- ADA has surged by 13.73% on weekly charts.

- Cardano fundamentals suggest the trend trend reversal is imminent.

As reported earlier by AMBCrypto, Cardano [ADA] has experienced a sustained surge over the past week. ADA has exploited the cryptocurrency market rebound following Fed rate cuts last week.

In fact, as of this writing, ADA was trading at $0.4018. This marked a 11.5% increase on monthly charts with an extension to the bullish trend by 13.73% over the past week.

Since hitting a local low of $0.303 earlier this month, ADA has maintained an upward momentum. These market conditions have sparked both optimism and skepticism within the Cardano community in equal measures.

Inasmuch, the popular crypto analyst Ali Martinez has shown skepticism with his recent analysis suggesting a trend reversal.

The prevailing market sentiment

In his analysis, Martinez Pointed out that the TD Sequential indicator has just flashed a sell signal on Cardano’s daily charts. The analyst posits that this suggests an upcoming correction although for a short term.

Source: X

In context, when a sell signal flashes on the daily charts, it implies that the prices have risen for a considerable period and the market may be overextended. Thus, investors usually interpret this as a signal to take profits or prepare for a reversal or price decline.

In this case, the signal suggests a potential short-term correction. Therefore, Cardano is likely to experience a temporary pullback before attempting another uptrend.

What ADA charts say

While the metric highlighted by Martinez suggests a potential next move for ADA, it’s vital to determine what other indicators say.

Source: Santiment

For starters, Cardano’s Price DAA divergence has remained negative over the past 7 days. At press time, ADA’s price DAA divergence was -45.63. When an asset is set like this, it suggests that prices are rising while active addresses are not.

This suggests a bearish reversal since the price increase is not supported by the corresponding increase in user activity which indicates a weakening demand or reduced market interest.

Therefore, this suggests that the price rally is unsustainable as it’s driven by a declining user base. Thus it signals the price will reverse downward since the momentum is fading even though the price hasn’t yet reflected it.

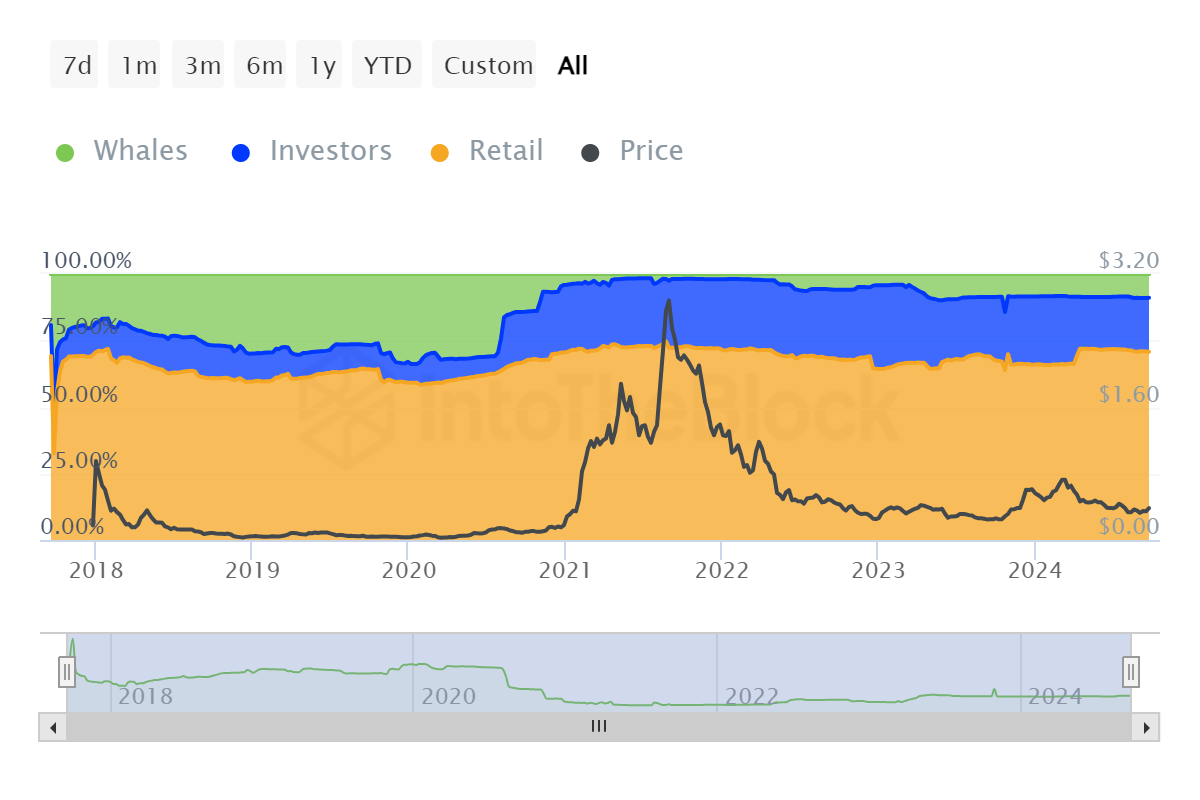

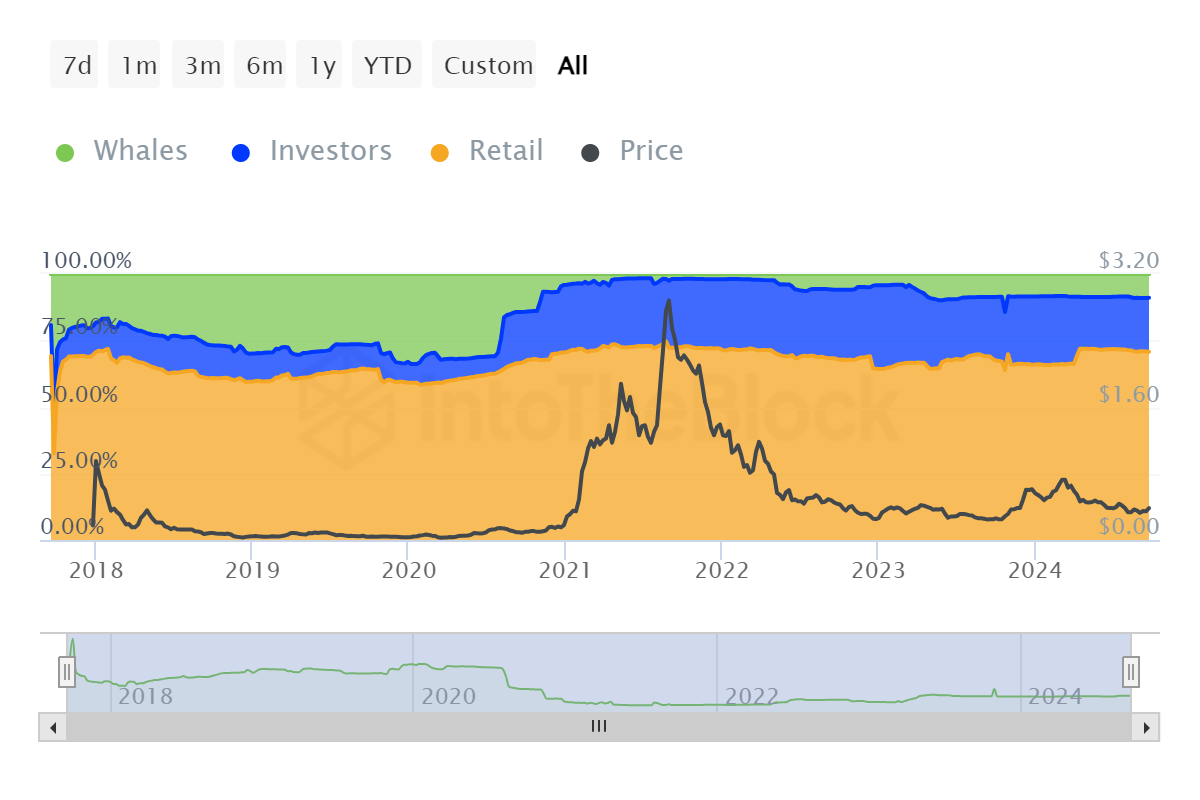

Source: IntoTheBlock

Additionally, Cardano’s ownership by concentration is widely concentrated by retail traders. According to data from IntoTheBlock, Cardano’s retail traders own 70.70% of ADA tokens, whales 8.95%, and investors 20.34%.

This is concerning especially because retail traders are more susceptible to emotional decision-making such as panic selling or FOMO. This leads to higher price volatility.

Read Cardano’s [ADA] Price Prediction 2024–2025

Equally, retail traders trade based on trends and hype rather than long-term values. This may imply that the market lacks the long-term stability that arises from whales and other institutional participants.

Simply put, although, ADA has experienced a surge over the past week, it might experience a pullback. The fundamentals don’t support a sustained rally. In a such scenario, if the price experiences a correction, ADA will retrace to the critical support level at $0.345.