- ADA surges 114% but faces strong rejection at $0.70 resistance level.

- Cardano’s on-chain metrics suggested a short-term cool-down, despite bullish liquidation sentiment.

Cardano [ADA] has been one of the star performers for the week, as it gained more than 114% before encountering significant resistance.

The explosive move caught many traders off guard, pushing the price from its consolidation zone around $0.42 to challenge the critical $0.70 barrier.

However, momentum has since cooled, with ADA setting a 14% retracement in the last 48 hours. A pullback this strong indicates selling at higher levels as traders take profits from the recent rally.

ADA’s potential consolidation

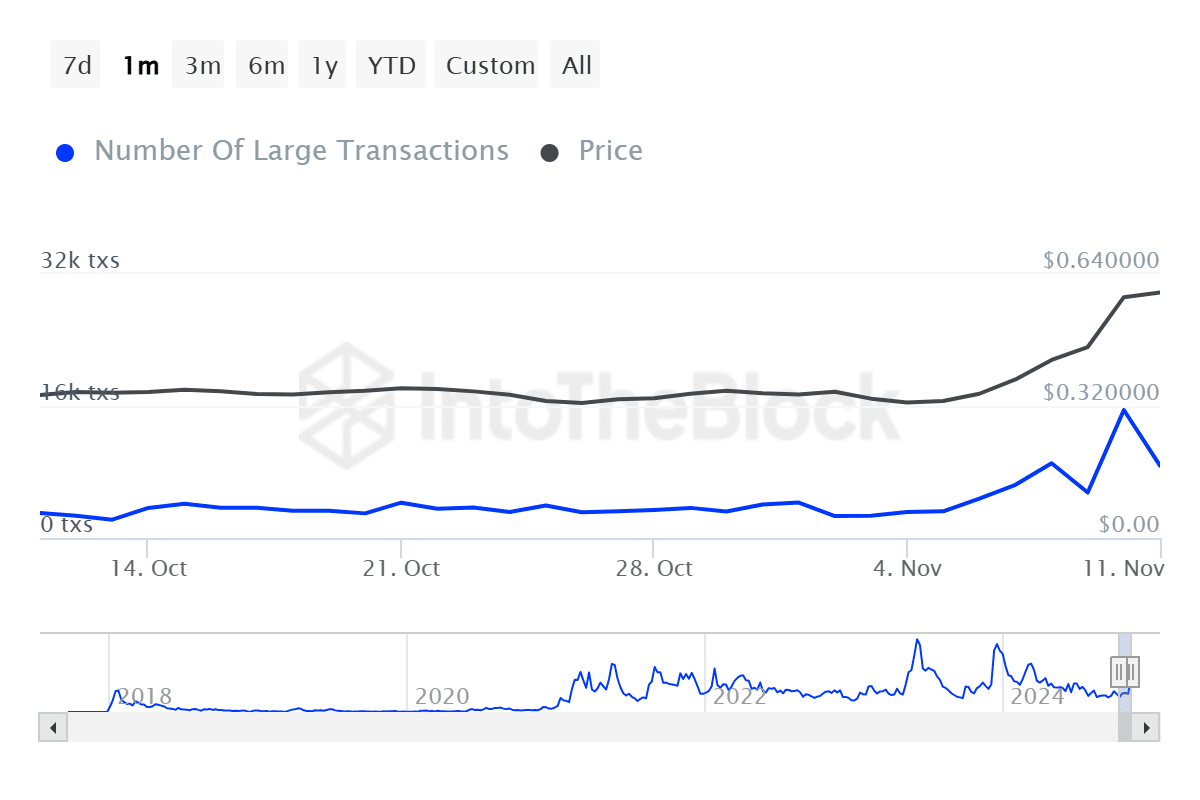

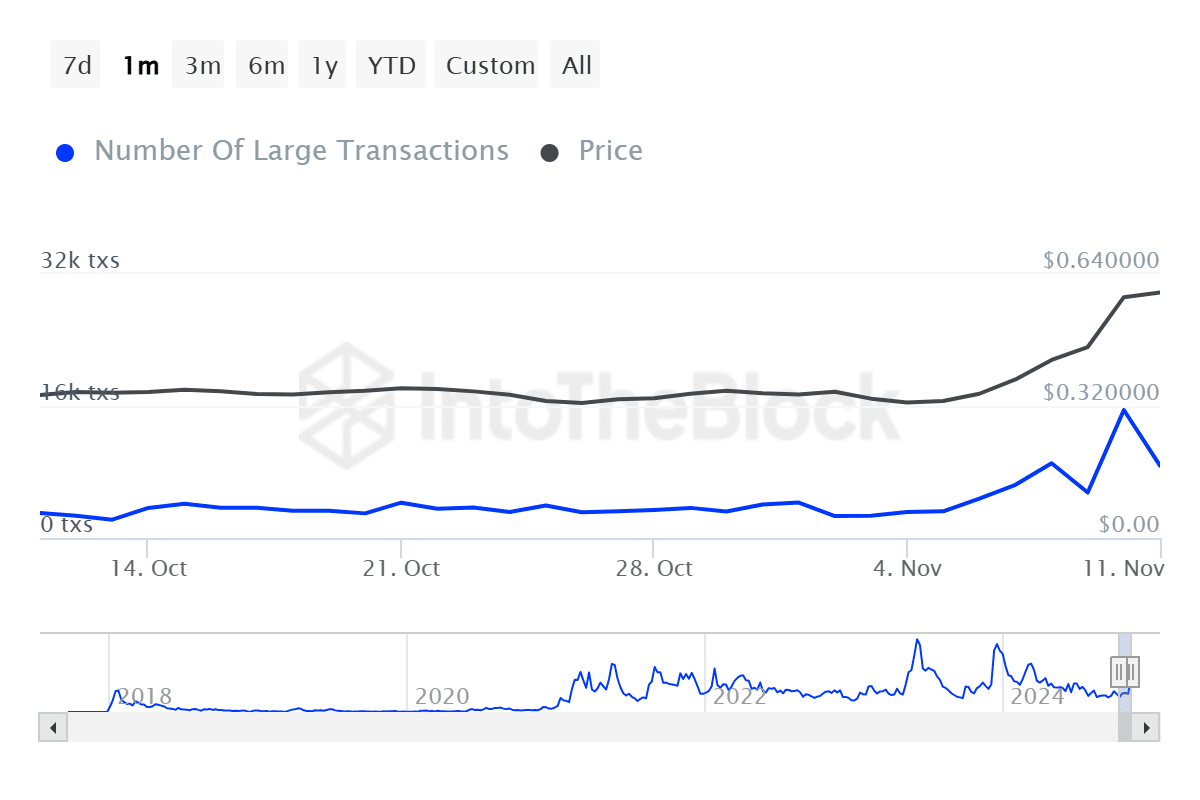

According to AMBCrypto’s analysis of the IntoTheBlock, ADA’s short-term prospects painted a mixed picture.

The altcoin’s large transactions fell by 24% over the last day, suggesting reduced institutional activity after the strong price spike.

Source: IntoTheBlock

This could hold in the short run as ADA major players were in a sit-and-observe situation, as they assessed the market dynamics and the price behavior at these key resistance levels.

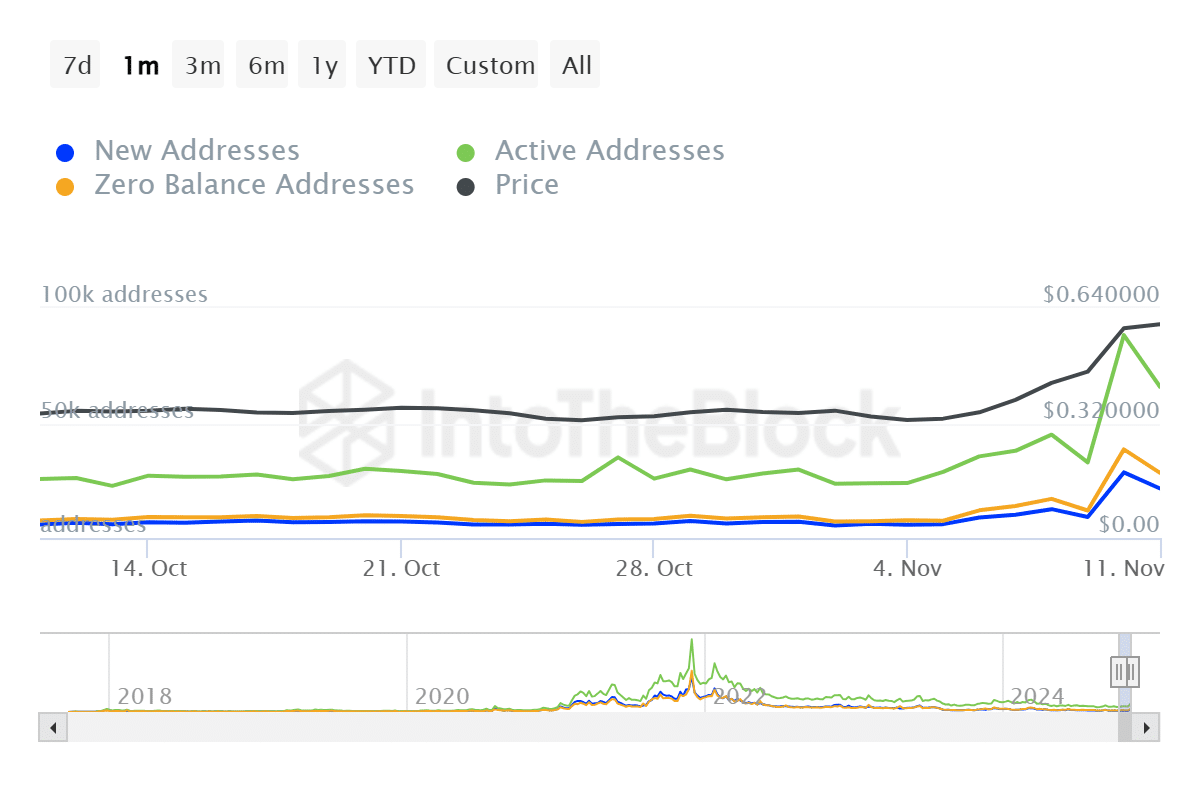

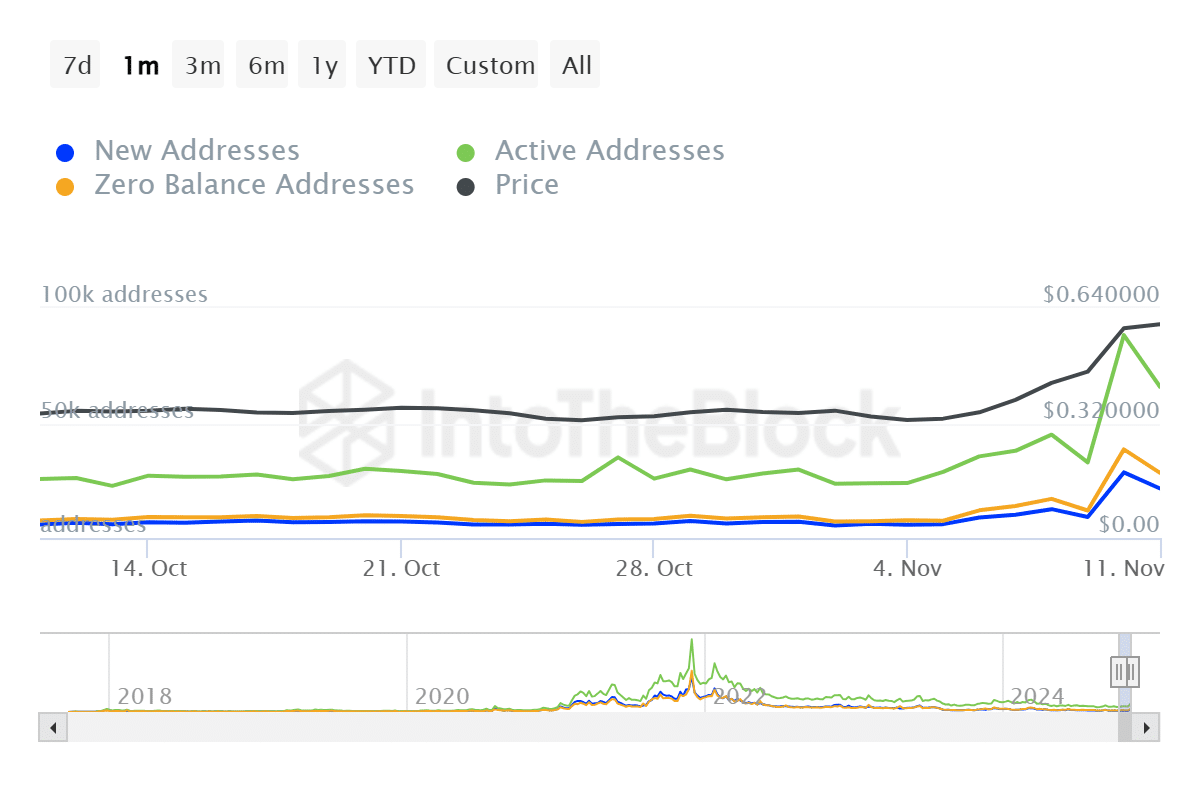

Similarly, active addresses were down 25%, indicative of a slight pullback in ADA network participation.

Source: IntoTheBlock

These metrics typically indicate a cooling period may be necessary before the next significant move for the altcoin.

THIS suggests strong support

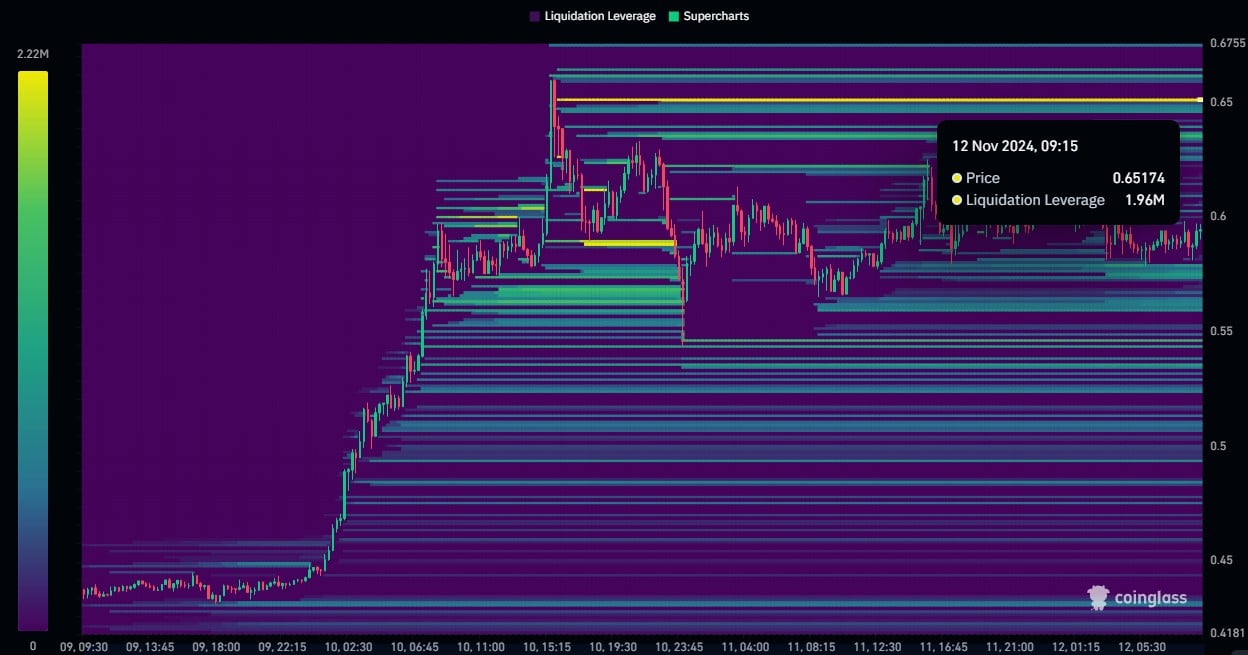

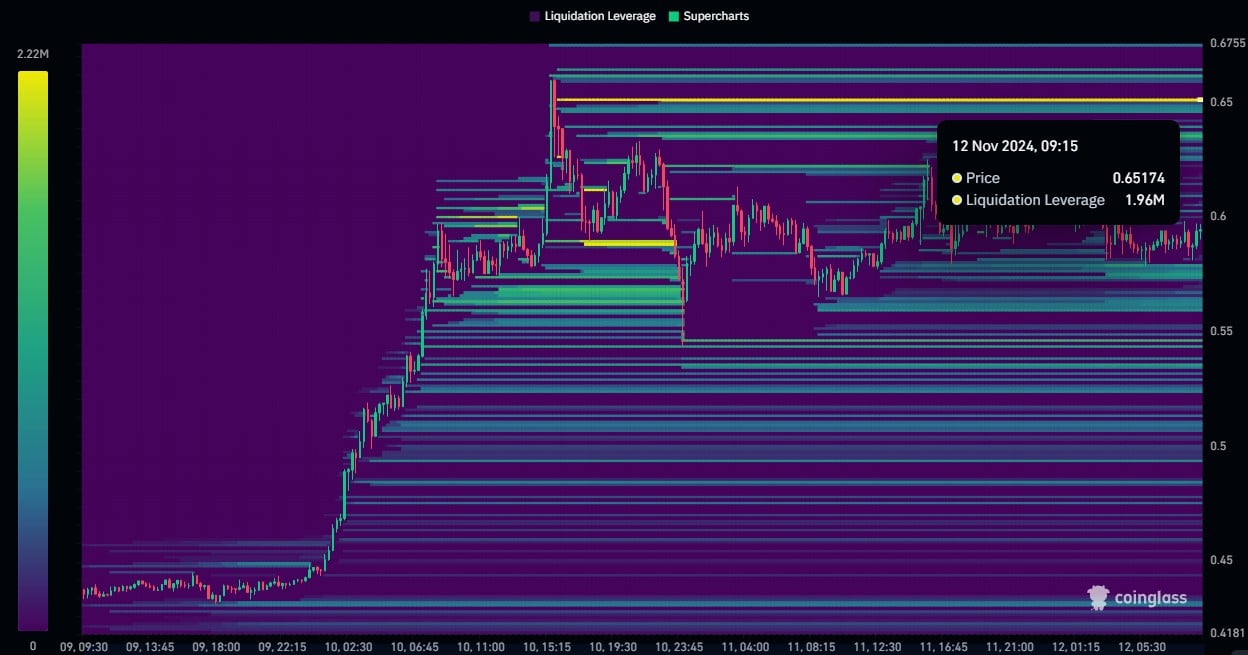

Despite this pullback, Coinglass liquidation data indicated a potentially bullish outlook. A large liquidation level rested at $0.65, holding around $1.96 million worth of ADA in liquidity.

This would be a large pool of orders acting as a solid support zone and can potentially prevent further downside.

Source: Coinglass

Remain cautiously optimistic!

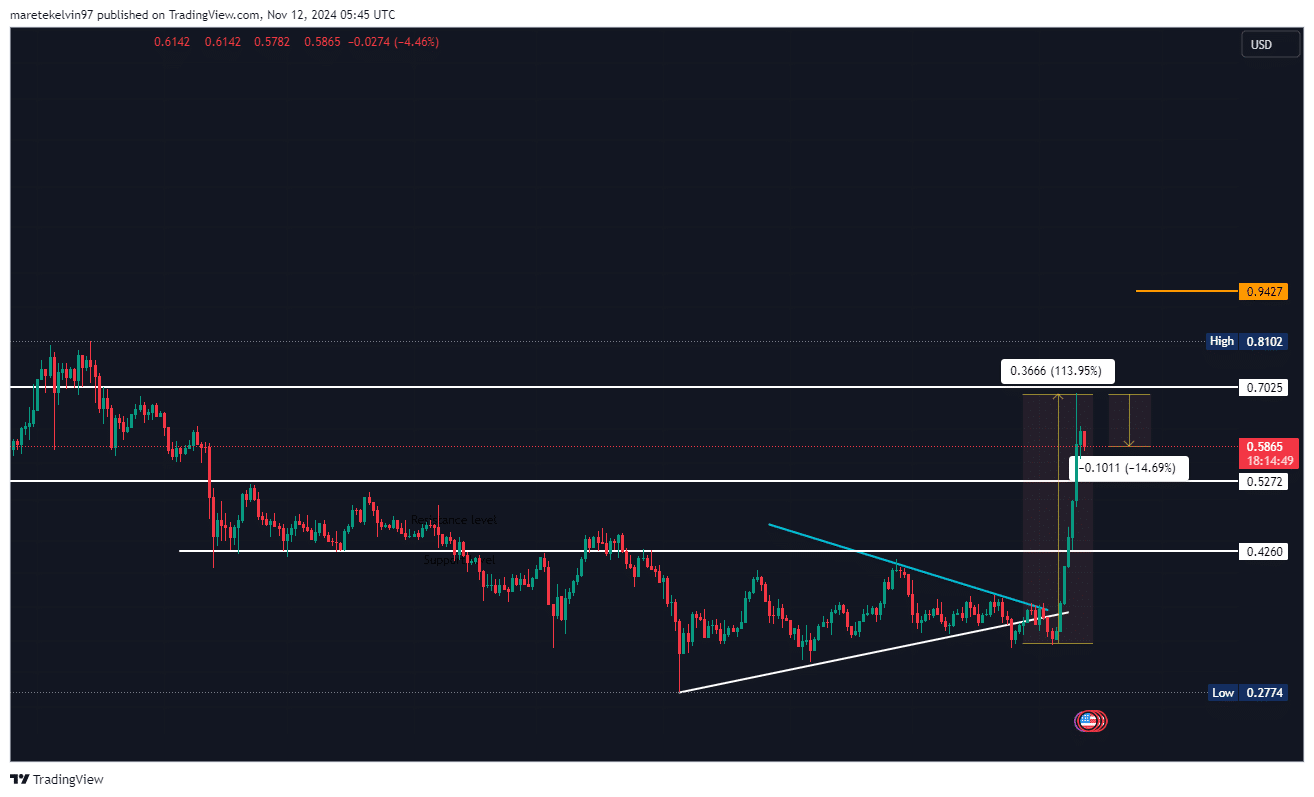

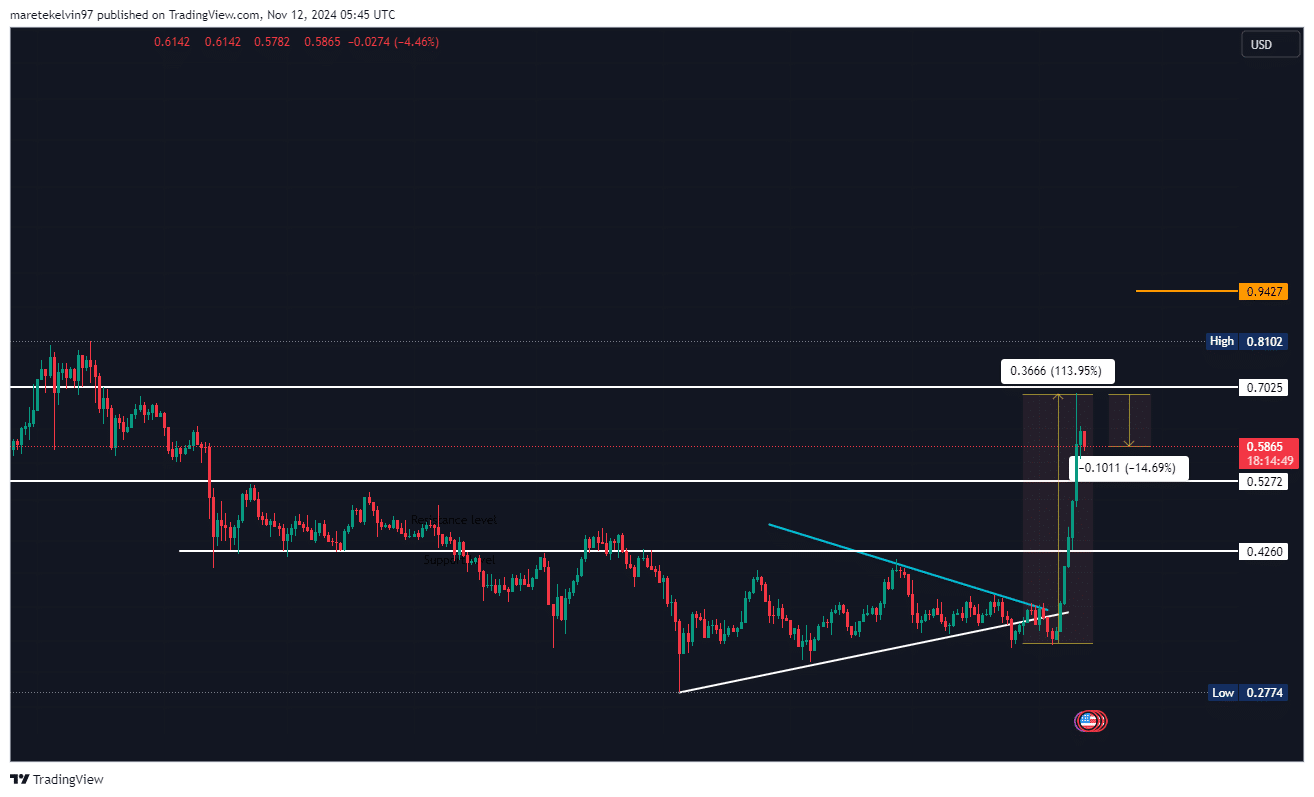

From a technical standpoint, the price action of ADA has broken out of a multi-week descending triangle pattern, which usually is a bullish sign.

Read Cardano’s [ADA] Price Prediction 2024–2025

While the rejection at $0.70 suggested immediate resistance, the formation of higher lows indicated maintaining a bullish market structure.

Should ADA successfully defend these levels, another attempt at breaking $0.70 could materialize in the near future.

Source: TradingView