- A Crypto VC projected a positive outlook for Celestia, citing rising Ethereum blob fees.

- However, more TIA supply was expected to hit the market in 2025, which could affect prices.

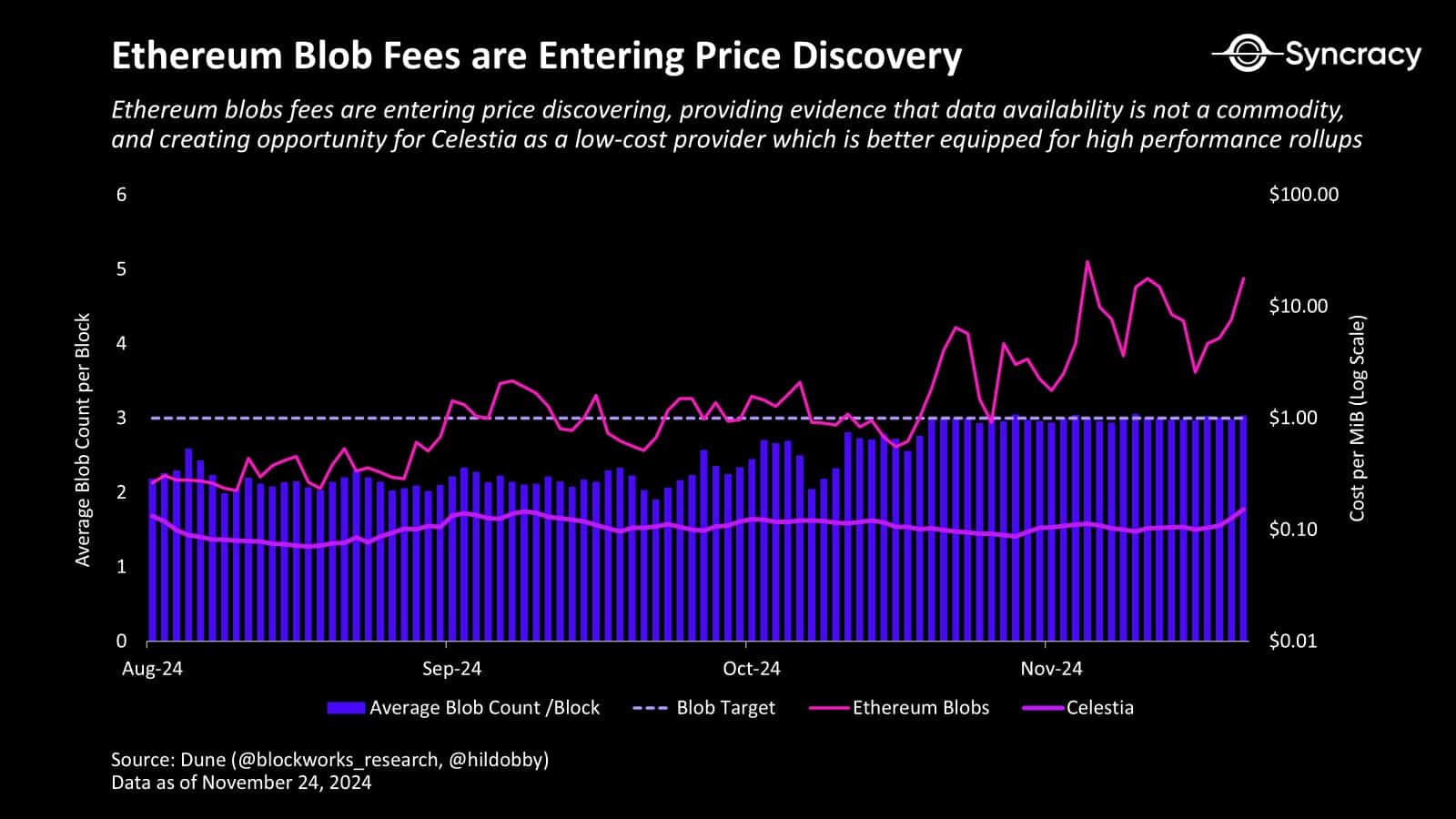

Ethereum [ETH] blob fees have hit record highs and could boost data availability providers like Celestia, according to crypto VC and analyst Ryan Watkins of Syncracy Capital.

Watkins projected that the increased L2 transaction costs (blob fees) could force some protocols to opt for Celestia.

He said,

“With Ethereum blob fees entering price discovery, a big opportunity is opening for Celestia…Creates potential for Celestia to capture high-performance L2s which Ethereum cannot service due to high fees and low throughput.”

Source: Syncracy Capital

Will TIA benefit?

Based on the above development, Watkins believed that Ethereum’s end-game and rollup-centric roadmap could be positive for Celestia in the long term.

But will TIA price benefit from these positive fundamentals?

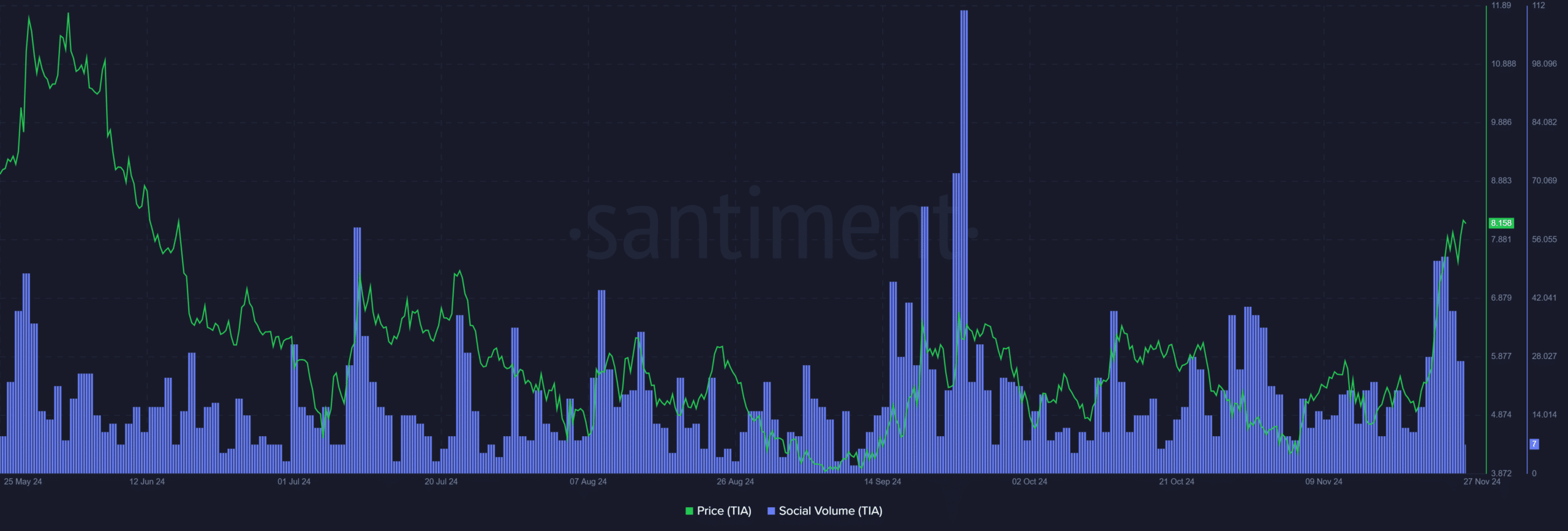

The market interest in TIA hit a monthly high, as indicated by the surge in social volume. Rising interest across social media has always correlated positively with TIA’s price. As of press time, TIA was up 10% on the daily chart, valued at $8.4.

Source: Santiment

Additionally, the market positioning was skewed towards bulls. According to Binance Top Traders positions, over 70% were long TIA, suggesting more players expected an extra uptrend for the TIA.

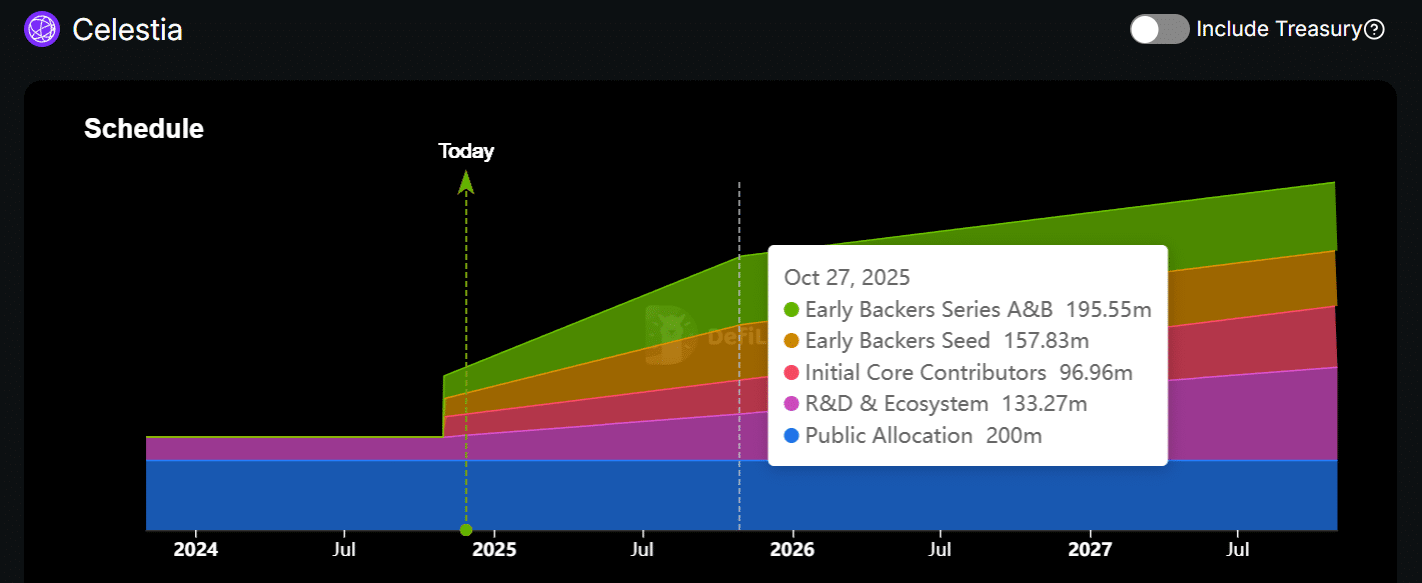

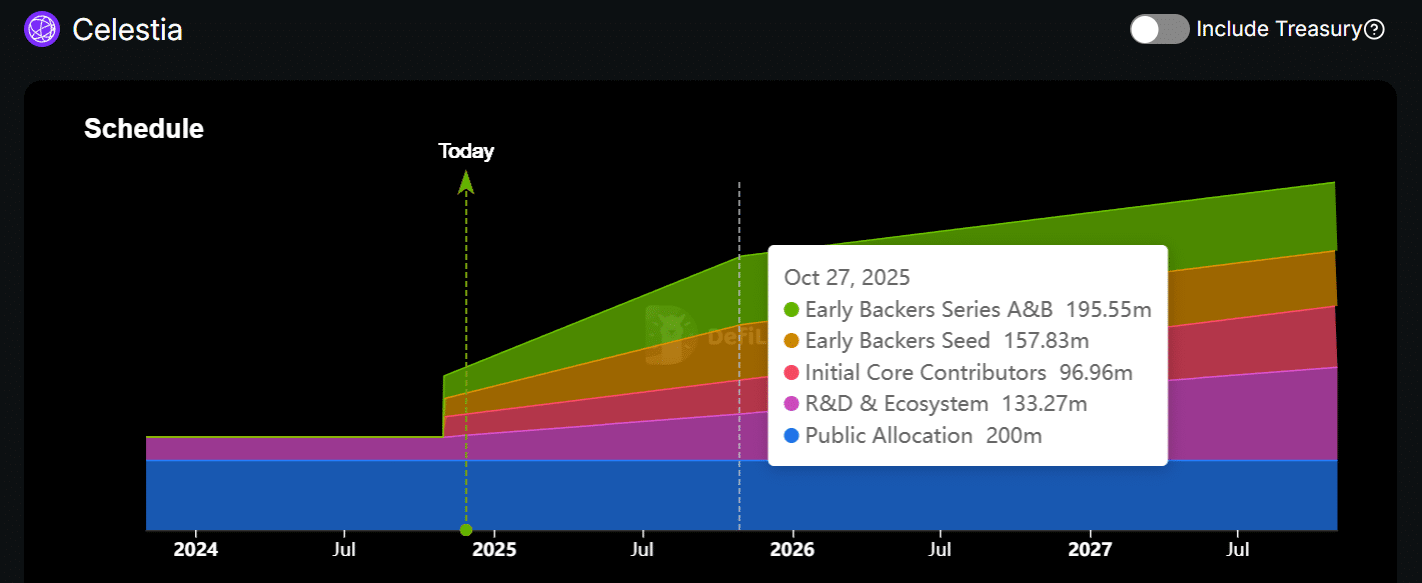

However, there was a small problem, especially for long-term investors who were eyeing holding the token for several months.

As of this writing, less than 50% of the TIA supply was in the market, with more than half of the total token supply, which started being unlocked in October, to intensify in 2025.

About 7 million TIA tokens ($57 million) will be emitted in the next seven days.

Source: DeFiLlama

The expected uptick in inflation and supply pressure as early investors cash out could affect TIA price dynamics for long-term holders.

Read Celestia [TIA] Price Prediction 2024-2025

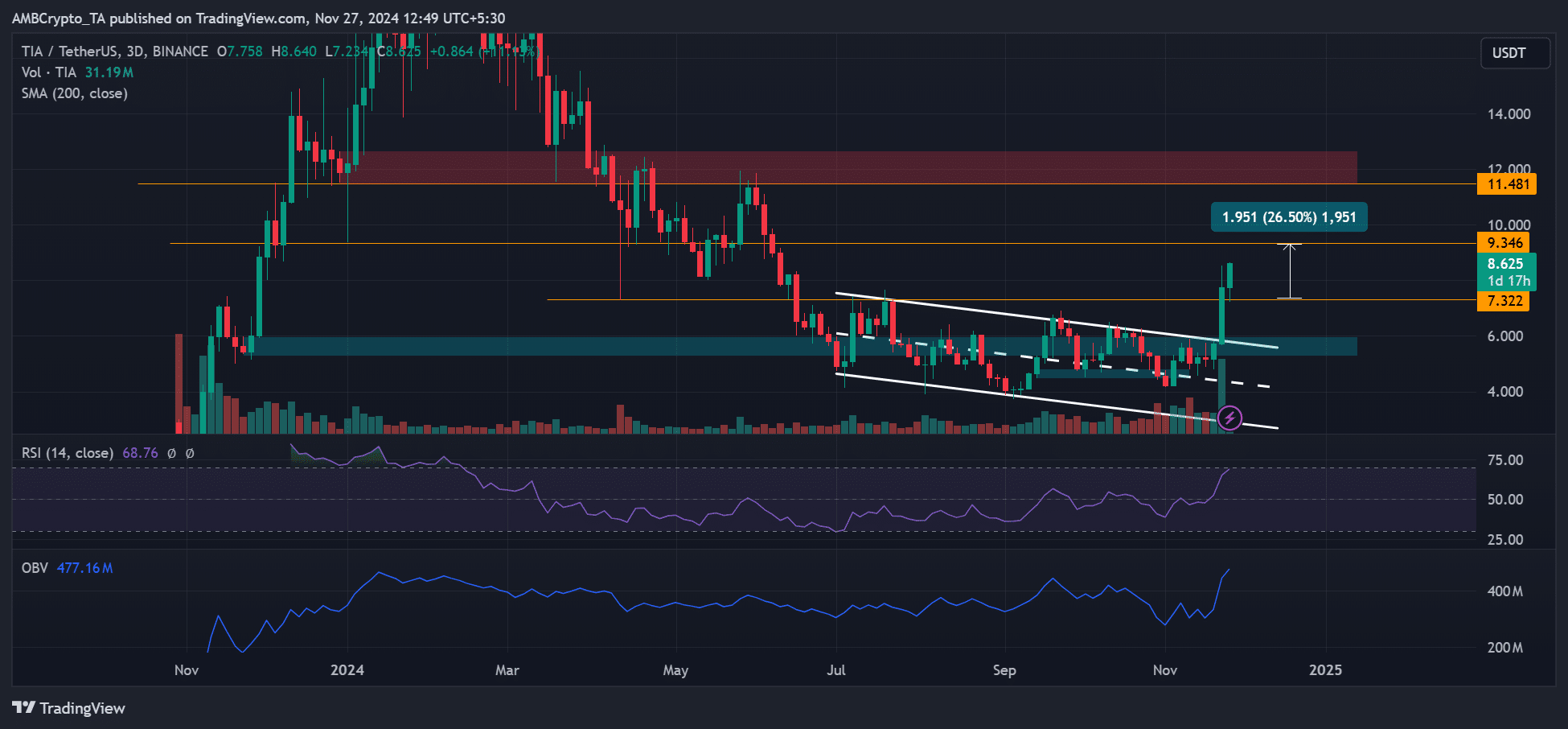

That said, the immediate targets on the price charts were $10 and $12. The strong demand and ongoing uptrend momentum could embolden bulls to target these levels.

However, the most crucial supply zone was at $12, a strong resistance that dragged TIA below $10 from May.

Source: TIA/USDT, TradingView