- DEXE price movement indicates strong investor sentiment despite weeks of decline.

- More than 67% of investors are still in profit, and most of them are long-term investors.

DeXe [DEXE] has been strained in recent weeks.

The altcoin price has continuously declined, erasing some of its earlier gains. But stepping back to the weekly time frame offers a more optimistic outlook.

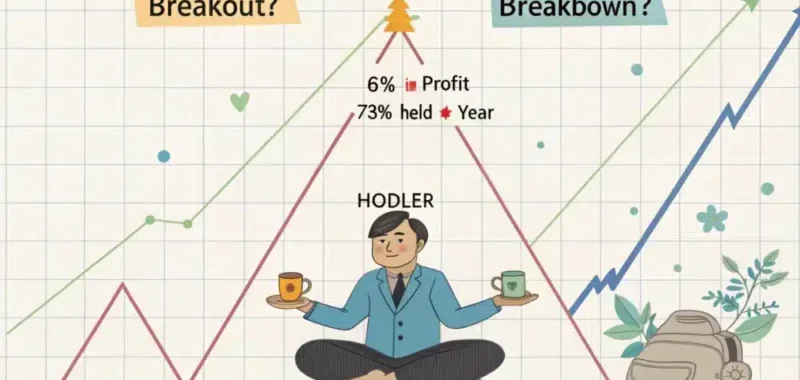

Price action is now ranging in a symmetrical triangle — a setup frequently observed prior to large breakouts. This setup usually reflects a tug-of-war between bulls and bears.

But the major question is: will bulls give way, or will bears hold up the support of the triangle and compel a reversal?

Consolidation can mean reversal

Historically, symmetrical triangles usually signal a pull-and-push between buyers and sellers. For DEXE, the narrowing price range shows gathering momentum.

A strong breakout outside the triangle could establish its direction for its next move. If triangle support holds its muscles, DEXE may turn around, especially if market sentiment is still intact.

Source: TradingView

However, a breakdown below the support will expose DEXE to further downside pressure. Even so, on-chain data adds a hopeful twist.

HODLer sentiment still optimistic

Even though the pullback painted an overly bearing picture, HODLer sentiment remained intact.

Based on on-chain data from IntoTheBlock, 67% of DEXE holders were in profit at press time. This indicated that most investors bought at lower price points and believed in the long-term value of the project.

To add some icing to the cake, the majority of these profitable addresses were not even short-term traders. In fact, 73% of them have held onto their tokens for over a year.

This kind of level of long-term holding is evidence of the tremendous degree of confidence in DEXE’s fundamentals and future price appreciation.

Source: IntoTheBlock

Long holding behavior implies long-term conviction

These kinds of holding patterns typically mean experienced players in the market who are not worried about the short-term moves.

Long-term holders purchase on dips in the market and accumulate when there is uncertainty around it — just the kind of scenario DEXE finds itself in today. These figures give strength to the bullish case.

This long-hold behavior can restrict panic selling and cushion the downside. In fact, it may even support a rebound once the broader market stabilizes.

What’s coming next for DEXE?

All signs now converge on the triangle.

Rebound from the support can spur a short-term rally, or a drop below can postpone recovery. Either way, the existence of strong hands in place counters any bearish impact.

With DEXE stuck at decisive support, the next few days will determine what its next significant move is.