- Chainlink preparing for a breakout.

- Whales are accumulating LINK as end of year nears.

Chainlink [LINK] neared a potential breakout as it approached a critical point in the market.

At press time, LINK was trading within a falling wedge pattern on the weekly timeframe, and many traders anticipated a significant upward movement soon.

These developments could push LINK’s price higher as it became an even more vital player in the crypto world.

LINK price action and prediction

Looking at recent price action, Chainlink has gained around 0.5% over the past week. However, the last 24 hours saw a decline of 5.6%.

Despite the short-term losses, LINK’s trading volume surged by over 10%, with approximately $290 million changing hands.

The volume-to-market-cap ratio sat at 4%, indicating sufficient liquidity to support continued trading activity.

As LINK moves toward a possible breakout, all eyes are on the $15 level. If LINK can break and hold above this resistance, it could trigger a rally that targets $50 by next year.

Source: TradingView

LINK is currently trading below the 50-day moving average, and flipping this level could reignite bullish momentum. Traders are closely watching for this signal, as it could confirm a breakout from the falling wedge pattern.

If the breakout occurs, LINK could see a strong move higher, making it a top contender in the crypto market during the final quarter of the year.

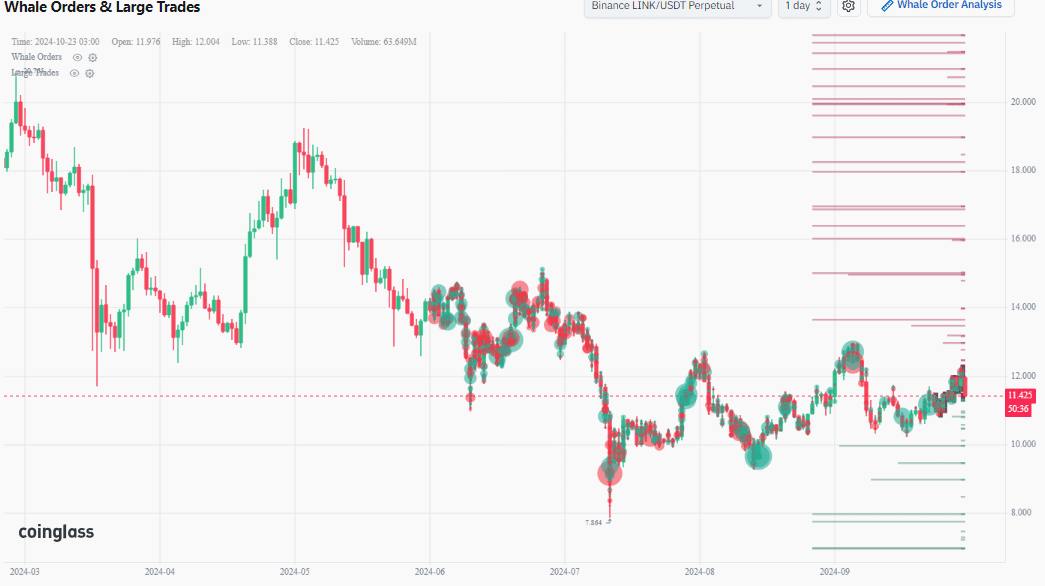

Whale orders and large trades

Large trades and whale orders are offering further clues about LINK’s future direction. On the K-line chart, large trades appear as circles, with the size representing the trade amount.

Whale orders are marked by horizontal lines, with Chainlink’s big orders concentrated around the $11 zone.

These trades suggest that large investors are positioning themselves for a move higher, as whales typically accumulate when they expect a price increase.

The longer these orders remain unfilled, the more likely it is that they will drive LINK’s price higher.

Source: Coinglass

LINK expanding into RWA and AI

Chainlink’s expansion into real-world assets (RWA) and artificial intelligence (AI) is also setting the stage for a significant price boost.

Chainlink’s role as a provider of secure oracles for smart contracts positions it perfectly for the upcoming tokenization of RWAs.

As major financial players like BlackRock explore tokenizing stocks, bonds, and real estate, Chainlink could become a central infrastructure for these assets.

Read Chainlink’s [LINK] Price Prediction 2024–2025

This integration could absorb massive amounts of liquidity into LINK, further driving its price higher.

Chainlink is at a pivotal moment. If LINK holds key support levels and breaks above $15, the sky may be the limit.