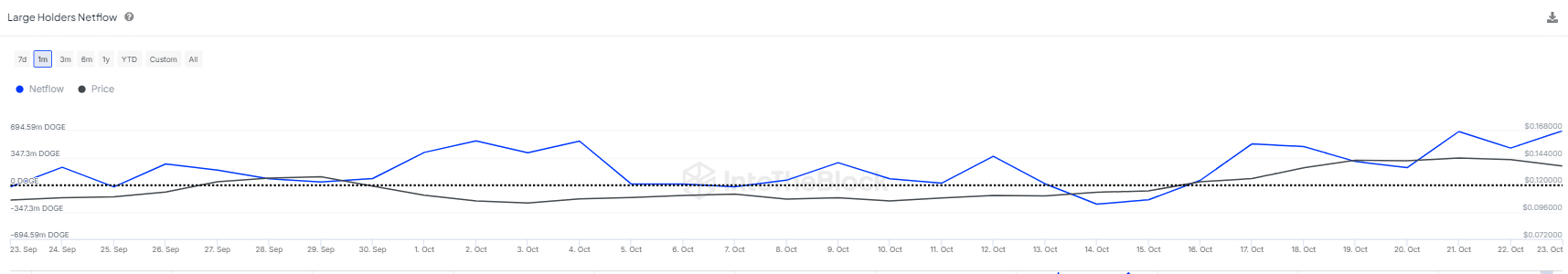

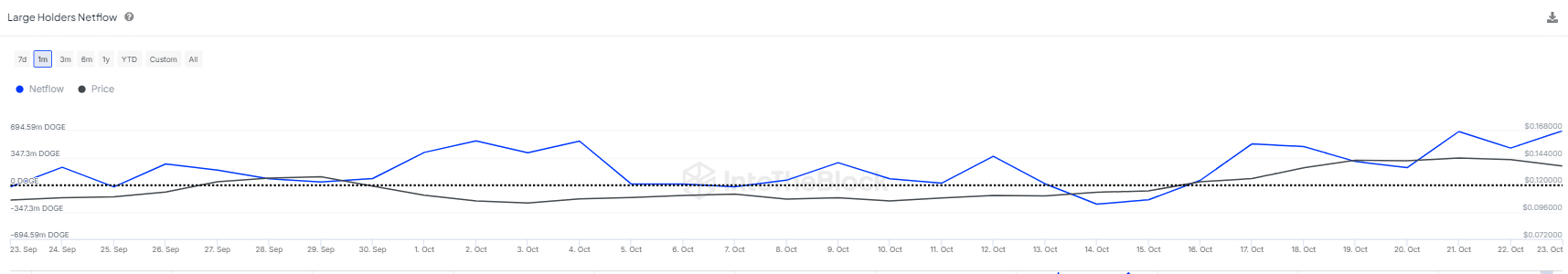

Source : IntoTheBlock

Since BTC’s earlier pullback from $69K, large holders have been withdrawing substantial amounts of Dogecoin from exchanges, with current withdrawals exceeding 500 million coins.

This indicates that both traders and investors are maintaining confidence in DOGE, anticipating it to soon hit $0.14 and potentially rally toward $0.20.

This optimism may also incentivize HODLers to stay invested, believing that the next market cycle could yield significantly higher returns. According to AMBCrypto, the current “dip” is likely a short-term resistance.

Realistic or not, here’s DOGE market cap in BTC’s terms

Once Bitcoin regains bullish momentum, DOGE could be on track to hit $0.20 by the end of Q4.

In the meantime, short-term gains remain possible as DOGE continues to dominate the top memecoin charts, making the current dip an opportune moment for investors to enter.