- Is Dogecoin on the cusp of a bearish retracement after its latest rally?

- On-chain data showed sustained demand, although there are signs of a potential profit-taking build-up.

Dogecoin [DOGE] went through the most bullish two weeks that have been observed in months.

However, its impressive performance has pushed deep into overbought territory, raising questions. Should traders take short-term profits or wait for more potential upside?

Dogecoin was trading at $0.145, at press time, after gaining 41.95% from its lowest price point in October so far.

In other words, Dogecoin bulls have been quite busy putting up a firm assault against the bears.

But, are Dogecoin bulls about to go for recess? The king of the memecoin was expected to face resistance above the $0.141 price range based on historic performance.

The bulls pushed above that price point but have notably been facing more difficulty maintaining their momentum above it in the last three days.

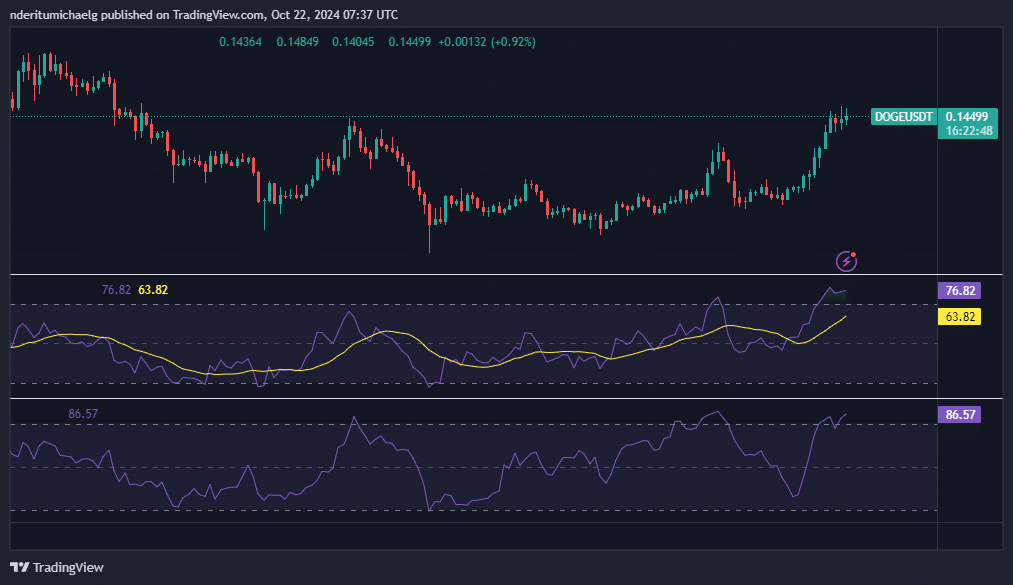

Source: TradingView

DOGE’s RSI was already in overbought territory and also indicated a cooling down of the bullish momentum.

Similarly, the MFI’s slight dip after being overbought suggests that some traders are starting to take profits.

Despite the growing resistance, the bulls continued to show resilience, judging by the lack of a rush to take profits.

This suggested that most Dogecoin holders were expecting prices to continue on a bullish trajectory. DOGE’s price action at press time was significantly lower than its YTD high.

Will Dogecoin induce profit-taking?

IntoTheBlock data pointed out that 80% of Dogecoin holders were in the money at current price levels.

Only 16% were out of money, which meant there was a lot of demand near the bottom range.

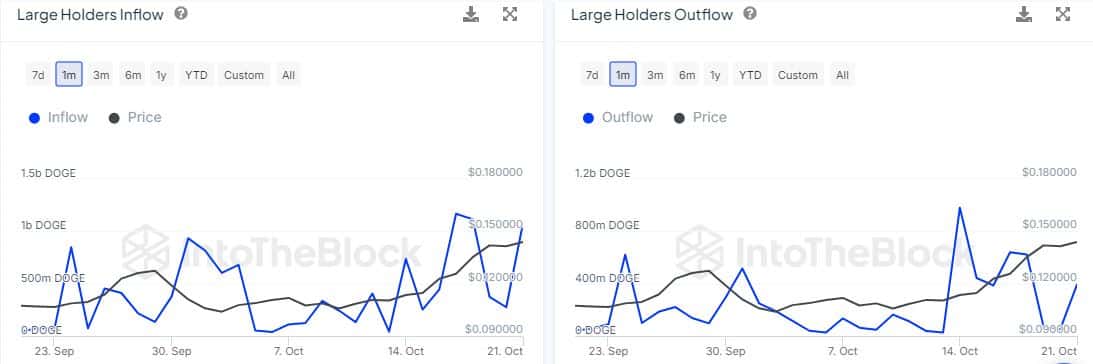

Large holder in-flows bounced from 274.5 million DOGE, on the 20th of October, to 1.08 billion DOGE on the 21st of October. This indicates there was strong bullish momentum.

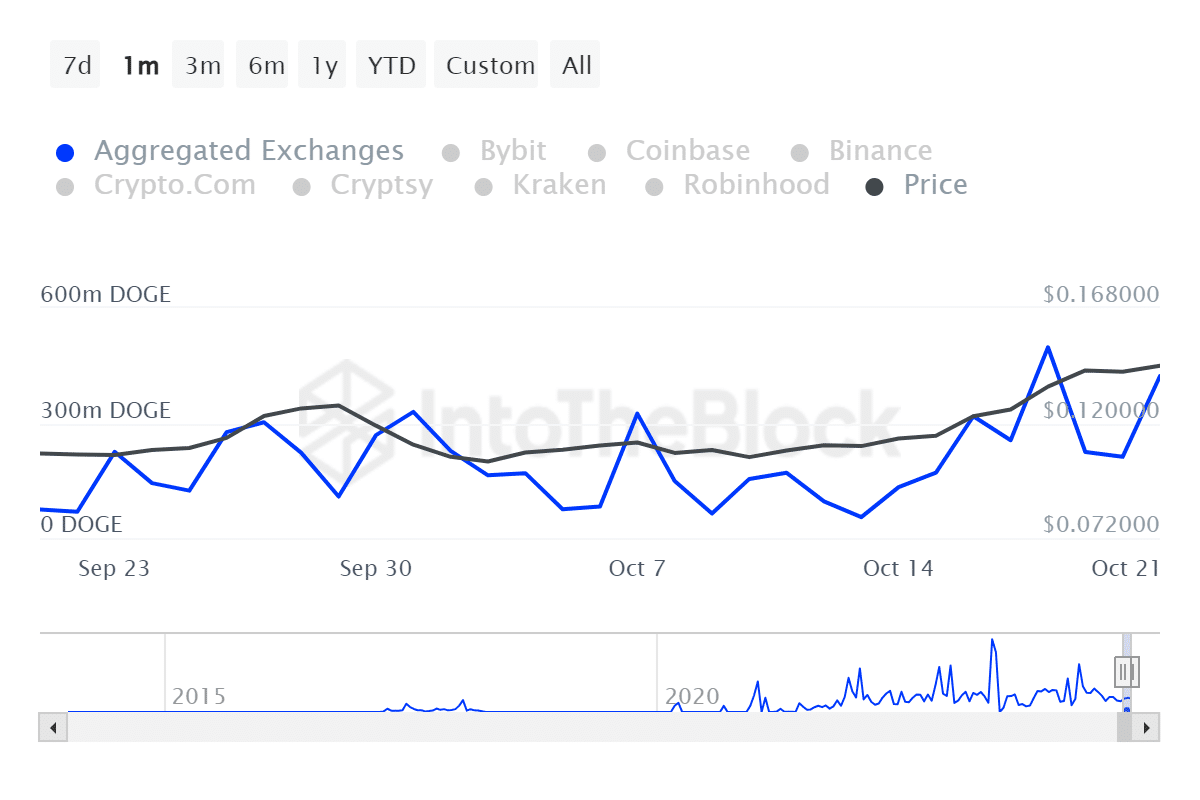

Source: IntoTheBlock

On the other hand, large holder outflows bounced from 52.23 million to 392.2 million, in the same period. This confirms a substantial surge in sell pressure from the whale category.

However, inflows into large holder accounts were notably higher, which explains why the price is still holding on to recent gains.

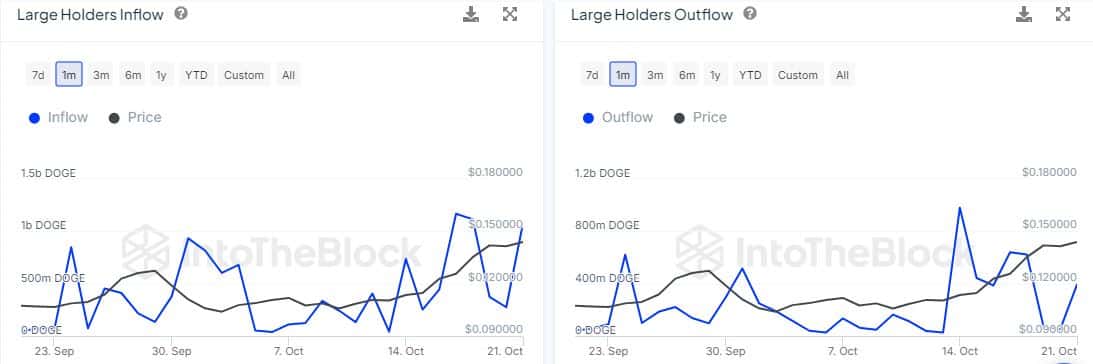

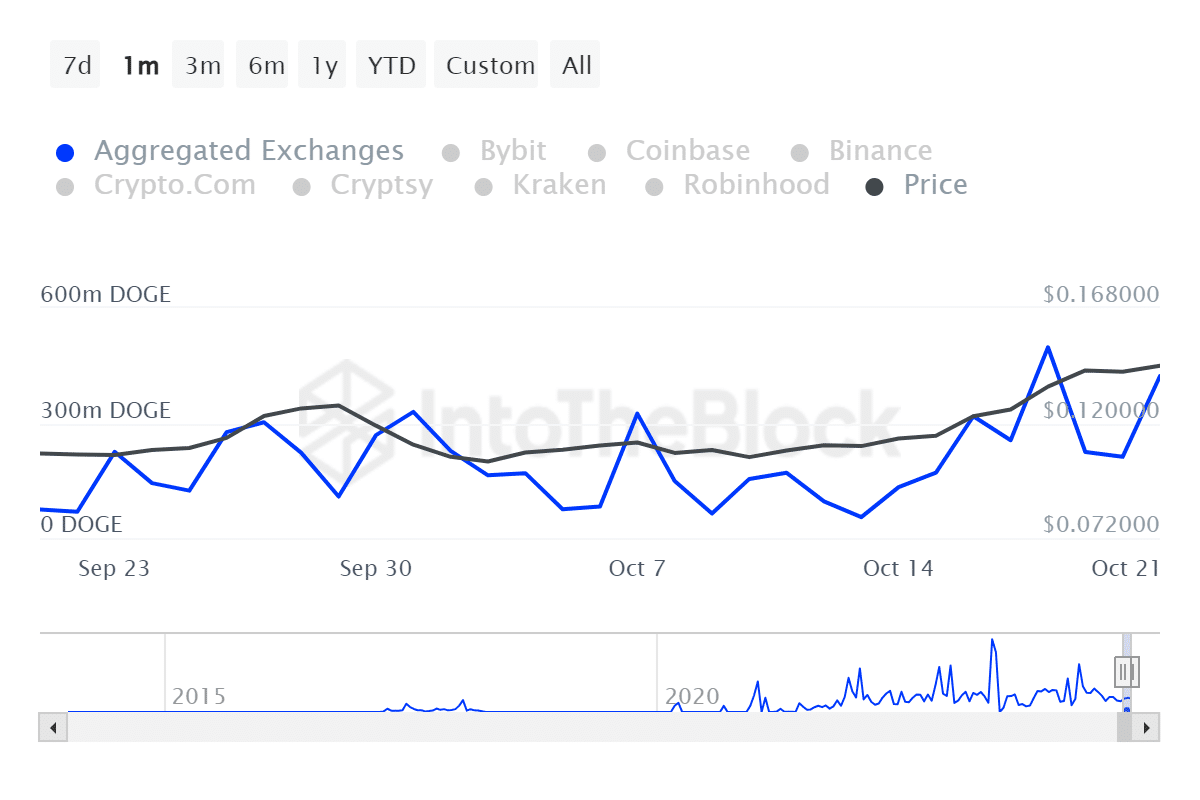

An assessment of Dogecoin exchange flows also revealed that exchange outflow volume peaked at 422.56 million DOGE on the 21st of October. Exchange inflow volumes were slightly lower, at $371.71 million DOGE.

Source: IntoTheBlock

Realistic or not, here’s DOGE market cap in BTC’s terms

However, AMBCrypto noted that there was a spike in exchange inflows on the 18th of October, which was notably higher than outflows during the same session.

This was the first instance that may have indicated a surge in selling pressure. However, exchange outflows have since regained dominance over inflows.