- Mark Yusko predicted a likely bear phase in mid-2025 after BTC taps $150K.

- On-chain metrics showed extra room for growth for BTC.

According to Mark Yusko, CEO and founder of investment advisory firm Morgan Creek Capital, crypto could enter a bear market phase by mid-2025.

In a recent interview with Cointelegraph, Yusko stated,

“We have another bear market starting mid-2025, and we enter crypto winter again”

Yusko expected the market to top when Bitcoin [BTC] hits $150K and then plunge, citing historical trends associated with parabolic rallies. He added,

‘The $150K range is certainly possible. It’s a 50% premium above fair value. We’ll likely get there and, unfortunately, enter a bear market.”

Yusko believed a US BTC national reserve could accelerate the $150K target. Interestingly, other analysts predicted a $1M per BTC if the US BTC reserve goes through. But Yusko was skeptical about the high price target.

BTC cycle status

Market top calls have increased since BTC cleared the $100K milestone. Some projected March 2025, while others eyed Q3-Q4 2025 as a likely tipping point for BTC.

Yusko’s mid-2025 target is the latest bear call timeline. But do on-chain metrics paint the same picture?

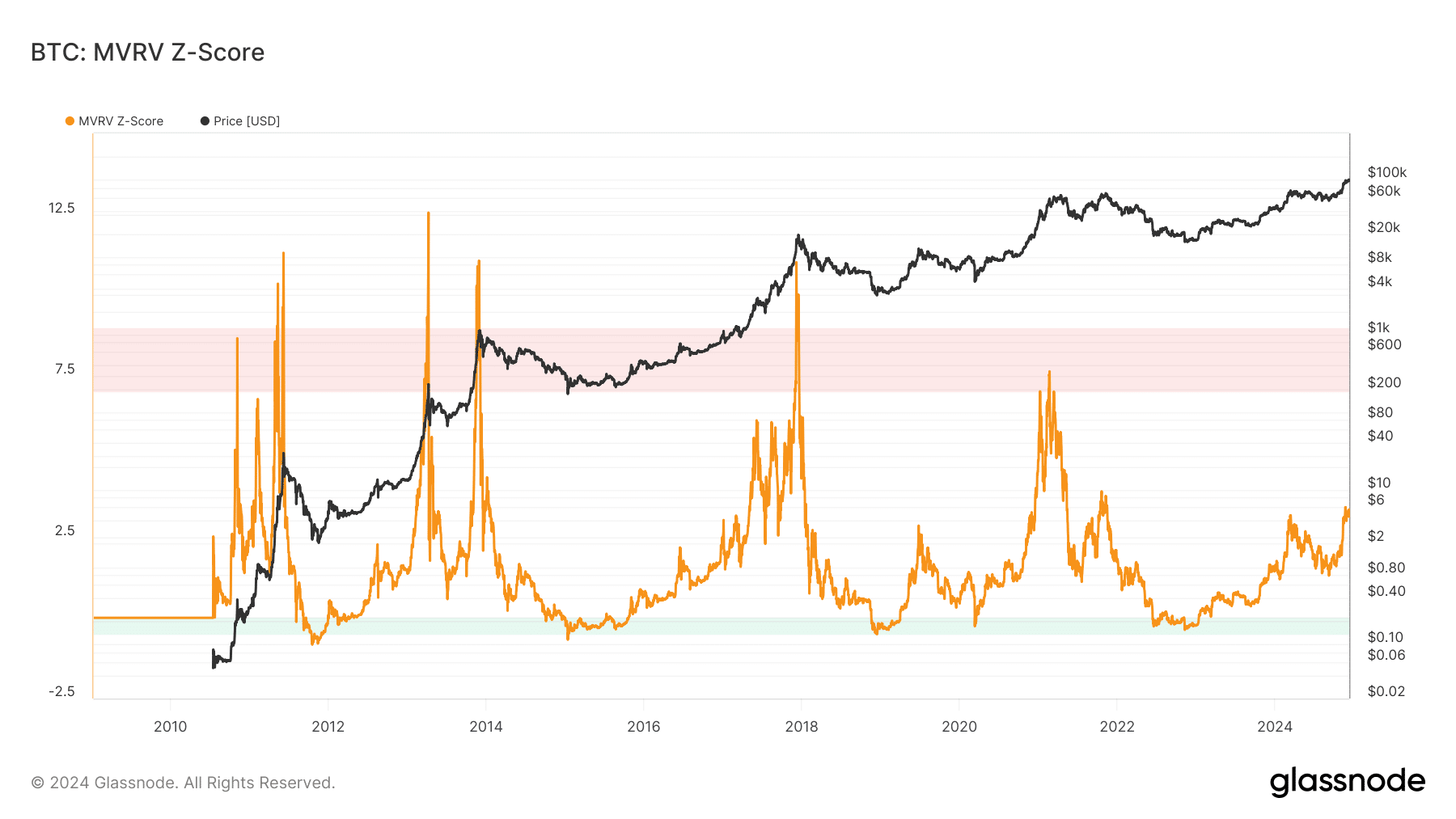

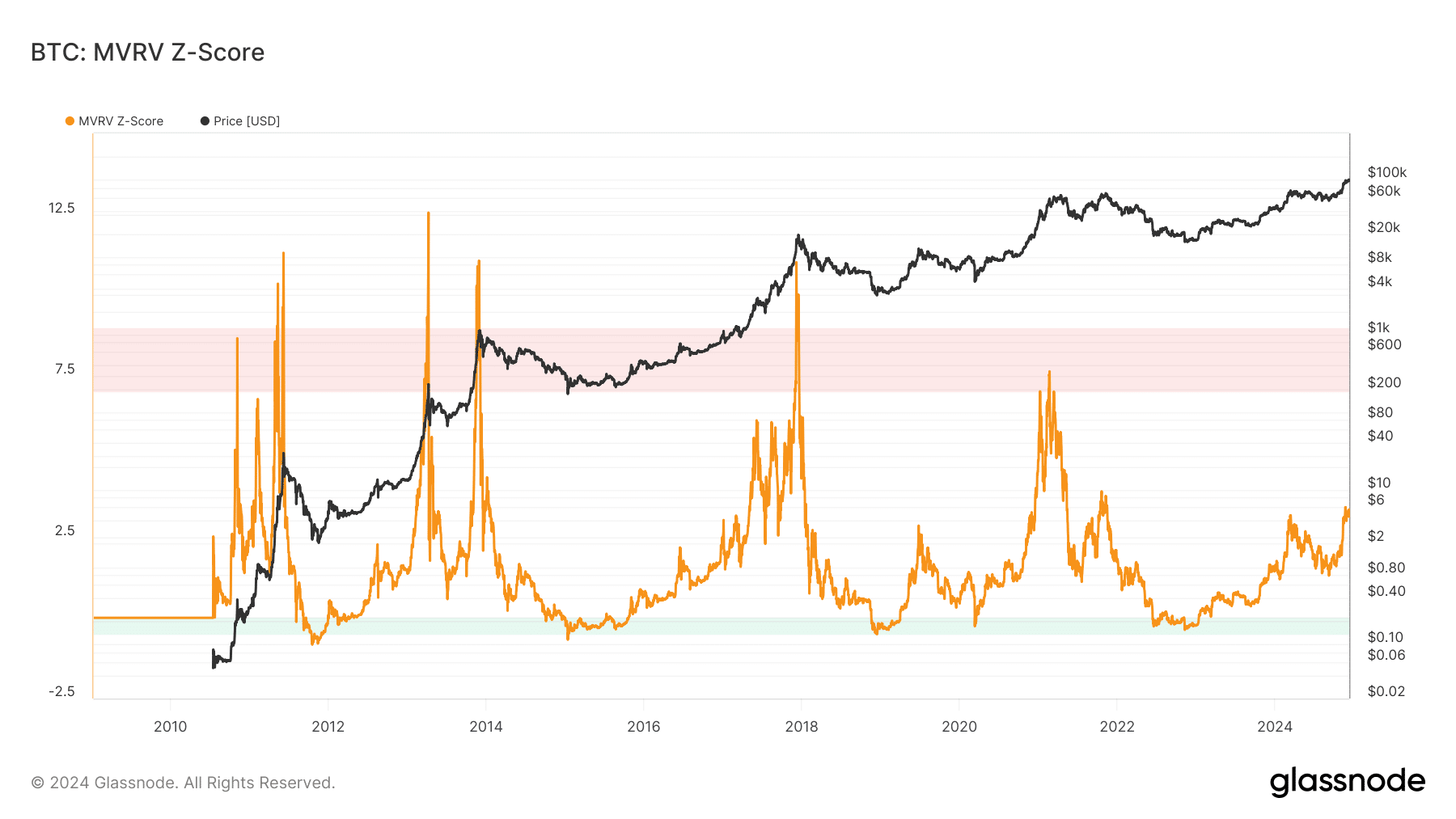

Source: Glassnode

One of the top indicators, the MVRV-Z score, showed enough headroom for BTC growth before topping. The valuation metric correctly marked the last cycle tops when it crossed 7 (upper band).

The current reading of 3 mirrored 2020 December patterns. In the last cycle, the metric topped at 7 (March 2021) and 4 (October 2021).

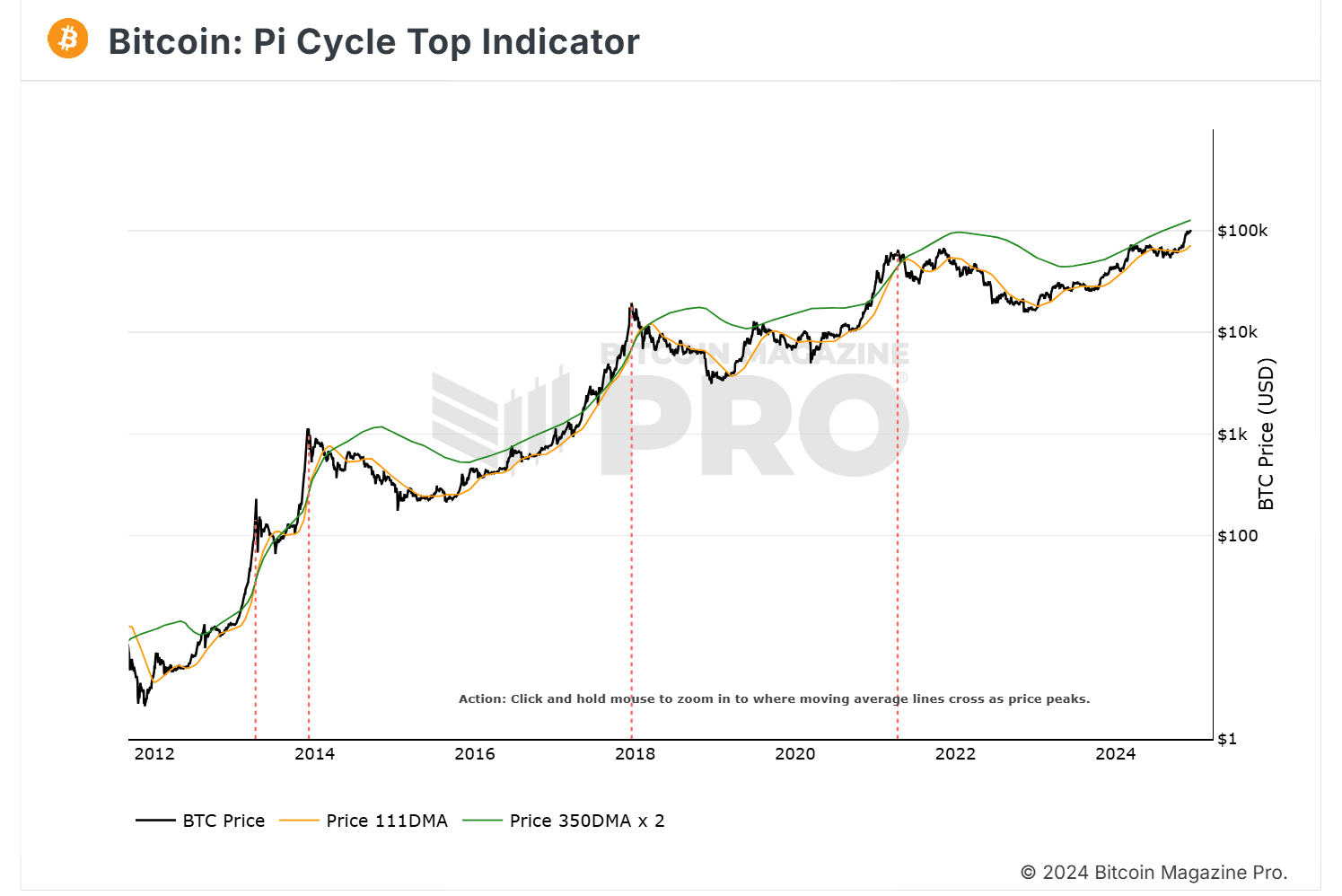

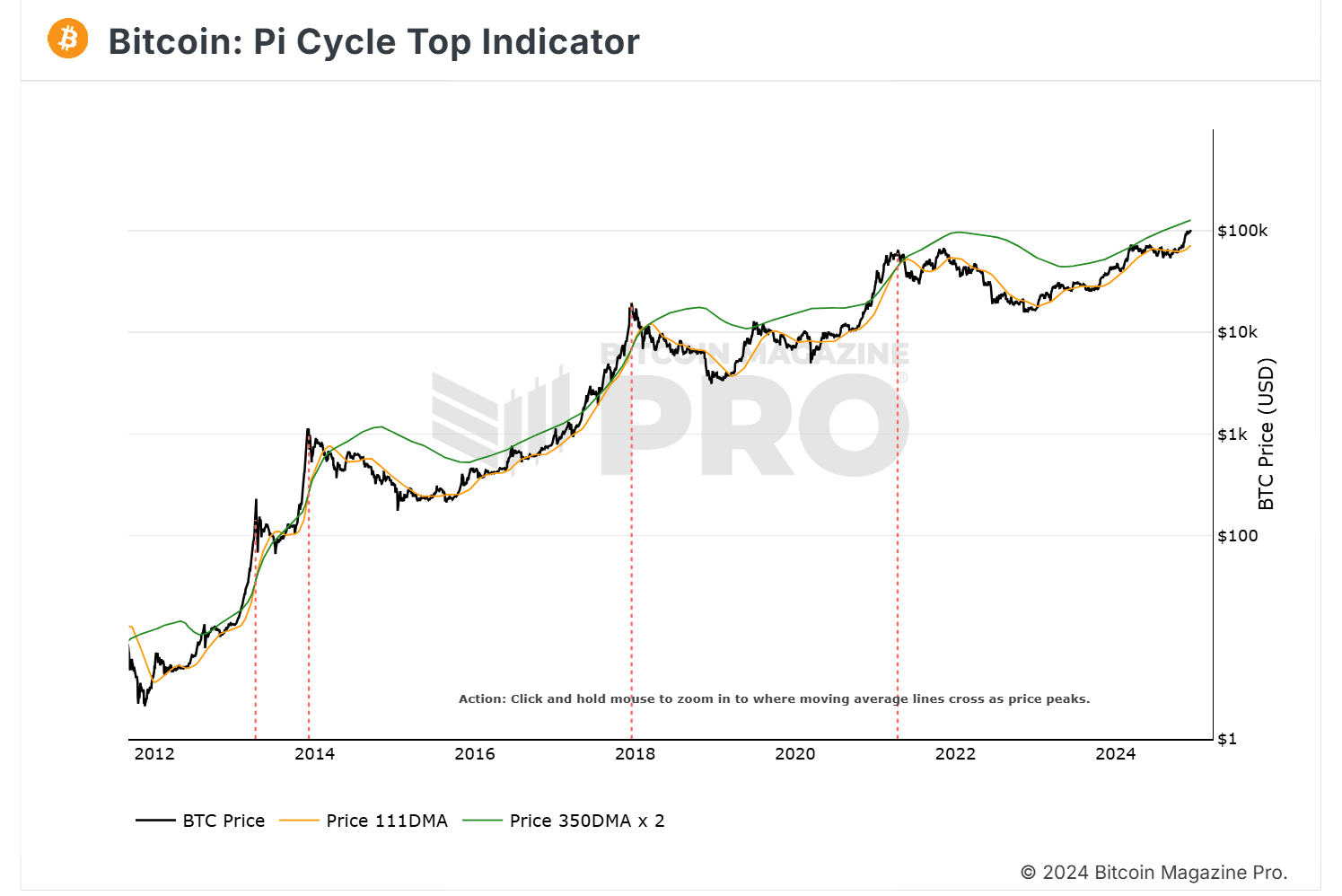

Another accurate top signal, Pi Cycle Top, which is based on a cross between two long-term moving averages, had a wide gap as of this writing. This suggested more room for growth before a likely top.

Source: BM Pro

Historically, a BTC top and overall ‘bear market phase’ always begin the year after the halving.

Read Bitcoin [BTC] Price Prediction 2024-2025

However, some analysts believe BTC might not experience an intense bear phase like previous cycles, citing increased institutional players.

But the absolute 2025 market top timeline and bear phase intensity remain to be seen. One thing is for sure, though—per on-chain metrics, there was still room for BTC to grow.