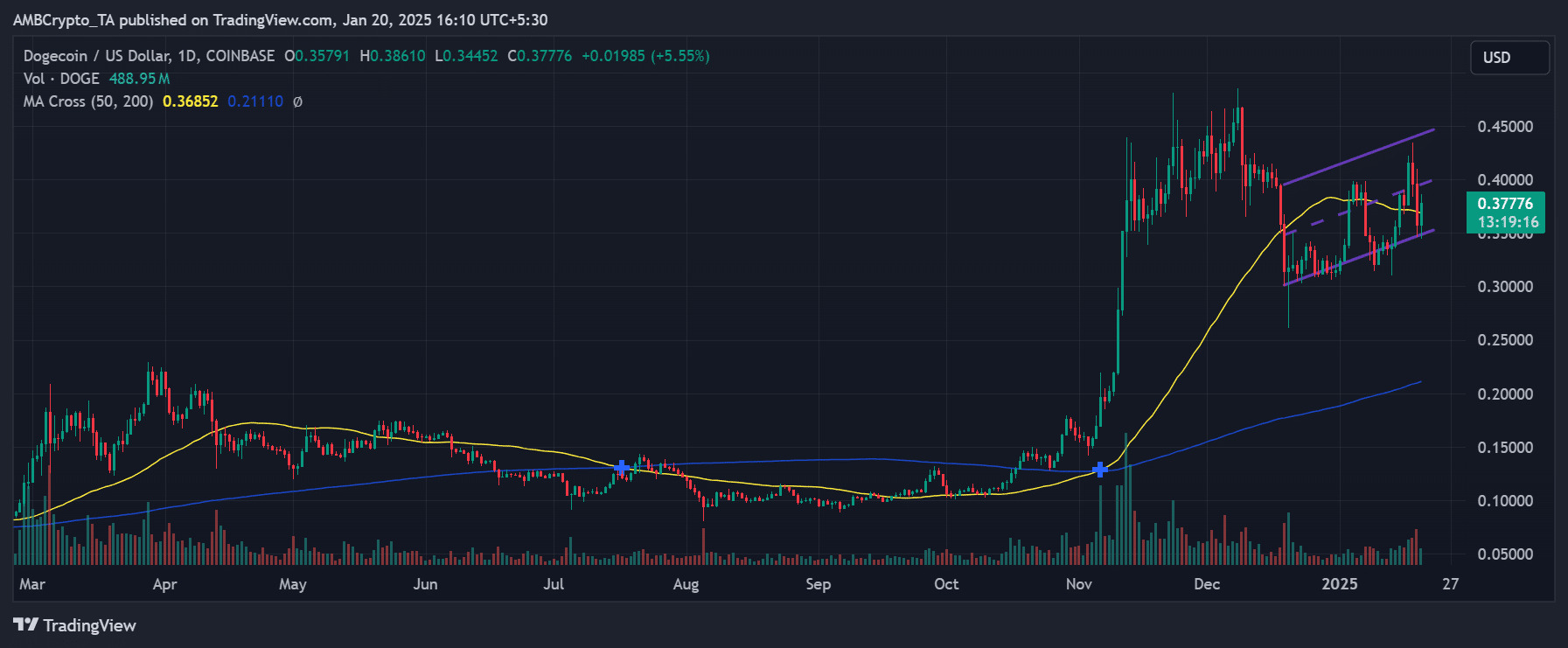

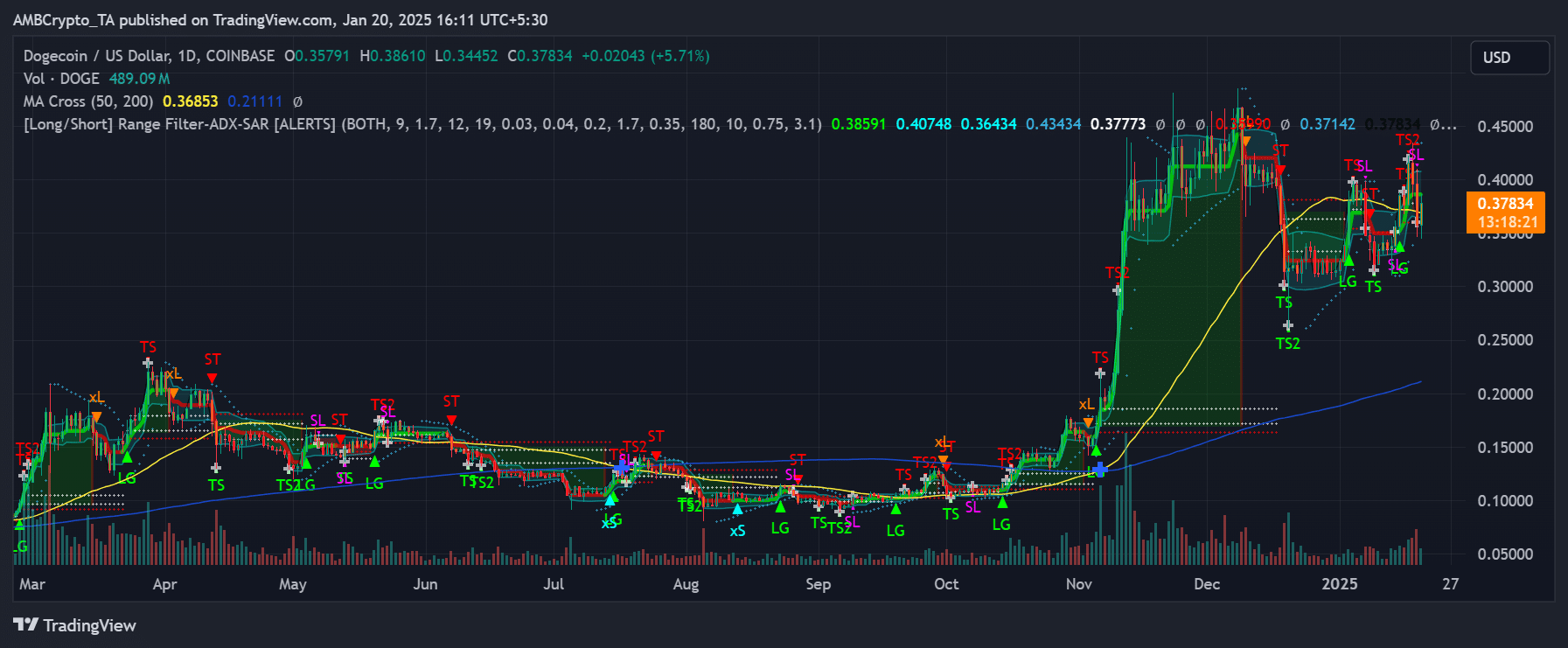

- Dogecoin’s 50-day MA (at $0.36853) maintained a healthy gap above 200-day MA (at $0.21111) amid rising volume.

- DOGE remained dominant, with over $55 billion in market capitalization.

Dogecoin [DOGE] remains dominant, despite recent competition from the launch of TRUMP and MELANIA memecoins.

While these new entrants have sparked speculation and activity, DOGE has demonstrated resilience, with its price maintaining an upward trajectory.

But can DOGE sustain its relevance in an evolving memecoin market?

Dogecoin’s technical structure signals power move

Dogecoin was trading at $0.37834 at press time, reflecting a 5.55% increase in the last session.

The attached charts showed a clear ascending channel pattern, with the price consistently bouncing between the support and resistance levels.

This formation suggests that DOGE could be gearing up for further gains if it maintains its position within the channel.

Source: TradingView

The 50-day moving average of $0.36853 has acted as solid support, and the price remains comfortably above the 200-day moving average of $0.21111, signaling bullish momentum.

Furthermore, the Relative Strength Index (RSI) hovered around the neutral zone, indicating that DOGE was not yet overbought and had room for additional upside.

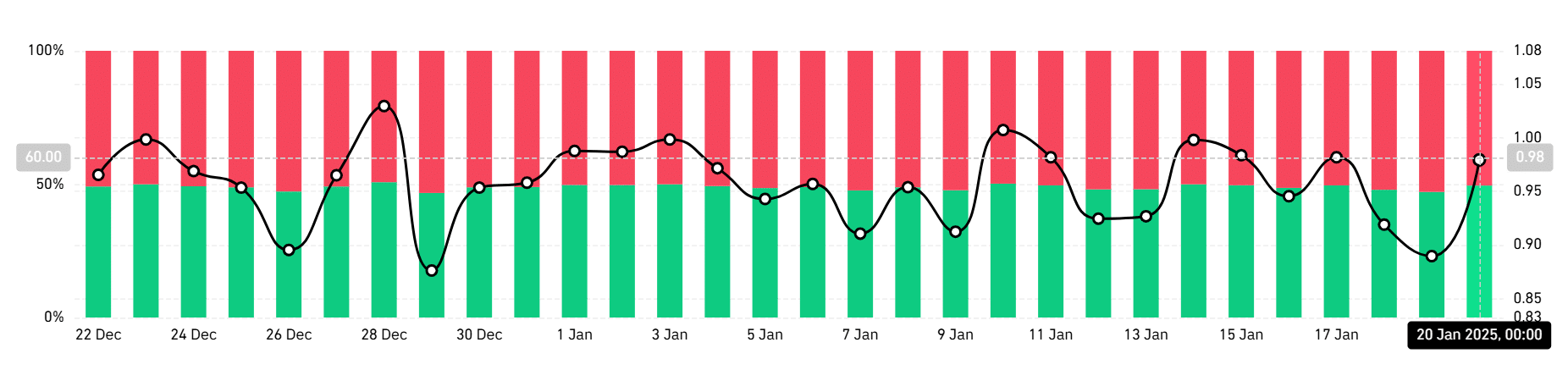

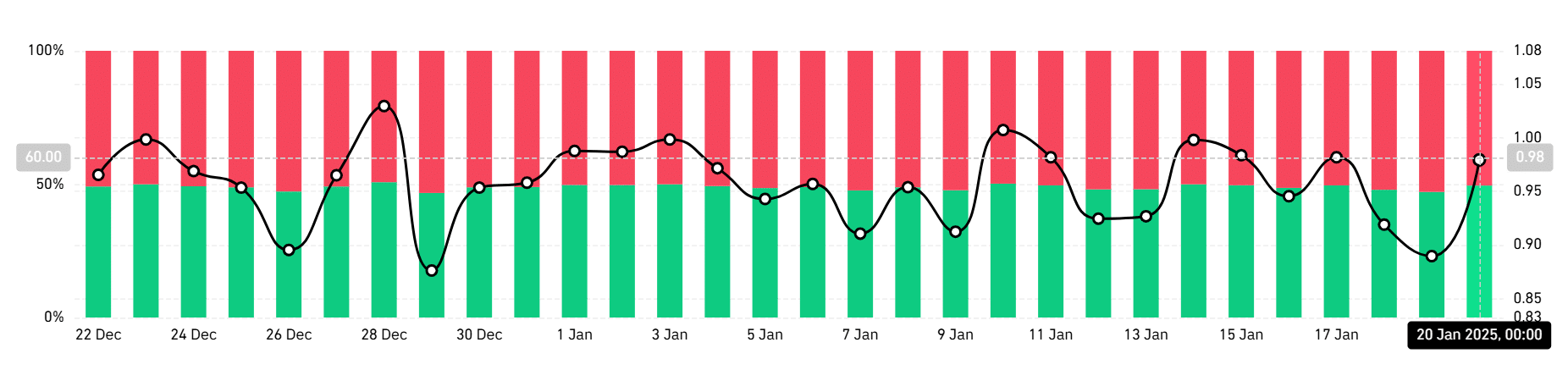

Market sentiment shows sustained accumulation

On-chain metrics painted an increasingly bullish picture for Dogecoin.

The long-versus-short ratio demonstrated clear buyer dominance, with green candles consistently outpacing red across multiple timeframes.

This pattern suggested strategic accumulation rather than speculative trading, which is particularly significant given the current memecoin market dynamics.

Source: Coinglass

According to data, its market capitalization was over $55 billion at press time, with OFFICIAL TRUMP at over $11 billion.

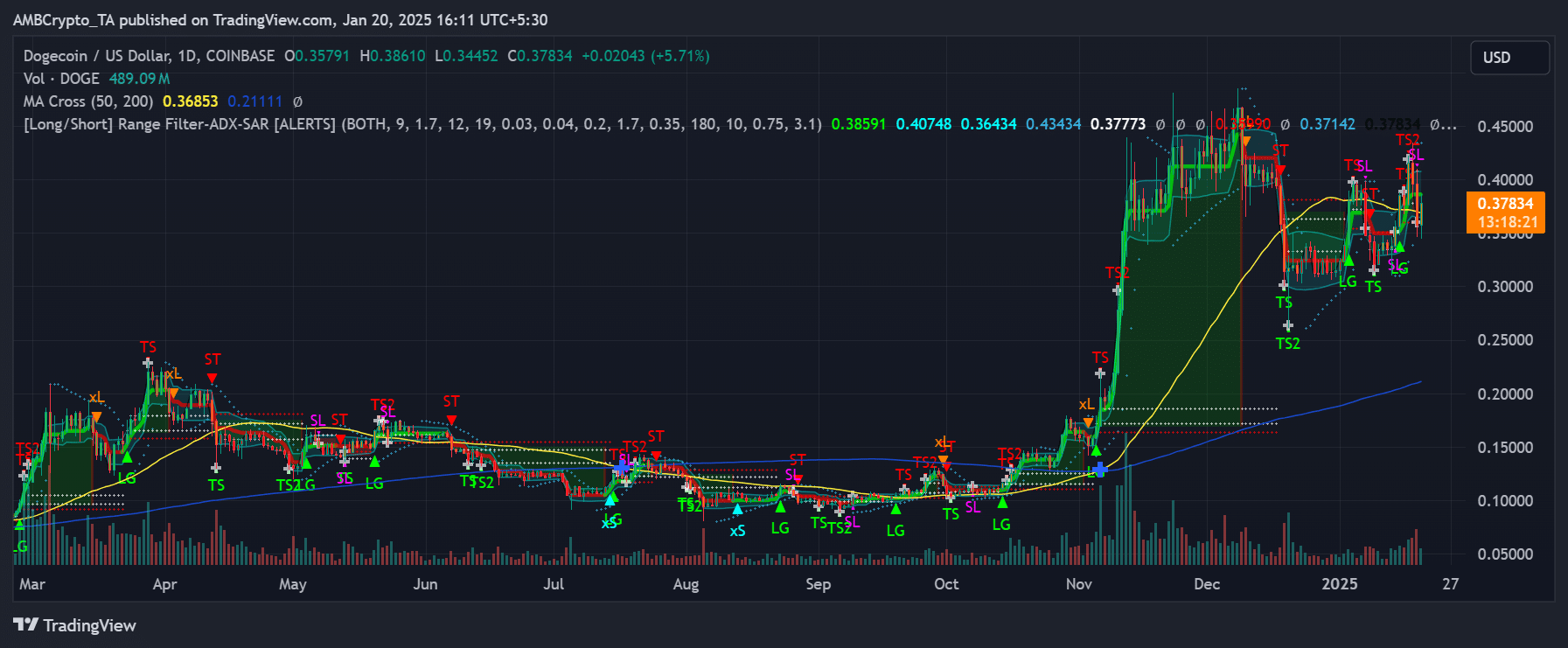

Technical patterns reveal hidden strength

The ADX-SAR system has triggered multiple bullish signals since November, with each signal preceding significant price movements.

The current technical setup showed the formation of a strong support base around $0.36, reinforced by the 50-day MA.

This structure, combined with decreasing selling pressure evident in recent volume patterns, suggests accumulation at higher levels.

Source: TradingView

Furthermore, Dogecoin’s RSI maintains a healthy range between 40-60, avoiding overbought conditions despite price appreciation.

This technical equilibrium typically precedes sustained upward movements, particularly when accompanied by the current volume profile.

The Long/Short ADX-SAR chart indicates a mix of buying and selling pressure, with recent green candles suggesting accumulation at lower levels.

This could indicate institutional or whale interest, further supporting DOGE’s price stability.

Can Dogecoin hold its ground?

While the emergence of TRUMP and MELANIA memecoins has added excitement to the space, DOGE’s consistent performance and established presence provide a level of stability that newer entrants lack, at least for now.

Realistic or not, here’s DOGE market cap in BTC’s terms

For now, Dogecoin’s upward trajectory and on-chain activity suggest that it is well-positioned to navigate the challenges of an increasingly crowded market.

Whether DOGE can maintain its dominance or yield to new competitors remains to be seen.