- SPX6900, Fartcoin, and Ethena were the biggest winners in the past week.

- Bitget Token, Hyperliquid, and OKB were the biggest winners on the other end of the table.

The cryptocurrency market continues to display its trademark volatility, bringing a mix of exceptional gains and significant losses this week.

From SPX6900’s [SPX] explosive rally to Bitget Token’s [BGB] bearish slump, market participants witnessed dramatic shifts in sentiment and price movements.

This article provides a comprehensive breakdown of the top gainers and losers, analyzing the factors behind these trends and what they may mean for the week ahead.

Biggest winners

SPX6900 [SPX]

SPX6900 emerged as the star of the week, delivering a remarkable 45% surge. It started the week trading at $0.9157, logging a modest 3% uptick before volatility struck, causing a 6% dip.

This initial pullback may have shaken off weaker hands, but it set the stage for an extraordinary rally. On the 2nd of January, SPX gained nearly 26% in a single session, driven by bullish sentiment and robust market momentum.

The rally pushed SPX past key psychological resistance levels, demonstrating strong investor interest. By the end of the week, it closed at $1.3240, cementing its position as the top performer among cryptocurrencies.

From a technical perspective, SPX’s ability to post higher highs consistently indicates bullish strength.

While such explosive growth often invites profit-taking, the sustained interest suggests the potential for further gains in the near term, particularly if broader market conditions remain supportive.

Fartcoin [FARTCOIN]

Fartcoin [FARTCOIN] secured the second spot among the week’s top gainers with a 35% increase despite a turbulent start. The week began with a 12% dip to $0.8655, reflecting bearish sentiment.

However, the token rebounded strongly, fueled by speculative buying and renewed market confidence.

The most notable rally occurred on the 2nd of January, when FARTCOIN peaked at $1.5230, riding on strong buying pressure. This surge underscored the power of market sentiment in driving price action.

By the week’s end, profit-taking led to a 6% pullback, closing at $1.4261.

From a technical standpoint, FARTCOIN’s resilience in recovering from sharp dips and sustaining its gains highlights strong investor interest, though short-term corrections remain possible.

Ethena [ENA]

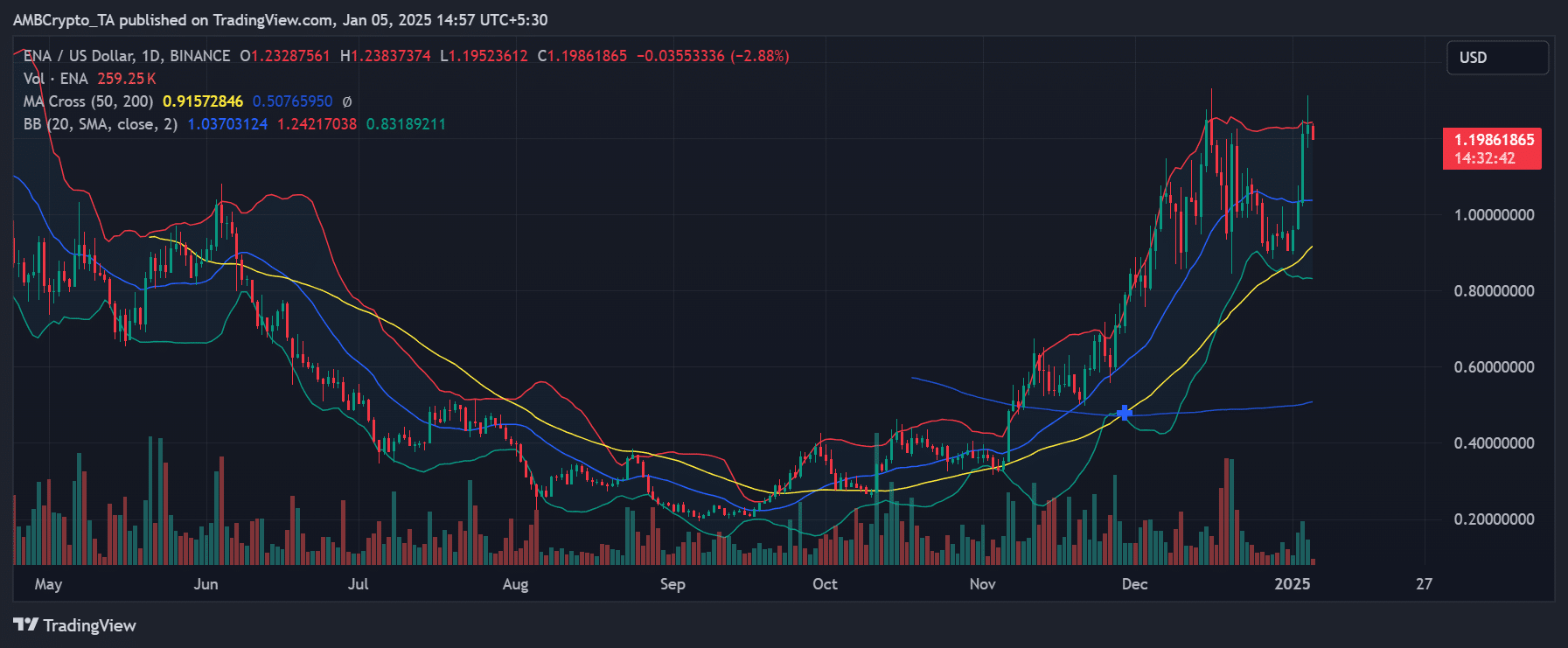

Ethena [ENA] delivered a solid performance, closing the week with a 26% gain. Starting at $0.94, the token initially showed slight bearishness, but quickly rebounded.

The pivotal moment came on the 3rd of January, when ENA surged by over 17%, reaching $1.21. This sharp rise was driven by heightened buying pressure as investors grew more optimistic.

Source: TradingView

By week’s end, ENA stabilized at $1.23, showcasing its strength amid market volatility.

Technical indicators like Bollinger Bands suggest increased price volatility, with ENA frequently testing its upper band—a hallmark of bullish momentum.

Additionally, the MACD remained in positive territory, further confirming upward pressure. However, traders should remain cautious, as rapid gains may trigger profit-taking.

Top 1,000 gainers

Beyond the top 100, smaller-cap tokens delivered extraordinary returns.

Black Agnus [FTW] led the charge with a staggering 3,900% increase, followed by CatX [CATX] and MOG PEPE [PEPE], which posted gains of 3,480% and 2,826%, respectively.

Biggest losers

Bitget Token [BGB]

Bitget Token experienced the steepest decline among major tokens, falling 22% this week. It began trading at $6.3 but faced immediate bearish momentum, leading to a sharp 16% dip.

Despite brief midweek recovery attempts, BGB ended the week at $6, firmly in a downtrend.

Technical analysis reveals that BGB was approaching its 50-day moving average, which could act as a support level. However, the lack of strong buying interest raises questions about its ability to rebound.

This sharp decline may be part of a broader market correction, with traders likely awaiting clearer signs of recovery before committing.

Hyperliquid [HYPE]

Hyperliquid [HYPE] posted a 12% weekly decline, ranking as the second-highest loser. Starting at $27.5, the token faced consistent selling pressure, driving it down to $25 by the week’s end.

Despite minor recovery attempts, HYPE’s trajectory remained bearish, reflecting broader market uncertainty.

From a technical standpoint, HYPE was testing critical support levels, with its current volatility indicating investor apprehension.

While its fundamentals remain strong, the market’s indecisiveness suggested that traders may be cautious until more favorable conditions emerge.

OKB [OKB]

OKB [OKB] experienced a rollercoaster week, ending as the third-highest loser with a 3% decline. OKB ended the week as the third-highest loser, recording a 3% decline.

The token started at $50, dipping early in the week due to bearish sentiment. Midweek, it attempted a recovery, testing the $51 resistance level, but the lack of sustained momentum limited its upward potential.

OKB closed at $50.5 by the week’s end, offering some stability but leaving traders uncertain about its next move.

Source: TradingView

The RSI for OKB hovers near neutral, reflecting balanced buying and selling pressures.

While the token remained above its 50-day moving average, cautious trading volumes suggested that market participants should await stronger signals before re-entering.

Top 1,000 losers

Outside the top 100, the most significant losses were observed in speculative tokens.

Hot Doge [HOTDOGE] saw a dramatic 99% decline, followed by TRUMP DOGS [DOGS] and TRUMP MEME [MEME], which fell by 98% and 97%, respectively.

Conclusion

SPX6900, FARTCOIN, and ENA demonstrated the market’s potential for explosive growth, while BGB, HYPE, and OKB reminded traders of the challenges posed by bearish momentum.

Here’s the weekly recap of the biggest gainers and losers. It’s crucial to bear in mind the volatile nature of the market, where prices can shift rapidly.

Thus, doing your own research (DYOR) before making investment decisions is best.