- Dogecoin has gained by 9% in 24 hours, outperforming all other top-ten largest cryptos by market cap.

- An approaching golden cross on the daily chart and rising open interest hint at more gains.

Dogecoin [DOGE] has outperformed all the top-ten largest cryptos by market capitalization in the last 24 hours after a 9% gain. DOGE traded at $0.169 at press time while trading volumes had increased by 38% per CoinMarketCap.

The recent rally brings Dogecoin’s 30-day gains to 51%, with the meme coin being among last month’s top performers.

However, Dogecoin’s uptrend has not been entirely smooth. After hitting a 6-month high of $0.174 on 29th October, DOGE later plunged by around 22% within five days before rebounding.

The drop appeared to be a bear trap as DOGE has swiftly reversed from this downtrend. Furthermore, technical indicators show that the uptrend is, once again, gaining momentum.

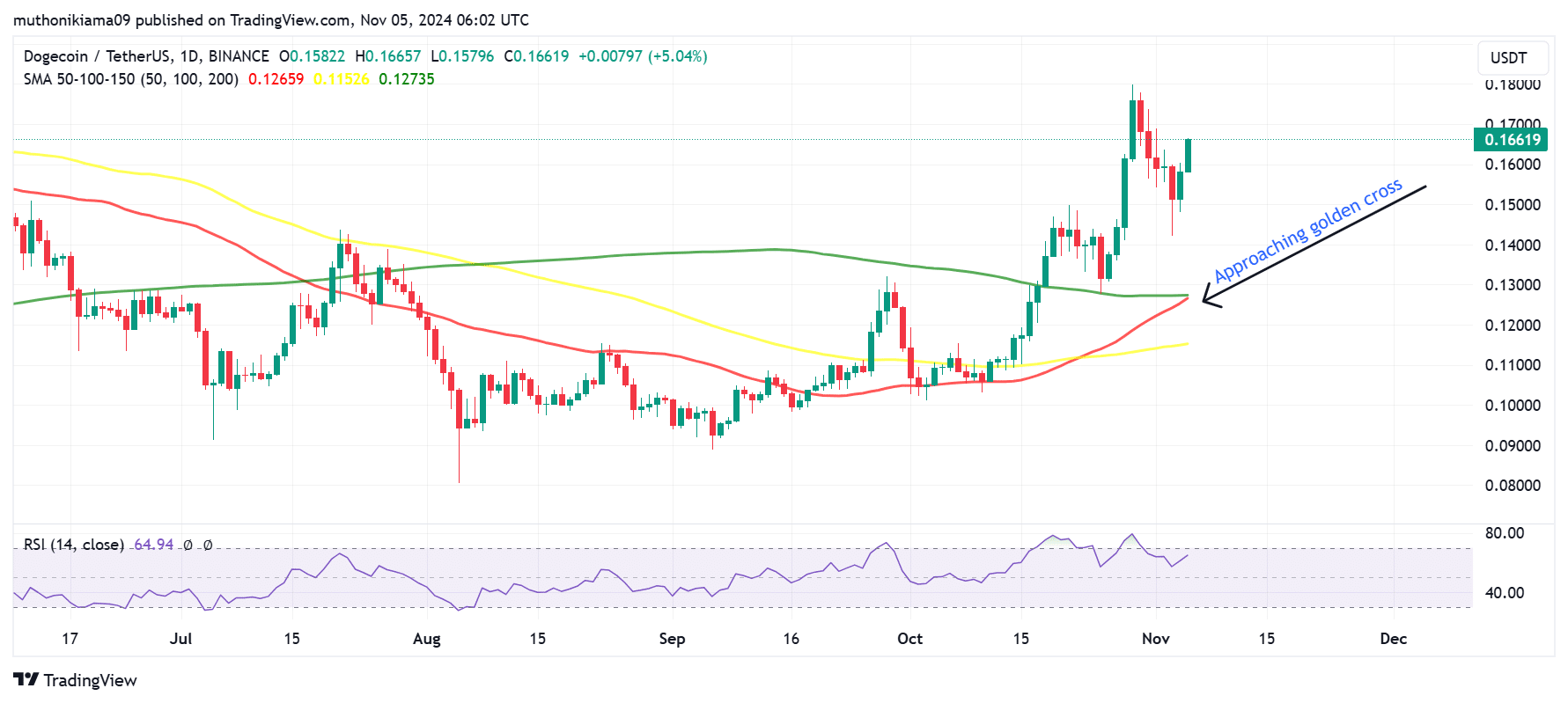

In fact, there is an approaching golden cross on the one-day chart. The 50-day Simple Moving Average is rising and converging with the 200-day SMA. If a crossover happens, it will indicate rising positive momentum and a sign that DOGE could rise further.

Source: Tradingview

The Relative Strength Index at 64 also shows that the bullish momentum is strengthening as buying pressure rises.

These bullish signs suggest that DOGE has shaken off the bear trap, with the recent uptrend being likely to continue.

Dogecoin long positions on the rise

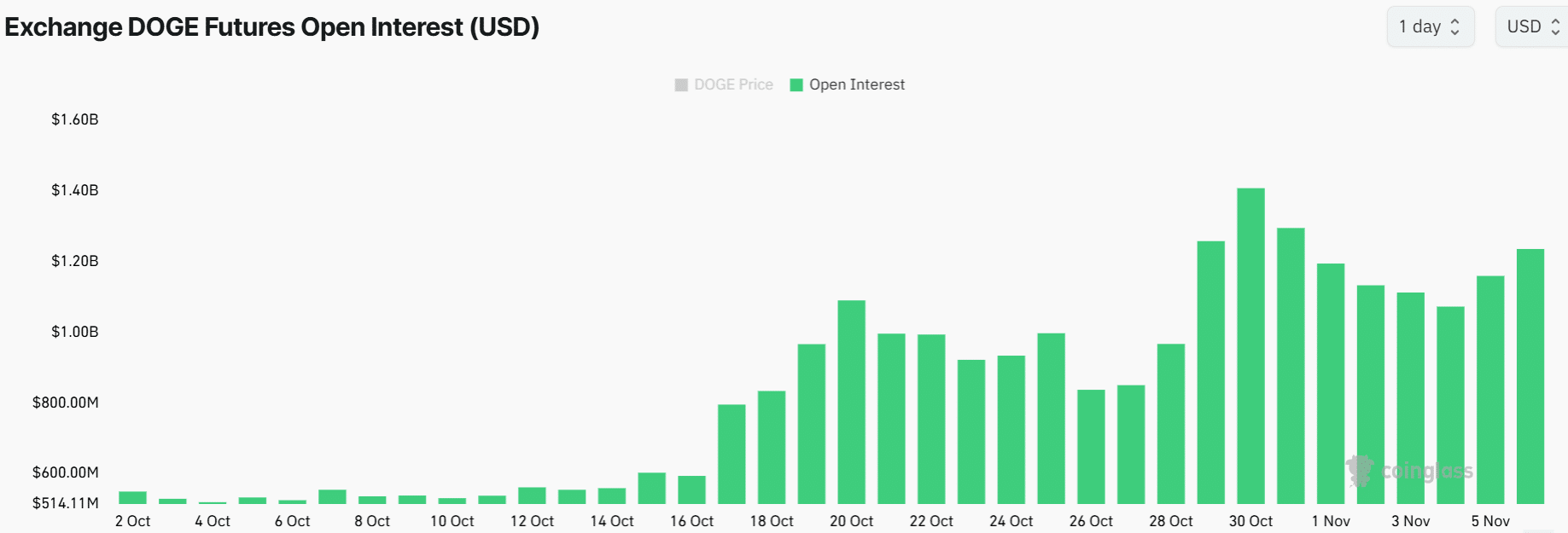

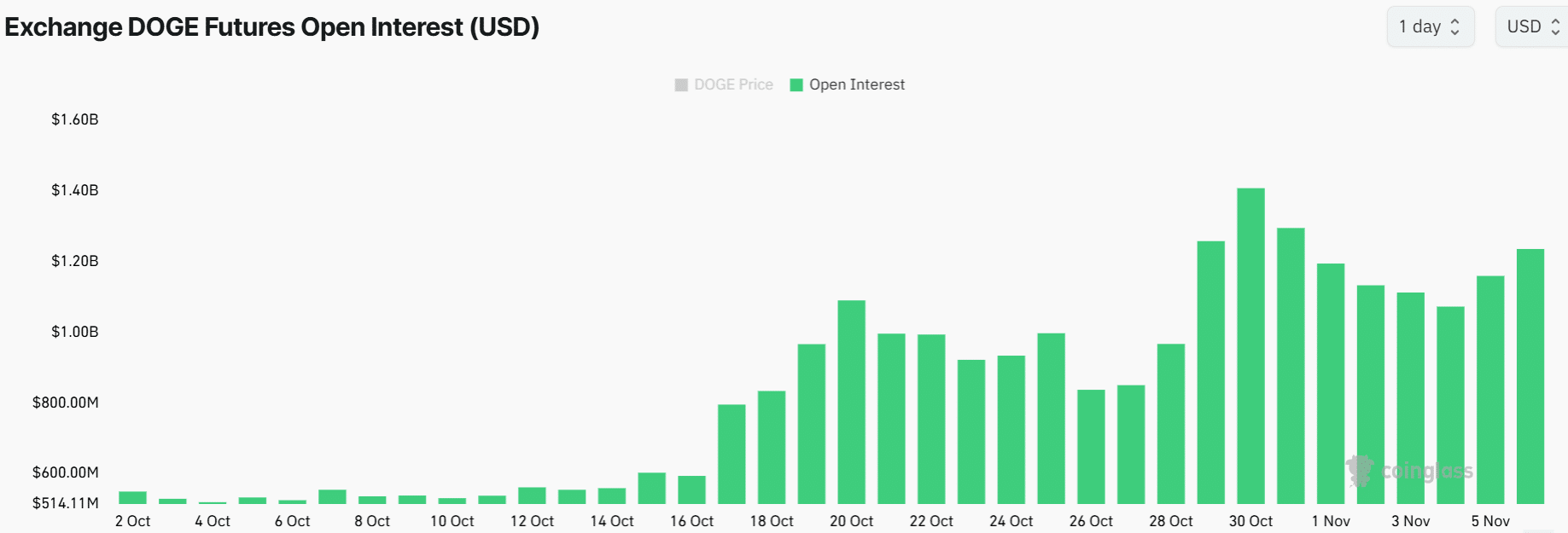

Dogecoin’s open interest is rising rapidly suggesting increased interest by derivative traders in the meme coin. At press time, OI had surged by 17% in 24 hours to $1.24 billion.

Source: Coinglass

This rising OI is due to a surge in long positions around Dogecoin. The long/short ratio has increased from 0.93 to 1.02 in the last 2 days showing that long traders are now more than short traders. On Binance, 62% of traders with open positions are going long on DOGE.

While a surge in open interest and the long/short ratio shows bullish sentiment, it could also result in volatile price movements.

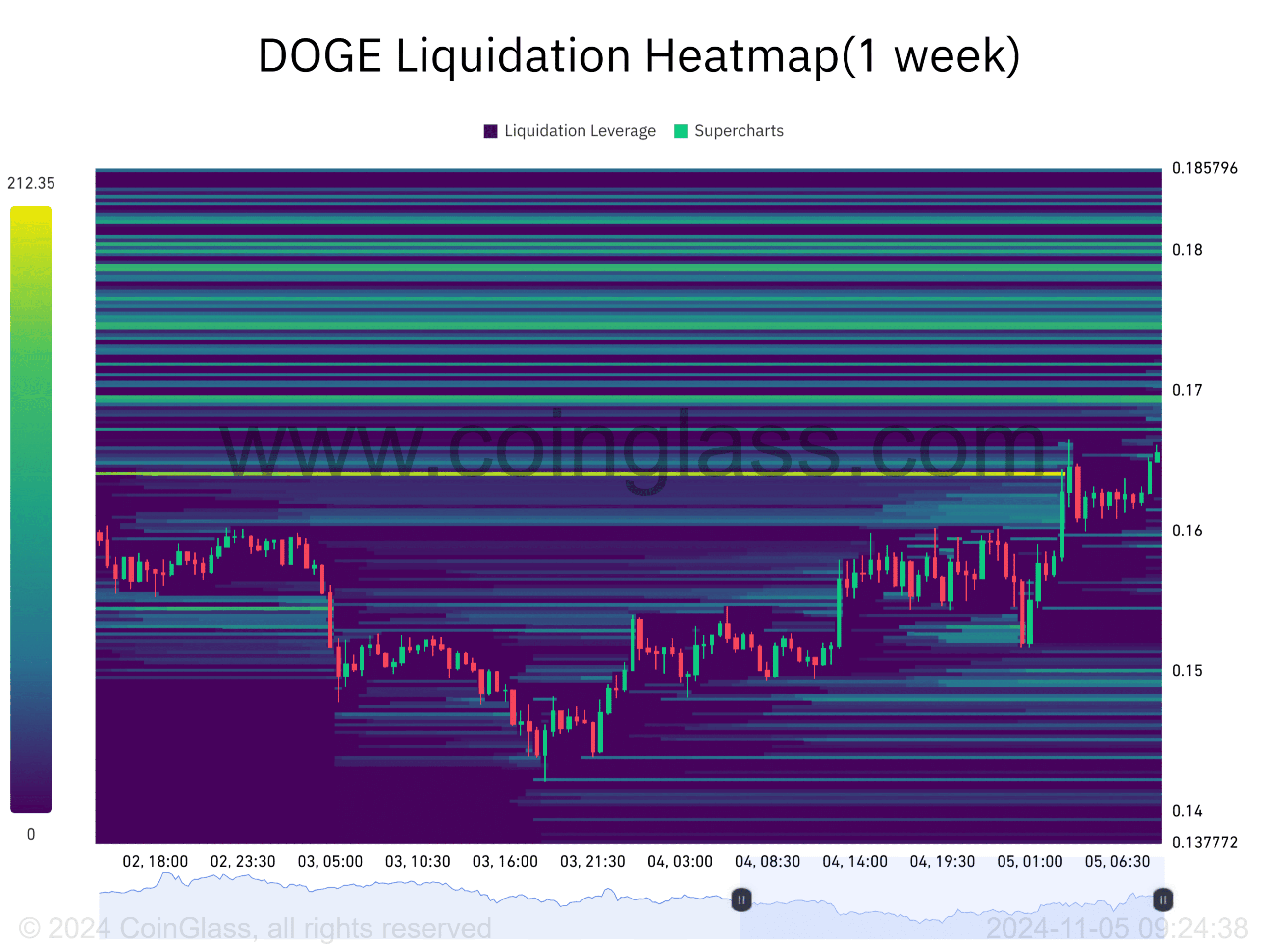

Dogecoin’s liquidation heatmap shows…

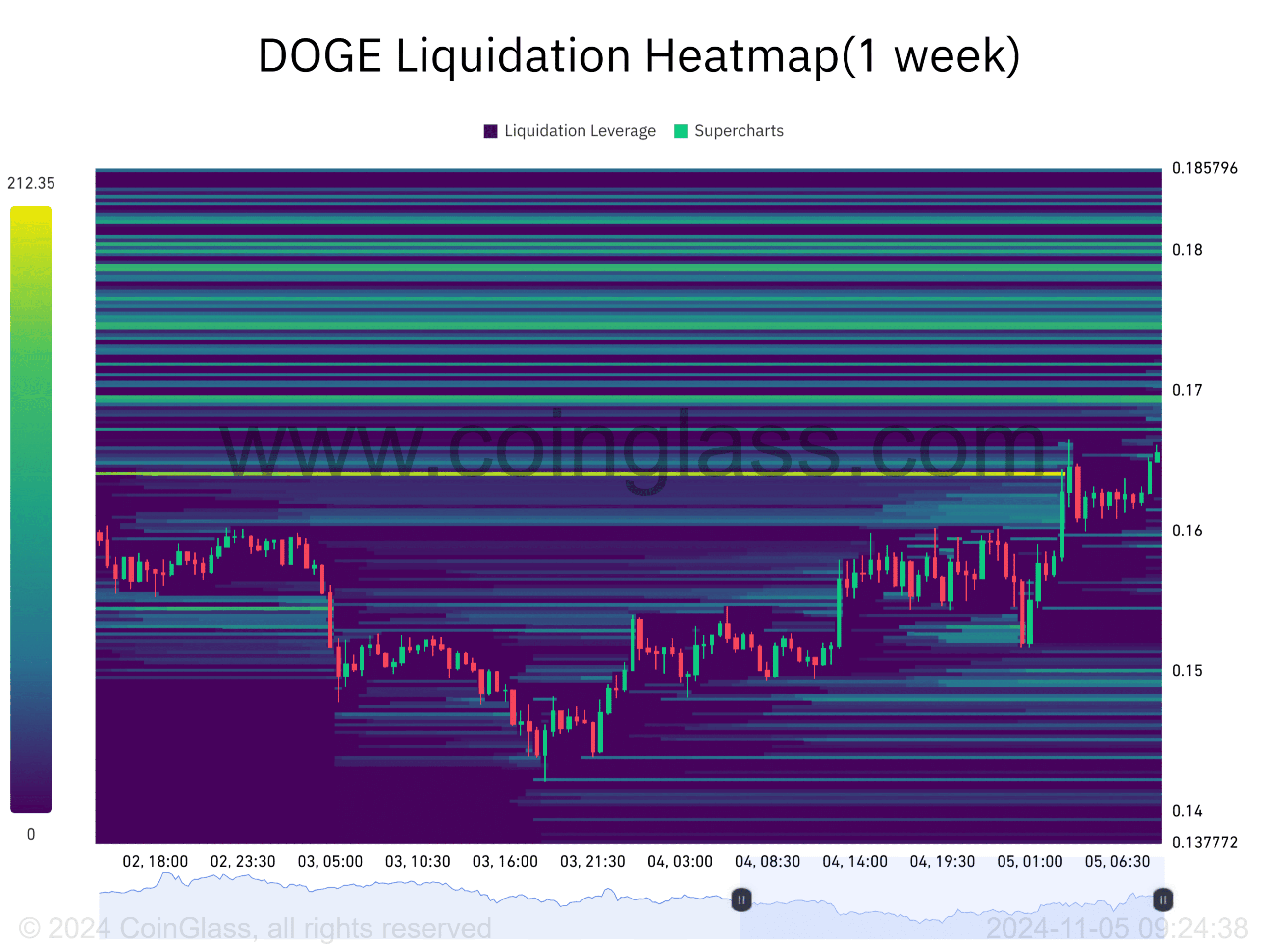

A look at the Dogecoin liquidation heatmap with a one-week lookback period shows that most of the open positions, which were primarily shorts, were liquidated following the meme coin’s uptrend.

There are also significantly fewer liquidations below price. However, there is a liquidation pool at $0.169 suggesting that this price might act as a magnet that could pull prices higher.

Source: Coinglass

This heatmap also shows that there is an influx of liquidity around DOGE, correlating with rising trading volumes as more traders become more interested in the token.

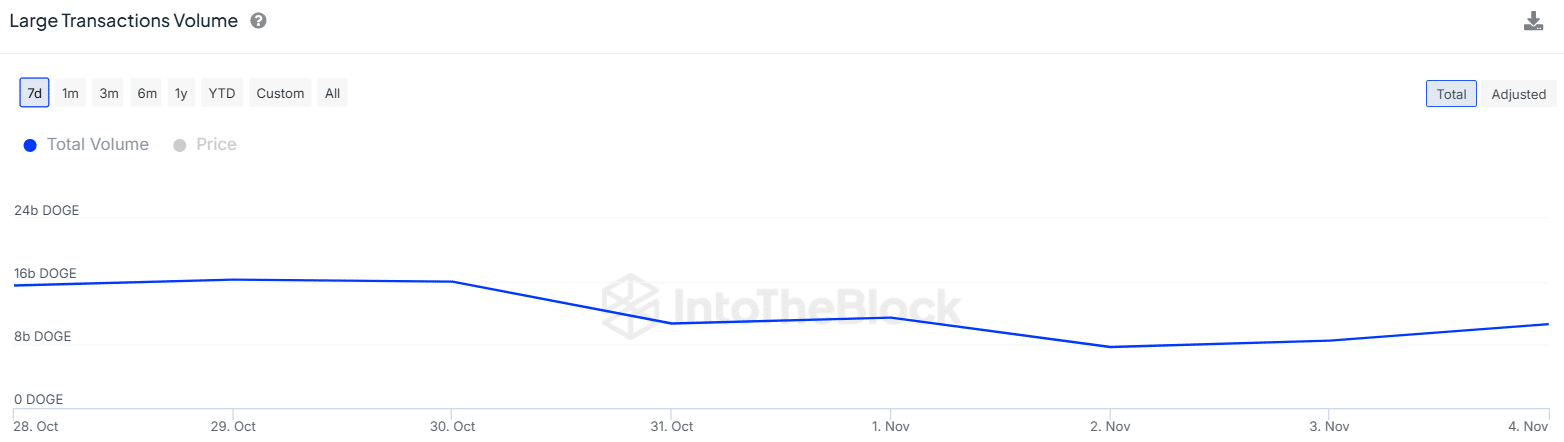

Are whales betting on Dogecoin?

Data from IntoTheBlock shows that whale activity around Dogecoin is on the rise again. In the last two days, large DOGE transactions exceeding $100,000 have increased by 37% from 7.72 billion to 10.62 billion.

Source: IntoTheBlock

Is your portfolio green? Check out the Dogecoin Profit Calculator

When whale activity is rising, it could bode well for the meme coin if these large traders are buying.

Nevertheless, whales and retail traders have nearly equal control over Dogecoin’s supply. As such, activity from the two cohorts is needed to drive prices higher.